Gold Slumps: Back-to-Back Weekly Declines Mark 2025 Trend

Table of Contents

Factors Contributing to the Gold Price Slump

Several intertwined factors are contributing to the current gold price slump and the uncertain gold price forecast 2025. Understanding these elements is crucial for investors seeking to manage their gold investment wisely.

Strengthening US Dollar

The US dollar and gold prices share an inverse relationship. A stronger dollar makes gold more expensive for those holding other currencies, thus dampening demand. Recent economic indicators point to a strengthening US dollar, contributing significantly to the current gold market decline.

- Recent US Economic Indicators: Positive economic data, such as strong employment figures and robust consumer spending, have boosted investor confidence in the US economy. This bolsters the dollar's value.

- Federal Reserve Policy: The Federal Reserve's monetary policy decisions significantly influence the dollar's strength. While interest rate hikes have recently paused, the expectation of future increases continues to support the dollar.

- US Dollar Index Percentage Change: The US Dollar Index (DXY) has seen a notable increase of X% in the past [time period], directly correlating with the decline in gold prices. This inverse correlation highlights the significant impact of the dollar’s strength on gold investment.

Rising Interest Rates

Higher interest rates make alternative investments, such as bonds, more attractive. Bonds offer a fixed yield, unlike gold, which produces no income. This shift in investor preference away from non-yielding assets contributes to the gold price slump.

- Impact on Investor Sentiment: Rising interest rates reduce the appeal of gold as a haven for capital preservation, driving investors towards higher-yielding alternatives.

- Current and Projected Interest Rates: Current interest rates are at X%, with projections for further increases in the coming months. This expectation further diminishes gold's attractiveness as an investment.

Reduced Safe-Haven Demand

Gold is traditionally viewed as a safe-haven asset during times of economic uncertainty or geopolitical instability. However, improving global economic sentiment has lessened the demand for gold as a protective investment.

- Geopolitical Events and Investor Confidence: While some geopolitical tensions persist, the overall global economic outlook appears to be improving, reducing the perceived need for gold as a safe haven. Positive economic news from major economies can further reduce safe-haven demand.

- VIX Volatility Index: The VIX, a measure of market volatility, has decreased recently, indicating reduced investor anxiety and less demand for gold as a hedge against uncertainty. This comparatively lower VIX compared to previous periods of geopolitical uncertainty highlights a shift in investor behavior.

Increased Gold Supply

An increase in gold supply can also put downward pressure on prices. This can stem from increased gold mining production or the selling of gold reserves by central banks.

- Increased Gold Mining Output: Recent reports suggest an increase in gold mining production from major gold-producing countries, potentially contributing to the oversupply and impacting gold prices.

- Central Bank Gold Reserves: While central bank gold sales are not currently significant, any future large-scale sales could add to the downward pressure on prices.

Implications for Gold Investors

The current gold price slump presents both challenges and opportunities for investors. Understanding the short-term outlook and planning a long-term strategy is essential for navigating this dynamic market.

Short-Term Outlook

The short-term outlook for gold prices remains uncertain. Further price declines are possible depending on the trajectory of the US dollar, interest rates, and global economic conditions. However, several factors could trigger a rebound.

- Potential Catalysts for Price Increases: A sudden shift in global economic sentiment, a weakening US dollar, or a reduction in interest rate hikes could lead to increased demand for gold. Unexpected geopolitical events may also boost its safe-haven appeal.

- Analyst Forecasts: While short-term predictions are inherently speculative, some analysts foresee a potential price rebound in the coming [timeframe], citing [specific reasons cited by analysts]. However, it's crucial to remember that these are only predictions, and actual outcomes may differ significantly.

Long-Term Investment Strategy

Despite the current slump, many analysts maintain a positive long-term outlook for gold. A diversified portfolio that includes gold, as part of a long-term strategy, can mitigate risk.

- Long-Term Holding Strategies: For long-term investors, the current decline may present a buying opportunity. A "buy and hold" strategy, coupled with dollar-cost averaging, can help mitigate the impact of price fluctuations.

- Diversification and Risk Management: Diversification across various asset classes, including precious metals, equities, and bonds, is crucial for managing risk and reducing volatility in a portfolio.

Alternative Precious Metals

Investors seeking diversification within the precious metals market can consider alternatives such as silver, platinum, or palladium. These metals often exhibit different price correlations with gold, offering potential for hedging and diversification.

- Price Performance Comparison: While gold has experienced a recent slump, other precious metals like silver and platinum have shown varying degrees of price movement. Analyzing their price trends in relation to gold can provide insights into diversification opportunities. [Include data on price movements.]

Conclusion

The current gold price slump is a result of several interconnected factors: a strengthening US dollar, rising interest rates, reduced safe-haven demand, and potential increases in gold supply. This situation presents both short-term challenges and potential long-term opportunities for investors. Understanding the current gold trends 2025 and analyzing the gold price forecast 2025 requires careful monitoring of these factors. To manage your gold investment wisely, stay informed about the gold market decline, conduct thorough research, and consider consulting with a qualified financial advisor before making any significant investment decisions. Understanding the current gold trends 2025 is crucial for making informed investment choices in this evolving market.

