Harvard And Yale: Proposed Endowment Tax Hike Explained

Table of Contents

The Rationale Behind the Proposed Harvard and Yale Endowment Tax Hike

The proposed tax on university endowments stems from growing concerns about income inequality and the perceived unfairness of tax-exempt status for wealthy institutions. Proponents argue that universities like Harvard and Yale, boasting endowments in the tens of billions of dollars, possess significant resources that could be better utilized to address the escalating cost of higher education.

-

Addressing Income Inequality: The vast wealth concentrated in university endowments stands in stark contrast to the rising student debt burden faced by millions of American students. The average student loan debt is now over $37,000, placing a significant financial strain on graduates. A tax on these endowments could help redistribute wealth and alleviate this burden.

-

Increasing Affordability and Accessibility: A significant portion of university endowment revenue is currently allocated to areas beyond direct student aid. Advocates for the tax argue that a portion of these funds should be redirected to lower tuition costs, increase financial aid packages, and expand access to higher education for low-income students. Harvard's endowment, for example, exceeds $50 billion, while Yale's is not far behind. Even a small percentage tax could generate billions for student aid.

-

Funding Public Initiatives: Revenue generated from a tax on university endowments could be used to fund other vital public initiatives, such as improving K-12 education, bolstering community colleges, or expanding affordable healthcare. This would represent a shift in resource allocation, aiming to address broader societal needs.

Potential Impacts on Harvard and Yale

A tax on their endowments would undoubtedly have significant financial consequences for Harvard and Yale. The exact impact would depend on the tax rate, but even a modest percentage could lead to substantial budget cuts.

-

Impact on Financial Aid Programs: Reduced revenue could necessitate cuts to financial aid programs, potentially making higher education less accessible to low- and middle-income students. This could disproportionately affect students from underrepresented backgrounds.

-

Effect on Research Funding and Faculty Salaries: Research funding, a cornerstone of these institutions' academic missions, could be severely impacted. Similarly, faculty salaries and benefits might be reduced, potentially leading to a decline in faculty quality and research output.

-

Reduced Investment in New Initiatives: The universities might have to curtail investments in new academic programs, infrastructure improvements, and technological advancements, hindering their ability to remain at the forefront of higher education and research. For example, a 1% tax on Harvard's endowment would represent hundreds of millions of dollars in lost revenue.

Arguments Against the Proposed Tax

Opponents of the proposed tax raise several valid concerns. They argue that such a tax could have detrimental consequences for universities and the broader philanthropic landscape.

-

Chilling Effect on Future Donations: A tax on existing endowments could discourage future donations, harming the long-term financial health of universities and potentially reducing their ability to fund scholarships, research, and other crucial initiatives. The fear is that wealthy donors may be less inclined to contribute if their gifts are subject to taxation.

