Governor Signs Bill Eliminating Mississippi Income Tax: Hernando's Outlook

Table of Contents

Potential Economic Benefits for Hernando

The elimination of state income tax could inject new life into Hernando's economy, creating a ripple effect across various sectors.

Increased Investment and Job Creation

A lower-tax environment is incredibly attractive to businesses. The Mississippi income tax elimination could incentivize businesses to relocate to Hernando, bringing with them job opportunities and potentially higher salaries. Industries sensitive to tax burdens, such as manufacturing, technology, and logistics, might find Hernando a more appealing location than previously. This economic development could significantly boost Hernando's job market.

- Increased business relocation: Companies looking for lower operational costs may choose Hernando as their new home.

- Startup opportunities: The reduced tax burden could encourage entrepreneurship and the growth of new businesses.

- Expansion of existing businesses: Existing Hernando businesses may expand operations, creating more jobs and boosting the local economy.

This Hernando MS jobs growth would directly translate to a more robust local economy, improving the standard of living for many residents.

Boost to the Local Real Estate Market

Reduced taxes often translate to increased property values. The Mississippi income tax elimination could attract new residents to Hernando, boosting demand for housing and increasing Hernando real estate prices. This influx of new residents could lead to:

- Increased home sales: A more attractive tax environment will likely increase the number of people looking to buy homes in Hernando.

- Higher property assessments: As demand increases, so too will the value of existing properties in the area.

- Influx of new residents: People seeking a lower tax burden may relocate to Hernando, increasing the population and further stimulating the economy.

This positive feedback loop in the housing market would benefit both homeowners and the broader community.

Increased Consumer Spending and Retail Growth

With more disposable income due to the elimination of state income tax, Hernando residents are likely to increase their consumer spending. This rise in spending would have a significant impact on the local economy, driving retail growth and supporting local businesses. This means:

- Increased retail sales: Local shops and businesses will see a boost in sales as residents have more money to spend.

- Support for local shops: The increased consumer spending will help to sustain and grow local businesses.

- Growth of service industries: The increased population and consumer spending will likely stimulate growth in related service industries.

This positive effect on Hernando economy would create a thriving and dynamic community.

Potential Challenges and Considerations

While the Mississippi income tax elimination offers considerable promise, it's crucial to consider potential drawbacks.

Impact on Public Services

The loss of income tax revenue could lead to funding challenges for essential public services in Hernando. This could impact:

- Potential budget cuts: Local governments might need to make difficult decisions regarding funding for schools, infrastructure, and other vital services.

- Need for alternative revenue streams: New methods of generating revenue, such as increased property taxes or other fees, might become necessary.

- Impact on essential services: Reduced funding could potentially affect the quality or availability of essential services for Hernando residents.

Careful planning and the exploration of alternative funding mechanisms will be critical to mitigate these potential challenges.

Tax Shifting and Unintended Consequences

The absence of income tax may lead to tax shifting, where the burden shifts to other taxes. This could mean:

- Increased property tax rates: To compensate for lost income tax revenue, local governments might increase property taxes.

- Impact on low-income households: Increased property taxes or sales taxes could disproportionately affect low-income families.

- Potential for sales tax increases: State and local governments may consider raising sales taxes to offset the revenue loss.

Understanding the potential for these tax reform impacts and proactively addressing them is crucial to ensure a smooth transition.

Hernando's Future After Mississippi Income Tax Elimination

The Mississippi income tax elimination presents a complex picture for Hernando's future. While the potential economic benefits, like increased investment and job creation, are considerable, careful consideration must be given to potential challenges such as the impact on public services and potential tax shifting. The long-term Hernando economic outlook will depend on how effectively the community adapts and manages these changes. Monitoring the situation and implementing proactive strategies will be key to maximizing the benefits and mitigating the risks of this significant tax reform.

Call to action: Stay informed about the ongoing impact of the Mississippi income tax elimination on Hernando and its residents. Learn more about Hernando's economic development initiatives by [link to relevant resource].

