Grim Retail Sales: A Sign Of Looming Bank Of Canada Rate Cuts?

Table of Contents

The Deteriorating Retail Sales Landscape in Canada

Analyzing recent sales figures reveals a worrying trend. Statistics Canada reported a [insert specific percentage]% drop in retail sales in [insert month/quarter], marking the [insert description, e.g., steepest decline in several years]. This grim retail sales performance isn't uniform across all sectors.

- Specific percentage drop in retail sales: [Insert precise percentage and timeframe from Statistics Canada data].

- Key sectors showing significant declines: The furniture and electronics sectors have been particularly hard hit, indicating a significant pullback in discretionary spending. [Insert data supporting this, sourced from Statistics Canada or other reputable sources].

- Geographical variations: While the national picture is grim, some provinces have experienced more significant declines than others. [Mention any regional disparities, citing data sources].

This weakening in Canadian retail underscores a broader economic slowdown and raises serious questions about consumer confidence and future spending. The sustained weakness in consumer spending points to a potential need for the Bank of Canada to reconsider its current monetary policy.

Inflation's Persistent Impact on Consumer Behavior

The inflationary squeeze is a major driver behind the grim retail sales figures. Persistent high inflation is eroding purchasing power, forcing Canadians to tighten their belts.

- Current inflation rate and impact on disposable income: Canada's current inflation rate of [insert current rate] is significantly reducing disposable income for many households, leaving less money for non-essential purchases.

- Increased cost of essential goods: The rising cost of essential goods, such as groceries and energy, is leaving less room in household budgets for discretionary spending, directly impacting retail sales.

- Consumer confidence indices: Consumer confidence indices are closely tracking retail sales, reflecting a growing pessimism about the economic outlook. [Cite relevant consumer confidence indices and their recent trends].

This inflationary pressure is directly impacting consumer behavior, leading to reduced spending and contributing significantly to the grim retail sales data.

The Bank of Canada's Response: Rate Cuts on the Horizon?

The Bank of Canada's primary mandate is to maintain price stability and promote sustainable economic growth. Recent interest rate decisions reflect their attempts to control inflation, even if it means dampening economic activity.

- The Bank of Canada's mandate: The Bank aims to keep inflation at its 2% target. Recent rate hikes were aimed at curbing inflation, but the resulting impact on retail sales raises questions about the effectiveness and future direction of monetary policy.

- Analyzing monetary policy decisions: The Bank has [describe recent rate hikes and their stated rationale]. However, the sustained weakness in retail sales, coupled with potentially slowing inflation, could prompt a reversal of this strategy.

- Potential scenarios leading to rate cuts: Sustained weakness in retail sales and a demonstrable slowdown in inflation could lead the Bank of Canada to consider rate cuts to stimulate economic activity. Expert opinions vary on the timing and magnitude of any potential cuts. [mention diverse expert opinions from reputable financial news sources].

Alternative Factors Influencing Retail Sales

While inflation and interest rates are significant factors in the current grim retail sales picture, other elements are also at play.

- Supply chain disruptions: Lingering supply chain issues continue to impact the availability and pricing of certain goods, hindering consumer spending in affected sectors.

- Changes in consumer preferences: Shifts in consumer preferences, driven by factors like sustainability concerns and changing lifestyles, are also influencing retail spending patterns.

- Seasonality: It's important to account for seasonal fluctuations when analyzing retail sales data; however, even accounting for seasonality, the current figures remain concerning.

Understanding these additional factors provides a more comprehensive picture of the forces shaping the current retail landscape.

Conclusion

The grim retail sales data in Canada is a significant economic indicator, suggesting a potential need for a shift in monetary policy. The persistent impact of inflation on consumer behavior, combined with the weakening retail sales, raises the possibility of the Bank of Canada initiating rate cuts to stimulate the economy. While other factors contribute to the current retail climate, the interplay of inflation and interest rates remains a dominant force. Keep a close eye on grim retail sales data and the Bank of Canada's response—it could significantly impact your financial future. Stay informed about the evolving economic situation by following reputable financial news sources and, if needed, seeking advice from a qualified financial advisor.

