Get The Best Personal Loan Interest Rates Today: A Simple Guide

Table of Contents

Understanding Personal Loan Interest Rates

Before you start your search for low interest personal loans, it's crucial to grasp the factors that determine your interest rate. Understanding these elements will empower you to make informed decisions and improve your chances of getting the best possible deal.

Factors Affecting Interest Rates

Several key factors influence the interest rate you'll receive on a personal loan. These include:

- Credit Score: Your credit score is arguably the most significant factor. A higher credit score (generally 700 or above) demonstrates creditworthiness to lenders, leading to lower interest rates. Conversely, a lower credit score typically results in higher rates, reflecting a greater perceived risk for the lender.

- Loan Amount: Generally, larger loan amounts tend to come with slightly higher interest rates. Lenders assess the risk associated with larger loans as potentially higher.

- Loan Term: The length of your loan (e.g., 12 months, 36 months, 60 months) directly impacts your interest rate. Longer loan terms usually mean lower monthly payments but higher overall interest paid. Shorter terms mean higher monthly payments but less interest paid over the life of the loan.

- Lender Type: Different lenders—banks, credit unions, and online lenders—have varying interest rate structures and lending criteria. Credit unions often offer more competitive rates for their members, while online lenders might provide a streamlined application process but potentially higher rates.

- Annual Percentage Rate (APR): The APR is the annual cost of borrowing, expressed as a percentage. It encompasses the interest rate plus any fees associated with the loan. Always compare APRs when comparing different loan offers to get a true picture of the total cost.

Types of Personal Loans and Their Rates

Personal loans are broadly categorized into secured and unsecured loans, and they can have either fixed or variable interest rates.

- Secured Loans: These loans require collateral (like a car or savings account) to secure the loan. Secured loans generally offer lower interest rates because the lender has less risk.

- Unsecured Loans: These loans don't require collateral. They tend to have higher interest rates due to the increased risk for the lender.

- Fixed-Rate Loans: The interest rate remains constant throughout the loan term, providing predictable monthly payments.

- Variable-Rate Loans: The interest rate fluctuates based on market conditions. While initially they might offer lower rates, they can increase over time, making budgeting unpredictable.

How to Find the Best Personal Loan Interest Rates

Now that you understand the factors influencing interest rates, let's explore how to actively secure the best rates for your personal loan.

Check Your Credit Score

Before applying for any loan, check your credit score. A free credit report is available annually from AnnualCreditReport.com. Knowing your score empowers you to understand where you stand and take steps to improve it if necessary.

- Improve Your Credit Score (if needed):

- Pay down existing debts.

- Pay bills on time.

- Limit new credit applications.

- Monitor your credit report regularly.

