Gas Prices Climb: A 20-Cent Per Gallon Rise

Table of Contents

Reasons Behind the 20-Cent Gas Price Increase

Several interconnected factors contribute to this recent 20-cent per gallon rise in gas prices. Understanding these contributing elements is crucial to navigating the current economic landscape.

Crude Oil Price Fluctuations

Global crude oil prices are a primary driver of gasoline costs. Fluctuations in the global market significantly impact what we pay at the pump.

- Geopolitical Instability: Tensions in oil-producing regions, such as the ongoing conflict in Ukraine, often lead to supply disruptions and increased crude oil prices. This directly translates to higher gas prices for consumers.

- OPEC Decisions: Decisions by the Organization of the Petroleum Exporting Countries (OPEC) regarding oil production quotas can dramatically affect global supply and, consequently, prices. A reduction in production often leads to price increases.

- Supply Chain Disruptions: Unexpected events, like natural disasters or logistical bottlenecks, can disrupt the global oil supply chain, further escalating crude oil and subsequently, gas prices.

The correlation between crude oil prices and gas prices is undeniable; a rise in crude oil futures contracts usually predicts a similar increase at the gas pump.

Refinery Capacity and Production

Refinery issues play a crucial role in gas price fluctuations. Reduced production capacity directly impacts the gasoline supply.

- Planned and Unplanned Maintenance: Regular maintenance at refineries is necessary, but unplanned shutdowns due to unexpected equipment failures or unforeseen circumstances can severely constrict gasoline supply.

- Labor Issues: Labor disputes and workforce challenges within refineries can also lead to production slowdowns, affecting the availability of gasoline and increasing prices.

- Capacity Constraints: Existing refinery capacity might not always meet the growing demand, particularly during peak travel seasons, exacerbating price increases.

Lower refinery output directly translates to less gasoline available, pushing prices upwards.

Seasonal Demand and Increased Travel

Increased seasonal driving significantly influences gasoline demand and prices. Summer vacation season, for instance, sees a sharp rise in travel, boosting demand and, consequently, prices.

- Peak Travel Seasons: Summer months and holiday periods witness a surge in gasoline consumption, driving up demand and leading to higher prices at the pump. This increased demand often outstrips supply.

- Increased Road Trips: Longer road trips during peak seasons further contribute to the heightened demand for gasoline, resulting in price increases.

Understanding seasonal demand patterns is vital for anticipating gas price fluctuations throughout the year.

Government Regulations and Taxes

Government policies, taxes, and environmental regulations also impact the final price of gasoline.

- Federal and State Taxes: Gas taxes vary by state and contribute significantly to the overall cost.

- Environmental Regulations: Regulations aimed at reducing emissions can increase production costs, indirectly affecting prices.

- Carbon Taxes: Some jurisdictions are implementing carbon taxes, adding to the cost of gasoline.

Impact of the 20-Cent Gas Price Increase on Consumers

The 20-cent per gallon increase in gas prices has widespread consequences for consumers.

Increased Transportation Costs

The most immediate impact is the increase in daily commuting costs and travel expenses.

- Daily Commute: For those who commute daily, the increased gas price represents a notable increase in their monthly expenses.

- Travel Expenses: Road trips and vacations become more expensive, affecting tourism and leisure activities.

- Delivery Costs: The increased cost of fuel affects transportation costs for goods, potentially leading to higher prices for consumers. This ripple effect impacts the entire supply chain.

- Disproportionate Impact on Low-Income Households: For low-income households, the increased gas prices represent a larger percentage of their income, potentially impacting their ability to meet other essential needs.

Inflationary Pressure

The gas price increase contributes to overall inflation, impacting the cost of living.

- Ripple Effect: Higher transportation costs increase the prices of goods and services, as businesses pass along the increased fuel costs to consumers.

- Economic Slowdown: Increased fuel costs can contribute to a broader economic slowdown as consumer spending decreases.

Consumer Behavior Changes

Consumers are likely to adapt their behavior in response to higher gas prices.

- Reduced Driving: Many people may reduce unnecessary driving to conserve fuel and save money.

- Public Transportation: Increased use of public transportation is a potential response to higher gas costs.

