Growth Of Canada's Leading Natural Gas Producer: Market Dominance And Future Outlook

Table of Contents

Market Share and Production Capacity of Canada's Leading Natural Gas Producer

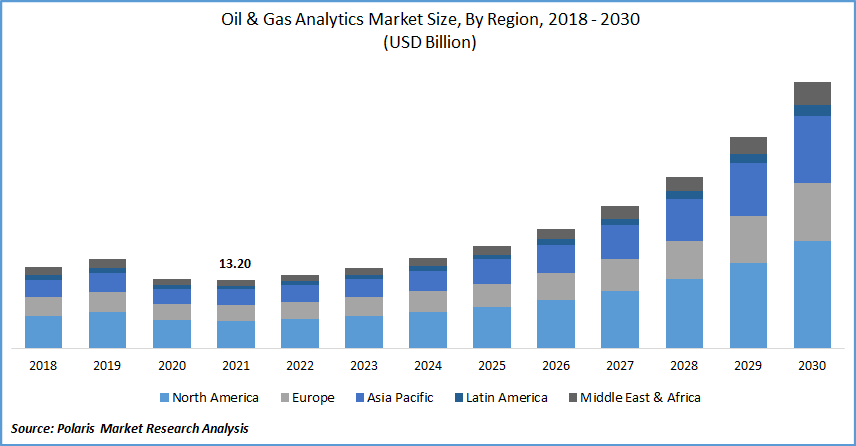

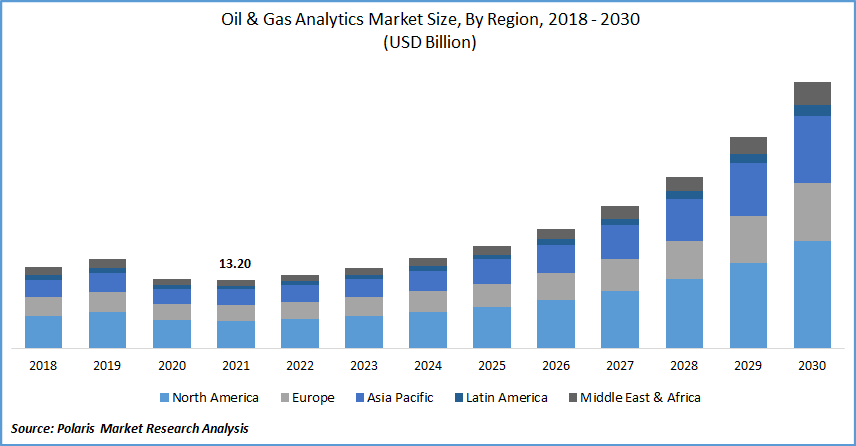

Analyzing the market share of Canada's leading natural gas producer reveals a dominant player in the Canadian energy market. This company consistently holds a significant portion of the total natural gas production within Canada. While precise figures fluctuate yearly, a consistent trend of market leadership is observable.

-

Percentage of total Canadian natural gas production: The leading producer typically accounts for [Insert Percentage Range, e.g., 30-40%] of total Canadian natural gas production, significantly outweighing its competitors. This dominance stems from extensive infrastructure and a large reserve base.

-

Key producing regions and infrastructure: Major production hubs are concentrated in [mention key provinces/regions, e.g., Alberta, British Columbia], leveraging existing pipeline networks and processing facilities for efficient extraction and transportation.

-

Comparison to other major Canadian natural gas producers: Other significant players exist, but none approach the scale of operations or market share held by the leading producer. The gap in production capacity highlights the dominant position of the market leader.

-

Impact of technological advancements on production capacity: Continuous investment in technology, such as enhanced oil recovery techniques and horizontal drilling, has been pivotal in boosting production capacity and efficiency over the past five years. [Include a chart or graph illustrating production growth if data is available].

Strategic Initiatives and Investments Driving Growth

The sustained growth of Canada's leading natural gas producer is a result of strategic decision-making and substantial investment across various facets of the business.

-

Recent major acquisitions or partnerships: Strategic mergers and acquisitions have expanded reserves, infrastructure, and market reach, solidifying the company's position as a dominant force. [Mention examples if publicly available, focusing on their impact on market share and production].

-

Investment in new exploration and production technologies (e.g., shale gas extraction): Significant capital expenditure in advanced technologies like shale gas extraction has significantly improved access to previously untapped reserves, leading to production increases and operational efficiencies.

-

Pipeline expansion projects and their impact on market access: Investing in and expanding pipeline infrastructure ensures efficient transportation of natural gas to domestic and international markets, facilitating growth and reducing transportation costs.

-

Focus on environmental sustainability and emission reduction initiatives: Increasing emphasis on environmental stewardship is evident through investments in carbon capture and storage technologies and other emission-reduction strategies, reflecting a proactive approach to regulatory compliance and environmental responsibility.

Challenges and Opportunities in the Canadian Natural Gas Market

Despite its dominance, Canada's leading natural gas producer faces several challenges and benefits from numerous opportunities in the evolving energy landscape.

-

Impact of global energy price volatility: Fluctuations in global energy prices directly impact profitability. Hedging strategies and diversified markets are crucial for mitigating these risks.

-

Environmental regulations and carbon pricing policies: Stringent environmental regulations and carbon pricing mechanisms pose significant challenges, demanding investment in cleaner technologies and emission-reduction initiatives.

-

Competition from other energy sources (e.g., renewables): Increasing competition from renewable energy sources necessitates strategic diversification and adaptation to maintain market share.

-

Opportunities for export to global markets: Growing global demand for natural gas presents significant opportunities for export growth, expanding the market reach and revenue streams for the leading producer.

