Government's Spring Budget: A Disappointing Outlook For Voters?

Table of Contents

Tax Changes and Their Impact on Household Budgets

The Government's Spring Budget introduced several tax changes with varying impacts across different income brackets. These alterations significantly influence household budgets and contribute to the overall sense of disappointment among voters.

Income Tax Adjustments: The announced changes to income tax are a mixed bag. While the higher earners might see a minor decrease in their tax burden, the majority will face either stagnation or a slight increase in their income tax rates.

- Example 1: The basic rate income tax threshold remained unchanged, squeezing low-to-middle income earners. This means less disposable income for families already struggling with the cost of living crisis.

- Example 2: A slight increase in the higher-rate tax threshold offered minimal relief to higher earners, failing to significantly alleviate the pressure on their disposable income.

- Impact: The overall impact on disposable income for a vast majority of taxpayers appears negative, reinforcing the narrative of a disappointing budget.

Indirect Tax Increases: The Government's Spring Budget also saw increases in indirect taxes, which disproportionately affect lower-income households. These measures further exacerbate the cost of living crisis and fuel public discontent.

- Example 1: A rise in VAT on certain essential goods will lead to a substantial increase in the cost of everyday items.

- Example 2: Increases in excise duties on fuel, alcohol, and tobacco will add to the already considerable burden on household budgets.

- Impact: These indirect tax increases significantly contribute to the rising inflation rate, impacting the purchasing power of all citizens, but particularly those with limited disposable income. The budget offers little relief from the ongoing cost of living crisis.

Public Spending Cuts and Their Consequences

The Government's Spring Budget also introduced cuts to public spending, raising concerns about the quality and accessibility of essential public services.

Healthcare Funding: Proposed cuts to healthcare funding have sparked widespread criticism. The Government's commitment to the NHS is arguably undermined by these measures.

- Example 1: Reduced funding for hospital services could lead to longer waiting lists and potential compromises on patient care.

- Example 2: Cuts to mental health services raise concerns about the availability of critical support for those struggling with their mental wellbeing.

- Impact: The potential consequences of reduced healthcare funding are severe, highlighting a lack of investment in a crucial public service.

Education Funding: Similar concerns surround proposed cuts to education funding. The long-term impact on the quality of education and future generations is a subject of considerable debate.

- Example 1: Reduced funding for schools could result in increased class sizes and a decline in educational standards.

- Example 2: Cuts to university funding could lead to increased tuition fees, restricting access to higher education for many students.

- Impact: These cuts threaten to undermine the UK's future workforce and social mobility, adding to the sense of disappointment surrounding the budget.

Economic Predictions and Long-Term Impact

The Government's economic forecasts accompanying the Spring Budget paint a somewhat uncertain picture. While some positive growth is projected, concerns remain about the long-term impact on the economy and employment.

- GDP Growth: The projected GDP growth is modest, raising questions about the budget's ability to stimulate sustainable economic expansion.

- Inflation Outlook: The inflation outlook remains uncertain, suggesting that the cost of living crisis may persist for some time.

- Unemployment Rate: While the unemployment rate is predicted to remain relatively stable, the long-term effects of the budget on employment remain unclear.

- Impact: The overall economic outlook offers little reassurance, failing to address the core concerns of many voters.

Conclusion: A Disappointing Budget for Many?

In conclusion, the Government's Spring Budget presents a disappointing outlook for many voters. The combination of tax increases, significant public spending cuts, and a somewhat uncertain economic forecast suggests a challenging financial future for a considerable portion of the population. The budget fails to adequately address the rising cost of living, while cuts to vital public services raise serious concerns about the quality of life for many citizens. The Government's Spring Budget seems to prioritize short-term financial measures over the long-term wellbeing of its citizens.

What are your thoughts on the Government's Spring Budget? Share your opinions in the comments section below! The upcoming months will likely reveal the true political implications of this budget and whether further adjustments are necessary to address the widespread concerns it has raised.

