Grayscale ETF Filing: Could It Send XRP To New Price Heights?

Table of Contents

The Grayscale Victory and its Implications for Crypto Regulation

Grayscale's court victory represents a monumental shift in the regulatory landscape for cryptocurrencies in the US. The judge's ruling, essentially compelling the SEC to approve the GBTC conversion to a spot Bitcoin ETF, signals a potential weakening of the SEC's previously stringent stance on digital asset investment vehicles. This has profound implications for the entire crypto market.

- Increased likelihood of other crypto ETFs being approved: The Grayscale win sets a powerful precedent, increasing the probability of approvals for other cryptocurrency ETFs, including those based on Ethereum or other altcoins.

- Potential for reduced regulatory uncertainty in the crypto market: This victory injects a much-needed dose of regulatory clarity, potentially attracting more institutional investors who previously hesitated due to the uncertain regulatory environment.

- Positive sentiment shift among institutional investors: The ruling has boosted investor confidence, signaling a more favorable regulatory outlook for digital assets and encouraging greater institutional participation in the crypto market.

- Discussion of the SEC's next steps and potential appeals: While the SEC could appeal the ruling, the decision has significantly altered the landscape, prompting speculation about potential compromises or a shift in their overall regulatory strategy. The future will depend on their next steps.

How a Positive Regulatory Environment Could Benefit XRP

Reduced regulatory uncertainty, spurred by the Grayscale win, could significantly benefit XRP. A clearer regulatory framework fosters increased confidence and reduces the risks associated with investment in digital assets.

- Increased institutional adoption and investment: With less regulatory ambiguity, institutional investors – who often require stringent regulatory compliance – may become more comfortable investing in XRP.

- Greater liquidity in XRP markets: Increased institutional investment generally leads to higher trading volumes and improved market liquidity, making it easier to buy and sell XRP.

- Potential for integration into mainstream financial platforms: A more positive regulatory climate could pave the way for the integration of XRP into mainstream financial platforms and payment systems, expanding its reach and utility.

- Reduced risk associated with holding XRP: Reduced regulatory uncertainty diminishes the risk associated with XRP, making it a more attractive investment option for risk-averse investors.

XRP's Unique Position in the Crypto Market

XRP’s distinct features and ongoing developments place it in a unique position to benefit from the changing regulatory landscape.

- XRP's use case in cross-border payments and its partnerships with financial institutions: XRP's primary use case focuses on facilitating fast and low-cost cross-border payments, a function already utilized by several financial institutions. This existing infrastructure could see significant expansion with increased regulatory clarity.

- The ongoing Ripple vs. SEC lawsuit and its potential resolution: A favorable outcome in the Ripple lawsuit could further boost XRP’s price and adoption. The Grayscale decision may indirectly influence this case, creating a more positive environment for Ripple's defense.

- Comparison with other cryptocurrencies and its potential to outperform: Compared to other cryptocurrencies, XRP's focus on real-world utility and its established partnerships could give it a competitive edge in a market increasingly influenced by regulatory factors.

- Discussion of technical analysis and potential price targets: While technical analysis offers potential insights into price movements, predicting XRP price targets remains speculative. However, a more positive regulatory outlook could significantly influence price trends.

Potential Challenges and Risks

Despite the positive implications of the Grayscale victory, several factors could still hinder XRP's price increase.

- Continued regulatory scrutiny of cryptocurrencies: Even with the Grayscale win, regulatory uncertainty remains a significant risk. The SEC could still pursue stricter regulations affecting XRP or other cryptocurrencies.

- Market volatility and general economic conditions: The cryptocurrency market is notoriously volatile, and broader economic conditions can significantly impact its performance.

- Competition from other cryptocurrencies: XRP faces competition from other cryptocurrencies vying for market share. Its ability to maintain its position will depend on its continued innovation and adoption.

- Potential for the SEC to appeal the Grayscale decision: An appeal by the SEC could prolong regulatory uncertainty and negatively affect investor sentiment, including for XRP.

Conclusion

The Grayscale ETF filing's success presents significant implications for the entire cryptocurrency market, including XRP. A positive regulatory environment could drive increased institutional adoption and potentially elevate XRP's price. However, challenges like continued regulatory scrutiny and market volatility remain. The potential for the Grayscale ETF filing to send XRP to new price heights is undeniable, but careful consideration of these factors is crucial. Stay informed about the evolving regulatory landscape and the Ripple vs. SEC lawsuit to make informed decisions regarding your XRP investment. Continue researching the Grayscale ETF and its potential impact on the XRP price. Learn more and stay updated on this developing story!

