High Stock Market Valuations: A BofA Analysis And Investor Reassurance

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

BofA regularly publishes reports and analyses assessing market valuations, using key metrics like price-to-earnings ratios (P/E ratios) and the cyclically adjusted price-to-earnings ratio (Shiller PE), also known as the CAPE ratio. Their research incorporates a broad range of economic indicators and historical data to gauge market health and potential risks.

- Key findings from BofA's research on valuation multiples: Recent BofA reports may indicate that current P/E ratios are above historical averages, suggesting potentially overvalued markets in certain sectors. However, they also consider factors like interest rates and future earnings growth, leading to a nuanced perspective.

- Comparison of current valuations to historical averages and other market indicators: BofA's analysis often compares current valuation multiples to long-term historical averages and benchmarks them against other relevant indicators, such as inflation rates and economic growth projections. This comparative analysis helps determine whether current valuations are truly excessive or fall within a reasonable range considering prevailing economic conditions.

- BofA's outlook on the sustainability of current valuations: BofA's outlook may vary depending on the specific time period and economic circumstances. They may express a cautiously optimistic, neutral, or even slightly bearish view depending on their analysis of prevailing macroeconomic conditions and risks. It's crucial to consult their most recent reports for the up-to-date perspective.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations. Understanding these factors is crucial for informed investment decisions.

-

Low interest rates: Historically low interest rates make borrowing cheaper for corporations and encourage investment, pushing up stock prices. This has been a significant factor in recent years, reducing the attractiveness of fixed-income investments.

-

Strong corporate earnings: Robust corporate earnings, particularly in certain sectors, can justify higher stock prices based on strong fundamentals and future growth expectations.

-

Quantitative easing (QE): Past periods of quantitative easing by central banks have injected liquidity into the market, potentially contributing to inflated asset prices. The effects of past QE programs continue to ripple through the system.

-

Inflationary pressures and their effect on valuations: Inflation erodes the purchasing power of money, influencing investors' appetite for riskier assets and ultimately impacting valuations. BofA's analysis incorporates inflation projections in evaluating the sustainability of current stock prices.

-

Detailed explanation of each factor and its influence on stock prices: Each of these factors interacts with each other in complex ways. For example, low interest rates can fuel corporate borrowing and investment, leading to higher earnings and thus supporting higher stock valuations. However, high inflation can counter this trend by increasing the discount rate applied to future earnings.

Addressing Investor Concerns about High Stock Market Valuations

Many investors worry about market corrections or bubbles when valuations are high. BofA acknowledges these concerns and emphasizes risk mitigation strategies.

- Diversification strategies recommended by BofA: BofA typically recommends diversifying across various asset classes, geographies, and sectors to reduce overall portfolio risk. This is a crucial strategy to mitigate the impact of any potential market downturn.

- Importance of long-term investment horizons: BofA emphasizes that long-term investing helps to ride out market fluctuations, making short-term volatility less significant. Focusing on long-term growth is key to weathering market corrections.

- Potential benefits of dollar-cost averaging: Dollar-cost averaging, a strategy of investing a fixed amount regularly regardless of market price, helps to mitigate the risk of investing a lump sum at a market peak.

- Risks of trying to time the market: BofA generally cautions against trying to time the market, as successfully predicting market tops and bottoms is exceptionally difficult.

Alternative Investment Strategies in a High-Valuation Environment

Given high stock market valuations, BofA may suggest considering alternative investment strategies.

- Discussion of bonds, real estate, commodities, or other asset classes: These assets can offer diversification benefits and potentially lower correlations to stocks, reducing overall portfolio volatility. Bonds, for example, can act as a ballast during stock market downturns.

- Analysis of the risk/reward profile of these alternatives: BofA's analysis would carefully consider the risk-reward profile of each alternative investment, providing investors with context for making informed decisions.

- Mention any BofA recommendations regarding asset allocation: Based on its assessment of the market and individual investor risk tolerance, BofA might recommend a specific asset allocation strategy that incorporates a mix of traditional stocks and alternative assets.

Conclusion: Navigating High Stock Market Valuations with Confidence

BofA's analysis of high stock market valuations provides a nuanced perspective, acknowledging the elevated valuation levels but also considering underlying economic factors and long-term growth prospects. While the market presents inherent risks, strategies such as diversification, a long-term investment horizon, and dollar-cost averaging can help mitigate these risks. Investors should also consider exploring alternative investment options as part of a well-diversified portfolio. To understand high stock market valuations better and learn more about BofA's analysis of high stock market valuations, consult with a financial advisor and conduct thorough research using resources available from reputable financial institutions like BofA. Manage your portfolio effectively in this environment of high stock market valuations by staying informed and adopting a well-defined investment strategy.

