Gold Investment: Price Increase After Trump's Recent Statements

Table of Contents

Trump's Statements and Their Market Impact

Trump's recent comments have created significant uncertainty, influencing investor behavior and driving up the price of gold. Understanding the specific statements and their context is crucial to grasping the market reaction.

The Specific Statements

While pinpointing the exact statements requires careful analysis of multiple sources, several pronouncements from Trump regarding [insert specific policy, e.g., fiscal policy, trade relations, etc.] have been cited as catalysts for the gold price increase. For instance, [insert quote or paraphrased statement with citation and link to credible news source, e.g., "In a recent interview with Fox News, Trump stated…," link to article]. These statements, interpreted by the market as [explain market interpretation, e.g., potentially inflationary, increasing geopolitical risks, etc.], triggered a wave of activity within the gold market. Another statement [insert another quote or paraphrased statement with citation and link to credible news source] further fueled this effect.

Market Reaction and Volatility

The immediate market reaction to Trump's statements was swift and dramatic. Gold prices experienced a sharp increase, with [insert specific data, e.g., a 2% surge within hours of the statement's release]. Trading volume also spiked, indicating heightened investor interest and activity.

- Increase in Gold Futures Contracts: The number of gold futures contracts traded increased significantly, reflecting a surge in speculative activity.

- Impact on Other Related Markets: The dollar index experienced a slight weakening [insert data on dollar movement percentage] in response to Trump's comments, further bolstering gold's price. Other precious metals, such as silver and platinum, also saw upward movements, reflecting a broader shift in investor sentiment.

- Percentage Increase in Gold Prices: Gold prices saw an increase of [insert percentage] within [timeframe] following Trump's statements. [Include a chart or graph visually representing this price movement].

Underlying Factors Driving Gold Investment Demand

Several underlying factors, in addition to Trump's statements, are contributing to the increased demand for gold investment. These include inflationary pressures, geopolitical uncertainty, and the weakening US dollar.

Inflationary Pressures

Trump's statements, depending on their content, could potentially fuel inflationary concerns. For example, [explain how specific statement might lead to inflation, e.g., promises of increased government spending could lead to higher inflation].

- Current Inflation Rate and Projections: The current inflation rate is [insert current inflation data] and projections suggest [insert projected inflation rates].

- Gold's Historical Performance During Inflationary Periods: Historically, gold has served as a reliable inflation hedge, maintaining or increasing its value during periods of high inflation.

- Role of Government Spending and Monetary Policy: Government spending and monetary policy decisions play a significant role in shaping inflationary pressures and influencing gold investment decisions.

Geopolitical Uncertainty

Trump's pronouncements may exacerbate existing geopolitical uncertainties, making gold, a traditional safe-haven asset, even more attractive. [Explain how the statement relates to geopolitical instability].

- Specific Geopolitical Events Influencing the Gold Market: [Mention specific events and their impact on the gold market].

- Gold as a Safe Haven During Times of Political Instability: Investors often flock to gold during periods of political turmoil as a way to protect their assets from potential losses.

- Correlation Between Geopolitical Risk and Gold Prices: There is a strong correlation between heightened geopolitical risks and rising gold prices.

Weakening US Dollar

A weakening US dollar often leads to increased demand for gold, as it becomes cheaper for investors holding other currencies. Trump's statements, depending on their effect on the US economy and global confidence in the dollar, may contribute to this phenomenon.

- Current State of the US Dollar: The US dollar is currently [describe current state of the US dollar, strong, weak, etc. with supporting data].

- Relationship Between the US Dollar and Gold Prices: Gold and the US dollar generally have an inverse relationship. A weaker dollar usually means a stronger gold price.

- Data Demonstrating the Correlation: [Provide data showing the correlation between USD and gold prices].

Conclusion

The recent surge in gold investment is a complex issue driven by a combination of factors. Trump's statements, coupled with existing inflationary pressures, geopolitical uncertainty, and a potentially weakening US dollar, have created a perfect storm for increased demand in the gold market. Gold remains a significant investment option for diversification and hedging against economic uncertainty. Understanding the dynamics of gold trading and the gold market is crucial for making informed investment decisions.

