High Stock Market Valuations: A BofA Analyst's Reassuring View For Investors

Table of Contents

Understanding Current High Stock Market Valuations

What constitutes "high" stock market valuations? Several key metrics are used to assess this. The Price-to-Earnings ratio (P/E ratio) is a commonly used indicator, comparing a company's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating a higher valuation. Another important metric is the Shiller PE ratio (also known as the cyclically adjusted price-to-earnings ratio or CAPE ratio), which smooths out earnings fluctuations over a longer period (typically 10 years), offering a more stable measure of valuation.

Several factors contribute to the current high valuations:

- Low Interest Rates: Historically low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like stocks.

- Strong Corporate Earnings: Many companies have reported robust earnings growth, bolstering investor confidence and driving up stock prices.

- Technological Innovation: Breakthroughs in technology, particularly in sectors like AI and biotechnology, have fueled significant growth and investment.

- Positive Investor Sentiment: Overall optimistic investor sentiment contributes to higher demand and pushes prices upward.

Let's look at some data. For instance, the S&P 500's P/E ratio currently sits around [Insert Current S&P 500 P/E Ratio], which is [higher/lower] than its historical average. Similarly, the Shiller PE ratio is at [Insert Current Shiller PE Ratio], providing further context. Analyzing these metrics across different sectors (e.g., technology, healthcare, financials) reveals varying levels of valuation, highlighting the importance of sector-specific analysis.

BofA Analyst's Key Arguments for a Reassuring Outlook

BofA Global Research recently published an analyst report offering a more nuanced perspective on current high stock market valuations. The analyst's key argument centers on the sustainability of these valuations, suggesting that while elevated, they are not necessarily unsustainable in the current macroeconomic environment.

The reasoning behind this view includes:

- Strong Earnings Growth Projections: The analyst's projections indicate continued strong earnings growth for many companies, justifying the current valuations to some extent.

- Continued Low Interest Rates (potentially): While interest rate hikes are possible, the analyst suggests that rates may remain relatively low for an extended period, supporting the equity market.

- Sector-Specific Opportunities: The analyst highlights specific sectors, such as [mention specific sectors highlighted by the BofA analyst], as offering particularly attractive investment opportunities despite the overall high valuations.

The BofA analyst’s investment strategy leans toward a long-term view, acknowledging the inherent volatility of the market but emphasizing the potential for continued growth in select sectors. Their report provides specific data and models supporting these assertions.

Potential Risks and Considerations

Despite the reassuring view, it's crucial to acknowledge potential risks associated with high stock market valuations:

- Market Corrections: High valuations often precede market corrections, making it essential to prepare for potential price drops.

- Inflationary Pressures: Rising inflation can erode the value of investments and impact corporate profitability.

- Interest Rate Hikes: Increased interest rates can make borrowing more expensive for companies, potentially slowing economic growth.

The BofA analyst addresses these risks by emphasizing the importance of diversification and risk management. Their analysis incorporates various scenarios, including those with higher interest rates and increased inflation, to gauge the potential impact on different sectors and investment strategies. This approach aims to provide a balanced assessment, acknowledging the uncertainties while maintaining a cautiously optimistic outlook.

Investment Strategies for Navigating High Valuations

Navigating high stock market valuations requires a strategic approach that emphasizes risk management and diversification:

- Portfolio Diversification: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) and sectors can help mitigate risks.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer potential opportunities even in a high-valuation market.

- Long-Term Investment Horizon: A long-term perspective allows investors to ride out short-term market fluctuations and benefit from long-term growth.

Following the BofA analyst's insights, investors should prioritize thorough research and consider sector-specific opportunities. Actively managing your portfolio and adjusting your strategy based on market conditions and economic indicators is crucial.

Conclusion: Making Informed Decisions in a High Stock Market Valuation Environment

The BofA analyst's perspective on high stock market valuations offers a reassuring outlook, but it is not without acknowledging inherent risks. While valuations are elevated, continued earnings growth, potential sustained low-interest rates (or a slow and measured increase), and sector-specific opportunities provide reasons for cautious optimism. However, investors must remain mindful of potential market corrections, inflationary pressures, and interest rate hikes. Therefore, a well-diversified portfolio, a focus on value investing, and a long-term investment horizon are crucial for navigating this environment effectively. Conduct further research, consult with a financial advisor, and develop a robust investment strategy tailored to your risk tolerance and financial goals. Understanding high stock market valuations is key to making informed decisions in today’s market.

