GOP Tax Plan: Does It Really Cut The Deficit? A Mathematical Look

Table of Contents

Analyzing the Projected Revenue Effects of the GOP Tax Plan

Static vs. Dynamic Scoring: Understanding the Methods

Estimating the revenue impact of a tax plan involves choosing a scoring method. Two primary approaches exist: static and dynamic scoring. Understanding the differences is crucial to evaluating the accuracy of deficit projections related to the GOP Tax Plan.

-

Static scoring: This method assumes that tax revenues change only in direct response to changes in tax rates. It doesn't account for behavioral changes (e.g., individuals working more or less due to altered tax rates). It's a simpler, more straightforward approach, but often criticized for underestimating the true impact of tax cuts.

-

Dynamic scoring: This approach attempts to incorporate the indirect effects of tax changes on economic behavior. It considers factors like labor supply elasticity (how much people change their work hours in response to tax changes) and investment decisions. While more complex, dynamic scoring offers a potentially more accurate picture, but is susceptible to differing assumptions and modeling choices.

-

Differing Assumptions: The choice of elasticity of labor supply significantly impacts the results. A higher elasticity implies that individuals will adjust their work hours significantly in response to tax changes, leading to different revenue projections than a model using a lower elasticity. For example, a dynamic model with a high elasticity might show a smaller revenue loss from a tax cut than a static model.

-

Examples: Past GOP tax plan analyses have utilized both methods, leading to varying conclusions about the deficit impact. Comparing the analyses using different scoring methodologies reveals the significant variations possible based on the chosen approach.

Tax Cuts and Economic Growth: The Supply-Side Argument

A central tenet of many GOP tax plans is the belief that tax cuts stimulate economic growth, ultimately generating enough additional revenue to offset the initial revenue loss from lower tax rates. This argument relies on supply-side economics.

-

The Laffer Curve: This illustrates the relationship between tax rates and tax revenue. It suggests that there's an optimal tax rate that maximizes revenue; rates above this optimal point might actually reduce revenue as they stifle economic activity. GOP tax plans often cite the Laffer Curve to justify cuts, arguing that current rates are above the optimal level.

-

Drawbacks and Criticisms: Supply-side economics faces criticism for its reliance on assumptions about economic behavior that may not always hold true. Critics argue that tax cuts disproportionately benefit high-income earners, leading to increased inequality and little overall economic stimulus.

-

Historical Evidence: Historical evidence regarding the effectiveness of tax cuts in boosting economic growth is mixed. Some studies have found positive effects, while others have shown little or no impact. The results are often dependent on various factors like the specific design of the tax cut, the broader economic context, and the methodology used in the analysis.

-

Relevant Studies: Empirical studies on the effectiveness of tax cuts, such as those published by the Congressional Budget Office (CBO) and the Tax Policy Center, provide critical data points for evaluating the claims of GOP tax plans and their impact on the GOP Tax Plan Deficit.

Examining the Spending Side of the Equation

Mandatory vs. Discretionary Spending: Understanding the Budget

The federal budget consists of two main categories of spending: mandatory and discretionary. GOP tax plans often impact both, though indirectly in many cases.

-

Mandatory Spending: This includes entitlement programs like Social Security, Medicare, and Medicaid. These programs are required by law and constitute a significant portion of the federal budget. Changes to eligibility criteria or benefit levels could impact this category.

-

Discretionary Spending: This includes areas like defense, education, and infrastructure. These programs are subject to annual appropriations by Congress and are generally more easily adjusted.

-

Indirect Impacts: Tax cuts can indirectly affect spending. If tax cuts stimulate economic growth as proponents suggest, it could lead to increased tax revenue, potentially offsetting some of the cost of the tax cuts. However, a lack of growth, or slower-than-projected growth, would exacerbate the deficit.

-

Demographic Shifts: Changes in demographics, like an aging population, can significantly impact mandatory spending (e.g., increased demand on Medicare). This must be considered when evaluating the long-term effects of any GOP tax plan on the deficit.

Unfunded Tax Cuts and Their Long-Term Implications

Many GOP tax plans have involved unfunded tax cuts – that is, tax reductions that are not offset by corresponding spending cuts or revenue increases elsewhere in the budget. This approach leads to increased deficits and a growing national debt.

