High Stock Market Valuations: A BofA Analyst's View

Table of Contents

Understanding Current Stock Market Valuations

Determining whether current stock market valuations are truly “high” requires a nuanced understanding of key valuation metrics and their context.

Key Valuation Metrics

Several metrics help gauge whether the market is overvalued or undervalued. Key among these are:

-

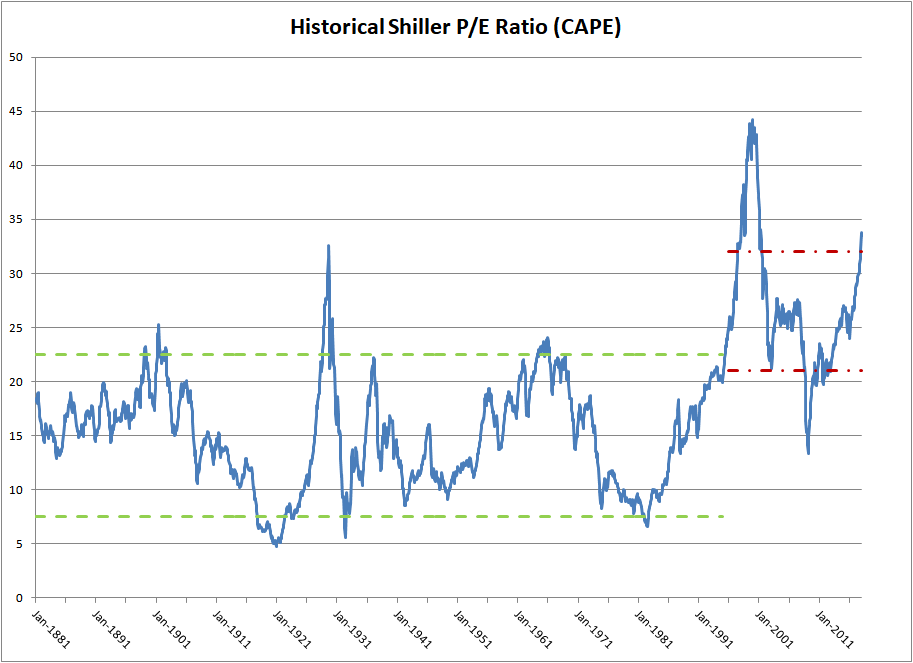

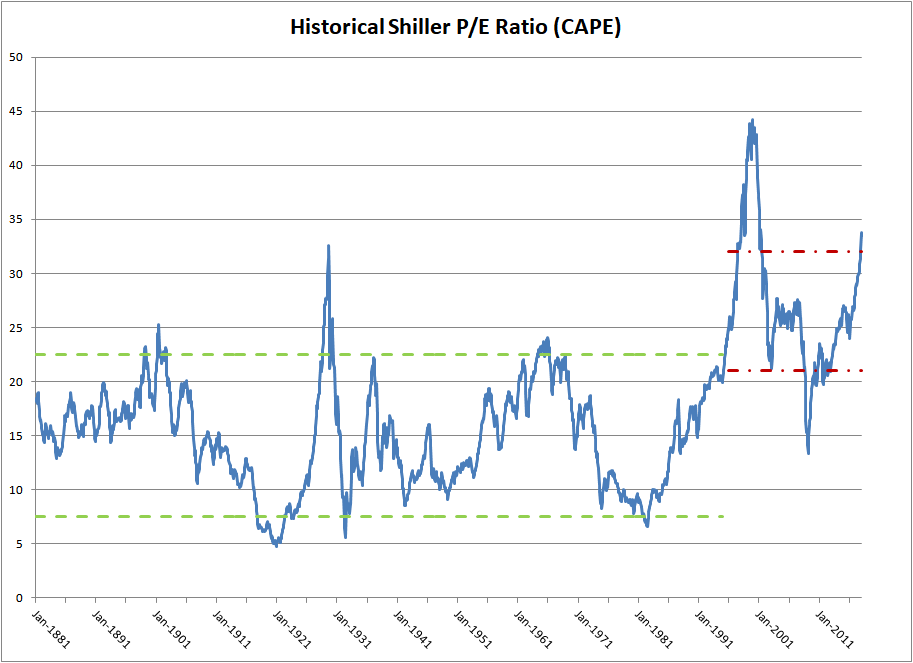

Price-to-Earnings (P/E) Ratio: This classic metric compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. Conversely, a low P/E ratio might signal undervaluation. Currently, the S&P 500's P/E ratio is [insert current S&P 500 P/E ratio], compared to its historical average of [insert historical average]. This comparison provides a valuable benchmark, although context is crucial.

-

Price-to-Sales (P/S) Ratio: This ratio compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings, providing a broader perspective on stock valuation. The current average P/S ratio for the market is [insert current market P/S ratio], offering another data point for analysis.

