Gaining Access To Stakes In Elon Musk's Private Companies

Table of Contents

Understanding the Landscape of Musk's Private Holdings

H3: Identifying Eligible Investment Vehicles:

Elon Musk's portfolio of private companies presents diverse investment opportunities, each with its own set of entry barriers. SpaceX, the leading space exploration company, routinely secures funding from established venture capital firms and high-net-worth individuals. The Boring Company, focused on infrastructure innovation, has also attracted significant investment, though potentially at a smaller scale than SpaceX. Neuralink, developing brain-computer interfaces, remains in a more nascent stage, attracting a different type of investor focusing on cutting-edge biotechnologies.

- Funding Rounds: Each company participates in funding rounds (Series A, B, C, etc.), with later rounds typically commanding higher valuations and increased minimum investment amounts.

- Investor Types: Venture capitalists (VCs), angel investors, and sovereign wealth funds are the primary players in these funding rounds. High-net-worth individuals may also participate, often through their own investment vehicles or in conjunction with VC firms.

- Investment Minimums: Expect extremely high minimum investment requirements, often in the millions of dollars, particularly for later-stage funding rounds.

H3: Navigating the Complexities of Private Equity:

Investing in private equity is vastly different from trading publicly listed stocks. Understanding the nuances is crucial.

- Dilution: As a company raises more funding, existing shareholders' ownership percentage decreases (dilution). This is a normal part of private equity investing but impacts your ultimate return.

- Preferred Stock: Investors often receive preferred stock, which offers certain advantages over common stock, such as preferential treatment in liquidation events.

- Liquidation Preferences: These clauses determine how funds are distributed if the company is sold or liquidated. They often prioritize returns for early investors.

- Valuation: Valuing a private company is inherently subjective and complex, relying on various methodologies that can differ significantly between investors.

Pathways to Accessing Stakes

H3: Networking and Relationship Building:

The importance of networking within the venture capital and private equity communities cannot be overstated. Building relationships with key players is essential.

- Industry Events: Attending conferences, seminars, and networking events focused on venture capital, space technology, and related fields offers opportunities to meet potential investors and company representatives.

- LinkedIn: Utilize LinkedIn to connect with individuals working in venture capital firms, within Elon Musk's companies, and in related industries.

- Cultivating Relationships: Building genuine relationships takes time and effort. Focus on providing value and demonstrating your knowledge and expertise.

H3: Venture Capital and Private Investment Firms:

Investing through established venture capital firms is a more accessible route for many, though still requiring significant capital.

- Research: Identify VC firms with a history of investing in disruptive technologies and companies aligned with Musk's ventures.

- Investment Strategies: Understand each firm's investment strategy, focusing on those specializing in seed, early-stage, or growth-stage investments in aerospace, technology, or biotechnology.

- Accredited Investor Status: You'll need to meet the requirements to be classified as an accredited investor, which generally involves a high net worth or annual income.

H3: Direct Investment (if possible):

Direct investment in Musk's companies is exceptionally difficult for most individuals.

- High Capital Requirements: The capital requirements are astronomical, typically exceeding tens or hundreds of millions of dollars.

- Extreme Competition: Demand far outstrips supply, making it incredibly challenging to secure an investment opportunity even with substantial capital.

Understanding the Risks and Rewards

H3: High Risk, High Reward:

Investing in private companies inherently carries substantial risk.

- Volatility: Early-stage investments are highly volatile and can experience significant ups and downs.

- Market Shifts: Changes in market conditions, regulatory landscapes, or technological advancements can dramatically affect a private company's prospects.

- Lack of Liquidity: Unlike publicly traded stocks, private equity investments are illiquid, making it difficult to quickly sell your stake if needed.

H3: Due Diligence is Paramount:

Thorough due diligence is paramount before investing in any private company.

- Legal Counsel: Consult with experienced legal counsel specializing in private equity investments.

- Financial Advisors: Work with financial advisors proficient in evaluating private investment opportunities.

