Gold's Double Dip: Analyzing Two Straight Weeks Of Losses In 2025

Table of Contents

The gold market experienced a surprising downturn in late 2025, with gold prices suffering two consecutive weeks of losses – a phenomenon we're calling "Gold's Double Dip." This unexpected dip, occurring amidst relatively stable market conditions, raises important questions for investors and market analysts alike. This article delves into the potential causes of this recent gold price decline, examining macroeconomic factors, geopolitical influences, and technical analysis to understand this significant market movement.

H2: Macroeconomic Factors Influencing Gold's Decline

Several significant macroeconomic factors likely contributed to Gold's Double Dip. The interplay of these factors created a perfect storm that negatively impacted gold's price.

H3: Strengthening US Dollar

The US dollar and gold prices typically exhibit an inverse relationship. When the dollar strengthens, gold becomes more expensive for holders of other currencies, leading to decreased demand and lower prices. Recent economic indicators point towards a strengthening dollar in late 2025.

- The US Federal Reserve's hawkish stance on interest rates signaled continued monetary tightening.

- Stronger-than-expected US employment figures boosted investor confidence in the dollar.

- Geopolitical stability (discussed further below) also contributed to the dollar's appeal as a safe-haven currency. This reduced the relative attractiveness of gold.

Future Federal Reserve policy decisions will continue to influence this dynamic. Any further interest rate hikes could further strengthen the dollar, potentially putting continued downward pressure on gold prices.

H3: Rising Interest Rates

Rising interest rates significantly impact gold's attractiveness as an investment. Unlike interest-bearing assets like bonds, gold does not generate income. Higher interest rates make bonds a more appealing alternative for investors seeking returns, diverting capital away from gold.

- The Federal Reserve implemented several interest rate hikes throughout 2025. Each hike correlated with a subsequent dip in gold prices.

- Higher interest rates increase the opportunity cost of holding gold, as investors could earn higher returns on alternative investments.

- This shift in investor sentiment has contributed to a decline in demand for gold, further impacting prices.

H3: Inflation Expectations

Gold is often seen as a hedge against inflation. However, changing inflation expectations can affect gold's performance. If inflation pressures decrease, the safe-haven demand for gold might diminish.

- Inflation rates showed signs of cooling in late 2025, lessening the perceived need for gold as an inflation hedge.

- This shift in inflation expectations likely contributed to reduced investor interest in gold.

- Comparing current inflation figures with those of the previous year reveals a notable decrease, influencing market sentiment.

H2: Geopolitical Events and Their Influence

Geopolitical events and the resulting investor sentiment also play a crucial role in gold price fluctuations.

H3: Easing Geopolitical Tensions

Reduced geopolitical uncertainty can lead to a decrease in demand for gold as a safe-haven asset. Investors may shift their focus to riskier assets with potentially higher returns.

- The de-escalation of certain international conflicts contributed to a calmer global environment.

- Positive developments in international trade negotiations further reduced investor anxiety.

- This relative stability diminished the perceived need for a safe-haven asset like gold.

H3: Shifting Investor Sentiment

Changes in investor confidence and risk appetite significantly influence gold investment strategies. A shift toward riskier assets can negatively impact gold's performance.

- Data shows a decrease in gold ETF (Exchange-Traded Fund) flows, indicating reduced investor interest in gold.

- Investors appeared to be favoring growth stocks and other assets perceived as having higher growth potential.

- This shift in investor sentiment is a critical factor contributing to Gold's Double Dip.

H2: Technical Analysis of Gold Price Movements

Technical analysis provides further insights into the recent gold price movements.

H3: Chart Patterns and Support Levels

Analysis of gold price charts reveals that key support levels were broken during the double dip. This suggests a potentially stronger downward trend.

- The chart displayed a classic "double top" pattern, indicating a potential reversal of the previous upward trend.

