Goldman Sachs Deciphers Trump's Preferred Oil Price Range Through Social Media

Table of Contents

Goldman Sachs's Methodology: Mining Social Media for Clues

Goldman Sachs employed a sophisticated methodology to extract meaningful insights from Donald Trump's social media presence. Their process involved a multi-stage approach combining keyword research, advanced sentiment analysis, and rigorous data cleaning. The study focused primarily on Twitter and Facebook, analyzing posts from a specific timeframe relevant to Trump's presidency (the exact timeframe would need to be specified based on the original Goldman Sachs research). The sheer volume of data processed represents a significant undertaking in the realm of social media analytics.

- Keywords tracked: "oil prices," "energy prices," "gas prices," "crude oil," "OPEC," "energy independence," "American energy."

- Sentiment analysis techniques: The team employed Natural Language Processing (NLP) algorithms to gauge the sentiment expressed in Trump's posts, classifying them as positive, negative, or neutral towards oil price levels.

- Data cleaning and filtering: This crucial step involved removing irrelevant posts, handling ambiguous language, and ensuring the accuracy and reliability of the analyzed data.

Trump's Implicit Oil Price Preferences Revealed

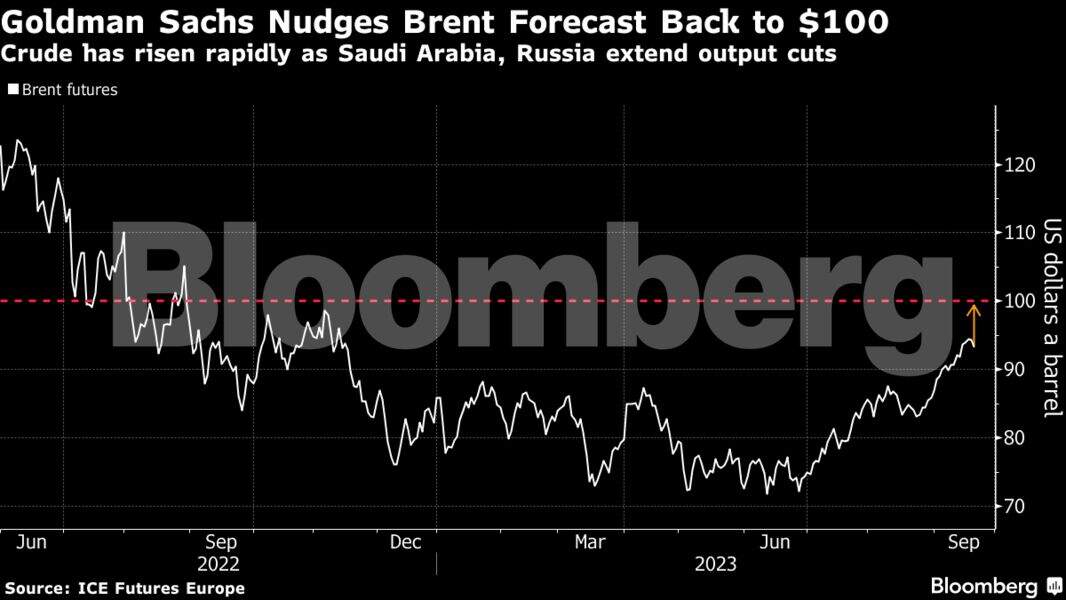

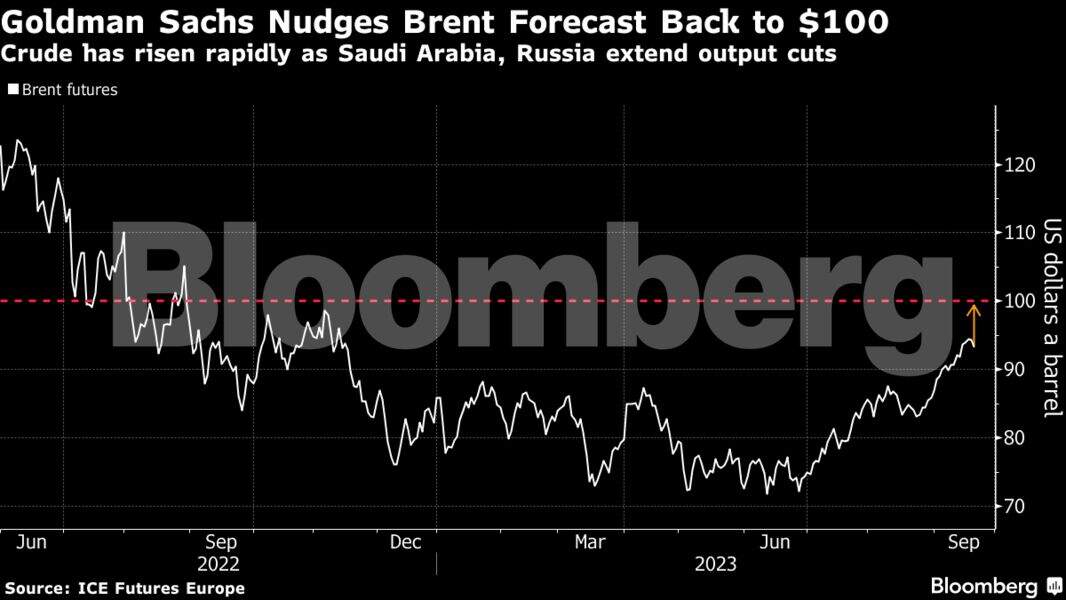

Goldman Sachs's analysis, while not explicitly stating a precise numerical range, suggested that Trump's social media activity indicated a preference for a range of oil prices that generally supported American energy production and economic growth. (Insert the specific range or approximate range, if available, from the original Goldman Sachs research here. For example: "The study suggested a preference for a range between $50 and $70 per barrel"). This preference likely stemmed from a desire to maintain low gasoline prices for consumers while simultaneously boosting the domestic energy sector.

- Examples of influential tweets/posts: (Include specific examples from the research, if available. For example: "A tweet expressing approval of low gas prices or a post criticizing OPEC's actions would be relevant here").

- Correlation between sentiment and oil price movements: The study likely explored the correlation between positive or negative sentiment expressed in Trump's posts and subsequent movements in oil prices, looking for patterns or predictive indicators. (Describe the findings, e.g., "positive sentiment correlated with lower oil prices," or similar).

- Limitations: It's crucial to acknowledge that this methodology has inherent limitations. Trump's social media presence can be volatile, and interpreting his statements requires careful consideration of context and potential biases.

Implications for Investors and Policymakers

Goldman Sachs's findings have significant implications for both investors and policymakers. For investors in the energy sector, understanding Trump's preferred oil price range could inform investment strategies and risk management. Policymakers, on the other hand, need to consider how this insight might shape future energy policies.