-

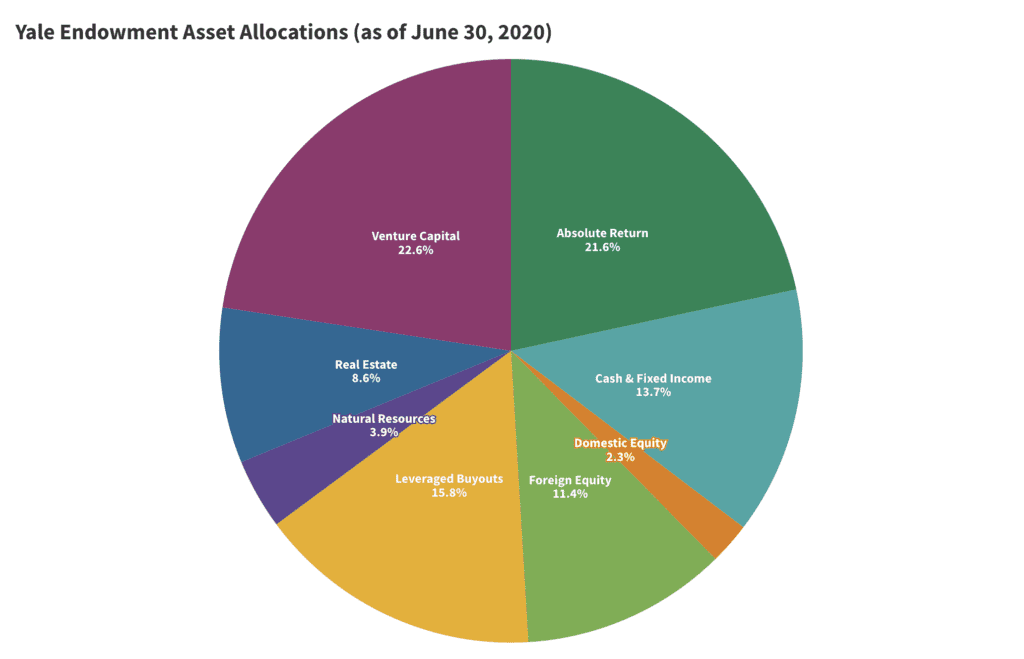

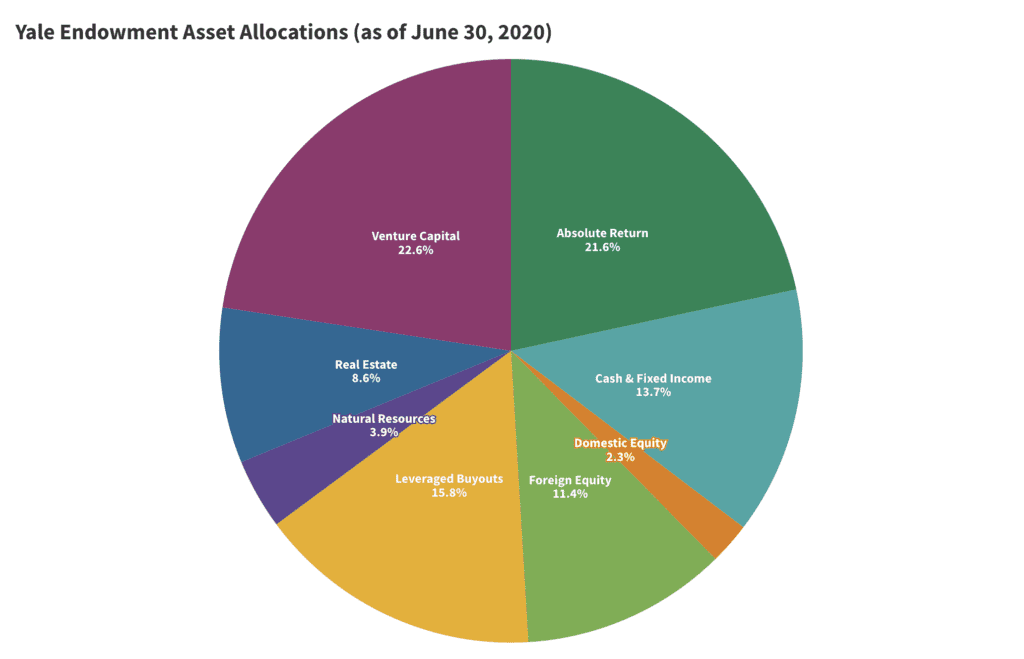

Harm to Long-Term Investment Strategies: Endowments are typically managed using long-term investment strategies designed to generate sustainable growth over many years. A tax could disrupt these strategies, potentially diminishing the overall value of the endowments over time and harming future generations of students.

-

Significant Contributions to Society: Universities already contribute significantly to society through education, research, and community engagement. Their economic impact extends far beyond their campuses, contributing to innovation, economic growth, and the overall well-being of society.

Alternative Solutions for Increasing Affordability

Instead of directly taxing endowments, several alternative solutions could address college affordability. These approaches offer a more nuanced and potentially more effective way to tackle the issue.

-

Increased Government Funding for Higher Education: Increased government funding could significantly reduce the need for tuition increases and provide more financial aid opportunities for students. This approach would address the issue more broadly, without singling out specific institutions.

-

Reform of Student Loan Programs: Simplifying and streamlining the student loan system, reducing interest rates, and expanding income-based repayment plans could alleviate the burden of student debt. This would benefit students regardless of the institution they attend.

-

Initiatives to Promote Greater Transparency in University Pricing: Increased transparency in how universities set tuition costs could empower students and families to make informed decisions and potentially encourage institutions to adopt more affordable pricing models.

Conclusion

The debate surrounding the proposed Harvard and Yale endowment tax hike highlights the complex interplay between income inequality, college affordability, and the role of philanthropy in higher education. While proponents argue that taxing these substantial endowments could generate funds for student aid and public initiatives, opponents express concerns about the potential chilling effect on future donations and the disruption of long-term investment strategies. Exploring alternative solutions, such as increased government funding and student loan reform, is crucial. Ultimately, finding a solution that addresses college affordability without hindering the vital contributions of universities to society remains a critical challenge. Learn more about the proposed Harvard and Yale endowment tax hike and share your thoughts on the future of university funding. Stay informed on the debate surrounding university endowment taxation by following reputable news sources and engaging with relevant organizations.

