GPB Capital Ponzi Scheme: Founder David Gentile Receives 7-Year Sentence

Table of Contents

1. The Magnitude of the GPB Capital Ponzi Scheme

The GPB Capital Ponzi scheme stands as a chilling example of large-scale financial fraud. Understanding its scale and mechanics is crucial to preventing future occurrences.

1.1 Financial Losses and Victim Count

The GPB Capital Ponzi scheme inflicted catastrophic financial losses on a vast number of victims. The sheer scale of the fraud is staggering.

- Investment Losses: Investors lost hundreds of millions of dollars, with individual losses ranging from thousands to millions. The exact total loss remains under final calculation due to the complexity of the scheme.

- Victim Demographics: The victims included a diverse range of investors, from sophisticated institutional players to everyday retail investors seeking higher returns. Many were retirees relying on the investment for their retirement income, making the impact even more devastating. This highlights the indiscriminate nature of such fraudulent investment schemes.

1.2 The Scheme's Mechanics

The GPB Capital Ponzi scheme operated by paying earlier investors with money from newer investors. This unsustainable structure is a hallmark of a classic Ponzi scheme.

- False Financial Statements: Gentile and his associates created and circulated false financial statements that grossly overstated the performance and value of GPB Capital's investments. These fraudulent investment reports were used to lure in new investors.

- Misappropriation of Funds: Instead of investing the funds as promised, a significant portion of the money was diverted for personal use by Gentile and others involved in the scheme, further fueling the fictitious profits reported to existing and prospective investors.

- Unsustainable Returns: The promised returns were far too high to be realistically achievable through legitimate investment strategies. This unsustainable nature of the returns should have been a red flag for investors, highlighting a crucial aspect of detecting a Ponzi scheme structure.

2. David Gentile's Conviction and Sentencing

David Gentile's conviction and sentencing mark a significant step in bringing justice to the victims of the GPB Capital Ponzi scheme.

2.1 The Charges and Trial

Gentile faced multiple serious charges related to his role in the fraud.

- Charges: The charges included wire fraud, securities fraud, and conspiracy to commit wire fraud and securities fraud. These charges reflect the multifaceted nature of his crimes and the deliberate intent to defraud investors.

- Key Evidence: The prosecution presented substantial evidence, including fraudulent financial documents, emails, and testimony from witnesses, to demonstrate Gentile's guilt. This evidence convincingly established his role in perpetrating the scheme.

2.2 The 7-Year Sentence and Implications

The seven-year sentence sends a strong message about the seriousness of financial crimes.

- Deterrent Effect: The sentence aims to deter others from engaging in similar fraudulent activities. The severity of the punishment reflects the significant harm caused by such schemes.

- Legal Implications: The conviction and sentence may have implications for other individuals involved in the GPB Capital scandal, potentially leading to further investigations and prosecutions. Restitution orders are also likely to be pursued to help compensate victims for their losses.

3. Regulatory Response and Investor Protection

The GPB Capital case highlights the importance of robust regulatory oversight and investor awareness.

3.1 SEC Investigation and Actions

The Securities and Exchange Commission (SEC) played a crucial role in investigating the GPB Capital Ponzi scheme.

- SEC Investigation: The SEC launched a comprehensive investigation into GPB Capital's activities, uncovering the fraudulent nature of the scheme.

- Civil Penalties: In addition to criminal charges, the SEC also imposed significant civil penalties on Gentile and others involved. The SEC actively worked to recover funds for victims.

3.2 Lessons Learned and Investor Safeguards

The GPB Capital case underscores the need for investors to exercise caution and due diligence.

- Due Diligence: Investors must thoroughly research any investment opportunity before committing their funds. This includes verifying the legitimacy of the investment and its returns.

- Professional Advice: Seeking advice from qualified financial advisors is crucial, especially for complex investments.

- Red Flags: Investors should be aware of red flags such as unrealistically high returns, pressure to invest quickly, and difficulty obtaining information about the investment.

Conclusion

The GPB Capital Ponzi scheme, culminating in David Gentile's seven-year sentence, serves as a stark reminder of the devastating consequences of investment fraud. The hundreds of millions of dollars lost and the countless victims affected underscore the critical need for investor awareness and protection. To avoid becoming a victim of a Ponzi scheme, learn to identify red flags, conduct thorough due diligence, and seek professional financial advice before investing. Report any suspicious investment activities to the SEC or other relevant authorities. Understanding GPB Capital's downfall should empower you to avoid similar schemes and protect your financial future. Protect yourself—learn to detect investment fraud and avoid Ponzi schemes.

