Gold Price Surge: Trump's EU Threats Fuel Trade War Fears

Table of Contents

Trump's Trade Policies and Their Impact on Gold Prices

President Trump's protectionist trade policies have created significant uncertainty in global markets. His administration's actions, including the imposition of tariffs on various goods from the EU and threats of further levies, have directly contributed to the current gold price surge. These actions represent a significant shift in global trade dynamics, triggering investor anxiety.

- Specific tariff announcements and their potential effects on global markets: The threat of tariffs on automobiles and agricultural products from the EU, for example, has created considerable uncertainty for businesses involved in these sectors, impacting their investment decisions and overall market sentiment. This uncertainty translates directly into increased demand for gold.

- Examples of industries affected: The automotive industry, agricultural producers, and numerous other sectors reliant on transatlantic trade face significant disruptions. This uncertainty ripples throughout the global economy.

- Market reactions to these announcements: Stock markets often react negatively to trade war escalations, reflecting investor concern about the potential negative impact on corporate profits and economic growth. This negative sentiment often leads investors to seek refuge in gold.

Historically, periods of heightened trade uncertainty have been strongly correlated with rising gold prices. Investors view gold as a hedge against risk, and the current climate of uncertainty is driving increased demand. Investor sentiment, characterized by risk aversion, plays a crucial role in this surge.

Gold as a Safe Haven Asset During Times of Economic Uncertainty

Gold's status as a safe haven asset is deeply rooted in its historical performance and inherent properties. It’s often viewed as a store of value that holds its worth even during times of economic turmoil.

- Gold's historical performance during periods of economic crisis: Throughout history, gold has shown a remarkable ability to maintain its value, or even appreciate, during economic crises and periods of geopolitical instability. This makes it an attractive investment during uncertain times.

- Its lack of correlation with other asset classes: Unlike stocks and bonds, gold often displays a negative or weak correlation with other asset classes. This makes it a valuable tool for portfolio diversification, helping to reduce overall portfolio volatility.

- Its role as a hedge against inflation: Gold is often considered a hedge against inflation because its price tends to rise when the purchasing power of fiat currencies declines.

Current geopolitical events, including the ongoing US-EU trade dispute and other global uncertainties, are significantly affecting investor confidence. This loss of confidence fuels increased demand for gold, further driving up its price. The anxieties surrounding potential economic downturns are bolstering gold's appeal as a secure investment.

Analyzing the Current Gold Market and Predicting Future Trends

The current gold market is characterized by significant volatility, reflecting the ongoing uncertainty surrounding global trade. The price of gold is reacting sensitively to every development in the US-EU trade negotiations and other geopolitical events.

- Analysis of recent gold price movements: Recent price movements show a clear correlation with the escalation and de-escalation of trade tensions. Any hint of a trade deal often leads to a decrease in gold's price, while renewed threats of tariffs result in a price increase.

- Key factors influencing the short-term and long-term outlook for gold: Short-term price movements are heavily influenced by news related to trade negotiations and other geopolitical events. Long-term trends are likely influenced by broader economic factors such as inflation and interest rates.

- Potential impact of central bank policies on gold prices: Central bank policies, particularly interest rate decisions, can significantly impact the price of gold. Low interest rates can boost demand for gold as an alternative investment.

Predicting future gold prices is inherently challenging due to the many influencing factors. However, given the current climate of uncertainty, a continued upward trend in gold prices remains a plausible scenario. The interplay of supply and demand will, as always, play a crucial role in determining the price.

Alternative Investment Options During a Trade War

While gold offers a compelling safe haven during trade wars, diversifying your portfolio is crucial. Other options include:

- Government bonds: Considered relatively low-risk investments, government bonds offer stability but may not offer high returns during periods of inflation.

- US Treasury Bills: Short-term government debt securities considered extremely safe, though their returns may be limited.

- Diversification strategies: A well-diversified portfolio across different asset classes is generally recommended to mitigate risks during times of economic uncertainty.

Conclusion

The current gold price surge is a direct consequence of President Trump's aggressive trade policies towards the EU, creating widespread uncertainty and fueling fears of a protracted trade war. This uncertainty has driven investors towards gold as a safe haven asset, leading to increased demand and higher prices. Understanding the interplay between trade tensions, investor sentiment, and the unique characteristics of gold as a safe haven is key to navigating this volatile market. Future gold price movements will likely be heavily influenced by the ongoing trade negotiations and broader global economic conditions.

Understanding the factors driving the current gold price surge is crucial for investors navigating these turbulent times. Stay informed about the evolving trade landscape and consider diversifying your portfolio with gold as a crucial hedge against trade war fears. Keep an eye on the gold price surge and its implications for your investment strategy. Monitor updates on the US-EU trade relations to make informed decisions about your investments in the face of future gold price surges.

Featured Posts

-

Euro Boelgesi Enflasyonu Ve Ecb Baskani Lagarde In Stratejisi

May 27, 2025

Euro Boelgesi Enflasyonu Ve Ecb Baskani Lagarde In Stratejisi

May 27, 2025 -

We Found 6 Easter Eggs In The Alien Earth Shorts Sxsw 2025

May 27, 2025

We Found 6 Easter Eggs In The Alien Earth Shorts Sxsw 2025

May 27, 2025 -

The Extreme Measures Mila Kunis Took To Prepare For Ashton Kutchers Role

May 27, 2025

The Extreme Measures Mila Kunis Took To Prepare For Ashton Kutchers Role

May 27, 2025 -

They Were Every Students Nightmare The Return Of Blue Books

May 27, 2025

They Were Every Students Nightmare The Return Of Blue Books

May 27, 2025 -

Aljzayryt Lltyran Nhw Alryadt Fy Alswq Alafryqy

May 27, 2025

Aljzayryt Lltyran Nhw Alryadt Fy Alswq Alafryqy

May 27, 2025

Latest Posts

-

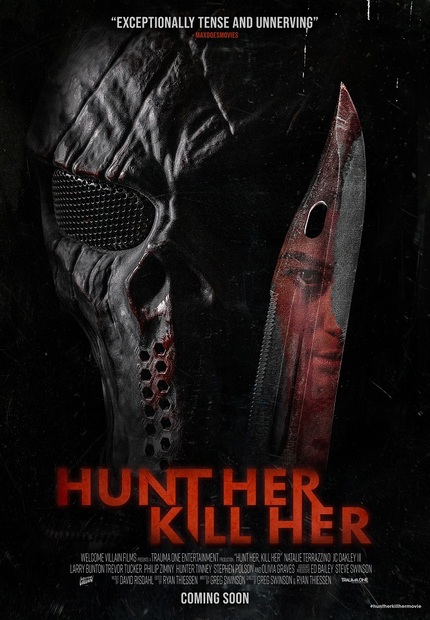

Louisiana Horror Film Sinners Coming Soon To A Theater Near You

May 29, 2025

Louisiana Horror Film Sinners Coming Soon To A Theater Near You

May 29, 2025 -

Louisiana Horror Film Sinners Premieres In Theaters

May 29, 2025

Louisiana Horror Film Sinners Premieres In Theaters

May 29, 2025 -

Sinners Louisiana Horror Films Theatrical Release Date Announced

May 29, 2025

Sinners Louisiana Horror Films Theatrical Release Date Announced

May 29, 2025 -

Upcoming Horror Movie Sinners Filmed In Louisiana

May 29, 2025

Upcoming Horror Movie Sinners Filmed In Louisiana

May 29, 2025 -

Louisiana Horror Film Sinners To Hit Theaters

May 29, 2025

Louisiana Horror Film Sinners To Hit Theaters

May 29, 2025