High Stock Market Valuations: A BofA Analysis And Investor Guidance

Table of Contents

BofA's Current Assessment of High Stock Market Valuations

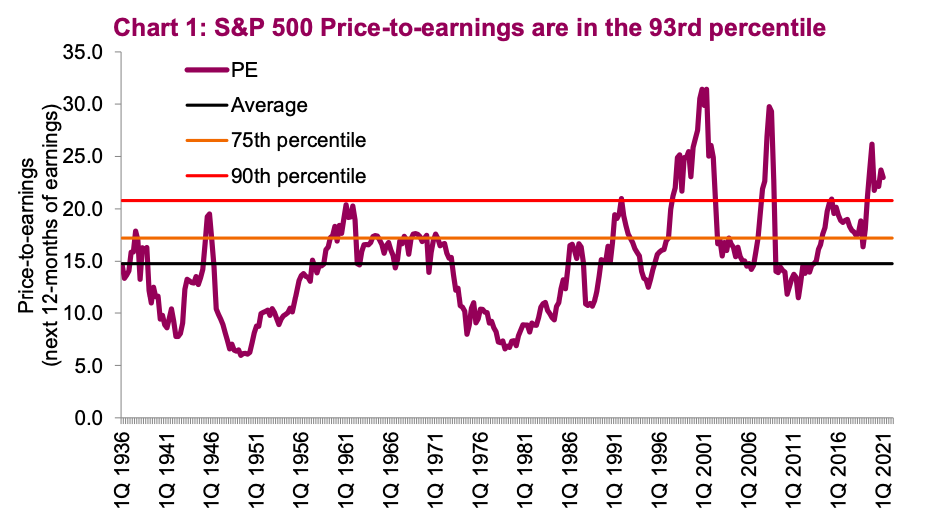

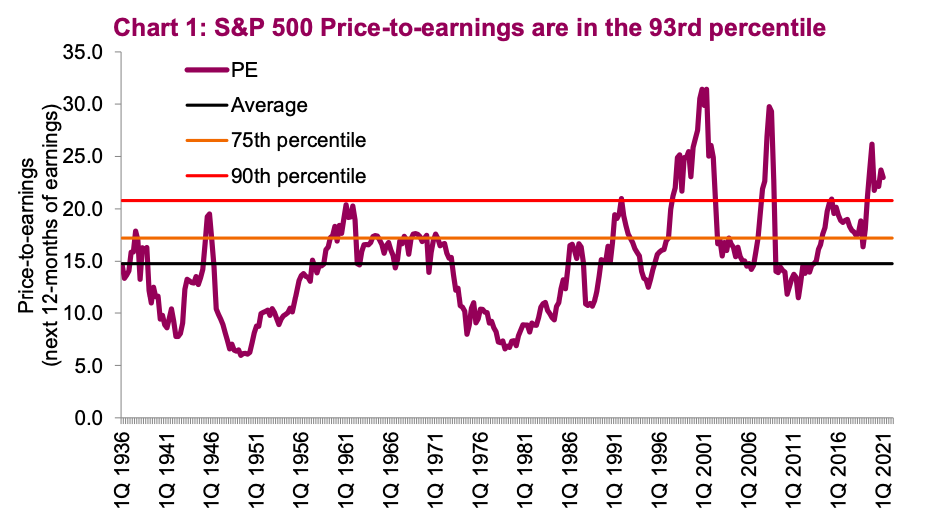

BofA's recent reports consistently flag the elevated nature of current stock market valuations. They utilize various metrics, including the widely-watched Shiller PE ratio (CAPE), which compares price to average earnings over the past ten years, and traditional P/E ratios, to gauge market health. These indicators suggest that many stocks are trading at premiums compared to historical averages, raising questions about sustainability.

Key Factors Contributing to High Valuations

Several factors contribute to these high stock market valuations:

-

Low Interest Rates: Historically low interest rates have fueled borrowing and investment, driving up asset prices across the board, including stocks. Lower borrowing costs incentivize companies to expand and investors to seek higher-yielding investments, thus boosting stock demand.

-

Strong Corporate Earnings (and Future Growth Potential): While some sectors experience challenges, many companies have reported strong earnings, bolstering investor confidence and supporting higher valuations. Furthermore, projections of future earnings growth, though subject to uncertainty, contribute to optimistic market sentiment. BofA’s analysis emphasizes this factor's significance in sustaining current valuations.

-

Inflationary Pressures: While inflation can negatively impact earnings in the long run, in the short term, it can drive stock prices up as companies attempt to pass on increased costs to consumers. However, persistent high inflation can eventually lead to market corrections, as BofA’s reports acknowledge.

-

Geopolitical Risks: Global uncertainty, including geopolitical tensions and trade wars, can create volatility in the market. Sometimes, investors flock to stocks as a relatively safe haven during times of global unease, further pushing valuations higher. BofA incorporates these unpredictable factors into its overall assessments.

