Gibraltar Industries (ROCK) Earnings Preview: What To Expect

Table of Contents

Recent Market Trends and Their Impact on Gibraltar Industries (ROCK)

The building materials market's health significantly impacts Gibraltar Industries' performance. Several macroeconomic factors are at play:

-

Housing Market Dynamics: The current state of housing starts and construction activity is a critical indicator. Strong growth in new home construction directly translates to higher demand for Gibraltar Industries' products, while a slowdown would likely negatively affect revenue. Analyzing permits issued and housing inventory levels provides valuable insights.

-

Inflationary Pressures and Supply Chain Disruptions: Inflation significantly impacts production costs. Rising prices for steel, aluminum, and other raw materials directly affect Gibraltar Industries' margins. Supply chain bottlenecks can lead to production delays and increased expenses. Monitoring commodity price indices and industry reports on supply chain resilience is crucial.

-

Commodity Price Volatility: Fluctuations in steel and aluminum prices are particularly important to watch. These are key components in many of Gibraltar Industries' products. Sharp increases can squeeze profit margins, while decreases could offer opportunities for increased profitability. Tracking metal futures markets and analyzing industry forecasts are essential for predicting future trends.

-

Macroeconomic Environment: The overall economic climate plays a significant role. Factors such as interest rates, consumer confidence, and overall economic growth directly influence consumer spending on home improvement and new construction – impacting demand for building products.

Key Performance Indicators (KPIs) to Watch for Gibraltar Industries (ROCK)

Investors should closely monitor several key performance indicators (KPIs) when the Q[Quarter] earnings are released:

-

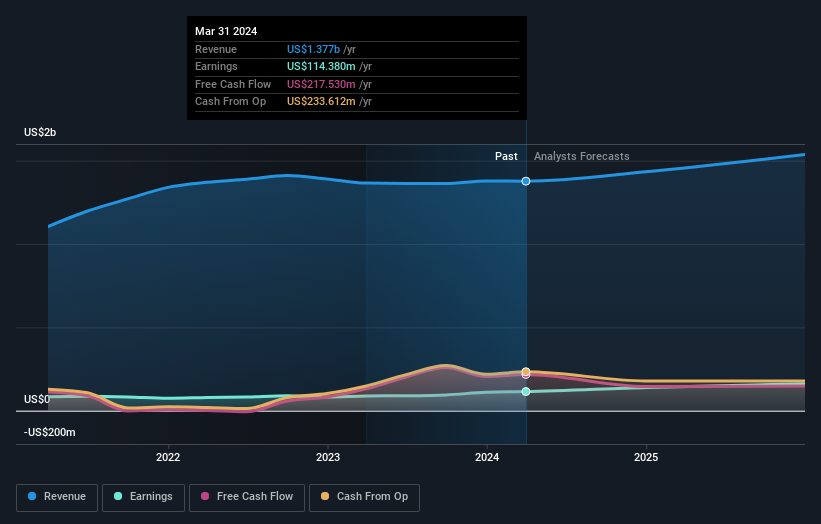

Revenue Growth: Year-over-year and quarter-over-quarter revenue growth will reveal the company's success in generating sales. A strong increase indicates robust demand for its products.

-

Net Income and Earnings Per Share (EPS): These metrics reflect the company's profitability. Comparing them to previous quarters and analyst estimates will provide a clear picture of performance.

-

Gross and Operating Margins: These margins illustrate the efficiency of Gibraltar Industries' operations. Compression in margins due to rising costs or reduced sales volume would raise concerns.

-

Debt-to-Equity Ratio: This ratio indicates the company's financial leverage. A high ratio might suggest increased financial risk.

-

Free Cash Flow: This KPI shows the cash generated by the business after accounting for capital expenditures. Strong free cash flow indicates the company's ability to fund growth, pay down debt, or return capital to shareholders.

Analyst Expectations and Price Target for ROCK Stock

Before the official announcement, it's crucial to review analyst predictions:

-

Consensus Estimates: The average earnings per share (EPS) estimate from leading analysts provides a benchmark against which to measure the actual results. Significant deviations from the consensus could impact the stock price.

-

Price Target Range: Analyst price targets offer a range of potential future stock prices. A wide range suggests uncertainty, while a narrow range implies greater consensus.

-

Buy, Sell, or Hold Ratings: Analyst ratings reflect their overall assessment of the stock's prospects. A preponderance of buy ratings suggests positive sentiment, while a significant number of sell ratings might indicate caution.

-

Market Reaction: The market's reaction to the actual earnings report will likely depend on whether the results meet or exceed analyst expectations. Positive surprises tend to boost the stock price, while negative surprises can lead to declines.

Potential Risks and Opportunities for Gibraltar Industries (ROCK)

Gibraltar Industries faces several potential risks and opportunities:

-

Competition: Intense competition from other building products manufacturers could pressure margins and hinder revenue growth.