-

Technological advancements in natural gas production and transportation: Continuous technological innovation remains crucial for maintaining a competitive edge, enhancing efficiency, and reducing environmental impact.

Future Outlook and Predictions for Canada's Leading Natural Gas Producer

The future outlook for Canada's leading natural gas producer is positive, but contingent upon several factors.

-

Projected production growth over the next 5-10 years: Sustained growth is anticipated, driven by ongoing exploration, technological advancements, and expanding market access. [Include projections if available from reputable sources].

-

Potential impact of geopolitical events and global energy demand: Geopolitical instability and global energy demand fluctuations can significantly impact market dynamics and future growth trajectories.

-

Expected investment in new technologies and infrastructure: Continued investment in infrastructure and cutting-edge technologies will be essential to maintain a competitive edge and sustain production growth.

-

Long-term sustainability strategy and its influence on growth: A strong commitment to environmental sustainability and responsible resource management will be critical for long-term growth and regulatory compliance.

Conclusion

The growth of Canada's leading natural gas producer is a complex story shaped by strategic investments, market conditions, and global energy trends. While challenges exist, including environmental concerns and price volatility, the company’s strong market position and focus on innovation position it for continued success. Understanding the future outlook for this key player is crucial for navigating the evolving Canadian energy landscape. To stay informed on the latest developments regarding Canada's leading natural gas producer and its impact on the market, continue to follow our analysis and insights. Learn more about the dynamic world of Canada's leading natural gas producer and its continued growth.

Featured Posts

-

Grand Slam Track Can This New League Save Athletics

May 11, 2025

Grand Slam Track Can This New League Save Athletics

May 11, 2025 -

Trumps China Negotiation Strategy Focus On Tariff Cuts And Rare Earth Minerals

May 11, 2025

Trumps China Negotiation Strategy Focus On Tariff Cuts And Rare Earth Minerals

May 11, 2025 -

Elliotts Exclusive Pipeline Stake A Russian Gas Gamble

May 11, 2025

Elliotts Exclusive Pipeline Stake A Russian Gas Gamble

May 11, 2025 -

Iftar Programi Hakkari Deki Hakim Ve Savcilar Bulustu

May 11, 2025

Iftar Programi Hakkari Deki Hakim Ve Savcilar Bulustu

May 11, 2025 -

Jon M Chus Crazy Rich Asians Tv Show Coming To Max

May 11, 2025

Jon M Chus Crazy Rich Asians Tv Show Coming To Max

May 11, 2025

Latest Posts

-

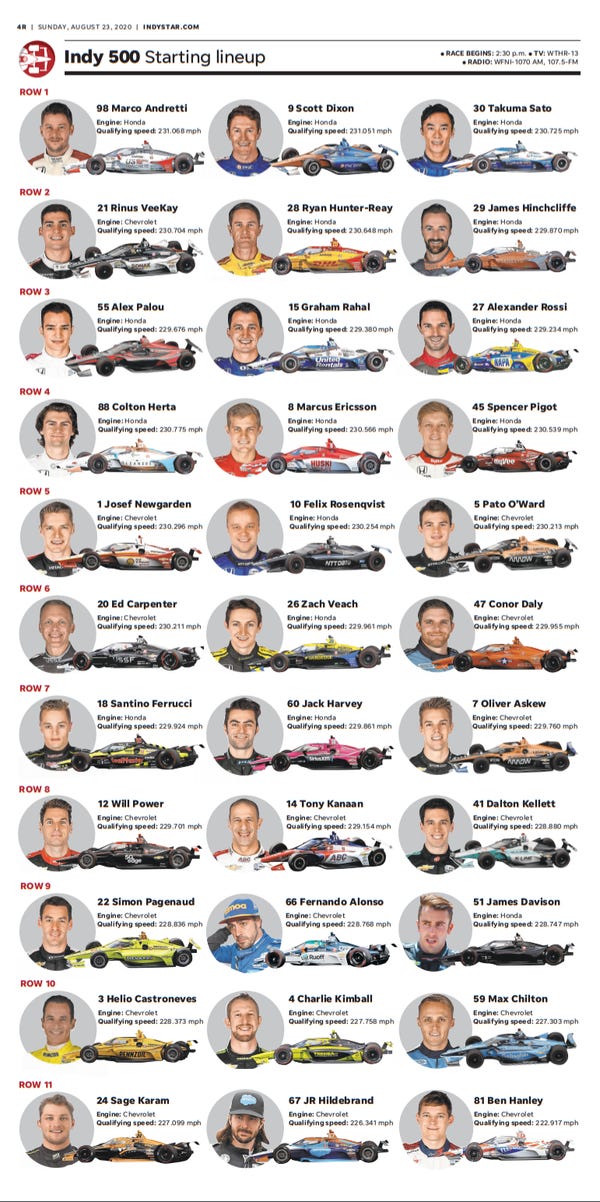

Latest Indy 500 Changes Pose Significant Risk To Drivers In 2025

May 11, 2025

Latest Indy 500 Changes Pose Significant Risk To Drivers In 2025

May 11, 2025 -

2025 Indy 500 Driver Safety Concerns Following Latest Announcement

May 11, 2025

2025 Indy 500 Driver Safety Concerns Following Latest Announcement

May 11, 2025 -

Indy 500 Announcement Increased Danger For Drivers In 2025

May 11, 2025

Indy 500 Announcement Increased Danger For Drivers In 2025

May 11, 2025 -

Indy 500 2025 New Rules Increase Driver Risk

May 11, 2025

Indy 500 2025 New Rules Increase Driver Risk

May 11, 2025 -

Supporting The Next Generation Rahals Driver Scholarship

May 11, 2025

Supporting The Next Generation Rahals Driver Scholarship

May 11, 2025