Featured Posts

-

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Journey

May 08, 2025

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Journey

May 08, 2025 -

Sonos And Ikeas Symfonisk Collaboration Officially Over Impact And Alternatives

May 08, 2025

Sonos And Ikeas Symfonisk Collaboration Officially Over Impact And Alternatives

May 08, 2025 -

Sve Opcije Na Stolu Grbovic O Formiranju Prelazne Vlade

May 08, 2025

Sve Opcije Na Stolu Grbovic O Formiranju Prelazne Vlade

May 08, 2025 -

Kripto Para Yatirimi Wall Street Kurumlarinin Degisen Perspektifi

May 08, 2025

Kripto Para Yatirimi Wall Street Kurumlarinin Degisen Perspektifi

May 08, 2025 -

Arsenal Vs Psg Gary Nevilles Prediction And What To Expect

May 08, 2025

Arsenal Vs Psg Gary Nevilles Prediction And What To Expect

May 08, 2025

Latest Posts

-

Boston Celtics Jayson Tatum Injured Ankle Pain Raises Concerns

May 08, 2025

Boston Celtics Jayson Tatum Injured Ankle Pain Raises Concerns

May 08, 2025 -

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025 -

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025

Is Colin Cowherd Unfairly Targeting Jayson Tatum

May 08, 2025 -

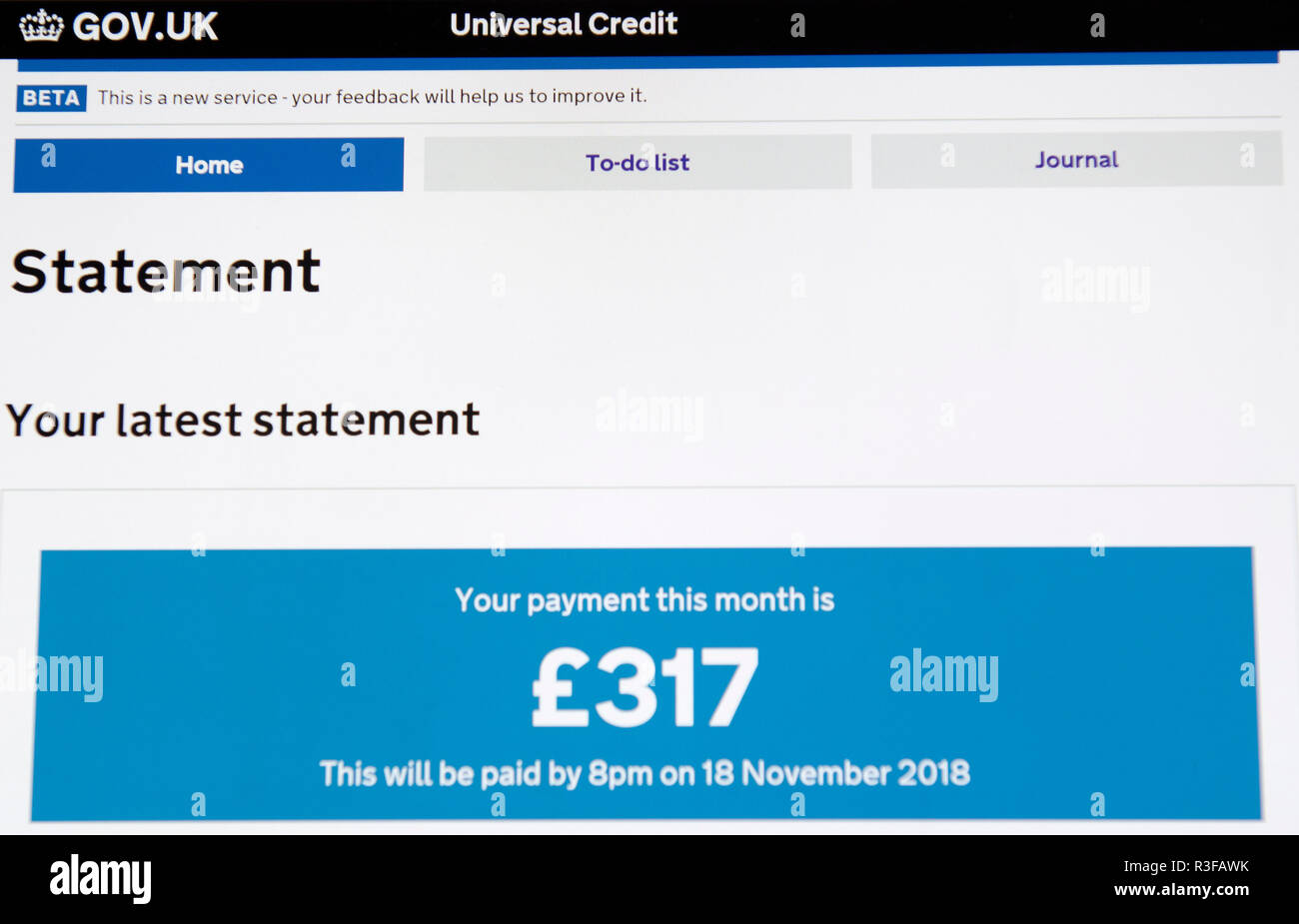

Universal Credit Back Payments Check If You Re Eligible

May 08, 2025

Universal Credit Back Payments Check If You Re Eligible

May 08, 2025 -

Jayson Tatums Ankle Pain And Potential Absence For Boston Celtics

May 08, 2025

Jayson Tatums Ankle Pain And Potential Absence For Boston Celtics

May 08, 2025