Featured Posts

-

January 6th Ray Epps Defamation Case Against Fox News Explained

Apr 28, 2025

January 6th Ray Epps Defamation Case Against Fox News Explained

Apr 28, 2025 -

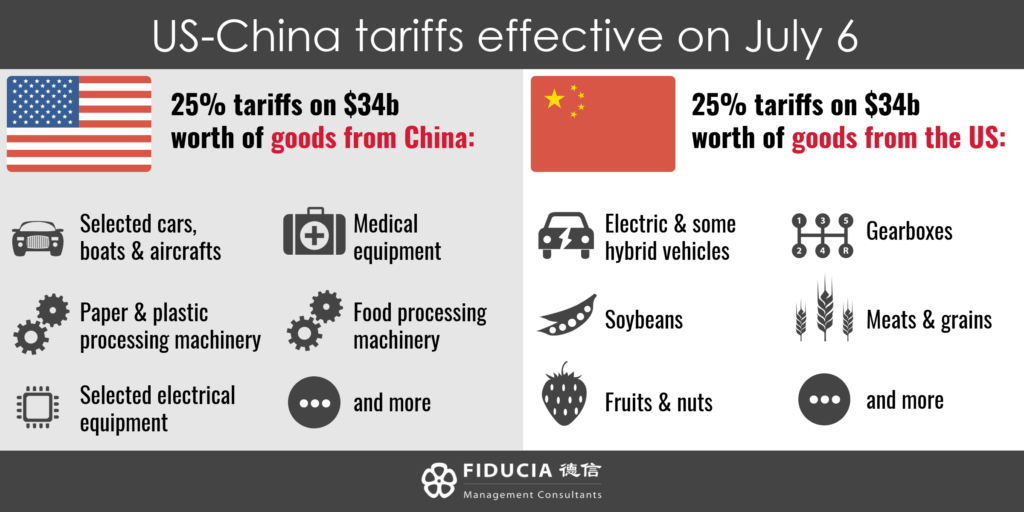

Chinas Tariff Exemptions Some Us Goods Get A Break

Apr 28, 2025

Chinas Tariff Exemptions Some Us Goods Get A Break

Apr 28, 2025 -

Los Angeles Wildfires A Reflection Of Societal Shifts In Gambling And Risk

Apr 28, 2025

Los Angeles Wildfires A Reflection Of Societal Shifts In Gambling And Risk

Apr 28, 2025 -

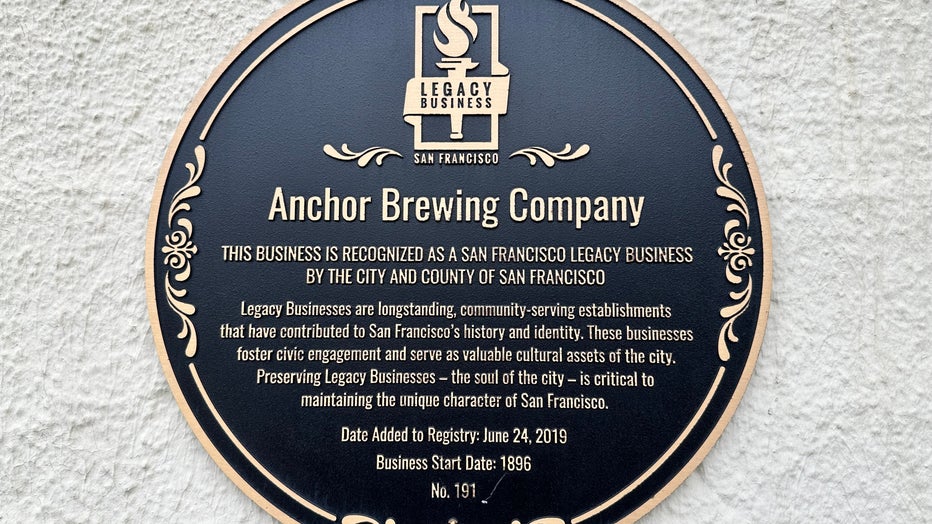

San Franciscos Anchor Brewing Company To Close Its Doors

Apr 28, 2025

San Franciscos Anchor Brewing Company To Close Its Doors

Apr 28, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Reveal

Apr 28, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Reveal

Apr 28, 2025

Latest Posts

-

Red Sox Breakout Season Predicting The Next Star

Apr 28, 2025

Red Sox Breakout Season Predicting The Next Star

Apr 28, 2025 -

Under The Radar Red Sox Player Poised For Breakout Season

Apr 28, 2025

Under The Radar Red Sox Player Poised For Breakout Season

Apr 28, 2025 -

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025 -

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025