Featured Posts

-

Heavy Traffic Movement In Darjeeling Finding Relief

May 05, 2025

Heavy Traffic Movement In Darjeeling Finding Relief

May 05, 2025 -

Volkanovski Vs Lopes Ufc 314 A Detailed Look At The Event

May 05, 2025

Volkanovski Vs Lopes Ufc 314 A Detailed Look At The Event

May 05, 2025 -

Unexpected Spring Snow 1 2 Inches Possible In Some Nyc Suburbs

May 05, 2025

Unexpected Spring Snow 1 2 Inches Possible In Some Nyc Suburbs

May 05, 2025 -

Analyzing Blake Lively And Anna Kendricks Interactions Body Language Reveals All

May 05, 2025

Analyzing Blake Lively And Anna Kendricks Interactions Body Language Reveals All

May 05, 2025 -

Thunderstorm Warning Me T Issues Alert For Kolkata And Nearby Regions

May 05, 2025

Thunderstorm Warning Me T Issues Alert For Kolkata And Nearby Regions

May 05, 2025

Latest Posts

-

Convicted Paedophile Receives Lengthy Prison Sentence

May 05, 2025

Convicted Paedophile Receives Lengthy Prison Sentence

May 05, 2025 -

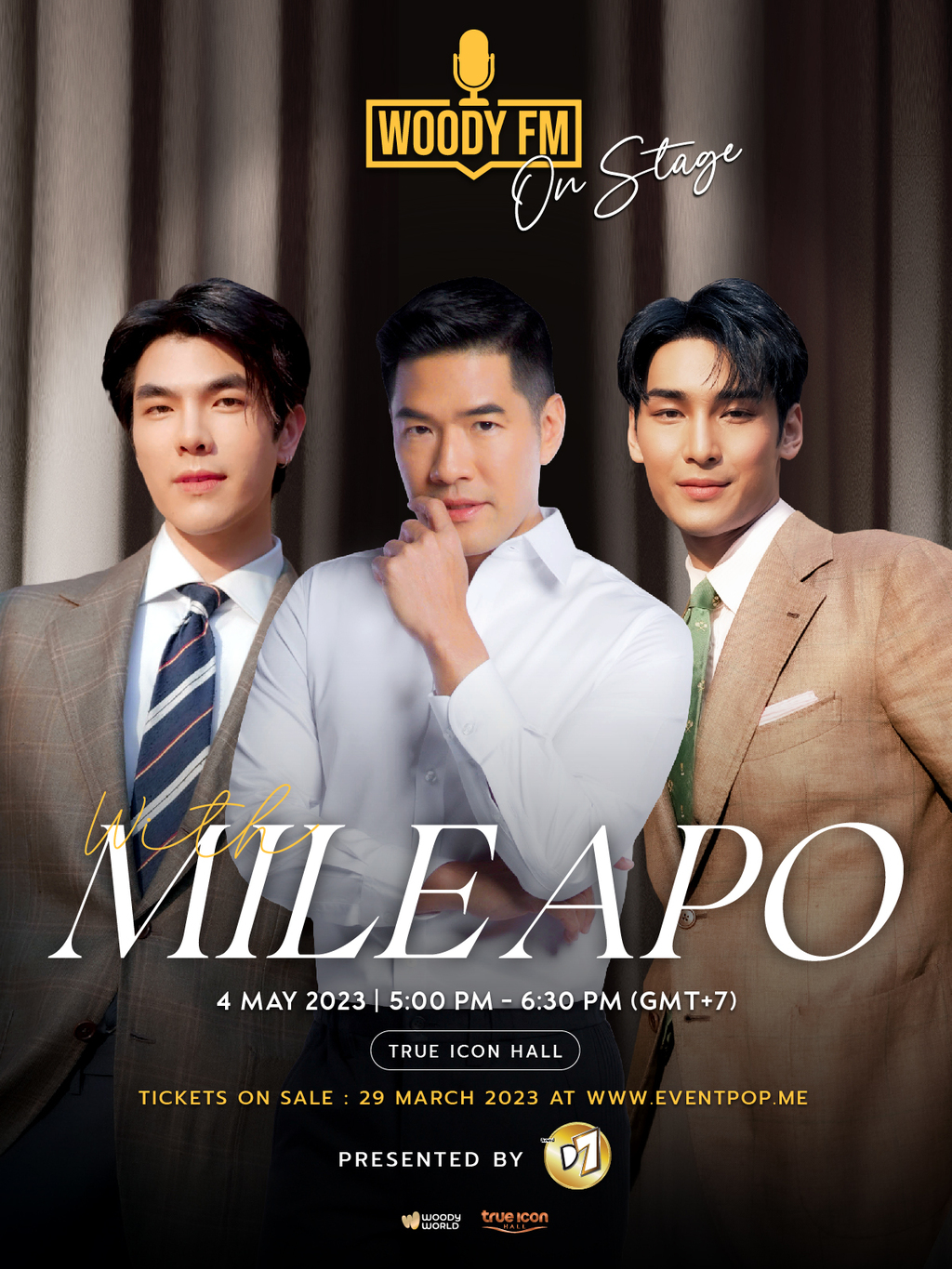

Apo Main Event Nelson Dong Secures A 390 000 Prize

May 05, 2025

Apo Main Event Nelson Dong Secures A 390 000 Prize

May 05, 2025 -

Hospital Hammer Threat Investigation Into Belfast Man James Burnss Motives

May 05, 2025

Hospital Hammer Threat Investigation Into Belfast Man James Burnss Motives

May 05, 2025 -

A 390 000 Win For Nelson Dong In Apo Main Event

May 05, 2025

A 390 000 Win For Nelson Dong In Apo Main Event

May 05, 2025 -

Belfast Hospital Hammer Incident Ex Soldier James Burnss Actions Investigated

May 05, 2025

Belfast Hospital Hammer Incident Ex Soldier James Burnss Actions Investigated

May 05, 2025