Featured Posts

-

Pre Earnings Analysis Gibraltar Industries Rock

May 13, 2025

Pre Earnings Analysis Gibraltar Industries Rock

May 13, 2025 -

Britanskoe Predlozhenie Obsuzhdenie Soglasheniya O Bezopasnosti S Es

May 13, 2025

Britanskoe Predlozhenie Obsuzhdenie Soglasheniya O Bezopasnosti S Es

May 13, 2025 -

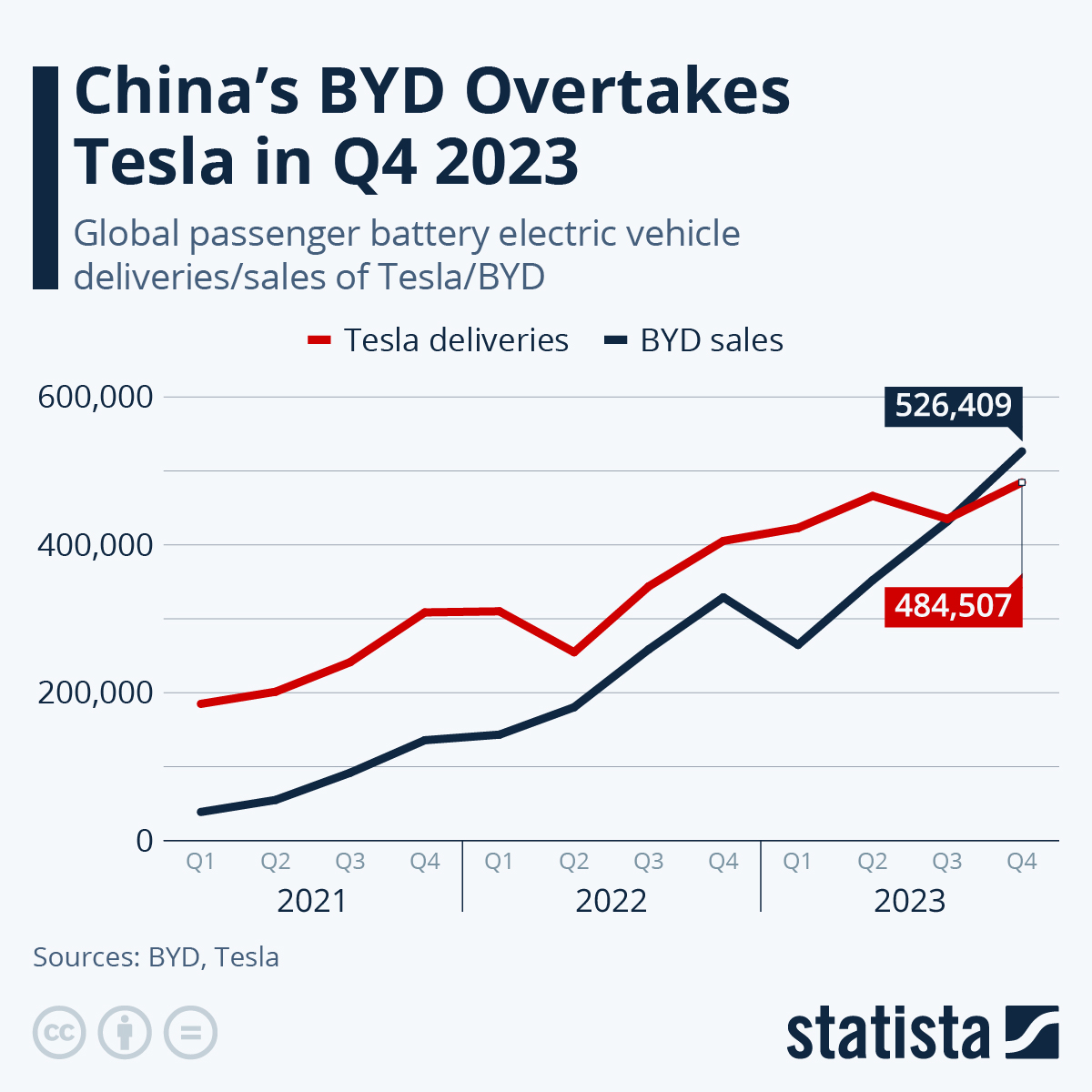

Chinas Byd Sets Sights On Global Domination 2030 Sales Projections

May 13, 2025

Chinas Byd Sets Sights On Global Domination 2030 Sales Projections

May 13, 2025 -

Rpts Poluchila Razreshenie Na Religioznuyu Deyatelnost V Myanme

May 13, 2025

Rpts Poluchila Razreshenie Na Religioznuyu Deyatelnost V Myanme

May 13, 2025 -

Romske Komunity Aktualizovany Atlas Na Zaklade Dat Z Aprila

May 13, 2025

Romske Komunity Aktualizovany Atlas Na Zaklade Dat Z Aprila

May 13, 2025