-

Defining Unfunded Tax Cuts: These are tax reductions implemented without a corresponding plan to reduce government spending or find alternative revenue sources to offset the loss of tax revenue.

-

Debt Accumulation: Unfunded tax cuts lead to a direct increase in the national debt. The government borrows money to cover the shortfall, accumulating debt over time.

-

Long-Term Consequences: A high national debt results in increased interest payments, reducing the government's ability to invest in other essential areas. It also limits the government's flexibility to respond to future economic shocks or crises.

-

Impact on Future Generations: The burden of a large national debt is often passed on to future generations, who must bear the cost of servicing this debt through higher taxes or reduced government services.

Considering External Factors and Unforeseen Events

Impact of Economic Recessions: A Critical Vulnerability

Economic forecasts are inherently uncertain, and recessions significantly impact both tax revenue and government spending. This is a critical factor when assessing the potential consequences of a GOP Tax Plan.

-

Tax Revenue During Recessions: Economic downturns usually lead to lower tax revenues as incomes fall and business activity declines. This directly impacts the ability to offset the cost of tax cuts.

-

Increased Government Spending: Recessions also tend to increase government spending due to increased demand for social safety net programs (e.g., unemployment benefits). This further exacerbates the deficit.

-

Historical Relationship: A historical analysis of the relationship between tax cuts and recessions is vital for understanding the risk associated with unfunded tax cuts. Examining past instances where tax cuts coincided with economic downturns provides valuable insights into the potential outcomes.

Unforeseen Economic Shocks: The Unpredictable Element

Economic forecasting involves inherent uncertainty. Unforeseen events can significantly impact tax revenue and government spending, undermining the assumptions underlying any deficit projection related to a GOP Tax Plan.

-

Uncertainty in Forecasting: Economic models are based on assumptions about future economic conditions, which are inherently uncertain. Unexpected events can render these models inaccurate.

-

Impact of Unexpected Events: Events like global pandemics, major geopolitical conflicts, or natural disasters can dramatically impact both tax revenue and government spending. These impacts are difficult to predict.

-

Limitations of Historical Data: While historical data is valuable, it cannot always accurately predict the impact of unprecedented events. The possibility of "black swan" events – highly improbable but potentially devastating events – further complicates the situation.

Conclusion

The impact of any GOP Tax Plan on the deficit is complex and depends on numerous intertwined factors. While proponents argue that tax cuts stimulate economic growth, leading to increased revenue and deficit reduction, critics point to the potential for increased national debt due to unfunded cuts and the limitations of economic forecasting. A thorough analysis requires careful consideration of both static and dynamic scoring methods, the interplay between tax cuts and spending, and the inherent uncertainties associated with economic predictions. To gain a clearer understanding of the potential consequences, a deeper dive into the specific details of each proposed GOP Tax Plan and independent economic analyses is crucial. Continue your research by exploring further analyses of the GOP Tax Plan Deficit using reputable sources to form your own informed opinion. Understanding the intricacies of the GOP tax plan and its effect on the deficit empowers you to make informed decisions about the future of our nation's finances.

