Has Wall Street Moved Past Trump's Trade War? An Analysis

Table of Contents

The Immediate Impact of Trump's Trade War on Wall Street

The announcement of tariffs and trade restrictions under Trump's trade war initiated immediate market reactions. Investor uncertainty led to increased volatility, with the stock market experiencing several dips. The impact wasn't uniform; certain sectors felt the brunt of the trade war far more than others. Keywords like "tariffs," "trade disputes," and "global trade" became central to market discussions.

-

Sectors Heavily Impacted: The technology, agriculture, and manufacturing sectors were among the hardest hit. Companies reliant on global supply chains faced significant disruptions and increased costs due to tariffs.

-

Specific Examples: Companies heavily involved in importing and exporting goods, particularly those with significant operations in China, experienced substantial financial losses. For example, [insert example of a technology company impacted by tariffs], saw its stock price decline by [percentage] during a specific period of the trade war. Similarly, [insert example of an agricultural company], faced challenges due to retaliatory tariffs imposed by other countries.

-

Quantifiable Data: Market analysis showed significant losses during the peak of the trade war. For instance, the S&P 500 experienced a [percentage] drop in [time period], while specific sectors like [sector] suffered even steeper declines. Investor sentiment, as reflected in various indices, indicated a considerable level of pessimism and risk aversion.

The Long-Term Economic Consequences of the Trade War

The long-term consequences of Trump's trade war extend beyond the initial market shocks. The disruption of established supply chains, increased costs, and uncertainty surrounding global trade policies have had lasting repercussions on economic growth and inflation. Keywords like "supply chains," "economic growth," and "inflation" remain relevant in assessing the lingering effects.

-

US-China Relations: The trade war significantly strained US-China relations, impacting bilateral trade and investment flows. The long-term effects of this strained relationship continue to play out in geopolitical dynamics and investment strategies.

-

Industry-Specific Impacts: Certain industries, particularly those relying heavily on imported components or exporting finished goods, experienced long-term restructuring and adjustments to their business models. The automotive industry, for example, faced challenges due to increased input costs from tariffs on imported parts.

-

Economic Recovery: While some sectors have recovered, the speed and extent of recovery vary significantly. Data on economic indicators, such as GDP growth and employment figures in affected sectors, can illustrate the uneven nature of this recovery. The full economic impact may take years to fully manifest.

Wall Street's Current Posture Regarding Global Trade

Currently, investor confidence regarding international trade remains somewhat fragile. Market sentiment is influenced by a number of factors, including ongoing geopolitical events and the unpredictable nature of trade policies. Keywords like "market sentiment," "risk assessment," and "global trade uncertainty" are crucial to understanding the current landscape.

-

Current Market Performance: While the stock market has largely recovered from the initial shocks, certain sectors still reflect the lingering effects of the trade war. Analyzing the performance of relevant sectors provides crucial insights into the extent of recovery.

-

Investor Strategies: Investors have adopted more cautious strategies, incorporating geopolitical risks and trade policy uncertainty into their risk assessments. Diversification and hedging techniques are commonly used to mitigate potential negative impacts.

-

Expert Opinions: Experts offer varying opinions on future trade relations. Some anticipate further trade conflicts, while others predict a period of stability and cooperation. These divergent opinions reflect the inherent uncertainty associated with global trade.

Has Wall Street Fully Recovered? A Comparative Analysis

A comparative analysis of market conditions before, during, and after Trump's trade war reveals a complex picture. While the stock market has largely rebounded, certain economic indicators reveal lingering effects. Keywords such as "market recovery," "economic indicators," and "stock market performance" are pivotal in evaluating the extent of recovery.

-

Market Trends: Graphs and charts showing stock market indices, sector-specific performance, and key economic indicators (e.g., inflation, GDP growth) before, during, and after the trade war offer a visual representation of market trends.

-

Economic Indicator Comparison: Comparing key economic indicators across these periods provides insights into the overall health of the economy and the extent of recovery.

-

Future Risks: The possibility of future trade conflicts, coupled with other global uncertainties, poses potential risks to market stability. Analyzing these potential risks is crucial for understanding future market dynamics.

Conclusion: Has Wall Street Truly Moved Past Trump's Trade War?

While Wall Street has demonstrably recovered from the immediate shock of Trump's trade war, a complete return to pre-trade war conditions is not fully evident. Lingering economic consequences and ongoing global trade uncertainties continue to influence market dynamics. The long-term effects of disrupted supply chains, increased costs, and strained international relations remain significant factors.

The legacy of Trump's trade war underscores the importance of understanding the profound influence of trade policy on financial markets. Unpredictability in global trade creates significant risks for investors. Stay informed about the impact of global trade policies on your investments by continuing your research on Trump's trade war legacy and its lasting consequences. Further research into specific sector performance, international trade agreements, and geopolitical analysis will provide a more comprehensive understanding of this complex issue.