Featured Posts

-

Man Utd Transfer News Ten Hags Failed E40m Pursuit Of Brian Brobbey

May 23, 2025

Man Utd Transfer News Ten Hags Failed E40m Pursuit Of Brian Brobbey

May 23, 2025 -

Qtr Thzm Amam Alkhwr Thlyl Dwr Ebd Alqadr Fy Almbarat

May 23, 2025

Qtr Thzm Amam Alkhwr Thlyl Dwr Ebd Alqadr Fy Almbarat

May 23, 2025 -

Savannah Guthries Mid Week Co Host Swap Who Filled In

May 23, 2025

Savannah Guthries Mid Week Co Host Swap Who Filled In

May 23, 2025 -

Turnir Za 4 Milliarda Pryamaya Translyatsiya Matcha Rybakinoy

May 23, 2025

Turnir Za 4 Milliarda Pryamaya Translyatsiya Matcha Rybakinoy

May 23, 2025 -

The Thames Water Bonus Scandal A Detailed Analysis

May 23, 2025

The Thames Water Bonus Scandal A Detailed Analysis

May 23, 2025

Latest Posts

-

Sylvester Stallone Suits Up For Tulsa King Season 3 First Look At New Set Image

May 23, 2025

Sylvester Stallone Suits Up For Tulsa King Season 3 First Look At New Set Image

May 23, 2025 -

Exclusive First Look Tulsa King Season 2 Blu Ray With Sylvester Stallone

May 23, 2025

Exclusive First Look Tulsa King Season 2 Blu Ray With Sylvester Stallone

May 23, 2025 -

Tulsa King Season 3 Sylvester Stallones New Suit Revealed In Set Photo

May 23, 2025

Tulsa King Season 3 Sylvester Stallones New Suit Revealed In Set Photo

May 23, 2025 -

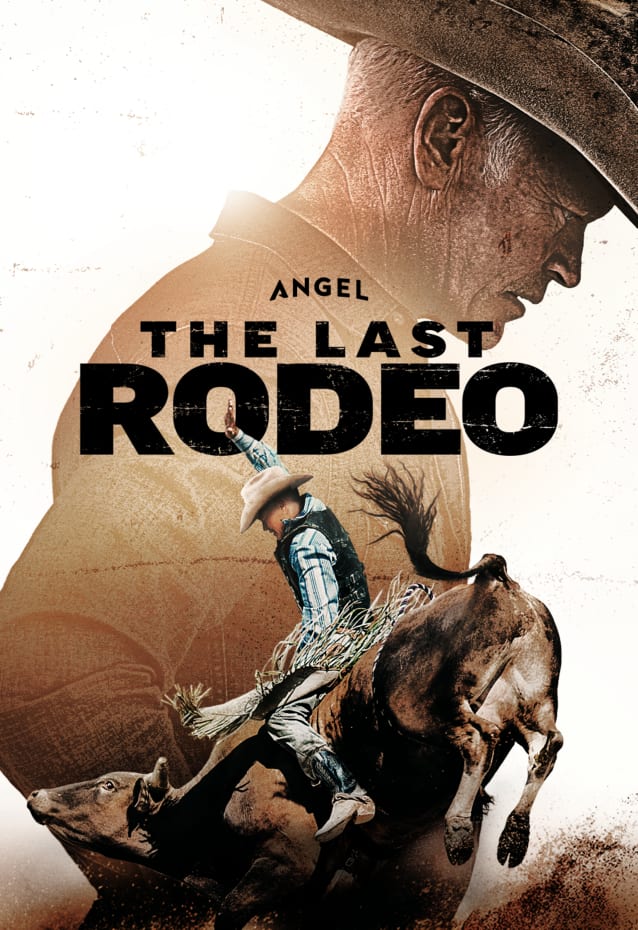

The Last Rodeo Movie Review A Critical Analysis

May 23, 2025

The Last Rodeo Movie Review A Critical Analysis

May 23, 2025 -

The Last Rodeo Film Review Is It Worth Watching

May 23, 2025

The Last Rodeo Film Review Is It Worth Watching

May 23, 2025