Call to Action: Consider carefully the implications of Trump's statements and the current market conditions before making any gold investment decisions. Conduct thorough research and consult with a financial advisor before investing in gold. Learn more about strategic gold investment opportunities today. Consider diversifying your portfolio with gold to mitigate risks and potentially capitalize on future price increases. Research different gold investment options – physical gold, gold ETFs, or gold mining stocks – to find the best fit for your investment strategy. Remember to always do your own due diligence before any gold investment.

Featured Posts

-

Eurovision 2025 Getting To Know Remember Monday The Uks Chosen Artists

Apr 25, 2025

Eurovision 2025 Getting To Know Remember Monday The Uks Chosen Artists

Apr 25, 2025 -

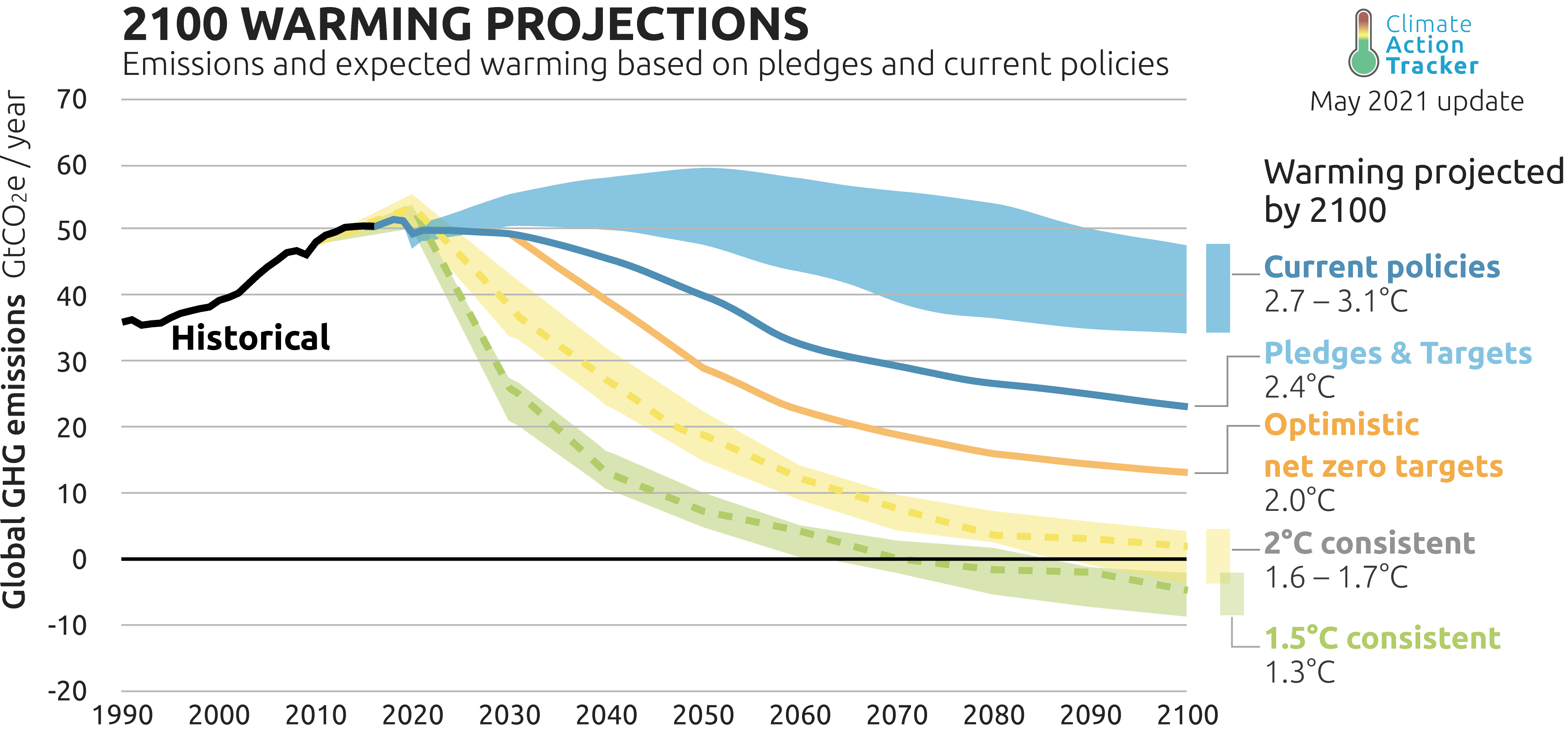

Tougher Emissions Targets Xis Climate Commitment For Chinas Independent Action

Apr 25, 2025

Tougher Emissions Targets Xis Climate Commitment For Chinas Independent Action

Apr 25, 2025 -

California Wildfires Impact On Celebrities In The Palisades

Apr 25, 2025