Featured Posts

-

Exploring The Countrys New Business Landscapes

Apr 29, 2025

Exploring The Countrys New Business Landscapes

Apr 29, 2025 -

Nyt Strands Hints And Answers For The March 3 2025 Puzzle

Apr 29, 2025

Nyt Strands Hints And Answers For The March 3 2025 Puzzle

Apr 29, 2025 -

Las Vegas Police Seek Publics Help To Locate Missing Paralympian Sam Ruddock

Apr 29, 2025

Las Vegas Police Seek Publics Help To Locate Missing Paralympian Sam Ruddock

Apr 29, 2025 -

The Pete Rose Posthumous Pardon Details And Implications

Apr 29, 2025

The Pete Rose Posthumous Pardon Details And Implications

Apr 29, 2025 -

Jeff Goldblum And Emilie Livingston A Look At Their Marriage And Children

Apr 29, 2025

Jeff Goldblum And Emilie Livingston A Look At Their Marriage And Children

Apr 29, 2025

Latest Posts

-

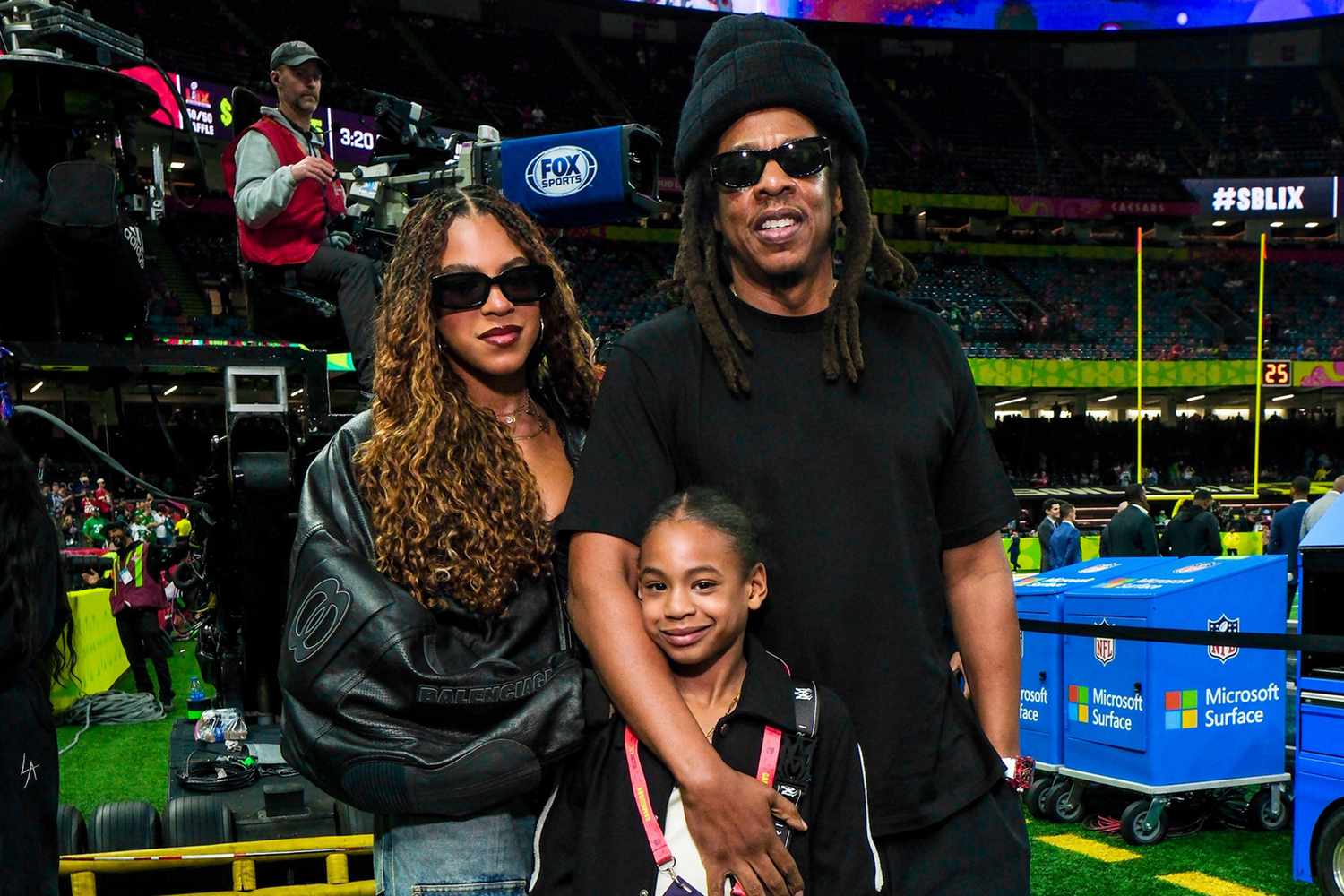

Beyonce And Jay Zs Daughters Blue Ivy And Rumis Matching Super Bowl Outfits

Apr 30, 2025

Beyonce And Jay Zs Daughters Blue Ivy And Rumis Matching Super Bowl Outfits

Apr 30, 2025 -

Blue Ivy Carter And Tina Knowles Eyebrows A Surprising Connection

Apr 30, 2025

Blue Ivy Carter And Tina Knowles Eyebrows A Surprising Connection

Apr 30, 2025 -

The Reasons Behind Beyonce And Jay Z Keeping Sir Carter Out Of The Public Eye

Apr 30, 2025

The Reasons Behind Beyonce And Jay Z Keeping Sir Carter Out Of The Public Eye

Apr 30, 2025 -

Understanding Beyonce And Jay Zs Decision To Keep Sir Carter Private

Apr 30, 2025

Understanding Beyonce And Jay Zs Decision To Keep Sir Carter Private

Apr 30, 2025 -

How To Get Blue Ivys Eyebrows A Guide From Tina Knowles

Apr 30, 2025

How To Get Blue Ivys Eyebrows A Guide From Tina Knowles

Apr 30, 2025