Featured Posts

-

Inscripcion De Candidatos Cne Fecha Limite Para No Participantes En Primarias

May 19, 2025

Inscripcion De Candidatos Cne Fecha Limite Para No Participantes En Primarias

May 19, 2025 -

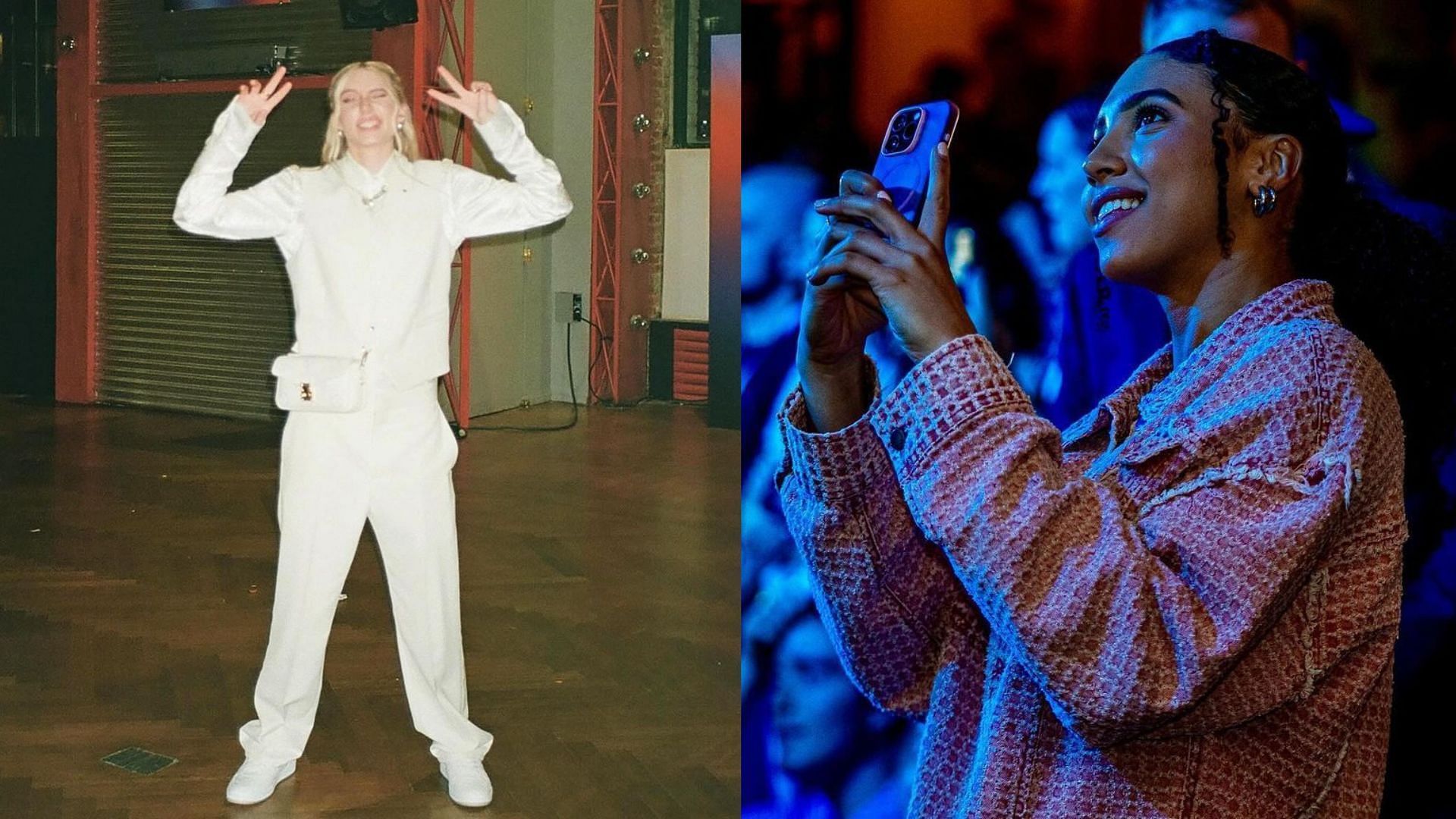

Wnba Draft 2025 Azzi Fudds Red Carpet Style With No 1 Pick Paige Bueckers

May 19, 2025

Wnba Draft 2025 Azzi Fudds Red Carpet Style With No 1 Pick Paige Bueckers

May 19, 2025 -