Featured Posts

-

2024 Financial Report Pcc Community Markets Announces Profit Increase

May 29, 2025

2024 Financial Report Pcc Community Markets Announces Profit Increase

May 29, 2025 -

Aj Odudu Responds To Mickey Rourkes Inappropriate Comment On Celebrity Big Brother

May 29, 2025

Aj Odudu Responds To Mickey Rourkes Inappropriate Comment On Celebrity Big Brother

May 29, 2025 -

Impacto Da Cidade Space X Opiniao Favoravel Dos Moradores Americanos

May 29, 2025

Impacto Da Cidade Space X Opiniao Favoravel Dos Moradores Americanos

May 29, 2025 -

Analyzing Putins Transformation Of Russias Economy For War

May 29, 2025

Analyzing Putins Transformation Of Russias Economy For War

May 29, 2025 -

A24 Delivers Another Hit New Horror Thriller Scores Big On Rotten Tomatoes

May 29, 2025

A24 Delivers Another Hit New Horror Thriller Scores Big On Rotten Tomatoes

May 29, 2025

Latest Posts

-

Horoscope For May 27 2025 Christine Haas Predictions

May 31, 2025

Horoscope For May 27 2025 Christine Haas Predictions

May 31, 2025 -

Jaime Munguias Tactical Adjustments Lead To Surace Rematch Win

May 31, 2025

Jaime Munguias Tactical Adjustments Lead To Surace Rematch Win

May 31, 2025 -

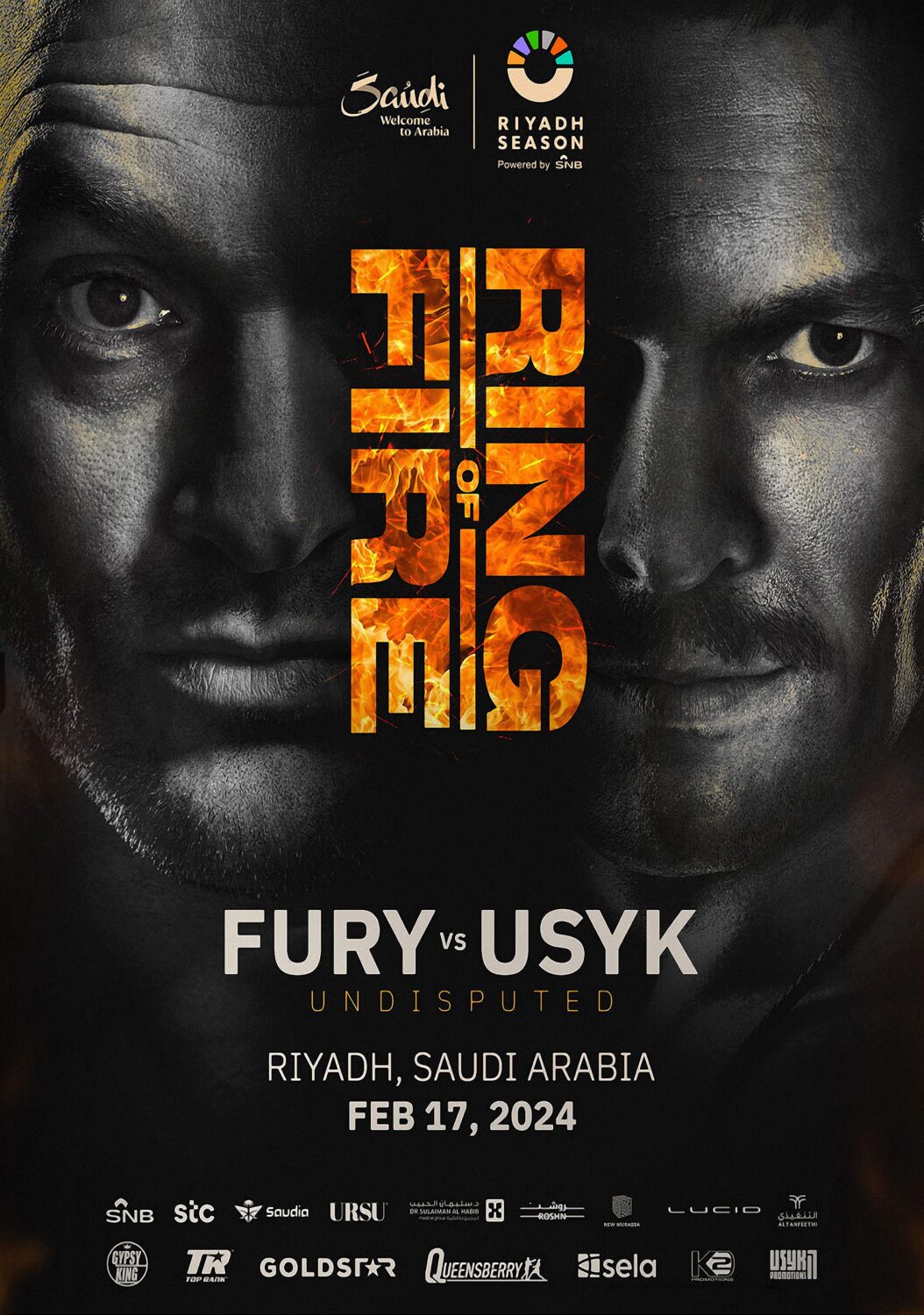

Fatal Fury Boxing May Showdown In Riyadh

May 31, 2025

Fatal Fury Boxing May Showdown In Riyadh

May 31, 2025 -

Canelo Vs Golovkin When Does The Fight Start Full Ppv Card Revealed

May 31, 2025

Canelo Vs Golovkin When Does The Fight Start Full Ppv Card Revealed

May 31, 2025 -

Munguia Vs Surace Ii How Adjustments Secured The Win

May 31, 2025

Munguia Vs Surace Ii How Adjustments Secured The Win

May 31, 2025