Featured Posts

-

Succes Ou Echec Analyse De L Audience De La Roue De La Fortune Avec Eric Antoine Apres 3 Mois

May 11, 2025

Succes Ou Echec Analyse De L Audience De La Roue De La Fortune Avec Eric Antoine Apres 3 Mois

May 11, 2025 -

Brewers Vs Yankees Updated Injury List March 27 30

May 11, 2025

Brewers Vs Yankees Updated Injury List March 27 30

May 11, 2025 -

Boxings Next Big Fight Cissokho Vs Kavaliauskas In Wbc Eliminator

May 11, 2025

Boxings Next Big Fight Cissokho Vs Kavaliauskas In Wbc Eliminator

May 11, 2025 -

Judge Considers 2026 World Baseball Classic A Potential Us Roster Spot

May 11, 2025

Judge Considers 2026 World Baseball Classic A Potential Us Roster Spot

May 11, 2025 -

Film Production In Uruguay Benefits And Challenges

May 11, 2025

Film Production In Uruguay Benefits And Challenges

May 11, 2025

Latest Posts

-

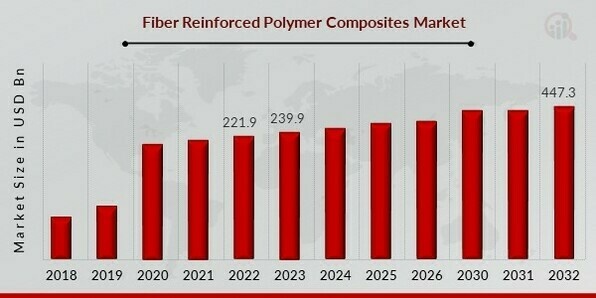

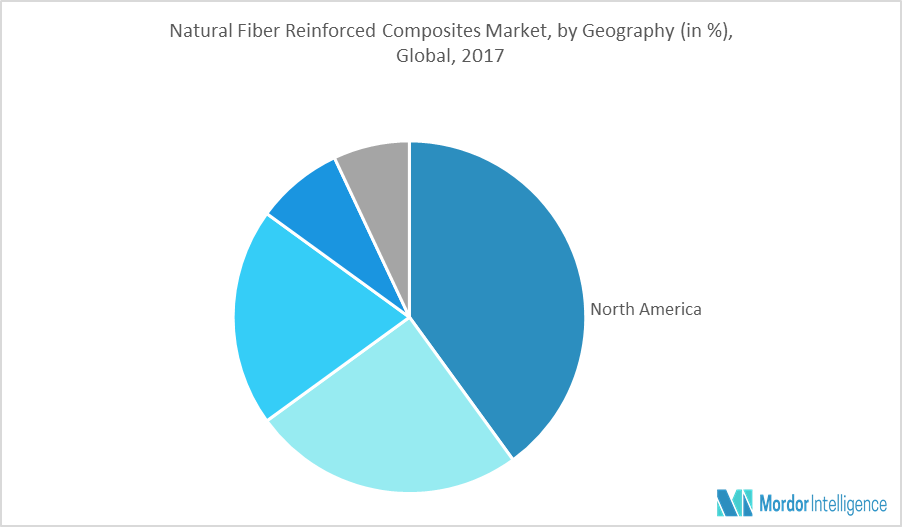

Global Natural Fiber Composites Market Trends Drivers And Future Projections To 2029

May 13, 2025

Global Natural Fiber Composites Market Trends Drivers And Future Projections To 2029

May 13, 2025 -

In Depth Study Of The Natural Fiber Composites Market 2029 Predictions

May 13, 2025

In Depth Study Of The Natural Fiber Composites Market 2029 Predictions

May 13, 2025 -

Natural Fiber Composites Market Research Report Global Forecast 2029

May 13, 2025

Natural Fiber Composites Market Research Report Global Forecast 2029

May 13, 2025 -

Comprehensive Analysis Of The Global Natural Fiber Composites Market To 2029

May 13, 2025

Comprehensive Analysis Of The Global Natural Fiber Composites Market To 2029

May 13, 2025 -

The Future Of Natural Fiber Composites A Market Forecast To 2029

May 13, 2025

The Future Of Natural Fiber Composites A Market Forecast To 2029

May 13, 2025