Todays Nyt Connections Answers March 17 Puzzle 645

May 19, 2025

Todays Nyt Connections Answers March 17 Puzzle 645

May 19, 2025 -

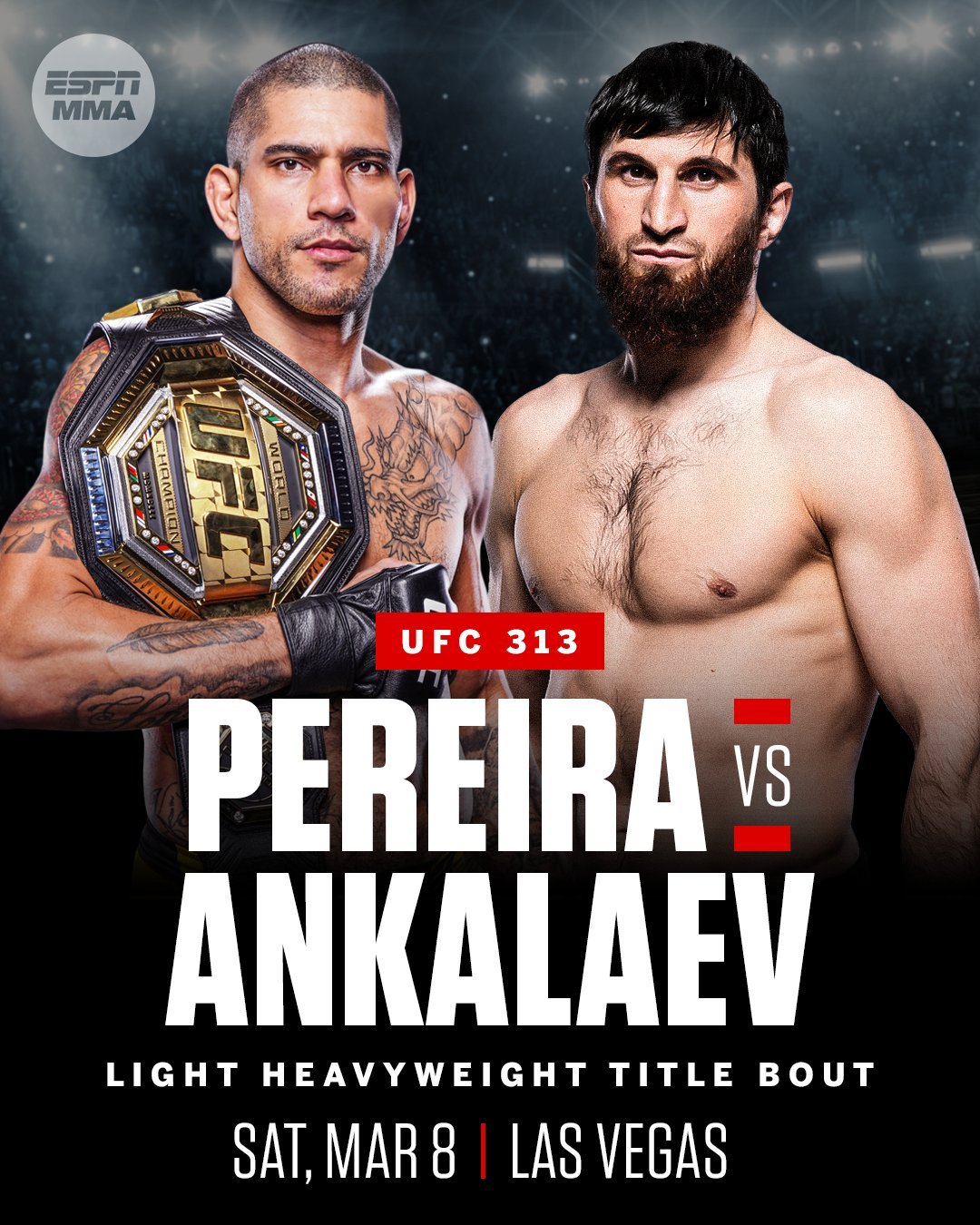

Analyzing The Ufc 313 Rookies A Pre Fight Breakdown

May 19, 2025

Analyzing The Ufc 313 Rookies A Pre Fight Breakdown

May 19, 2025 -

Gazzeli Cocuklar Cadirda Kuran Ezberi Bir Oegrenme Hikayesi

May 19, 2025

Gazzeli Cocuklar Cadirda Kuran Ezberi Bir Oegrenme Hikayesi

May 19, 2025