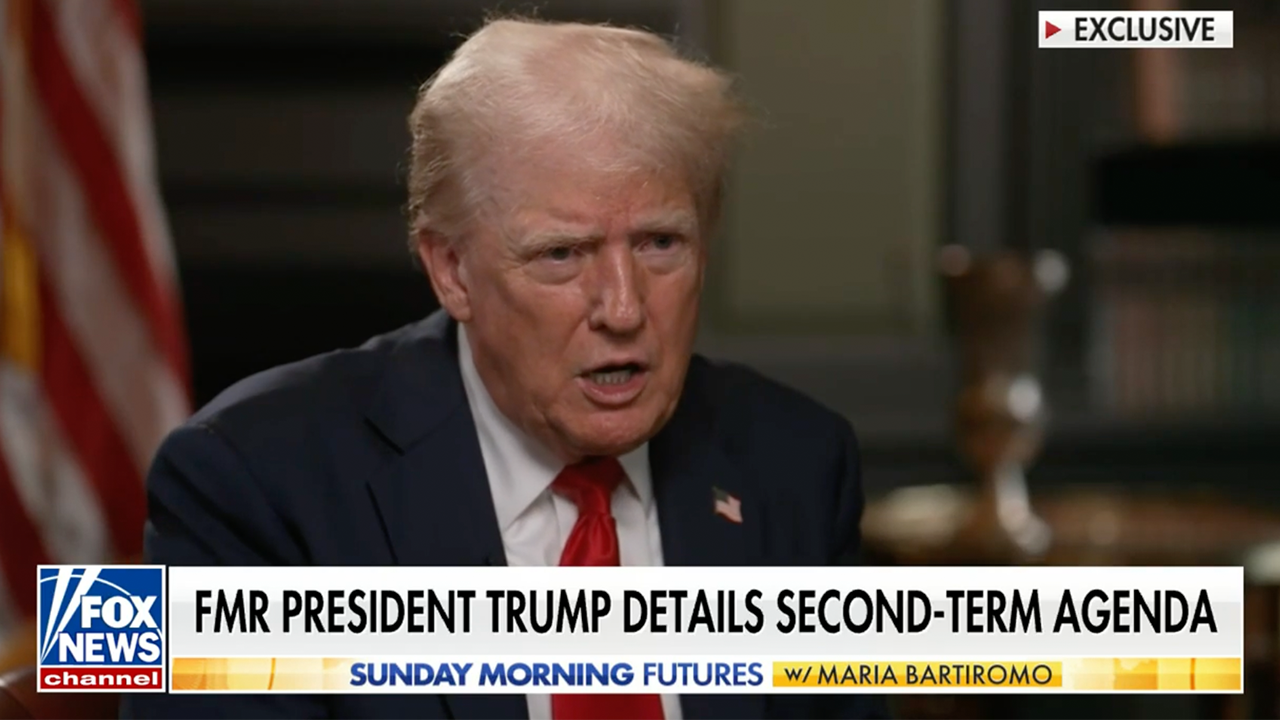

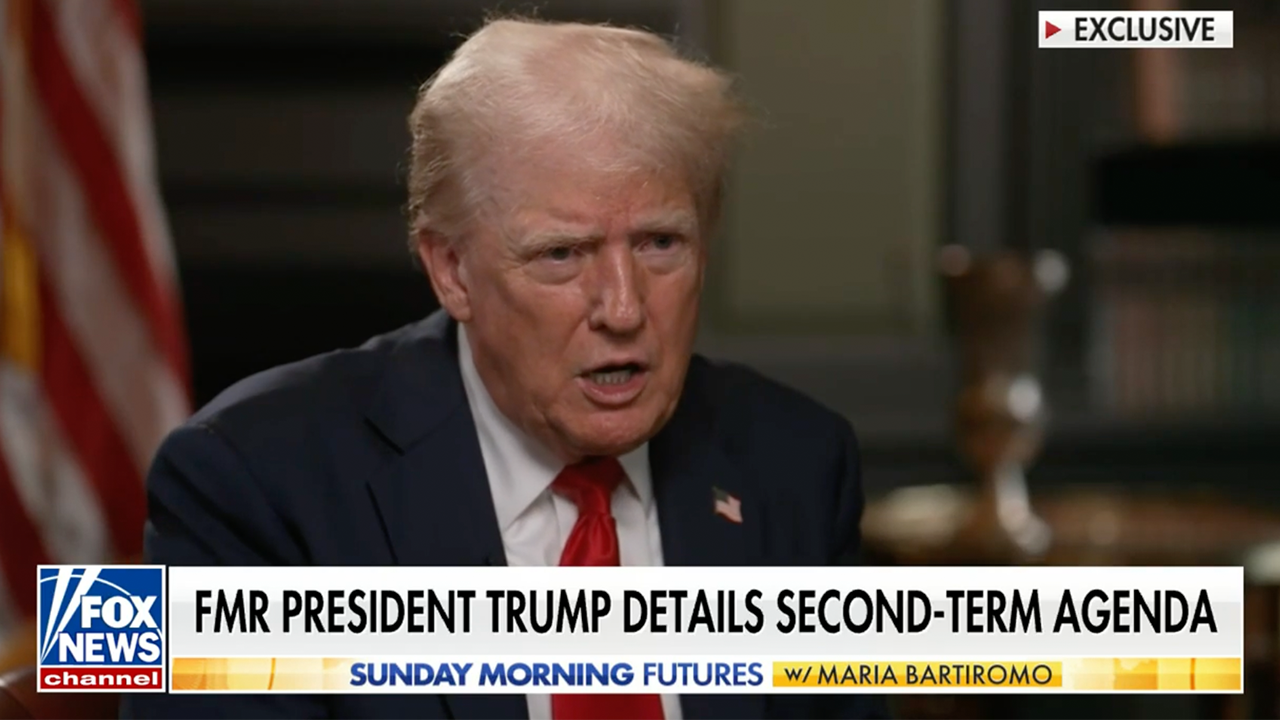

Gold Prices Jump After Trump's Conciliatory Remarks

Table of Contents

Trump's Remarks and Their Impact on Market Sentiment

President Trump's recent conciliatory statements regarding trade disputes, specifically those concerning China, significantly impacted market sentiment and gold prices. These remarks, contrasting sharply with his previously aggressive trade rhetoric, created a wave of optimism and reduced investor risk aversion. The keywords here are Trump's trade policy, market volatility, investor confidence, and gold as a safe haven.

- Key Statements: Trump's comments hinted at a potential de-escalation of the trade war, suggesting a willingness to compromise and find common ground with China. Specific details about the concessions offered are crucial for a complete analysis.

- Shift in Tone: This marked a significant departure from his earlier pronouncements, characterized by strong tariffs and aggressive trade actions. Investors had become accustomed to expecting higher volatility and uncertainty due to previous statements.

- Immediate Market Reaction: The stock market reacted positively to the news, with major indices experiencing a noticeable increase. However, the gold market showed an equally noteworthy reaction, indicating a complex interplay of factors.

- The Unexpected Gold Price Jump: Traditionally, a decrease in trade tensions and increased investor confidence is negative for gold, as it is seen as a safe haven asset. The price increase highlights the unexpected nature of the situation and the importance of other influencing factors.

Gold as a Safe Haven Asset

Gold has long held a position as a preferred safe haven asset, particularly during periods of economic uncertainty or geopolitical instability. Investors often turn to gold when market confidence is low, seeking to preserve capital and hedge against potential losses in other asset classes. This section focuses on safe haven assets, gold investment, risk aversion, economic uncertainty, and inflation hedging.

- Defining a Safe Haven Asset: A safe haven asset is characterized by its stability and low correlation with other asset classes. It typically provides a store of value during times of market turmoil.

- Historical Relationship: Throughout history, gold prices have frequently shown a positive correlation with periods of geopolitical tension or economic crises, acting as a hedge against inflation.

- Inflation Concerns: High inflation erodes the purchasing power of fiat currencies. Gold, being a finite resource, tends to retain its value or even appreciate in times of high inflation, acting as an inflation hedge.