Conclusion

Gaining access to stakes in Elon Musk's private companies presents a significant challenge, requiring substantial capital, extensive networking, and a deep understanding of private equity investments. The potential rewards are immense, but the risks are equally substantial. This high-risk, high-reward environment necessitates careful planning, thorough due diligence, and professional guidance. Begin your journey to exploring investment opportunities in Elon Musk's private companies today by researching reputable venture capital firms and building strong professional networks.

Featured Posts

-

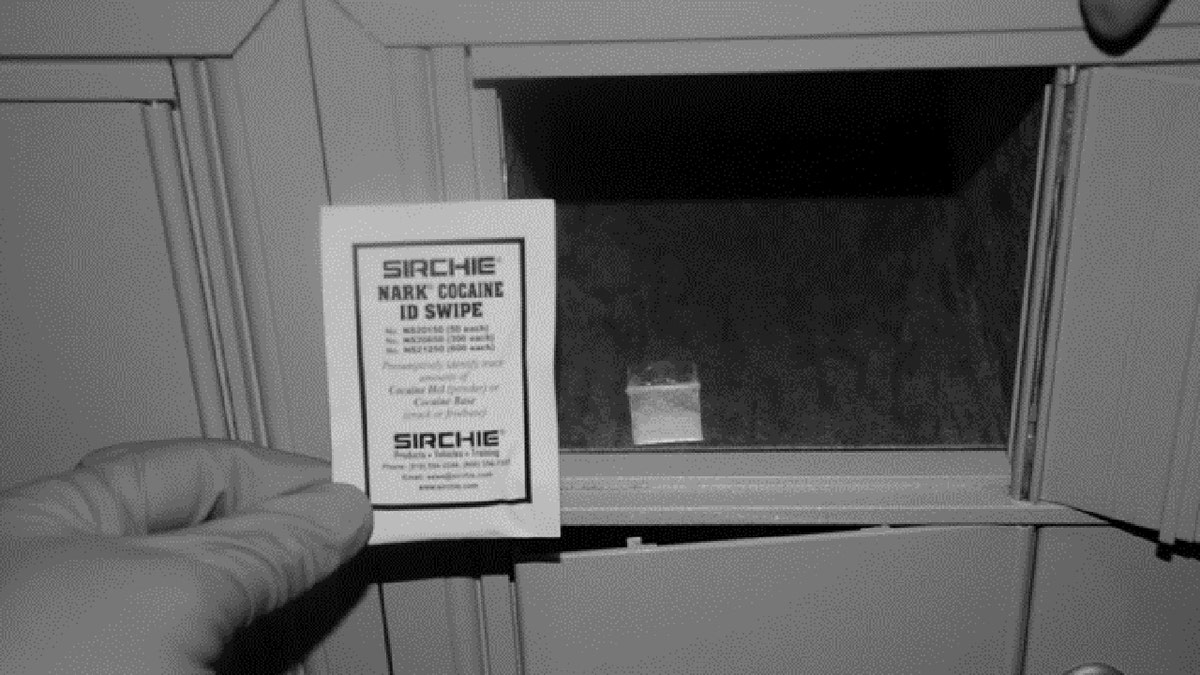

Cocaine Found At White House Secret Service Ends Probe

Apr 26, 2025

Cocaine Found At White House Secret Service Ends Probe

Apr 26, 2025 -