Featured Posts

-

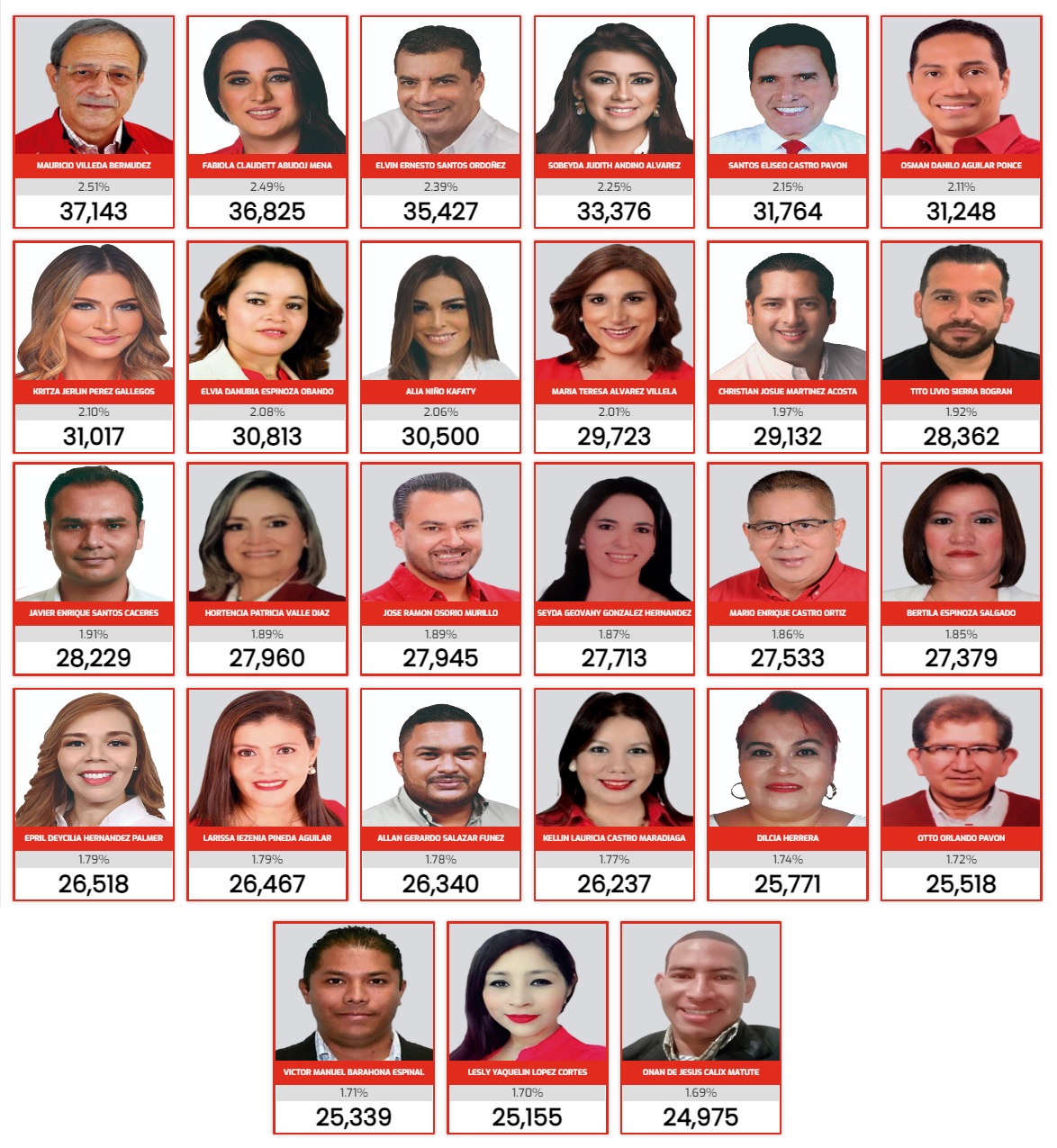

Elecciones Proximas Analisis De Los Aspirantes A Diputados De Nueva Corriente

May 19, 2025

Elecciones Proximas Analisis De Los Aspirantes A Diputados De Nueva Corriente

May 19, 2025 -

La Muerte De Juan Aguilera Un Legado En El Tenis Espanol

May 19, 2025

La Muerte De Juan Aguilera Un Legado En El Tenis Espanol

May 19, 2025 -

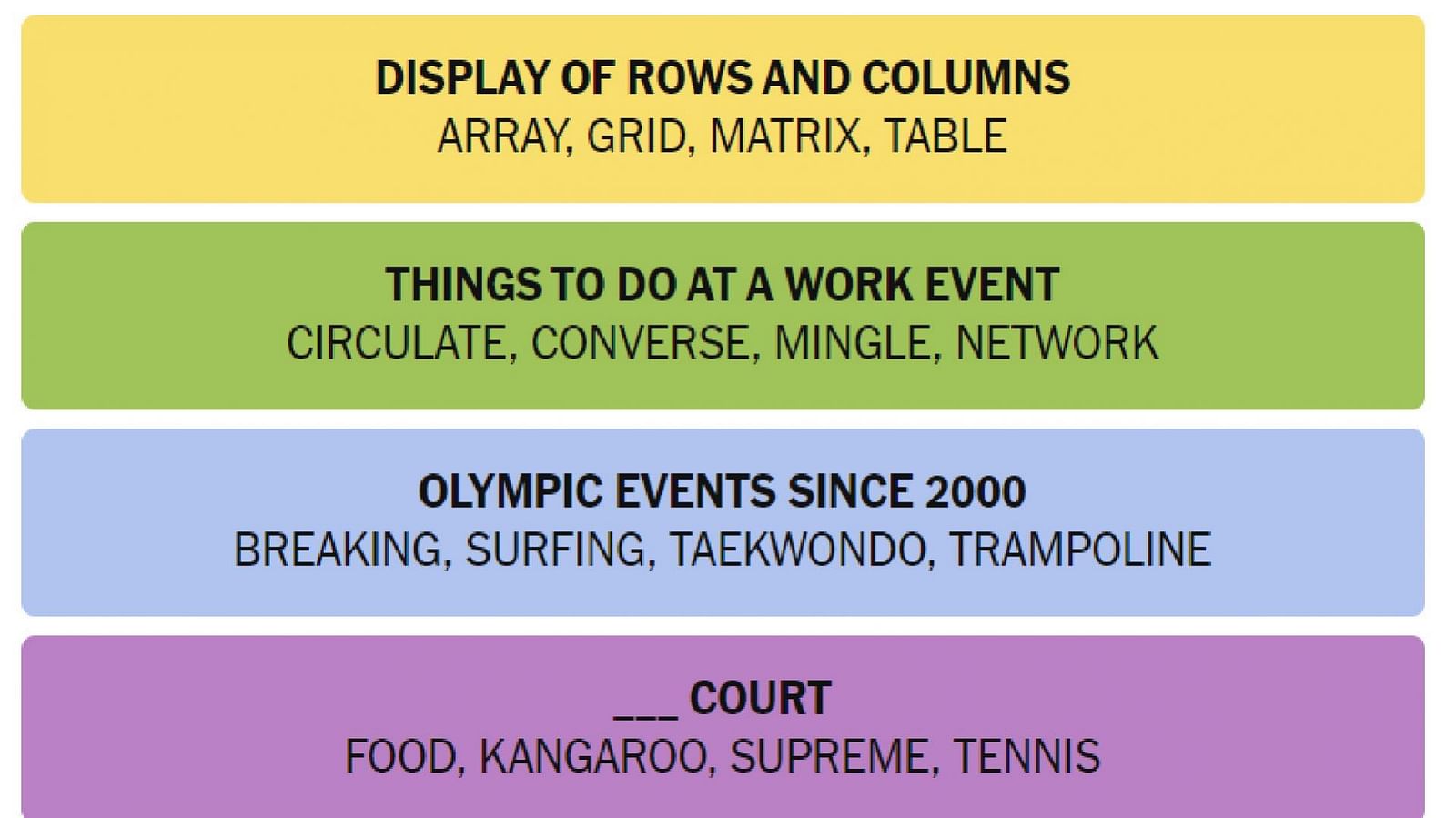

Nyt Connections Game Answers And Hints For May 8th Puzzle 697

May 19, 2025

Nyt Connections Game Answers And Hints For May 8th Puzzle 697

May 19, 2025 -

Fa Cup Final Erling Haalands Wembley Struggle

May 19, 2025

Fa Cup Final Erling Haalands Wembley Struggle

May 19, 2025 -

The Struggles Of A Starving Wife Earning Less Than An A List Husband

May 19, 2025

The Struggles Of A Starving Wife Earning Less Than An A List Husband

May 19, 2025