Analyzing the Gold Price Surge: Other Contributing Factors

While Trump's conciliatory remarks played a pivotal role, other factors contributed to the recent gold price increase. These include market speculation, currency fluctuations (especially the US dollar), and changes in global interest rates. Here, the keywords are gold price volatility, market speculation, currency fluctuations, US dollar, and interest rates.

- US Dollar Performance: The inverse relationship between the US dollar and gold prices needs to be considered. A weakening dollar can boost demand for gold, increasing its price.

- Global Interest Rates: Low interest rates often make gold a more attractive investment as it offers a store of value without the low returns associated with low-yield bonds.

- Market Speculation and Institutional Investment: Speculative trading and significant institutional investments in gold can also drive price fluctuations independently of fundamental economic factors.

The Future of Gold Prices: Predictions and Outlook

Predicting future gold prices is inherently challenging, due to the complex interplay of economic and geopolitical factors. However, by analyzing current trends and expert opinions, we can formulate a cautious outlook. Key terms here include gold price forecast, investment strategy, gold market outlook, and the future of gold.

- Expert Opinions: Various analysts offer diverse predictions about gold's future trajectory, reflecting the uncertainty in the market. A summary of prevalent views from reputable sources adds value.

- Influencing Factors: Continued trade developments (positive or negative), global economic growth rates, inflation levels, and other geopolitical events all significantly influence gold price movements.

Conclusion

This article has explored the reasons behind the recent surge in gold prices following President Trump's conciliatory remarks. While the unexpected shift in rhetoric played a crucial role, other factors like market speculation and the inherent safe-haven nature of gold also contributed to the price increase. The future direction of gold prices remains uncertain, subject to various economic and geopolitical factors.

Understanding the fluctuating dynamics of gold prices is crucial for investors. Stay informed about the latest developments impacting gold prices and adjust your investment strategy accordingly. Learn more about navigating the gold market and making informed decisions about gold investment.

Featured Posts

-

Choosing Makeup That Benefits Your Skin

Apr 25, 2025

Choosing Makeup That Benefits Your Skin

Apr 25, 2025 -

Increased Rent In La After Fires A Look At Price Gouging Claims

Apr 25, 2025

Increased Rent In La After Fires A Look At Price Gouging Claims

Apr 25, 2025 -

Is Ashton Jeanty The Chicago Bears 2025 Nfl Draft Target Analyzing The Hype

Apr 25, 2025

Is Ashton Jeanty The Chicago Bears 2025 Nfl Draft Target Analyzing The Hype

Apr 25, 2025 -

Newsoms Podcast Announcement Ignites Social Media Gaslighting Firestorm

Apr 25, 2025

Newsoms Podcast Announcement Ignites Social Media Gaslighting Firestorm

Apr 25, 2025 -

Nfl Mock Draft 2024 Saints Target Alvin Kamaras Replacement In Top 10

Apr 25, 2025

Nfl Mock Draft 2024 Saints Target Alvin Kamaras Replacement In Top 10

Apr 25, 2025

Latest Posts

-

Dragon Den Shock Unexpected Deal After Tense Showdown

May 01, 2025

Dragon Den Shock Unexpected Deal After Tense Showdown

May 01, 2025 -

Hdafy Aldwry Alinjlyzy Haland Ywse Alfarq Bed Hdfh Fy Mrma Twtnham

May 01, 2025

Hdafy Aldwry Alinjlyzy Haland Ywse Alfarq Bed Hdfh Fy Mrma Twtnham

May 01, 2025 -

Ahdth Trtyb Hdafy Aldwry Alinjlyzy Haland Ywasl Talqh

May 01, 2025

Ahdth Trtyb Hdafy Aldwry Alinjlyzy Haland Ywasl Talqh

May 01, 2025 -

Targets Revised Dei Strategy What Happened And What It Means

May 01, 2025

Targets Revised Dei Strategy What Happened And What It Means

May 01, 2025 -

Haland Ysjl Wytrbe Ela Ersh Hdafy Aldwry Alinjlyzy

May 01, 2025

Haland Ysjl Wytrbe Ela Ersh Hdafy Aldwry Alinjlyzy

May 01, 2025