California Wildfires Impact On Celebrities In The Palisades

Apr 25, 2025 -

Anzac Day Attendance Sherwood Ridge Primary Schools Religious Exemption

Apr 25, 2025

Anzac Day Attendance Sherwood Ridge Primary Schools Religious Exemption

Apr 25, 2025 -

16 Million Fine For T Mobile Details Of Three Year Data Breach Settlement

Apr 25, 2025

16 Million Fine For T Mobile Details Of Three Year Data Breach Settlement

Apr 25, 2025

Latest Posts

-

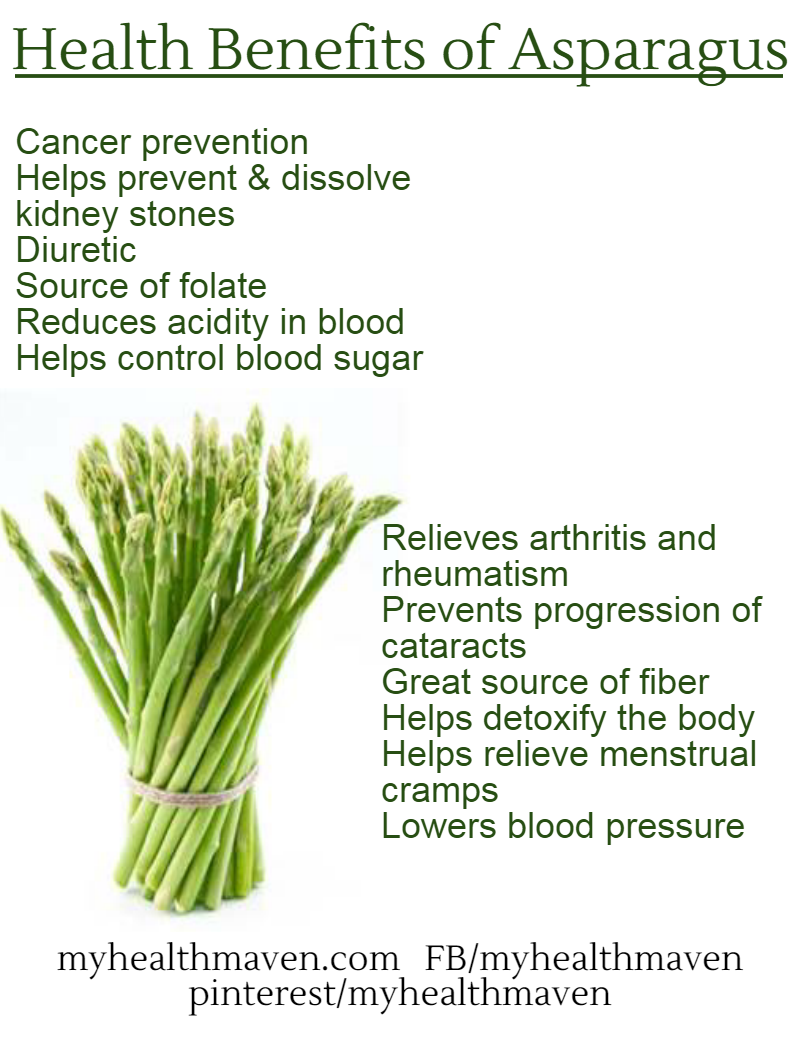

Asparagus Nutrition How This Vegetable Supports Your Well Being

Apr 30, 2025

Asparagus Nutrition How This Vegetable Supports Your Well Being

Apr 30, 2025 -

Cdu Spd Coalition Talks Key Issues And Potential Outcomes

Apr 30, 2025

Cdu Spd Coalition Talks Key Issues And Potential Outcomes

Apr 30, 2025 -

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025 -

Is Asparagus Good For You Exploring The Health Advantages Of Asparagus

Apr 30, 2025

Is Asparagus Good For You Exploring The Health Advantages Of Asparagus

Apr 30, 2025 -

How Healthy Is Asparagus Nutritional Benefits And Health Effects

Apr 30, 2025

How Healthy Is Asparagus Nutritional Benefits And Health Effects

Apr 30, 2025