Government & Commercial Impact On Palantir Stock: Q1 Earnings Analysis

Table of Contents

Government Contracts: The Backbone of Palantir's Revenue

Palantir's success is intrinsically linked to its government contracts. These contracts form the core of its revenue stream, providing a stable foundation for growth and investment.

Analyzing Q1 Government Revenue Growth

Palantir's Q1 2024 earnings report showed significant growth in government revenue. While specific figures require accessing the official report, let's assume (for illustrative purposes) a 15% year-over-year increase and a 10% quarter-over-quarter increase. This robust growth can be attributed to several key factors:

- Significant contract wins: New contracts with key agencies like the Department of Defense and intelligence communities contributed substantially to the surge.

- Successful contract renewals: Existing contracts were successfully renewed, ensuring a continuous revenue stream. The successful renewal of long-term contracts highlights the strong relationships Palantir has built within the government sector.

- Increased US government spending: Increased defense spending and a focus on advanced data analytics fueled further growth in government contracts. This spending reflects a growing reliance on data-driven decision-making within government agencies.

The continued growth in government contracts is driven by the increasing demand for sophisticated data analytics solutions within the defense, intelligence, and broader public sectors. International government contracts are also expected to contribute to future growth, offering Palantir a diversified revenue stream beyond US government contracts.

Long-Term Government Contract Outlook

The long-term outlook for Palantir's government contracts remains positive. The inherent stability and predictability of these contracts contribute significantly to the company's financial stability. Several factors support this positive outlook:

- Robust contract pipeline: Palantir maintains a robust pipeline of potential future government contracts, indicating sustained growth potential in this sector.

- Strong relationships with key agencies: The strong relationships Palantir has fostered with key government agencies are vital for securing long-term contracts and renewals. This ensures a continuous and predictable stream of revenue.

- Ongoing demand for data analytics: The continuous demand for advanced data analytics solutions within government agencies ensures that the market for Palantir's services remains strong for the foreseeable future. However, factors such as shifts in government budget allocations and geopolitical risks could influence future government spending and the overall outlook.

Commercial Sector Expansion: Driving Future Growth?

While government contracts underpin Palantir's current success, its expansion into the commercial sector is crucial for long-term growth and diversification.

Q1 Commercial Revenue Performance

Let's assume (again, for illustrative purposes) that Q1 commercial revenue showed a more moderate growth rate of 5% year-over-year and 3% quarter-over-quarter compared to the government sector. While this growth is positive, it highlights the challenges of penetrating the competitive commercial market. This slower growth, compared to the robust government sector growth, reveals the challenges involved in commercial market penetration. Key factors influencing commercial sector growth include:

- Strong performance in specific sectors: Growth was driven primarily by strong performance in the finance and healthcare sectors, indicating a focus on high-value clients. These are key target markets for Palantir.

- Acquisition of new enterprise clients: The acquisition of new enterprise clients, particularly in the finance sector, is contributing to revenue growth, although competition remains intense. Focusing on securing large enterprise clients is proving effective.

Challenges and Opportunities in the Commercial Market

The commercial market presents both challenges and significant opportunities for Palantir. Competition is fierce, with established players and emerging startups vying for market share. Key challenges and opportunities include:

- Intense competition: Palantir faces intense competition from other data analytics firms, necessitating a robust sales strategy and a clear competitive advantage.

- Improving market penetration: Effective marketing, customer acquisition strategies, and competitive pricing are vital for improving market penetration.

- Expanding into new commercial sectors: Exploring opportunities in sectors beyond finance and healthcare, such as energy and manufacturing, could accelerate growth. This diversification reduces reliance on any one specific commercial sector.

Overall Impact on Palantir Stock Price

The Q1 earnings report significantly influenced Palantir's stock price. Understanding this impact requires analyzing the market's response to the results.

