Government And Commercial Sectors Drive Palantir Stock Performance In Q1 2024

Table of Contents

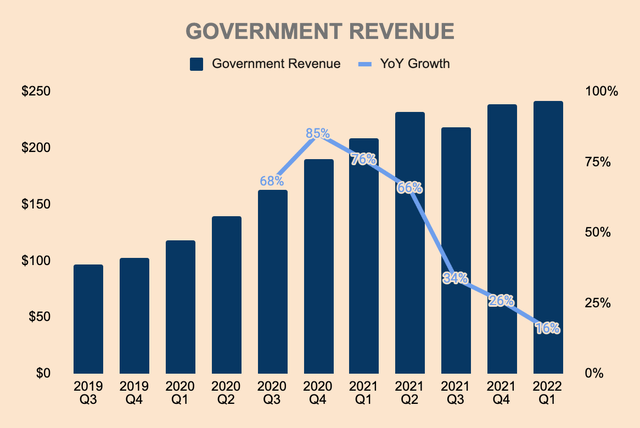

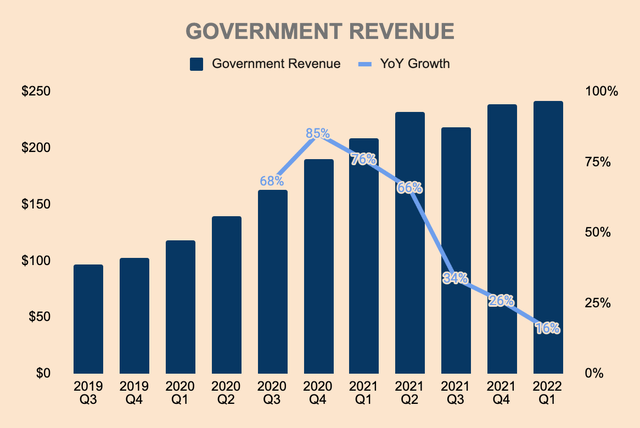

Government Sector: A Major Contributor to Palantir's Q1 Success

Palantir's Q1 success story is significantly attributed to its robust performance in the government sector. The company's government contracts are a cornerstone of its revenue and profitability, and Q1 2024 saw significant expansion in this area.

Increased Government Contracts and Spending

The growth in government contracts awarded to Palantir in Q1 2024 was substantial. This reflects the increasing reliance of governments worldwide on advanced data analytics and intelligence solutions. While specific figures may be subject to future disclosures, reports suggest a considerable uptick in contract awards and expansions. This translates directly into increased revenue and improved profitability for the company. The increased defense spending globally further contributed to this positive trend.

- Significant increase in contract awards from the US Department of Defense and various intelligence agencies.

- Expansion of existing contracts with key international defense partners, demonstrating continued confidence in Palantir's capabilities.

- New partnerships with several national security agencies, broadening Palantir's reach and market share.

Strategic Importance of Palantir's Government Solutions

Palantir's platforms, Gotham and Foundry, are specifically designed to address the complex data integration and analysis challenges faced by government agencies. These platforms offer unparalleled capabilities for intelligence analysis, cybersecurity, and other mission-critical operations. Governments are increasingly turning to Palantir because of its ability to:

- Integrate vast amounts of disparate data sources efficiently and securely.

- Provide advanced data visualization and analytics tools for effective decision-making.

- Improve operational efficiency and enhance the effectiveness of national security initiatives.

The unique value proposition of Palantir’s solutions in supporting national security and intelligence gathering initiatives is a driving force behind the continued growth in government contracts.

Commercial Sector Expansion: A Key Driver of Palantir's Q1 Growth

While government contracts are significant, Palantir's expansion in the commercial sector also played a crucial role in its Q1 2024 success. This indicates a wider adoption of Palantir's data analytics solutions across various industries.

Growth in Commercial Partnerships and Adoption

Q1 2024 witnessed a notable expansion of Palantir's commercial customer base. Several sectors saw significant growth in adoption, including healthcare, finance, and energy. This success stems from the increasing recognition of the value that Palantir's solutions bring to commercial organizations. The demand for data-driven decision-making and operational efficiency continues to drive this growth.

- Significant increase in new commercial clients across diverse sectors, showcasing the platform’s versatility.

- Expansion of existing partnerships with major corporations in various industries, highlighting the long-term value provided by Palantir's solutions.

- Successful implementation of Palantir's solutions resulting in tangible improvements to operational efficiency and profitability for several client organizations.

The Value Proposition of Palantir's Commercial Offerings

Palantir's commercial offerings empower businesses to leverage data for more efficient operations and better strategic decisions. The return on investment (ROI) is demonstrably positive, contributing to the increased adoption. Companies utilize Palantir's platforms to:

- Reduce costs by streamlining operations and identifying areas for improvement.

- Improve decision-making through data-driven insights, leading to better business outcomes.

- Gain a competitive advantage by leveraging superior data analytics capabilities.

The value proposition is clear: Palantir helps businesses unlock the potential of their data, leading to significant improvements in efficiency and profitability.