-

Regulatory Changes: Changes in building codes or environmental regulations can impact the production and sales of certain products.

-

Technological Advancements: The adoption of new technologies in the construction industry could create both opportunities and challenges for Gibraltar Industries.

-

Market Volatility: Economic downturns or unexpected market disruptions can negatively affect demand for building products.

Conclusion

This earnings preview for Gibraltar Industries (ROCK) has examined key market trends, important KPIs, analyst expectations, and potential risks and opportunities. Understanding these factors provides a more informed perspective on the upcoming earnings announcement and its potential implications for investors.

Call to Action: Stay tuned for the official Gibraltar Industries (ROCK) earnings release and continue following our analysis for further insights into the building products sector and the performance of ROCK stock. Keep an eye on our site for ongoing coverage and analysis of Gibraltar Industries and other key players in the building materials market. Remember to conduct your own thorough research before making any investment decisions related to Gibraltar Industries (ROCK) or any other stock.

Featured Posts

-

Gaza Hostages Families Confront A Continuing Nightmare

May 13, 2025

Gaza Hostages Families Confront A Continuing Nightmare

May 13, 2025 -

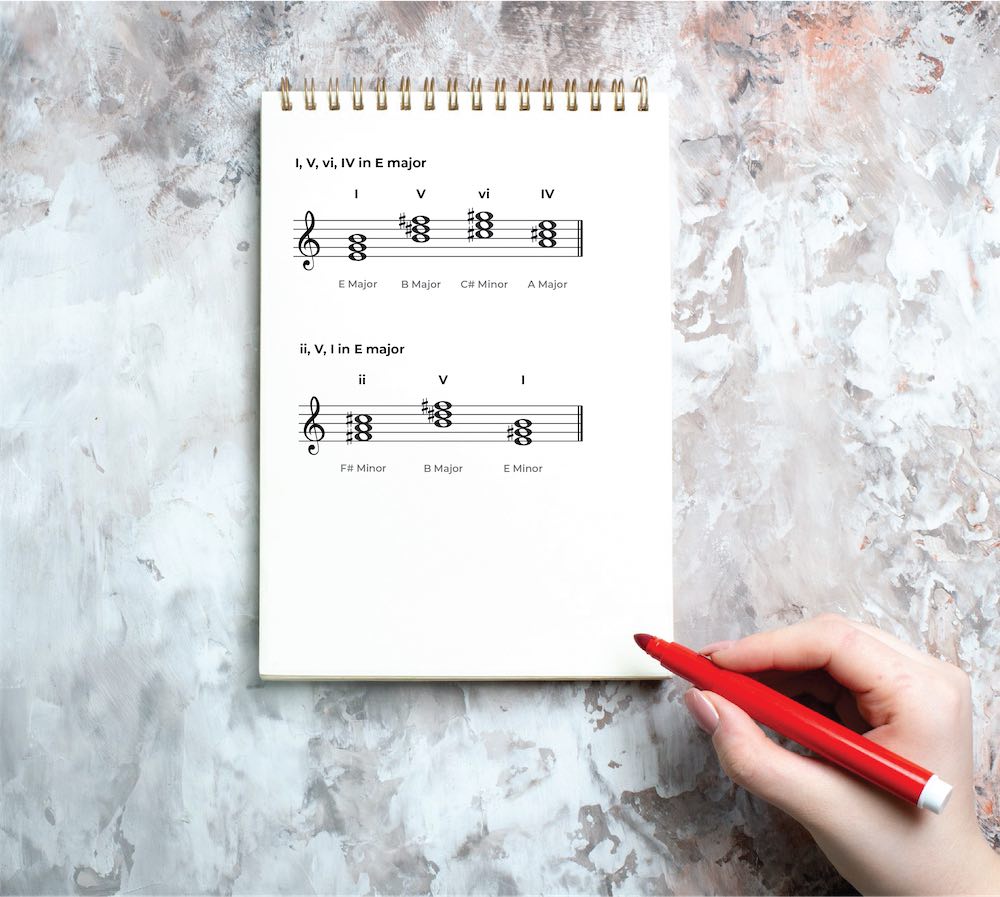

Cp Music Productions Experience The Harmony Of A Father Son Musical Team

May 13, 2025

Cp Music Productions Experience The Harmony Of A Father Son Musical Team

May 13, 2025 -

Drug Middlemen Reforms Republicans Revive Efforts In Budget Bill

May 13, 2025

Drug Middlemen Reforms Republicans Revive Efforts In Budget Bill

May 13, 2025 -

Doom Eternal The Dark Ages Expansion Play Station 5 Exclusive Location

May 13, 2025

Doom Eternal The Dark Ages Expansion Play Station 5 Exclusive Location

May 13, 2025 -

Federal Investigation Millions Lost In Corporate Email Data Breach

May 13, 2025

Federal Investigation Millions Lost In Corporate Email Data Breach

May 13, 2025