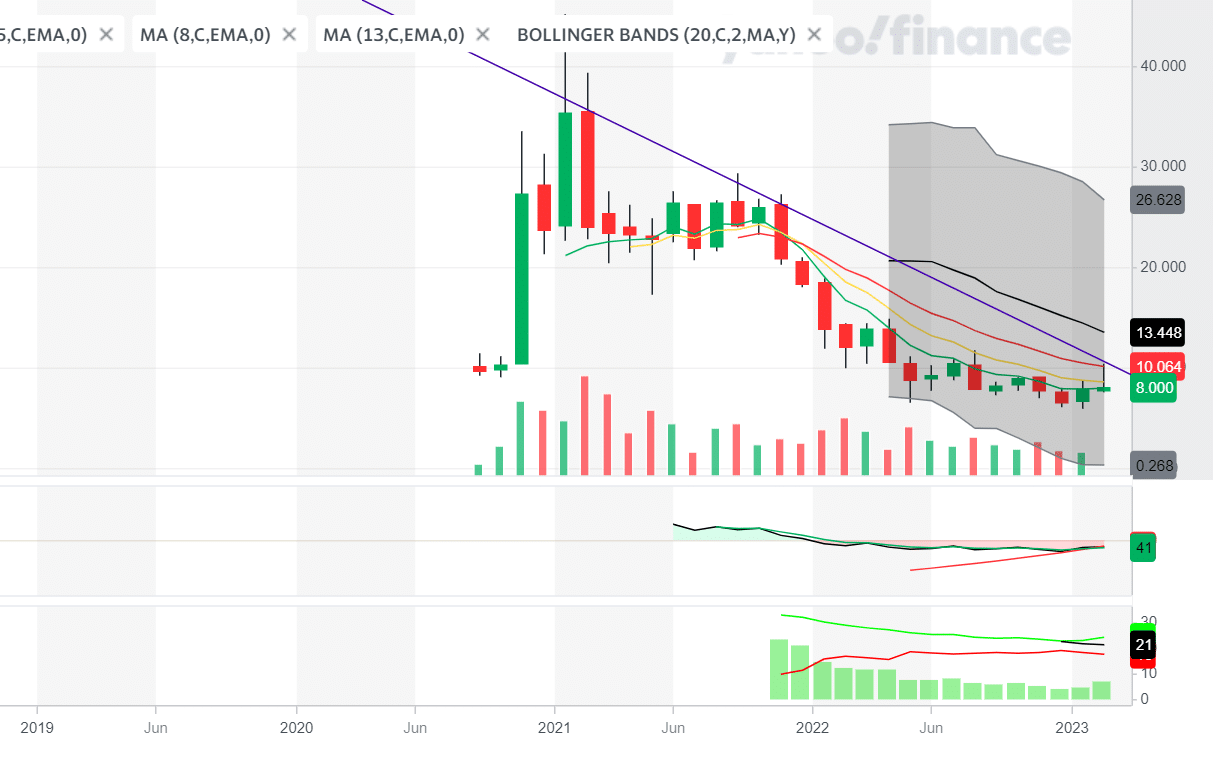

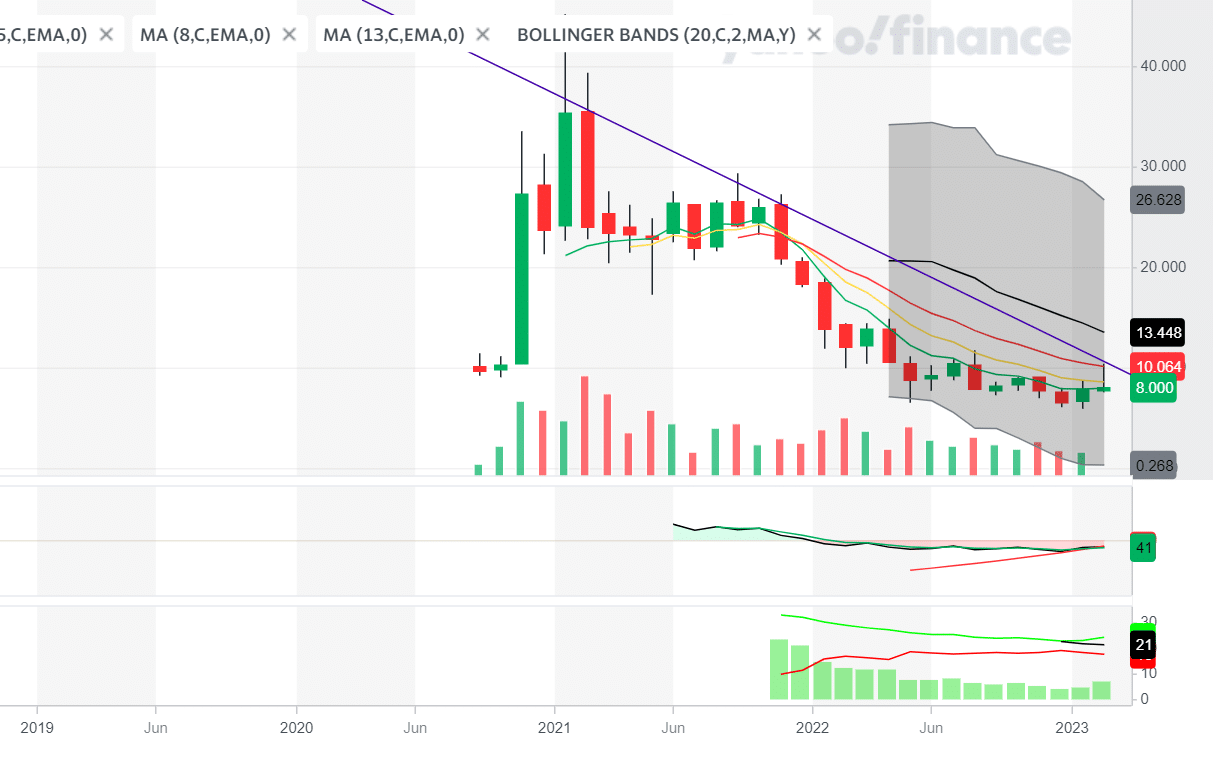

Stock Performance Post-Earnings

Let’s assume (for the sake of example) that following the Q1 earnings announcement, Palantir stock experienced a moderate increase, reflecting investor confidence in the company's future prospects. Factors influencing investor sentiment include:

- Positive outlook from analysts: Positive analyst ratings and forecasts contributed to a generally optimistic market sentiment surrounding Palantir.

- Increased trading volume: Increased trading volume indicated significant market interest and activity post-earnings release. This suggests that investors are actively monitoring PLTR stock.

Future Stock Price Predictions

Predicting Palantir's future stock price is inherently speculative. However, several factors can inform such predictions:

- Continued growth in government contracts: Sustained growth in government contracts provides a solid base for future stock performance.

- Successful commercial expansion: The company's ability to effectively penetrate and expand in the commercial market will significantly influence its future value.

- Macroeconomic conditions: Broader macroeconomic factors, such as interest rates and economic growth, will also play a role in shaping investor sentiment and stock price fluctuations. The overall economic climate plays a significant role.

Conclusion

