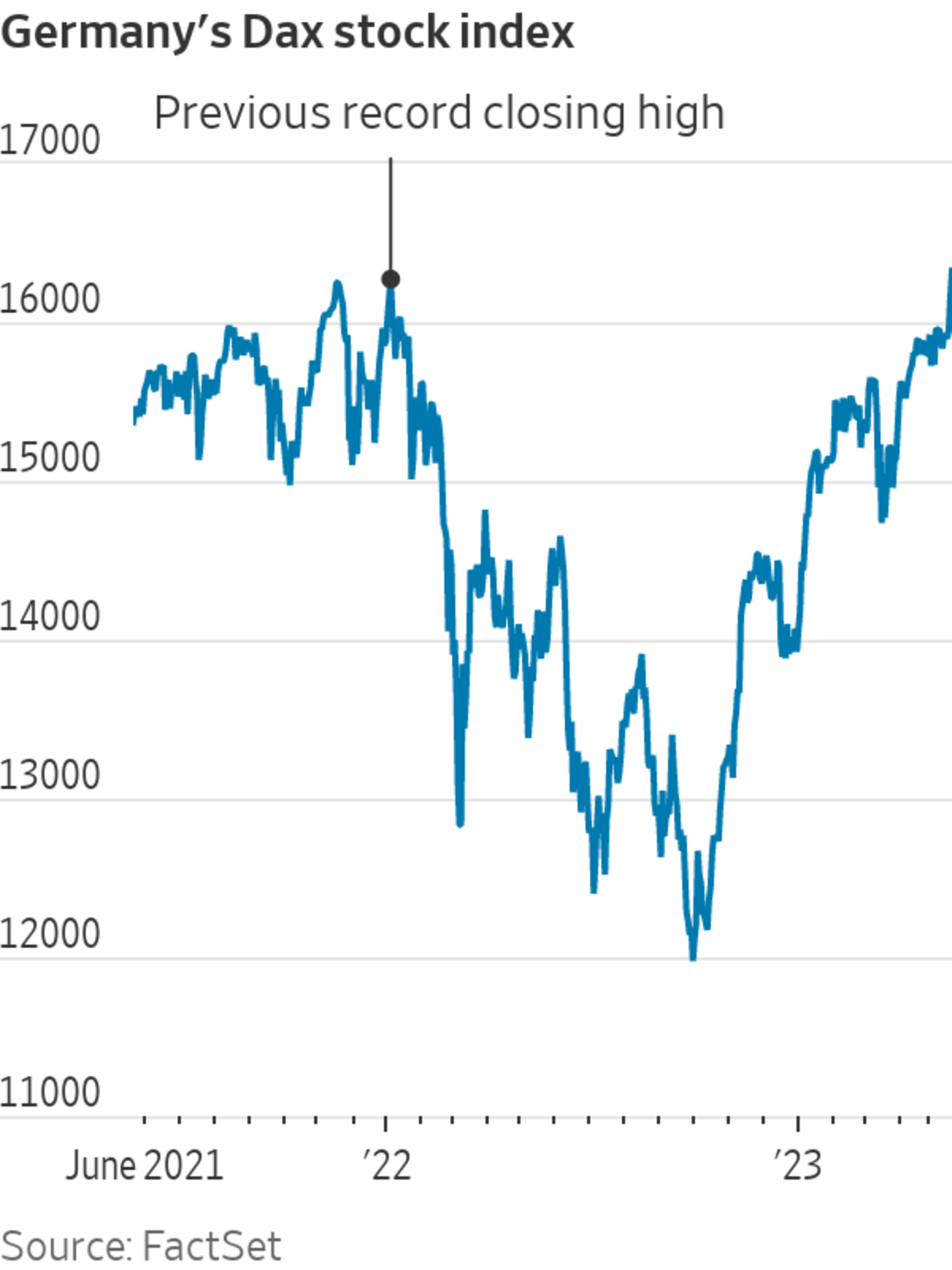

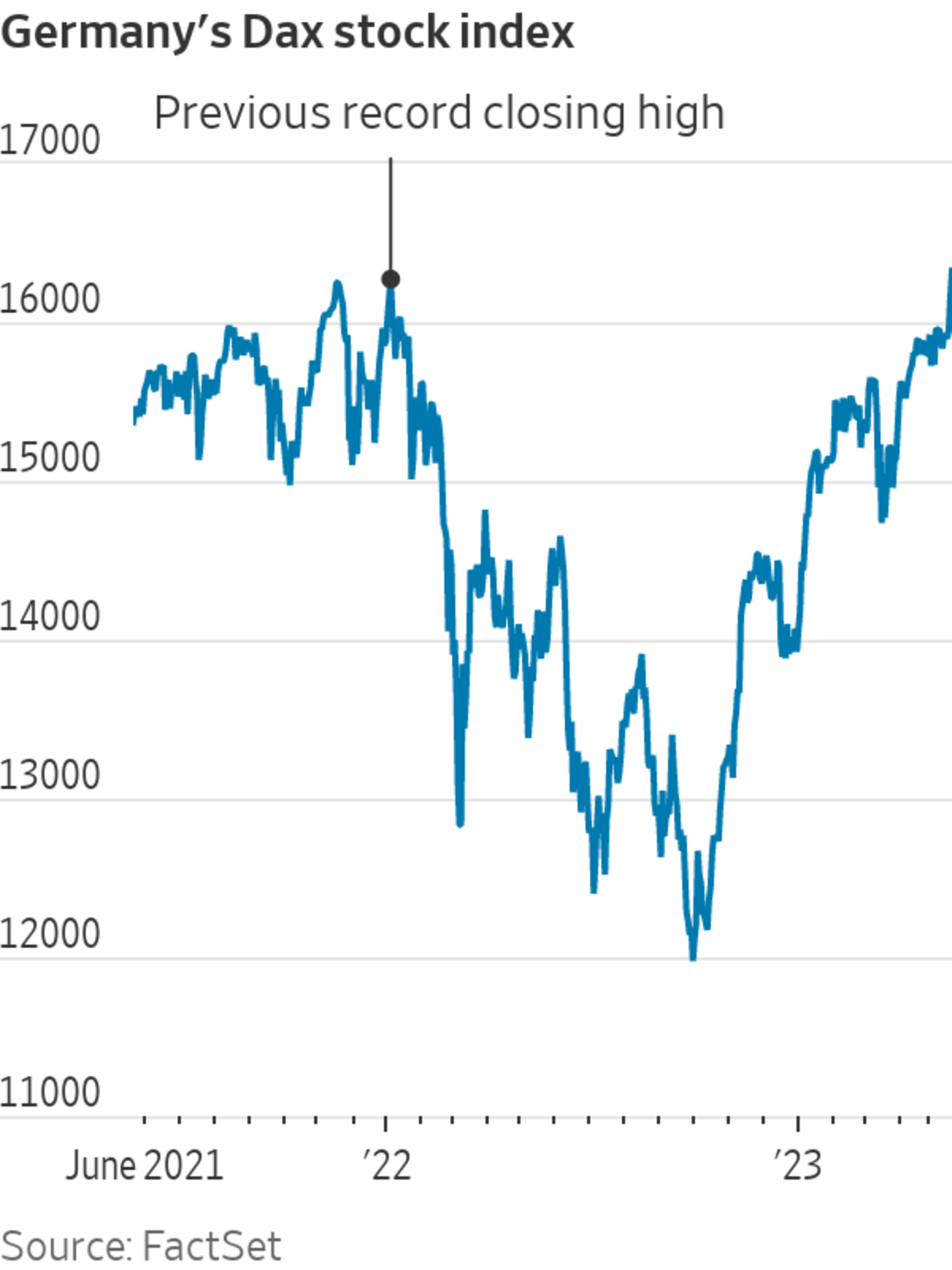

Germany's DAX Soars: Could Wall Street's Recovery Cast A Shadow?

Table of Contents

DAX's Recent Performance and Driving Factors

The DAX has shown remarkable resilience and growth in recent months. This upward trend can be attributed to several key factors contributing to the strength of the German economy.

- Strong German Exports: German companies have benefited from robust global demand, particularly in key sectors like automotive and machinery. Export figures have consistently exceeded expectations, bolstering corporate profits and investor confidence.

- Robust Industrial Production: Industrial production in Germany has shown signs of recovery, indicating a strengthening manufacturing sector. This is crucial for the DAX, as many of its constituent companies are heavily involved in manufacturing and export-oriented industries.

- Easing Inflation Concerns: While inflation remains a concern globally, Germany has seen a moderation in inflationary pressures compared to some other European nations. This easing of inflation has boosted consumer confidence and reduced pressure on the European Central Bank to aggressively raise interest rates.

- Positive Economic Indicators: Positive GDP growth figures and rising consumer confidence paint a picture of a relatively healthy German economy. These indicators suggest a sustainable economic foundation for continued DAX growth. For instance, the recent GDP growth of X% (replace X with actual data) points to a positive economic outlook.

The State of the US Economy and Wall Street's Recovery

The US economy, a major driver of global markets, is currently navigating a complex landscape. While inflation is gradually decreasing, interest rate hikes by the Federal Reserve continue to impact economic activity.

- Interest Rate Hikes: The Federal Reserve's efforts to curb inflation through interest rate hikes are creating uncertainty in the market. Higher interest rates can dampen economic growth and impact corporate investment.

- Inflation Control: The success of the Federal Reserve's inflation-control measures will significantly impact Wall Street's recovery. A faster-than-expected decline in inflation could boost investor sentiment and fuel a strong recovery. Conversely, persistent inflation could lead to prolonged market volatility.

- Corporate Earnings: Corporate earnings reports provide crucial insights into the health of US companies. Strong earnings, indicating robust economic activity and consumer spending, will be vital for Wall Street's recovery and could indirectly influence the DAX.

