High Stock Market Valuations: A BofA Analyst's Case For Investor Calm

Table of Contents

Understanding Current High Stock Market Valuations

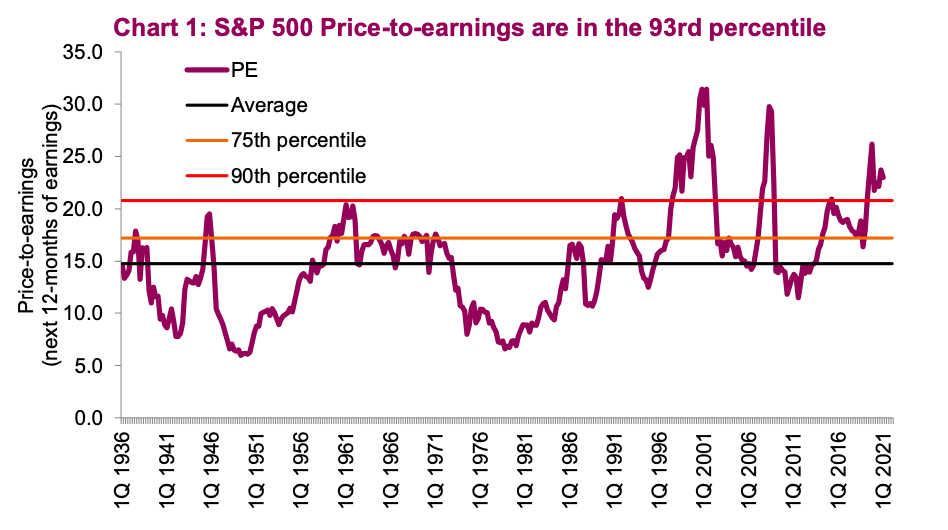

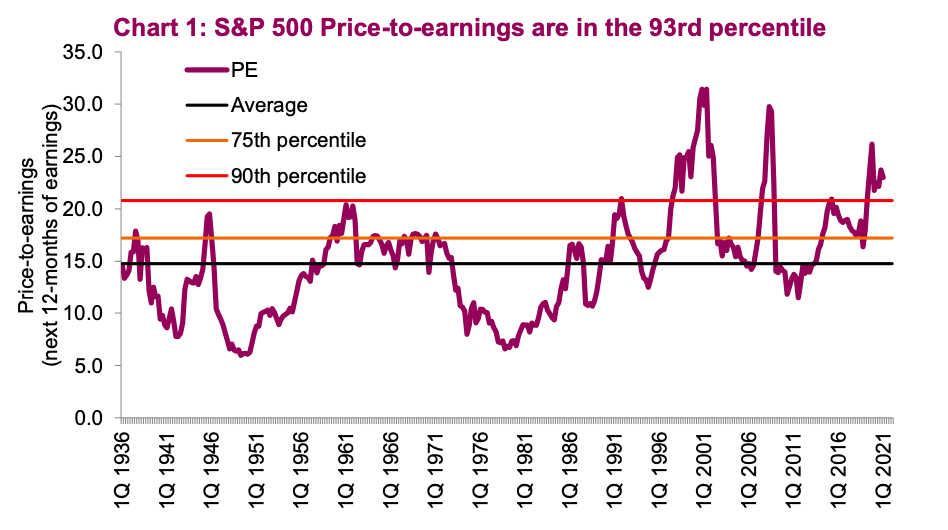

The current concern surrounding high stock market valuations is warranted. Several key metrics paint a picture of a market trading at elevated levels compared to historical averages.

Key Valuation Metrics

Several metrics are used to assess stock market valuation. Understanding their limitations is crucial for informed decision-making.

-

Price-to-Earnings Ratio (P/E Ratio): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings. Current market P/E ratios are significantly higher than their long-term averages, indicating potentially high valuations.

-

Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): This uses average inflation-adjusted earnings over the past ten years to smooth out short-term earnings volatility, providing a longer-term perspective on valuation. The Shiller PE often shows higher valuations than the standard P/E ratio.

-

Price-to-Sales Ratio (P/S Ratio): This compares a company's market capitalization to its revenue. It's often used for companies with negative earnings, providing an alternative valuation metric. Current P/S ratios across many sectors also suggest elevated valuations.

Factors Contributing to High Valuations

Several macroeconomic factors have contributed to these high stock market valuations:

-

Low Interest Rates: Historically low interest rates make borrowing cheaper for companies and investors, fueling increased investment and higher stock prices.