- Fuel-Efficient Vehicles: The price increase may encourage consumers to consider purchasing more fuel-efficient vehicles.

Potential Future Trends in Gas Prices

Predicting future gas prices is challenging, but analyzing current trends offers some insights.

Short-Term Outlook

In the coming weeks and months, gas prices are likely to remain volatile.

- Geopolitical Factors: Ongoing geopolitical instability will continue to influence crude oil prices and, consequently, gas prices.

- Economic Recovery: The pace of economic recovery will influence demand for gasoline.

- Refining Capacity: Any further disruptions to refining capacity will likely lead to price increases.

Long-Term Outlook

The long-term outlook for gas prices is complex, involving the transition to alternative energy sources.

- Electric Vehicles: The increasing adoption of electric vehicles will gradually reduce demand for gasoline.

- Renewable Energy: The growth of renewable energy sources could eventually lead to a decrease in reliance on fossil fuels.

- Government Initiatives: Government policies promoting alternative fuels and energy efficiency will play a significant role in shaping future gas prices.

Conclusion

The recent 20-cent per gallon rise in gas prices is a result of several interacting factors, including crude oil price fluctuations, refinery issues, seasonal demand, and government regulations. This gas price increase significantly impacts consumers through increased transportation costs and contributes to overall inflation. While the short-term outlook remains uncertain, the long-term trend suggests a gradual shift towards alternative fuels and a potential stabilization, or even decrease, in gasoline prices. Stay updated on the latest gas price climbs and learn how to mitigate the impact on your budget. Follow [Your Website/Source] for regular updates on gas price trends and fuel-saving tips.

Featured Posts

-

Dissecting The Recent Allegations Involving Blake Lively

May 22, 2025

Dissecting The Recent Allegations Involving Blake Lively

May 22, 2025 -

Suicide Claims Life Of Dropout Kings Vocalist Adam Ramey

May 22, 2025

Suicide Claims Life Of Dropout Kings Vocalist Adam Ramey

May 22, 2025 -

Britains Got Talent Walliams And Cowells Feud Explodes

May 22, 2025

Britains Got Talent Walliams And Cowells Feud Explodes

May 22, 2025 -

The Status Of Blake Lively And Taylor Swifts Friendship Following Recent Legal Issues

May 22, 2025

The Status Of Blake Lively And Taylor Swifts Friendship Following Recent Legal Issues

May 22, 2025 -

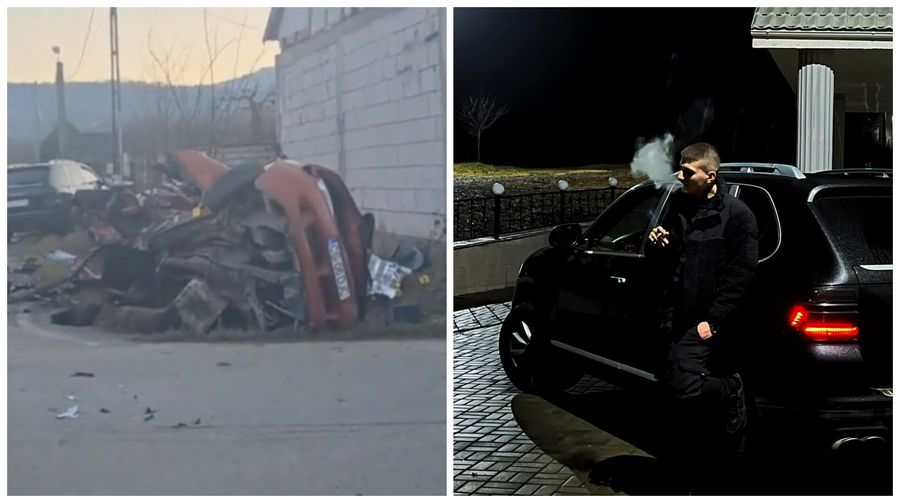

Fratii Tate In Bucuresti Parada Cu Bolidul De Lux Dupa Retinere

May 22, 2025

Fratii Tate In Bucuresti Parada Cu Bolidul De Lux Dupa Retinere

May 22, 2025