BofA's Valuation Models and Forecasts

BofA employs sophisticated valuation models, incorporating discounted cash flow analysis, relative valuation techniques (comparing to industry peers), and macroeconomic forecasts. Their models consider a wide range of factors, including interest rate expectations, inflation predictions, and projected corporate earnings growth.

BofA’s forecasts are, of course, subject to considerable uncertainty. However, their recent reports suggest a cautious outlook.

- Potential for a Market Correction: BofA acknowledges the risk of a market correction, given the current elevated valuations. The magnitude and timing of such a correction remain uncertain.

- Continued Growth (with caveats): BofA also acknowledges the possibility of continued growth, particularly if corporate earnings exceed expectations and interest rates remain low. However, this scenario is contingent upon numerous factors and is not their primary forecast.

BofA emphasizes that these projections are not guarantees and are subject to significant changes based on evolving economic conditions.

Identifying Potential Risks Associated with High Stock Market Valuations

While high stock market valuations can signal potential for further growth, investors must carefully consider associated risks:

Risk of a Market Correction

Given the current high valuations, the probability of a market correction—a significant drop in prices—is higher than in periods of lower valuations. A correction could be triggered by various factors, such as a sudden rise in interest rates, disappointing corporate earnings reports, or escalating geopolitical risks.

Interest Rate Hikes and Their Impact

Rising interest rates directly impact stock valuations. Higher rates increase the cost of borrowing for companies, potentially slowing economic growth and reducing corporate earnings. Furthermore, higher rates make bonds more attractive, diverting investment away from stocks.

Inflationary Pressures and their Effect on Earnings

Persistent high inflation erodes corporate profit margins by increasing input costs while potentially limiting pricing power. This can lead to lower earnings growth and negatively impact stock valuations.

- Reduced Consumer Spending: High inflation can lead to reduced consumer spending, directly impacting revenues for many companies.

- Increased Input Costs: Rising prices of raw materials, energy, and labor significantly increase the cost of production.

Investor Guidance and Strategies for Navigating High Stock Market Valuations

Navigating the current market requires a cautious yet proactive approach:

Diversification Strategies

Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. This strategy helps reduce the impact of potential market downturns in any single asset class.

Value Investing Approach

Consider adopting a value investing approach, focusing on undervalued stocks with strong fundamentals. Identify companies trading below their intrinsic value, offering potential for significant upside once the market recognizes their true worth.

Defensive Investing Tactics

To protect your portfolio during periods of market volatility:

- Increase Cash Holdings: Maintain a larger-than-usual cash position to capitalize on potential buying opportunities during market downturns.

- Invest in Defensive Sectors: Allocate a portion of your portfolio to defensive sectors (e.g., consumer staples, utilities) that are less sensitive to economic cycles.

Long-Term vs. Short-Term Investing

In this climate, a long-term investment horizon is generally recommended. Short-term market fluctuations should be viewed within the context of a broader, long-term strategy.

Conclusion

BofA's analysis clearly indicates that we are operating within a market characterized by high stock market valuations. While this presents opportunities for growth, it also significantly increases the risk of a correction. Understanding the factors contributing to these high valuations, coupled with the potential risks, is critical for successful investing. The key takeaways for investors are diversification, a focus on value, defensive strategies, and a long-term perspective. By carefully considering these points and adapting your investment strategy accordingly, you can better manage risk in high stock market valuations and navigate this challenging environment effectively. Remember, understanding high stock market valuations is key to making informed investment decisions. Consult with a financial advisor to tailor a strategy specific to your circumstances.

Featured Posts

-

Naomi Kempbell Vrazhayuchiy Obraz U Biliy Tunitsi

May 26, 2025

Naomi Kempbell Vrazhayuchiy Obraz U Biliy Tunitsi

May 26, 2025 -

The Hells Angels Motorcycle Club A Deeper Dive

May 26, 2025

The Hells Angels Motorcycle Club A Deeper Dive

May 26, 2025 -

Tour Of Flanders The Ultimate Duel Between Pogacar And Van Der Poel

May 26, 2025

Tour Of Flanders The Ultimate Duel Between Pogacar And Van Der Poel

May 26, 2025 -

Saint Brieuc La Charentaise Un Rempart Contre La Crise Pour Les Fabricants De Chaussures

May 26, 2025

Saint Brieuc La Charentaise Un Rempart Contre La Crise Pour Les Fabricants De Chaussures

May 26, 2025 -

Moto Gp Inggris Fp 1 Marquez Dominasi Insiden Motor Mogok Guncang Sirkuit

May 26, 2025

Moto Gp Inggris Fp 1 Marquez Dominasi Insiden Motor Mogok Guncang Sirkuit

May 26, 2025