-

Robust Corporate Earnings (and Future Growth Potential): Strong corporate profits, coupled with expectations of continued future growth, have supported higher stock prices.

-

Inflationary Pressures: While inflation can negatively impact stock valuations, in some cases, it can be seen as a sign of strong economic growth. However, this is a complex relationship, and rising inflation also leads to interest rate hikes which have a contradictory effect on valuations.

-

Quantitative Easing (QE) Effects: Past quantitative easing programs by central banks have injected significant liquidity into the market, potentially contributing to inflated asset prices.

Comparing to Historical Precedents

High stock market valuations are not unprecedented. However, it's vital to compare the current situation to past periods with similarly high valuations:

-

Dot-com Bubble (late 1990s): This period saw exceptionally high valuations in technology stocks, followed by a significant market correction. Key differences exist, however, including the underlying technologies and broader economic conditions.

-

Pre-2008 Financial Crisis: High valuations preceded the 2008 financial crisis. However, the underlying causes – subprime mortgages and excessive leverage – were quite different from the current situation.

-

Early 2020s: Post-COVID stimulus created a similar surge, followed by a sharp period of volatility.

The BofA Analyst's Perspective on Investor Calm

Despite the high valuations, the BofA analyst's report suggests a cautiously optimistic outlook.

Key Arguments for a Cautiously Optimistic Outlook

The BofA analysts' key arguments for investor calm include:

-

Strong Corporate Earnings Growth: They highlight continued strong earnings growth across many sectors as a justification for current prices.

-

Long-Term Growth Potential: The analysts emphasize the potential for long-term growth in certain sectors, particularly technology and renewable energy.

-

Limited Alternatives: They argue that with low interest rates and limited yield in fixed income investments, equities remain a relatively attractive asset class.

Addressing Potential Risks

While the BofA report advocates for calm, it doesn't ignore potential risks:

-

Market Correction: The potential for a significant market correction remains a real possibility.

-

Geopolitical Risks: Geopolitical instability, such as the war in Ukraine and tensions in other parts of the world, poses a significant risk.

-

Inflationary Pressures and Interest Rate Hikes: Persistent inflationary pressures could lead to further interest rate hikes, potentially impacting corporate profitability and investor sentiment.

-

Unexpected Economic Slowdown: An unexpected slowdown in economic growth could trigger a market downturn.

The BofA Analyst's Recommended Investment Strategy

The BofA analysts suggest a diversified investment strategy to mitigate risks associated with high stock market valuations:

-

Diversification across asset classes: Investing across different asset classes, such as stocks, bonds, and real estate, helps reduce overall portfolio risk.

-

Sector-specific strategies: Focus on sectors with strong long-term growth potential.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon can help weather short-term market fluctuations.

-

Risk Management: Implementing proper risk management techniques, such as stop-loss orders, is crucial.

Conclusion

Current high stock market valuations present a complex investment landscape. While several metrics indicate elevated levels, the BofA analyst’s report suggests a cautiously optimistic outlook, highlighting strong corporate earnings and long-term growth potential in certain sectors. However, potential risks, including a market correction, geopolitical uncertainty, and inflationary pressures, should not be underestimated. Don't let high stock market valuations cause undue anxiety. Develop a well-informed investment strategy based on sound research and seek professional advice when needed to navigate the current market conditions effectively. Consider diversifying your portfolio, focusing on long-term growth, and implementing appropriate risk management techniques. Remaining informed about market trends and seeking professional guidance are crucial for successfully navigating this environment of high stock market valuations.

Featured Posts

-

Analyzing Success And Failure In Meetings With Donald Trump

May 06, 2025

Analyzing Success And Failure In Meetings With Donald Trump

May 06, 2025 -

Affordable Products That Last

May 06, 2025

Affordable Products That Last

May 06, 2025 -

Tracee Ellis Ross On Dating Grief Growth And Choosing Herself

May 06, 2025

Tracee Ellis Ross On Dating Grief Growth And Choosing Herself

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Role Maria Shriver Speaks Out

May 06, 2025

Patrick Schwarzeneggers White Lotus Role Maria Shriver Speaks Out

May 06, 2025 -

How Robert Pattinson Handles Diaper Changes Like A Pro

May 06, 2025

How Robert Pattinson Handles Diaper Changes Like A Pro

May 06, 2025