-

Other Relevant Metrics: Other important valuation metrics include Price-to-Book (P/B) ratio, dividend yield, and market capitalization itself. These offer additional angles to assess market multiples and overall stock valuation.

It's crucial to remember that using these valuation ratios in isolation can be misleading. A comprehensive analysis requires considering multiple metrics and the broader economic context.

The Role of Interest Rates

Interest rates play a significant role in shaping stock market valuations. There's an inverse relationship: lower interest rates generally lead to higher stock valuations as investors seek higher returns in the equity market. Conversely, rising interest rates, like the current interest rate hikes by the Federal Reserve, can dampen stock valuations. Higher bond yields offer a competitive alternative to equities, potentially drawing investment away from the stock market. The impact of quantitative easing (QE) and its potential effect on future valuations remains a subject of ongoing debate. The discount rate, a critical component in valuation models, is directly influenced by prevailing interest rates.

BofA's Perspective on High Stock Market Valuations

BofA, a leading financial institution, provides valuable insights into the current market dynamics.

BofA's Analyst Predictions and Rationale

Recent reports from BofA Global Research and BofA Securities suggest [summarize BofA's stance on current valuations – optimistic, cautious, etc.]. [Insert specific quotes or data from BofA reports, with proper attribution]. Their analyst predictions are based on [explain the factors considered by BofA analysts, e.g., economic forecasts, earnings growth projections, geopolitical factors, etc.]. Their market outlook informs their investment strategy recommendations.

Factors Contributing to High Valuations (BofA's View)

BofA's analysis likely highlights several factors contributing to the current high stock market valuations:

- Low interest rates (past): Historically low interest rates spurred investment in equities.

- Strong corporate earnings: Robust corporate profits have supported higher valuations.

- Technological advancements: Innovation and technological disruption have fueled growth in specific sectors.

- Economic growth (past): Past periods of economic expansion have inflated market capitalization.

- Market sentiment: Investor confidence and optimism contribute to higher valuations. However, this can be fragile.

Risks and Opportunities Associated with High Valuations

While high stock valuations can indicate potential future growth, it's crucial to acknowledge associated risks.

Potential Downside Risks

High valuations inherently carry several risks:

- Market correction: A sharp decline in prices is a possibility if valuations become unsustainable.

- Inflation: Rising inflation erodes purchasing power and can lead to lower corporate profits, impacting stock valuations.

- Rising interest rates: Higher interest rates increase borrowing costs for companies and reduce investor appetite for equities.

- Geopolitical instability: Unforeseen geopolitical events can trigger market uncertainty and volatility. This is a key aspect of risk management. Diversification of a portfolio is essential in mitigating such risks.

Potential Investment Opportunities

Despite the risks, high valuations don't necessarily preclude investment opportunities:

- Sector rotation: Identifying undervalued sectors or companies within overvalued markets can yield profits.

- Value investing: Focusing on companies trading below their intrinsic value can offer attractive entry points.

- Dividend investing: Investing in dividend-paying stocks can provide a steady income stream regardless of market fluctuations. These are often more stable dividend stocks. This is another crucial aspect of investment strategy.

Conclusion: Navigating the Landscape of High Stock Market Valuations

Understanding current high stock market valuations requires careful consideration of various valuation metrics, the influence of interest rates, and the perspectives of leading financial institutions like BofA. While the potential for future growth exists, investors must be mindful of the inherent risks. By diversifying your portfolio, considering alternative investment strategies, and staying informed, investors can navigate this complex landscape more effectively. Stay informed about high stock market valuations by regularly reviewing market analyses and consulting with financial professionals. Understanding the nuances of high stock market valuations is crucial for making sound investment decisions.

Featured Posts

-

Mdkhnw Krt Alqdm Qst Njwm Lebwa Rghm Eadt Altdkhyn Aldart

May 10, 2025

Mdkhnw Krt Alqdm Qst Njwm Lebwa Rghm Eadt Altdkhyn Aldart

May 10, 2025 -

The Loss Of A Pioneer Remembering Americas First Openly Nonbinary Person

May 10, 2025

The Loss Of A Pioneer Remembering Americas First Openly Nonbinary Person

May 10, 2025 -

Melanie Griffith And Dakota Johnsons Family Unite At Materialist Premiere

May 10, 2025

Melanie Griffith And Dakota Johnsons Family Unite At Materialist Premiere

May 10, 2025 -

Could These 9 Nhl Players Break Alex Ovechkins Record

May 10, 2025

Could These 9 Nhl Players Break Alex Ovechkins Record

May 10, 2025 -

Best Deals On Elizabeth Arden Skincare Walmart Comparison

May 10, 2025

Best Deals On Elizabeth Arden Skincare Walmart Comparison

May 10, 2025