- Potential investment opportunities: Based on the predicted range, investors might focus on companies benefiting from stable or slightly higher oil prices, or those hedged against price volatility.

- Investment risks: Relying solely on this analysis for investment decisions carries risks; other market factors are crucial.

- Potential policy changes: Trump's perceived preferences could influence government actions related to energy production, regulation, and international energy agreements.

Criticisms and Alternative Interpretations

It's important to acknowledge potential criticisms of Goldman Sachs's methodology. Relying solely on social media data presents obvious limitations. The interpretation of Trump's often ambiguous statements could be subjective and prone to bias. Furthermore, other economic factors beyond Trump's social media activity significantly influence oil price movements.

- Limitations of social media data: Social media is only one piece of a much larger puzzle. Economic indicators, geopolitical events, and supply-demand dynamics all play crucial roles in shaping oil prices.

- Potential for biased interpretation: The analysis might inadvertently reflect the analysts' own biases. Independent verification and alternative interpretations are essential.

- Opposing viewpoints: Other research or analyses might provide contrasting perspectives on the relationship between Trump's statements and oil prices.

Conclusion: Understanding Trump's Influence on Oil Price Prediction Through Social Media Analysis

Goldman Sachs's research offers a fascinating—though not definitive—look at how social media analytics can be applied to oil price prediction. The study suggests a link between Trump's social media activity and his implicit preferences for a particular oil price range. While not a standalone prediction tool, this research highlights the potential for incorporating unconventional data sources into financial market analysis. However, the limitations of this methodology must be acknowledged, and investors and policymakers should utilize diverse data sources for a more complete and nuanced understanding. To learn more about oil price prediction and the impact of social media on financial markets, delve deeper into Goldman Sachs's research and explore other relevant publications on social media analytics. Understand the power of diverse data sources in oil price prediction.

Featured Posts

-

Bidens Ukraine Policy Under Scrutiny Vance Presses For Transparency

May 16, 2025

Bidens Ukraine Policy Under Scrutiny Vance Presses For Transparency

May 16, 2025 -

Kid Cudi Joopiter Auction Dates Items And Bidding Information

May 16, 2025

Kid Cudi Joopiter Auction Dates Items And Bidding Information

May 16, 2025 -

Braves Vs Padres A Winning Prediction For Atlanta

May 16, 2025

Braves Vs Padres A Winning Prediction For Atlanta

May 16, 2025 -

Leon Draisaitls Hart Trophy Bid A Closer Look At The Finalists

May 16, 2025

Leon Draisaitls Hart Trophy Bid A Closer Look At The Finalists

May 16, 2025 -

Ufc 314 Predictions Chandler And Pimbletts Joint Interview

May 16, 2025

Ufc 314 Predictions Chandler And Pimbletts Joint Interview

May 16, 2025