High Stock Market Valuations: A BofA Analyst's Perspective And Reassurance For Investors

Table of Contents

Understanding Current High Stock Market Valuations

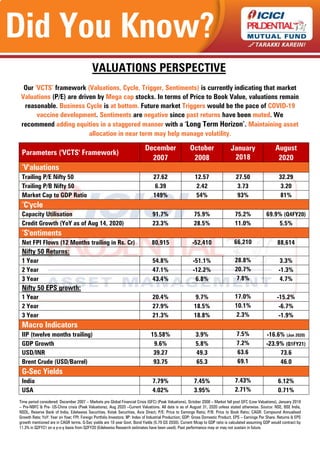

Assessing stock market valuations requires analyzing several key metrics. The most common include the Price-to-Earnings ratio (P/E ratio), which compares a company's stock price to its earnings per share, and the Shiller PE ratio (CAPE ratio), a cyclically adjusted P/E ratio that smooths out earnings fluctuations over a longer period (typically 10 years). High P/E ratios generally suggest that the market is pricing in significant future growth.

Several factors contribute to these high valuations:

- Low Interest Rates: Historically low interest rates make equities a more attractive investment compared to bonds, driving up demand and prices.

- Strong Corporate Earnings: Many companies have reported strong earnings, fueling investor confidence and supporting higher valuations.

- Technological Innovation: Rapid technological advancements continue to drive growth in specific sectors, boosting overall market valuations.

Let's look at some data: The S&P 500's P/E ratio currently sits at [insert current data], significantly above its historical average. Similarly, the Shiller PE ratio is [insert current data], also indicating elevated valuations. These figures, while high, don't necessarily signal an imminent crash, but they do highlight the need for cautious optimism and a well-defined investment strategy. Understanding these market capitalization levels is crucial for navigating the current climate.

BofA Analyst's Perspective on High Valuations

BofA's recent report offers a nuanced perspective on high stock market valuations. The analysts acknowledge the elevated levels but argue that several factors justify, at least partially, the current market prices. Their key findings include [insert specific findings from the BofA report, e.g., "a sustained period of strong corporate earnings growth," or "the potential for further technological disruption"]. The report emphasizes that [insert direct quote or paraphrase from the report highlighting their positive outlook, e.g., "while valuations are high, they are not necessarily unsustainable given the current economic environment"].

However, the BofA analysts aren't entirely dismissive of potential risks. They acknowledge the possibility of [insert risks mentioned in the report, e.g., "increased inflation," or "geopolitical uncertainty"] and advise investors to maintain a cautious approach. This balanced perspective underscores the importance of thorough due diligence and diversification.

Strategies for Investors in a High-Valuation Market

Investing in a high-valuation market requires a thoughtful and strategic approach. Here are some key strategies:

- Portfolio Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors can significantly reduce overall risk.

- Asset Allocation: Adjusting your portfolio's asset allocation based on your risk tolerance and long-term financial goals is paramount. Consider sectors less sensitive to market fluctuations.

- Long-Term Investment Approach: Focusing on long-term growth rather than short-term market timing can help ride out periods of volatility.

- Due Diligence and Research: Thorough research is crucial before investing in any asset. Understand the company's fundamentals, industry trends, and potential risks.

Addressing Investor Concerns about a Market Correction

A market correction, even a significant one, is a normal part of the market cycle. History shows that corrections happen periodically, and while their timing is unpredictable, they're not unusual. BofA's analysts [insert their perspective on the likelihood and potential severity of a correction, e.g., "believe a moderate correction is possible but unlikely to be catastrophic"].

Strategies for navigating a potential market downturn include:

- Having a Cash Reserve: Holding a sufficient amount of cash allows you to capitalize on potential buying opportunities during a downturn.

- Rebalancing Your Portfolio: Periodically rebalancing your portfolio can help you maintain your desired asset allocation and mitigate losses.

- Staying Disciplined: Avoid making impulsive decisions based on short-term market fluctuations. Stick to your long-term investment plan.

Making Informed Decisions in High Stock Market Valuations

In conclusion, while high stock market valuations present challenges, they don't necessarily signal an impending crash. BofA's analysis suggests a nuanced perspective, acknowledging elevated valuations but highlighting factors that could support continued growth. Investors should adopt a balanced approach, diversifying their portfolios, conducting thorough due diligence, and focusing on a long-term investment strategy. Understanding the potential for market corrections and having strategies to mitigate risk is also crucial. Learn more about navigating high stock market valuations and developing a robust investment strategy. Contact a financial advisor today!

Featured Posts

-

Essen Diese Eissorte Liegt In Nrw Ganz Vorn

May 24, 2025

Essen Diese Eissorte Liegt In Nrw Ganz Vorn

May 24, 2025 -

Joy Crookes New Single Carmen Is Out Now

May 24, 2025

Joy Crookes New Single Carmen Is Out Now

May 24, 2025 -

Real Time M56 Traffic Updates Major Delays Following Collision

May 24, 2025

Real Time M56 Traffic Updates Major Delays Following Collision

May 24, 2025 -

High Speed Chase Culminates In Unbelievable Texting And Refueling Stop

May 24, 2025

High Speed Chase Culminates In Unbelievable Texting And Refueling Stop

May 24, 2025 -

Joy Crookes Carmen A New Single To Listen To

May 24, 2025

Joy Crookes Carmen A New Single To Listen To

May 24, 2025

Latest Posts

-

Memorial Day Appliance Sales 2025 Forbes Vetted Deals

May 24, 2025

Memorial Day Appliance Sales 2025 Forbes Vetted Deals

May 24, 2025 -

Boise Sighting Actor Neal Mc Donough At Acero Boards And Bottles

May 24, 2025

Boise Sighting Actor Neal Mc Donough At Acero Boards And Bottles

May 24, 2025 -

Your Complete Guide To Memorial Day 2025 In Michigan Open Businesses And Services

May 24, 2025

Your Complete Guide To Memorial Day 2025 In Michigan Open Businesses And Services

May 24, 2025 -

Neal Mc Donoughs Pro Bull Riding Debut In The Last Rodeo

May 24, 2025

Neal Mc Donoughs Pro Bull Riding Debut In The Last Rodeo

May 24, 2025 -

Dallas Chef Tiffany Derrys Master Chef Judging Role

May 24, 2025

Dallas Chef Tiffany Derrys Master Chef Judging Role

May 24, 2025