Grants And Funding For Eco-Friendly SMEs

Table of Contents

Government Grants and Subsidies for Eco-Friendly Businesses

Government agencies across the globe recognize the importance of fostering sustainable businesses. Numerous programs offer green business grants and subsidies to help eco-friendly SMEs launch and expand. However, finding the right fit requires diligent research.

Identifying Relevant Government Programs

Locating suitable government funding starts with targeted searches. Instead of generic searches, utilize specific keywords. For instance, try "green business grants [your country/region]," "environmental grants for SMEs," or "sustainable business funding [your state/province]".

- Utilize Government Websites: Start with national, regional, and local government websites dedicated to environmental protection or small business support.

- Explore Grant Databases: Online grant databases, such as [Insert relevant grant database links here – adapt to region], aggregate funding opportunities from various sources.

- Network with Industry Associations: Join industry associations related to your sector. They often share information about relevant grants and funding opportunities.

- Examples of Government Agencies (Adapt to your region): In many countries, the Environmental Protection Agency (EPA), Department of Energy, and Small Business Administration (SBA) offer various programs.

Common Eligibility Criteria for Green Grants

Securing green grants usually involves meeting specific eligibility requirements. These often include:

- Business Registration: Your business must be legally registered and operating within the specified region.

- Environmental Impact: You'll need to demonstrate a clear environmental benefit from your business operations or products. This might involve reducing carbon emissions, promoting waste reduction, or using sustainable materials.

- Financial Projections: A well-structured business plan with realistic financial projections is essential to showcase the viability and potential impact of your project.

- Certifications: Holding certifications like B Corp, LEED, or other relevant sustainability certifications can significantly boost your application.

A strong business plan highlighting your commitment to sustainability and detailing your financial projections is paramount.

The Application Process for Government Funding

Applying for government funding is a structured process:

- Research: Thoroughly research the specific grant requirements and eligibility criteria.

- Application: Complete the application form accurately and comprehensively. Pay close attention to deadlines.

- Submission: Submit your application by the designated deadline.

- Follow-Up: Follow up on the status of your application as per the agency's guidelines.

A compelling grant proposal, showcasing your understanding of the grant's objectives and clearly outlining your project's impact, is critical for success. Include strong financial projections demonstrating the economic viability of your initiative.

Private Investment and Venture Capital for Sustainable SMEs

Beyond government grants, private investors increasingly recognize the potential of eco-friendly businesses. Impact investors and ESG (Environmental, Social, and Governance) funds are actively seeking opportunities to align their investments with sustainable goals.

Attracting Impact Investors and ESG Funds

To attract these investors, highlight your strong ESG profile:

- Showcase your environmental impact: Quantify your sustainability efforts, demonstrating tangible reductions in carbon footprint, waste, or resource consumption.

- Transparency and Accountability: Be transparent about your environmental and social performance. Provide data-driven evidence of your commitment.

- Investor Pitch Deck: Develop a compelling investor pitch deck that clearly articulates your business model, market opportunity, and environmental impact.

- Networking: Participate in industry events and utilize online platforms connecting sustainable businesses with investors.

Crowdfunding Platforms for Green Initiatives

Crowdfunding platforms offer an alternative route to secure funding. Platforms like Kickstarter and Indiegogo allow you to reach a broad audience and generate capital for your green initiatives.

- Compelling Story: Craft a compelling narrative around your project, highlighting its environmental benefits and appealing to potential backers' values.

- Social Media: Utilize social media to promote your campaign and engage potential investors.

- Rewards: Offer attractive rewards to incentivize contributions.

- Risk Assessment: Understand the risks involved in crowdfunding and develop contingency plans.

Other Funding Sources for Eco-Conscious Enterprises

Beyond government grants and private investment, several other avenues exist for securing funding:

Loans and Lines of Credit from Green Banks and Financial Institutions

Green banks and financial institutions offer specialized loan products designed for sustainable businesses.

- Green Loans: These loans often come with favorable terms and conditions compared to traditional loans, recognizing the positive environmental impact of your business.

- Lower Interest Rates: Many green banks offer lower interest rates as an incentive.

- Access to Capital: This can provide much-needed capital for sustainable projects.

Philanthropic Organizations and Foundations Supporting Environmental Projects

Many philanthropic organizations and foundations actively support environmental projects.

- Align with Mission: Identify foundations whose missions align with your business's environmental goals.

- Grant Proposals: Prepare well-researched grant proposals that clearly articulate your project's objectives, impact, and alignment with the foundation's values.

- Networking: Attend events and network with representatives from relevant foundations.

Conclusion

Securing funding for your eco-friendly SME requires a multi-pronged approach. By exploring government grants, private investment opportunities, and other funding sources, you can increase your chances of success. Remember, a strong business plan, a compelling narrative highlighting your environmental impact, and diligent research are crucial elements in securing the financial support needed for sustainable growth. Start your search for grants and funding for eco-friendly SMEs today! Explore the resources mentioned in this article and don't hesitate to contact relevant organizations for personalized advice. Your sustainable future awaits.

Featured Posts

-

Eurovisions Lumo A Design Fiasco Or Underrated Gem

May 19, 2025

Eurovisions Lumo A Design Fiasco Or Underrated Gem

May 19, 2025 -

Den Pagaende Debatten Mellan Pedro Pascal Och J K Rowling

May 19, 2025

Den Pagaende Debatten Mellan Pedro Pascal Och J K Rowling

May 19, 2025 -

Final Destination Bloodline Directors Discuss Franchise Shift

May 19, 2025

Final Destination Bloodline Directors Discuss Franchise Shift

May 19, 2025 -

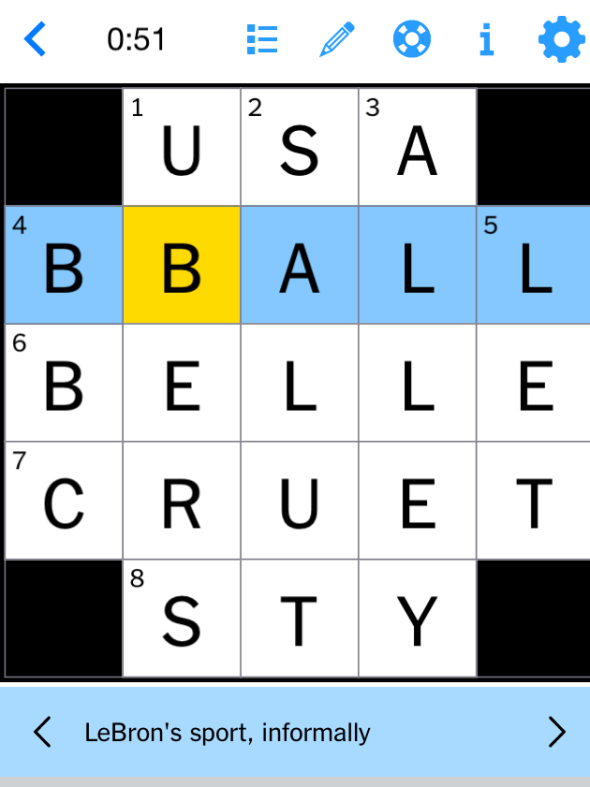

Nyt Mini Crossword February 26 2025 Solutions And Clues

May 19, 2025

Nyt Mini Crossword February 26 2025 Solutions And Clues

May 19, 2025 -

How Orlando Bloom Stays Fit The Cold Plunge Method

May 19, 2025

How Orlando Bloom Stays Fit The Cold Plunge Method

May 19, 2025