Hollywood At A Standstill The Combined Writers And Actors Strike

Apr 26, 2025

Hollywood At A Standstill The Combined Writers And Actors Strike

Apr 26, 2025 -

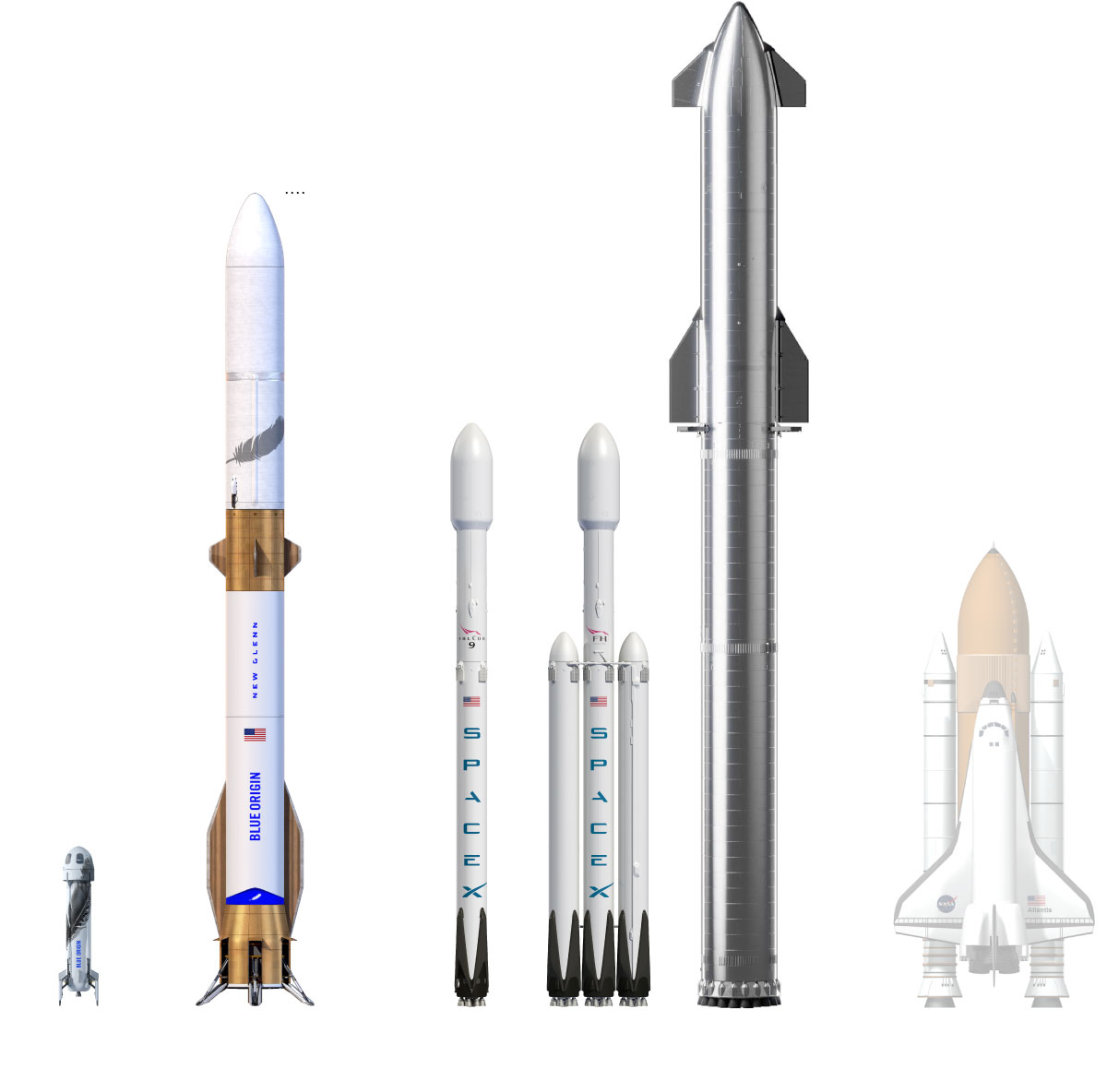

Blue Origin Rocket Launch Postponed Subsystem Issue Identified

Apr 26, 2025

Blue Origin Rocket Launch Postponed Subsystem Issue Identified

Apr 26, 2025 -

A Candid Conversation In The Easy Chair With Karli Kane Hendrickson

Apr 26, 2025

A Candid Conversation In The Easy Chair With Karli Kane Hendrickson

Apr 26, 2025 -

Pressure Mounts Trump Administration Targets Europes Ai Framework

Apr 26, 2025

Pressure Mounts Trump Administration Targets Europes Ai Framework

Apr 26, 2025

Latest Posts

-

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025 -

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025