Conclusion: Palantir's Q1 Success: A Testament to Government and Commercial Strength

Palantir's impressive Q1 2024 performance underscores the company's success in both the government and commercial sectors. The combination of strong government contracts and significant commercial growth demonstrates the versatility and value of its data analytics platforms. The future growth of Palantir is promising, given the continued demand for sophisticated data solutions and the increasing adoption of its technology across various sectors. The Palantir stock outlook remains positive, driven by the continued expansion in both its core markets. This makes Palantir stock an attractive investment opportunity for those interested in the future of data analytics.

Want to learn more about Palantir stock performance and investment opportunities? Explore further to understand the potential of investing in Palantir stock and stay informed about future growth prospects.

Featured Posts

-

Exploring The He Morgan Brother 5 Theories To Identify David In High Potential

May 10, 2025

Exploring The He Morgan Brother 5 Theories To Identify David In High Potential

May 10, 2025 -

Live Music And Events Your Easter Weekend Guide To Lake Charles

May 10, 2025

Live Music And Events Your Easter Weekend Guide To Lake Charles

May 10, 2025 -

Roberts On Being Mistaken For Former Gop House Leader A Cnn Politics Interview

May 10, 2025

Roberts On Being Mistaken For Former Gop House Leader A Cnn Politics Interview

May 10, 2025 -

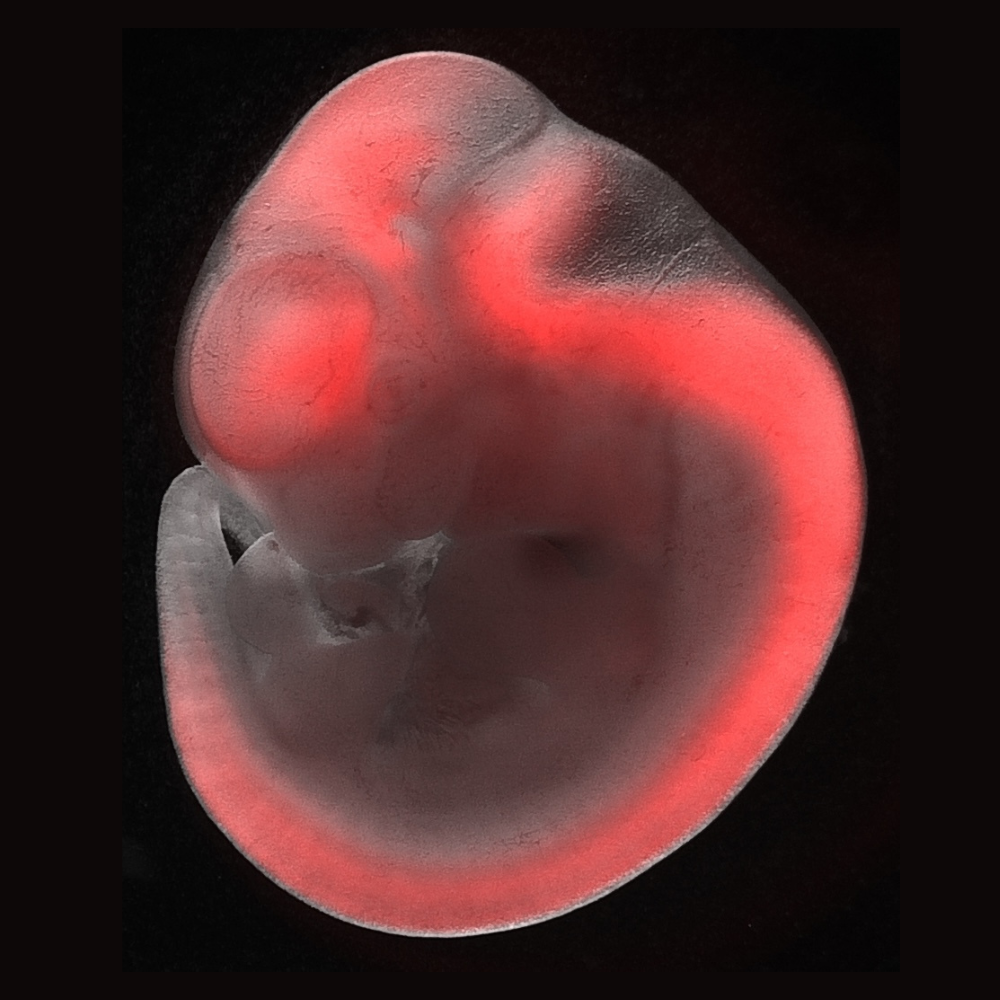

Is Us Taxpayer Money Funding Transgender Mouse Research A Detailed Look

May 10, 2025

Is Us Taxpayer Money Funding Transgender Mouse Research A Detailed Look

May 10, 2025 -

Troubled Nhs Trust Boss Pledges Cooperation In Nottingham Attacks Probe

May 10, 2025

Troubled Nhs Trust Boss Pledges Cooperation In Nottingham Attacks Probe

May 10, 2025