- Consumer Spending: Consumer spending is a significant driver of the US economy. A sustained increase in consumer spending could support corporate earnings and contribute to a strong Wall Street recovery. However, a decline in consumer spending could lead to a downturn.

- The Strong US Dollar: A strong US dollar can impact the DAX indirectly. It can make German exports more expensive in global markets and reduce the competitiveness of German companies.

DAX and Wall Street Interdependence: Correlation and Causation

Historically, the DAX and major US indices like the Dow Jones, S&P 500, and Nasdaq have exhibited a degree of correlation. This suggests that global economic events and investor sentiment can influence both markets simultaneously. However, this correlation doesn't necessarily imply direct causation.

- Global Events: Geopolitical risks, such as the ongoing war in Ukraine and escalating tensions in other parts of the world, can significantly impact both the DAX and Wall Street. Similarly, the global energy crisis influences economic growth and market sentiment in both regions.

- Investor Sentiment: Investor sentiment plays a critical role. Periods of global risk aversion often lead to sell-offs in both the DAX and US markets, illustrating a strong correlation driven by shared investor psychology.

- Portfolio Diversification: Many international investors hold diversified portfolios including both DAX and US stocks. This interconnectedness can lead to simultaneous movements in both markets, regardless of specific economic factors unique to either Germany or the US.

Potential Scenarios: Continued DAX Growth or a Wall Street-Induced Correction?

Several scenarios could unfold regarding the future performance of the DAX in light of a potential Wall Street recovery.

- Scenario 1: Continued DAX Growth: Despite a Wall Street recovery, the DAX could continue its upward trajectory. This scenario is plausible if the German economy remains robust, export markets remain strong, and investor confidence in the German market persists.

- Scenario 2: DAX Correction: A strong Wall Street recovery might lead to a DAX correction. This could occur if investors shift their focus towards the US market, leading to capital outflows from Germany and impacting the DAX. A sharp rise in the US dollar could also negatively impact German exports and the DAX's performance.

- Scenario 3: Decoupling of DAX and Wall Street: While less likely in the short term, a decoupling of the DAX and Wall Street is possible. This could happen if Germany's economy significantly outperforms the US, or if geopolitical factors disproportionately impact one market over the other.

Conclusion: Navigating the DAX's Future in a Changing Global Landscape

The relationship between the DAX and Wall Street's performance is complex and multifaceted. While a degree of correlation exists, the future performance of the DAX depends on a multitude of factors, including the strength of the German economy, global geopolitical events, and investor sentiment. The scenarios outlined highlight the uncertainty involved. Investors considering exposure to the DAX should carefully monitor both the German and US economic landscapes, paying close attention to indicators such as export performance, inflation rates, interest rates, and corporate earnings. By closely following the DAX index and Wall Street performance, investors can make better-informed decisions regarding their investment strategies in this dynamic and interconnected global market. Keep a close eye on the DAX index for optimal investment strategies.

Featured Posts

-

Burys Lost M62 Relief Road Exploring The Unbuilt Route

May 25, 2025

Burys Lost M62 Relief Road Exploring The Unbuilt Route

May 25, 2025 -

Yevrobachennya 2025 Khto Peremozhe Za Prognozom Konchiti Vurst

May 25, 2025

Yevrobachennya 2025 Khto Peremozhe Za Prognozom Konchiti Vurst

May 25, 2025 -

Ferrari Challenge Racing Days Conquer South Florida

May 25, 2025

Ferrari Challenge Racing Days Conquer South Florida

May 25, 2025 -

Dow Jones Climbs On Positive Pmi Report A Cautious Ascent

May 25, 2025

Dow Jones Climbs On Positive Pmi Report A Cautious Ascent

May 25, 2025 -

The Role Of Green Spaces In Mental Well Being A Seattle Case Study From The Pandemic

May 25, 2025

The Role Of Green Spaces In Mental Well Being A Seattle Case Study From The Pandemic

May 25, 2025

Latest Posts

-

The Future Of Bangladesh Europe Relations A Focus On Collaborative Growth

May 25, 2025

The Future Of Bangladesh Europe Relations A Focus On Collaborative Growth

May 25, 2025 -

Bangladeshs European Strategy Prioritizing Collaboration For Future Growth

May 25, 2025

Bangladeshs European Strategy Prioritizing Collaboration For Future Growth

May 25, 2025 -

Boosting Economic Growth Bangladeshs Collaborative Strategy In Europe

May 25, 2025

Boosting Economic Growth Bangladeshs Collaborative Strategy In Europe

May 25, 2025 -

The National Enquirer On Mia Farrow Ronan Farrows Involvement

May 25, 2025

The National Enquirer On Mia Farrow Ronan Farrows Involvement

May 25, 2025 -

Florida Film Festival Celebrity Sightings Mia Farrow And Christina Ricci

May 25, 2025

Florida Film Festival Celebrity Sightings Mia Farrow And Christina Ricci

May 25, 2025