Gold's Ascent: Trump's Trade Policies Fuel Investor Demand

Table of Contents

Safe-Haven Asset Status of Gold

Gold has historically served as a reliable safe haven during periods of economic uncertainty. Its inherent value and lack of correlation with traditional assets make it an attractive investment when market volatility rises. Trade wars and protectionist measures, by their very nature, inject uncertainty into the global economy, fueling market instability. This heightened volatility directly translates into increased demand for gold.

- Increased market uncertainty fuels demand for gold: When stocks and bonds falter, investors often seek the stability gold offers.

- Gold's non-correlation with traditional assets makes it attractive during market downturns: Unlike stocks or bonds, gold tends not to move in tandem with other asset classes, providing valuable diversification.

- Central bank gold reserves remain a significant factor: Central banks worldwide continue to hold substantial gold reserves, reinforcing its status as a globally recognized store of value. This confidence in gold as a secure asset contributes to its price stability during turbulent times.

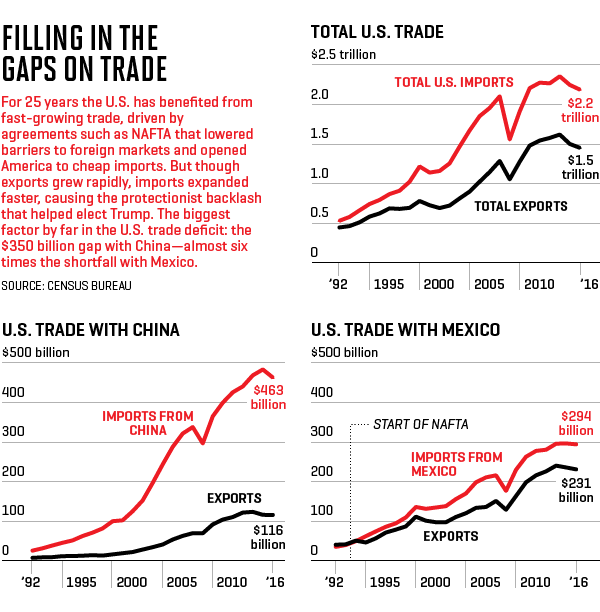

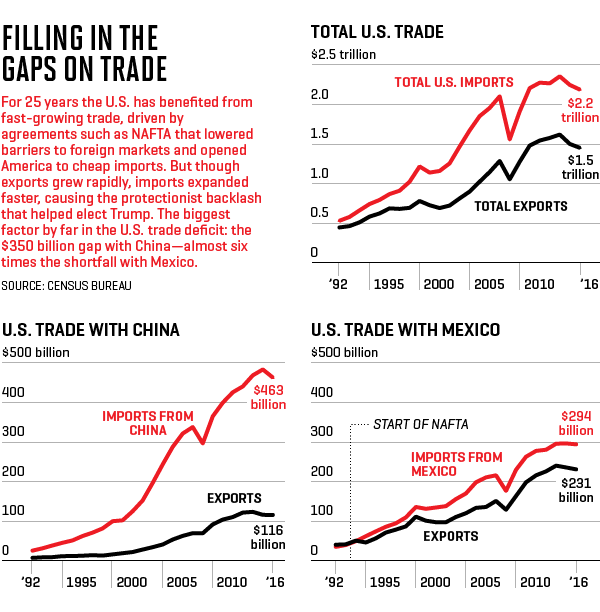

Impact of Trump's Trade Policies on Global Markets

The Trump administration implemented several significant trade policies that significantly impacted global markets. These included imposing tariffs on goods from China and other countries, sparking retaliatory measures and escalating trade disputes. These actions created a climate of uncertainty, impacting global supply chains and investor confidence.

- Tariffs on goods from China and other countries: These tariffs led to increased prices for consumers and disrupted established trade relationships.

- Trade disputes impacting global supply chains: The uncertainty surrounding trade policies led to disruptions in global supply chains, causing delays and increased costs for businesses.

- Increased investor anxiety due to trade policy uncertainty: The unpredictable nature of Trump's trade policies created considerable anxiety among investors, prompting many to seek safer investment havens.

Investor Behavior and Gold Demand

In response to the market uncertainty generated by Trump's trade policies, investors significantly altered their investment strategies. There was a marked shift towards gold as a hedge against risk, evidenced by a surge in demand for both physical gold and gold-backed investments.

- Increased investment in gold ETFs (Exchange Traded Funds): Gold ETFs provide investors with easy access to gold without the need to physically store it.

- Higher demand for physical gold: Many investors sought to own physical gold, viewing it as a tangible asset offering protection against economic instability.

- Diversification strategies including gold as a portfolio component: Gold's unique characteristics as a safe-haven asset made it a crucial element in many diversified investment portfolios.

Alternative Investments and Gold's Competitive Advantage

While US Treasury bonds are considered another safe-haven asset, gold often outperforms them during periods of heightened trade tension. This is because, unlike bonds, gold is not tied to the performance of a specific government or economy.

- Comparison of gold's returns vs. bonds during trade war periods: Historically, gold has demonstrated stronger returns than bonds during periods of economic uncertainty.

- Analysis of gold's performance relative to other commodities: Gold has maintained its value relatively well compared to other commodities during periods of trade conflict.

- Discussion on the role of inflation expectations in driving gold demand: When inflation rises, gold is often seen as a hedge against the devaluation of fiat currencies, further boosting demand.