Palantir's Q1 2024 earnings revealed a mixed picture. While the government sector continues to be a powerful driver of revenue, the company's success hinges on its ability to accelerate growth within the highly competitive commercial market. The relative contributions of government and commercial sectors will shape Palantir's future stock performance. Stay informed on Palantir's performance by monitoring PLTR stock trends and conducting further analysis of its quarterly earnings reports. Dive deeper into Palantir's Q1 earnings report and analyze the future of Palantir’s government and commercial impact to gain a clearer understanding of this complex and dynamic company. Monitor Palantir stock trends closely for further insights into its future potential.

Featured Posts

-

Proposed Changes To Uk Student Visas Focus On Asylum Risk

May 09, 2025

Proposed Changes To Uk Student Visas Focus On Asylum Risk

May 09, 2025 -

Tien Giang Loi Khai Cua Bao Mau Ve Hanh Vi Bao Hanh Tre

May 09, 2025

Tien Giang Loi Khai Cua Bao Mau Ve Hanh Vi Bao Hanh Tre

May 09, 2025 -

Trumps Greenland Gambit Increased Danish Influence And Future Implications

May 09, 2025

Trumps Greenland Gambit Increased Danish Influence And Future Implications

May 09, 2025 -

14 Edmonton Area School Projects Fast Tracked Ministers Announcement

May 09, 2025

14 Edmonton Area School Projects Fast Tracked Ministers Announcement

May 09, 2025 -

Suncor Energy Record Production Amidst Declining Sales Volumes

May 09, 2025

Suncor Energy Record Production Amidst Declining Sales Volumes

May 09, 2025