- Key support levels around $X and $Y were breached, signaling further bearish pressure. (Replace X and Y with actual price levels)

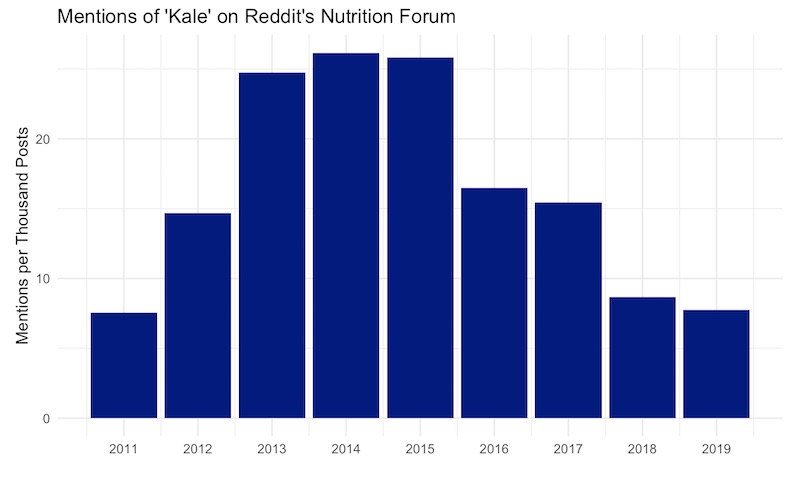

- The breakdown of these support levels suggests that further price decreases are possible. (Include relevant charts or graphs).

H3: Trading Volume and Volatility

Examining trading volume and volatility provides further context. High volume during the decline suggests a stronger, more significant trend.

- Trading volume increased significantly during the two-week period of decline, suggesting substantial selling pressure.

- Volatility also increased, indicating heightened uncertainty and rapid price swings.

- This high volume and volatility further reinforce the significance of Gold's Double Dip.

Conclusion:

Gold's Double Dip in late 2025 resulted from a confluence of factors. The strengthening US dollar, rising interest rates, cooling inflation expectations, easing geopolitical tensions, and a shift in investor sentiment all contributed to the decline. Technical analysis, highlighting broken support levels and increased trading volume, confirms the significance of this downturn.

Key Takeaways: Understanding the interplay between macroeconomic factors, geopolitical events, and investor sentiment is crucial for navigating the gold market. Monitoring these variables allows investors to make better-informed decisions.

Call to Action: Staying informed is crucial for understanding Gold's Double Dip and future gold market fluctuations. Continue monitoring these key factors – and consider exploring resources such as financial news outlets and market analysis tools – to make informed investment decisions. Further research into "Understanding Gold's Double Dip" and "Navigating Gold's Price Fluctuations" can significantly enhance your investment strategy.

Featured Posts

-

Selling Sunset Star Accuses Landlords Of La Fires Price Gouging

May 05, 2025

Selling Sunset Star Accuses Landlords Of La Fires Price Gouging

May 05, 2025 -

The Cusma Negotiations Carneys High Stakes Meeting With Trump

May 05, 2025

The Cusma Negotiations Carneys High Stakes Meeting With Trump

May 05, 2025 -

Predicting The 2025 Tampa Bay Derby Odds Field And Kentucky Derby Implications

May 05, 2025

Predicting The 2025 Tampa Bay Derby Odds Field And Kentucky Derby Implications

May 05, 2025 -

Horners Prank Max Verstappens Fatherhood Quip

May 05, 2025

Horners Prank Max Verstappens Fatherhood Quip

May 05, 2025 -

Four West Bengal Districts Under Heatwave Warning

May 05, 2025

Four West Bengal Districts Under Heatwave Warning

May 05, 2025

Latest Posts

-

The Dress That Broke The Internet Emma Stones Snl Appearance

May 05, 2025

The Dress That Broke The Internet Emma Stones Snl Appearance

May 05, 2025 -

Emma Stones Popcorn Butt Lift Inspired Dress At Snl

May 05, 2025

Emma Stones Popcorn Butt Lift Inspired Dress At Snl

May 05, 2025 -

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 05, 2025

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 05, 2025 -

Indy Car On Fox A New Era For Open Wheel Racing

May 05, 2025

Indy Car On Fox A New Era For Open Wheel Racing

May 05, 2025 -

Cord Cutting Revolution Continues Fox And Espns Streaming Plans For 2025

May 05, 2025

Cord Cutting Revolution Continues Fox And Espns Streaming Plans For 2025

May 05, 2025