Conclusion

Trump's trade policies significantly contributed to increased market uncertainty, leading to a surge in demand for gold as investors actively sought safe havens. Gold's Ascent during this period highlights its enduring appeal as a hedge against risk and a store of value. Key takeaways include the strengthening of gold's safe-haven status, the impact of trade policy uncertainty on investor behavior, and the competitive advantages gold offers compared to alternative investments. Understanding Gold's Ascent and its connection to geopolitical events is crucial for informed investment decisions. Learn more about diversifying your portfolio with gold today!

Featured Posts

-

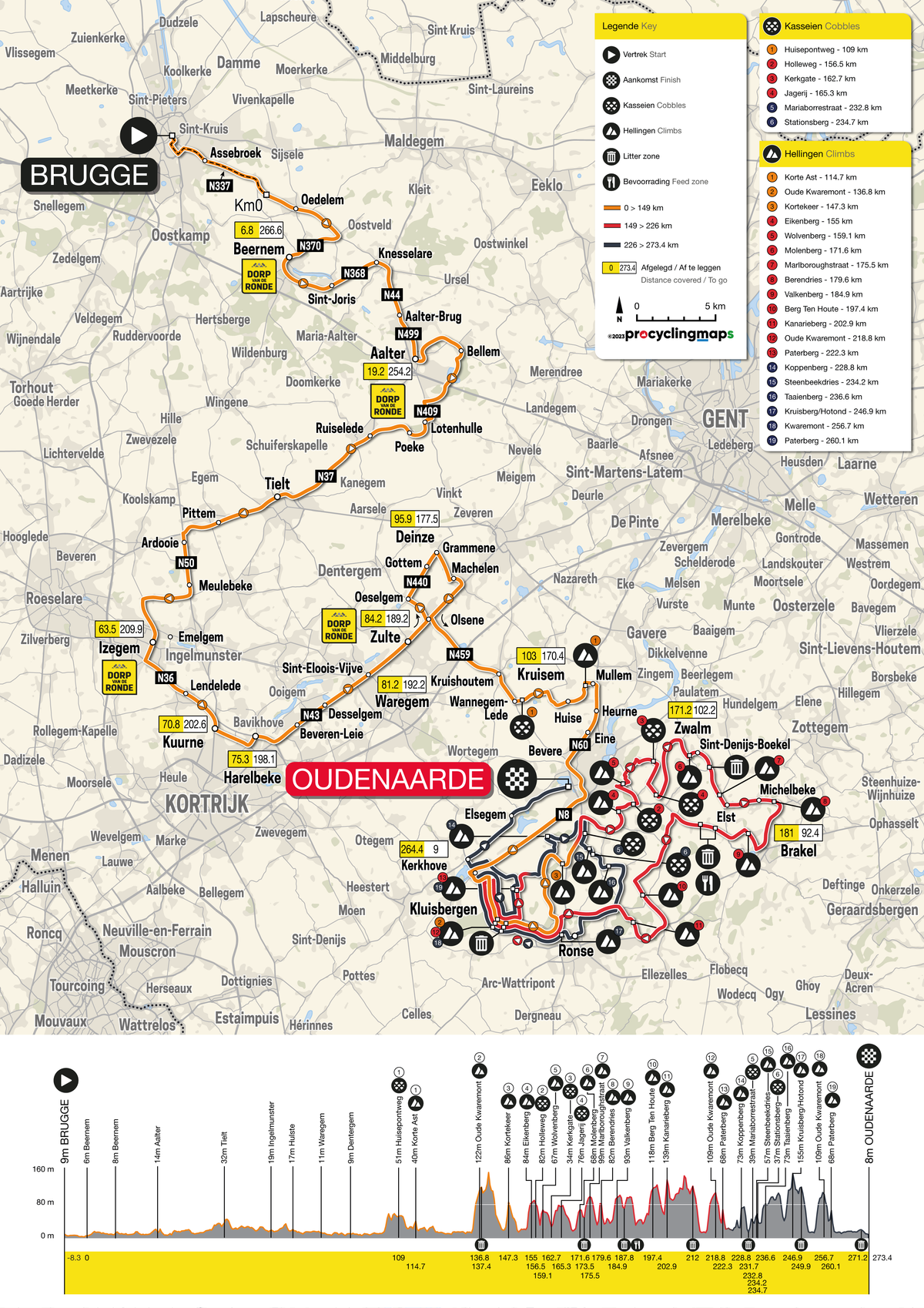

Tour Of Flanders 2024 Pogacars Unmatched Solo Victory

May 26, 2025

Tour Of Flanders 2024 Pogacars Unmatched Solo Victory

May 26, 2025 -

Find Your Calm In Rehoboth Beach A Relaxing Escape

May 26, 2025

Find Your Calm In Rehoboth Beach A Relaxing Escape

May 26, 2025 -

Une Nouvelle Dynamique Pour Les Diables Rouges L Analyse Rtbf

May 26, 2025

Une Nouvelle Dynamique Pour Les Diables Rouges L Analyse Rtbf

May 26, 2025 -

Virtue Signaling Has It Destroyed Architectural Integrity An Interview

May 26, 2025

Virtue Signaling Has It Destroyed Architectural Integrity An Interview

May 26, 2025 -

The Hells Angels Uncovering The Truth Behind The Legend

May 26, 2025

The Hells Angels Uncovering The Truth Behind The Legend

May 26, 2025