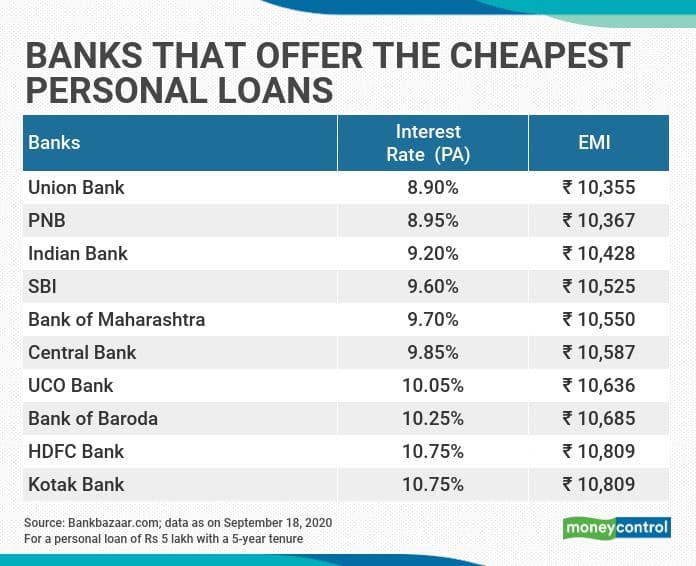

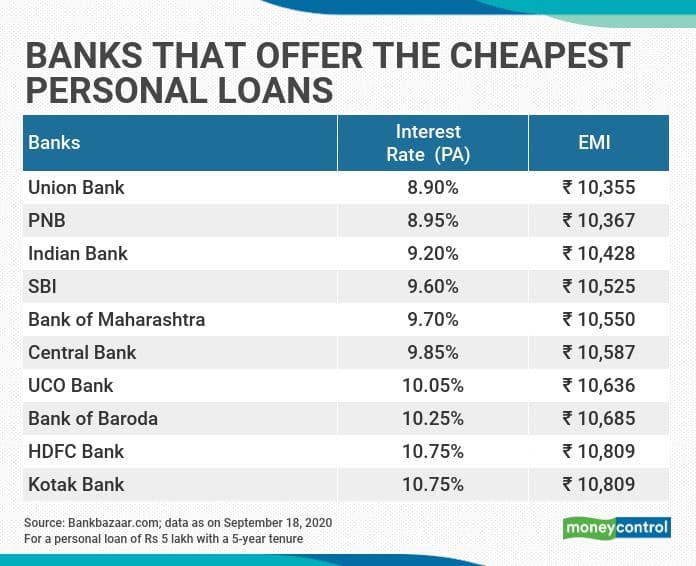

Shop Around and Compare Lenders

Don't settle for the first offer you receive. Compare personal loan offers from multiple lenders, including:

- Banks: Traditional banks offer a wide range of financial products but may have stricter lending criteria.

- Credit Unions: Credit unions often provide more competitive rates to their members.

- Online Lenders: Online lenders offer convenience and potentially faster processing times but may have higher interest rates in some cases.

Use online comparison tools to streamline the process and find the best personal loan rates tailored to your circumstances.

Negotiate with Lenders

Don't be afraid to negotiate! Especially if you have a strong credit score and multiple offers, you may be able to negotiate a lower interest rate. Having pre-approved offers from other lenders can strengthen your negotiating position.

Avoiding Personal Loan Traps

Securing a low interest personal loan also involves understanding and avoiding potential pitfalls.

Beware of High Fees

Many personal loans come with various fees that can significantly increase your overall cost. Be wary of:

- Origination Fees: These are upfront fees charged by the lender to process your application.

- Prepayment Penalties: These penalties are charged if you pay off your loan early.

- Late Payment Fees: These are charged if you miss a payment.

- Hidden Fees: Always read the fine print to avoid any unexpected costs.

Understand the Loan Terms

Before signing any loan agreement, meticulously review all the terms and conditions. Pay close attention to:

- Repayment Schedule: Understand your monthly payment amount and the total repayment period.

- Interest Capitalization: This is when accrued interest is added to the principal loan amount, increasing the total amount you owe.

- Default Penalties: Understand the consequences of missing payments.

Conclusion

Getting the best personal loan interest rates involves understanding the factors that influence your rate, actively comparing offers from various lenders, and negotiating effectively. By checking your credit score, shopping around, and carefully reviewing loan terms, you can significantly reduce the overall cost of your personal loan. Remember to be wary of hidden fees and always prioritize transparency. Get the best personal loan interest rates today! Start comparing offers now and find the ideal personal loan rates tailored to your financial needs. Secure the lowest personal loan interest rates and take control of your borrowing costs.

Featured Posts

-

Concussion Concerns Padres Arraez Sidelined After Field Collision

May 28, 2025

Concussion Concerns Padres Arraez Sidelined After Field Collision

May 28, 2025 -

Padres Embark On Road Trip Starting In Toronto

May 28, 2025

Padres Embark On Road Trip Starting In Toronto

May 28, 2025 -

Nintendos New Era A Pragmatic Approach To Gaming

May 28, 2025

Nintendos New Era A Pragmatic Approach To Gaming

May 28, 2025 -

Prakiraan Cuaca Jawa Tengah 23 April Hujan Lebat Di Beberapa Daerah

May 28, 2025

Prakiraan Cuaca Jawa Tengah 23 April Hujan Lebat Di Beberapa Daerah

May 28, 2025 -

Arsenal News Arteta U Turn On 76m Striker Eyes 60m Mbappe Style Star

May 28, 2025

Arsenal News Arteta U Turn On 76m Striker Eyes 60m Mbappe Style Star

May 28, 2025