Featured Posts

-

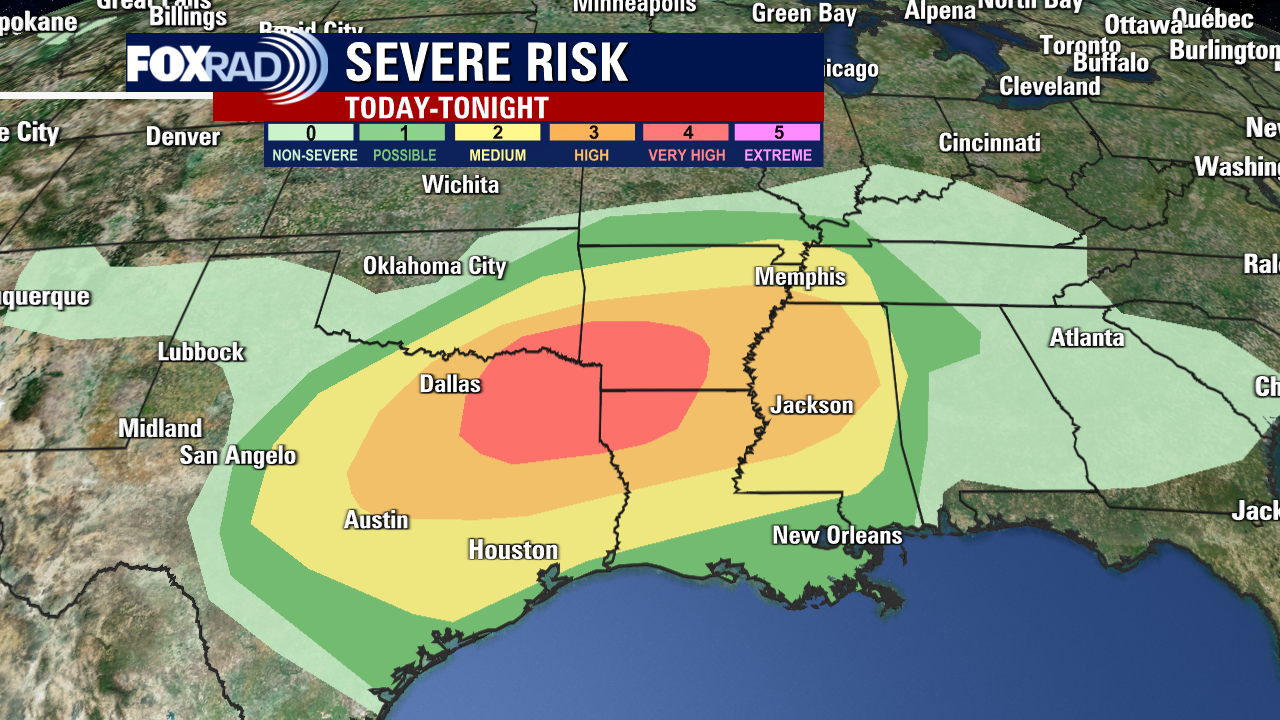

Severe Weather Alert Strong Winds And Potential Storms Approaching

May 20, 2025

Severe Weather Alert Strong Winds And Potential Storms Approaching

May 20, 2025 -

Glen Kamara Ja Teemu Pukki Vaihdossa Jacob Friisin Avauskokoonpano Paljastettu

May 20, 2025

Glen Kamara Ja Teemu Pukki Vaihdossa Jacob Friisin Avauskokoonpano Paljastettu

May 20, 2025 -

Ajatha Krysty Tewd Llhyat Bfdl Aldhkae Alastnaey Rwayt Jdydt

May 20, 2025

Ajatha Krysty Tewd Llhyat Bfdl Aldhkae Alastnaey Rwayt Jdydt

May 20, 2025 -

F1 Comeback Hopes For Mick Schumacher Haekkinen Weighs In

May 20, 2025

F1 Comeback Hopes For Mick Schumacher Haekkinen Weighs In

May 20, 2025 -

Situation D Urgence A La Gaite Lyrique Securite Du Site Et Intervention De La Mairie De Paris

May 20, 2025

Situation D Urgence A La Gaite Lyrique Securite Du Site Et Intervention De La Mairie De Paris

May 20, 2025

Latest Posts

-

Mntkhb Alwlayat Almthdt Thlathy Jdyd Fy Qaymt Bwtshytynw

May 21, 2025

Mntkhb Alwlayat Almthdt Thlathy Jdyd Fy Qaymt Bwtshytynw

May 21, 2025 -

From Food Startup To Business Mentor A Louth Success Story

May 21, 2025

From Food Startup To Business Mentor A Louth Success Story

May 21, 2025 -

Wjwh Jdydt Fy Sfwf Mntkhb Alwlayat Almthdt Thlathy Mmyz Yndm Lawl Mrt

May 21, 2025

Wjwh Jdydt Fy Sfwf Mntkhb Alwlayat Almthdt Thlathy Mmyz Yndm Lawl Mrt

May 21, 2025 -

96

May 21, 2025

96

May 21, 2025 -

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt Alamrykyt

May 21, 2025

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt Alamrykyt

May 21, 2025