High Stock Market Valuations: A BofA Perspective For Investors

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's current stance on the market often shifts, reflecting the dynamic nature of economic indicators and global events. While a precise declaration of "bullish," "bearish," or "neutral" changes frequently, their analysis relies heavily on several key valuation metrics. These metrics help them assess whether current market prices are justified by underlying fundamentals.

BofA employs a range of valuation metrics, including:

- Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio can suggest overvaluation.

- Shiller P/E (CAPE): This is a cyclically adjusted P/E ratio, smoothing out earnings fluctuations over a longer period (typically 10 years). It's considered a more robust measure of long-term valuation.

- Cyclically Adjusted Price-to-Earnings Ratio (CAPE): Similar to the Shiller P/E, this provides a more stable picture of valuation by accounting for economic cycles.

- Price-to-Sales ratio (P/S): This compares a company's market capitalization to its revenue, offering another perspective on valuation, especially useful for companies with volatile or negative earnings.

Specific data points from BofA reports are crucial but constantly evolving. To get the most up-to-date information, refer to their official publications and research. However, we can illustrate with hypothetical examples:

- BofA's target P/E ratio for the S&P 500: (Let's assume, for illustrative purposes, 22). A higher current P/E suggests potential overvaluation relative to BofA's target.

- Key indicators BofA uses to assess overvaluation: Interest rate levels, inflation rates, corporate earnings growth, and investor sentiment.

- BofA's assessment of current market sentiment: (This is highly variable and requires accessing their most recent reports).

Identifying Potential Risks Associated with High Valuations

Investing in a market characterized by high stock market valuations presents inherent risks. BofA's analysis likely highlights the following concerns:

- Increased Volatility: Highly valued markets are more susceptible to sharp price swings, potentially leading to significant losses in a short period.

- Potential for Correction: Overvalued markets often undergo corrections, where prices decline to reflect more sustainable levels. The magnitude of such a correction is difficult to predict.

- Reduced Future Returns: When valuations are already high, the potential for future returns is naturally diminished. Investors might experience lower gains compared to investing in a market with lower valuations.

BofA's sector-specific analysis may pinpoint certain industries or sectors exhibiting particularly high valuations, increasing their vulnerability to corrections.

- Risk of a market correction based on BofA's analysis: (Requires reference to their latest research).

- Sectors identified by BofA as particularly overvalued: (Requires reference to their latest research - examples might include technology or certain consumer discretionary sectors during periods of high valuations).

- BofA's recommendations for mitigating valuation risks: Diversification, strategic asset allocation, and a focus on quality companies with strong fundamentals are likely key strategies recommended by BofA.

Opportunities within a High-Valuation Market

Despite the risks, opportunities can exist even in a market with high stock market valuations. BofA might suggest strategies focusing on:

-

Undervalued Assets: Identifying companies or sectors trading below their intrinsic value requires meticulous research and analysis. This may involve looking at companies with strong fundamentals that have been temporarily overlooked by the market.

-

Strategic Sector Allocation: Concentrating on sectors perceived as less overvalued compared to the broader market can provide relative protection during corrections.

-

Value Investing: BofA's perspective on value investing might involve identifying companies trading at discounts to their perceived worth.

-

Investment strategies suggested by BofA for high-valuation environments: (Requires consulting their latest research – these could include value investing, contrarian strategies, or focused sector diversification).

-

Sectors BofA considers potentially less overvalued: (Requires consulting their latest research - this will vary depending on market conditions).

-

BofA's perspective on dividend stocks in a high-valuation market: Dividend stocks might offer a more stable income stream in a volatile environment, but their valuations should still be carefully examined.

BofA's Recommendations for Investors

BofA's recommendations are likely to emphasize a cautious yet opportunistic approach. They might suggest:

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) to reduce overall portfolio risk.

-

Strategic Asset Allocation: Adjusting the portfolio's allocation based on their assessment of market valuations and risk tolerance.

-

Focus on Quality: Prioritizing companies with strong fundamentals, sustainable earnings growth, and a solid balance sheet.

-

BofA's suggested asset allocation: (Requires access to their latest research).

-

BofA's outlook on specific asset classes (bonds, real estate, etc.): (Requires access to their latest research).

-

Call to action: Review your portfolio in light of BofA's analysis.

Conclusion: Navigating High Stock Market Valuations with a BofA Perspective

Understanding high stock market valuations is crucial for informed investment decisions. BofA's analysis provides valuable insights into the current market landscape, highlighting both potential risks and opportunities. Their recommendations emphasize the importance of diversification, careful asset allocation, and a focus on quality companies. To navigate this complex environment effectively, consult BofA's research for a deeper dive into the current market dynamics and refine your investment strategy to effectively manage these challenging valuations. Remember that market conditions change rapidly, so staying informed is key.

Featured Posts

-

Iftar Programi Hakkari Deki Hakim Ve Savcilar Bulustu

May 11, 2025

Iftar Programi Hakkari Deki Hakim Ve Savcilar Bulustu

May 11, 2025 -

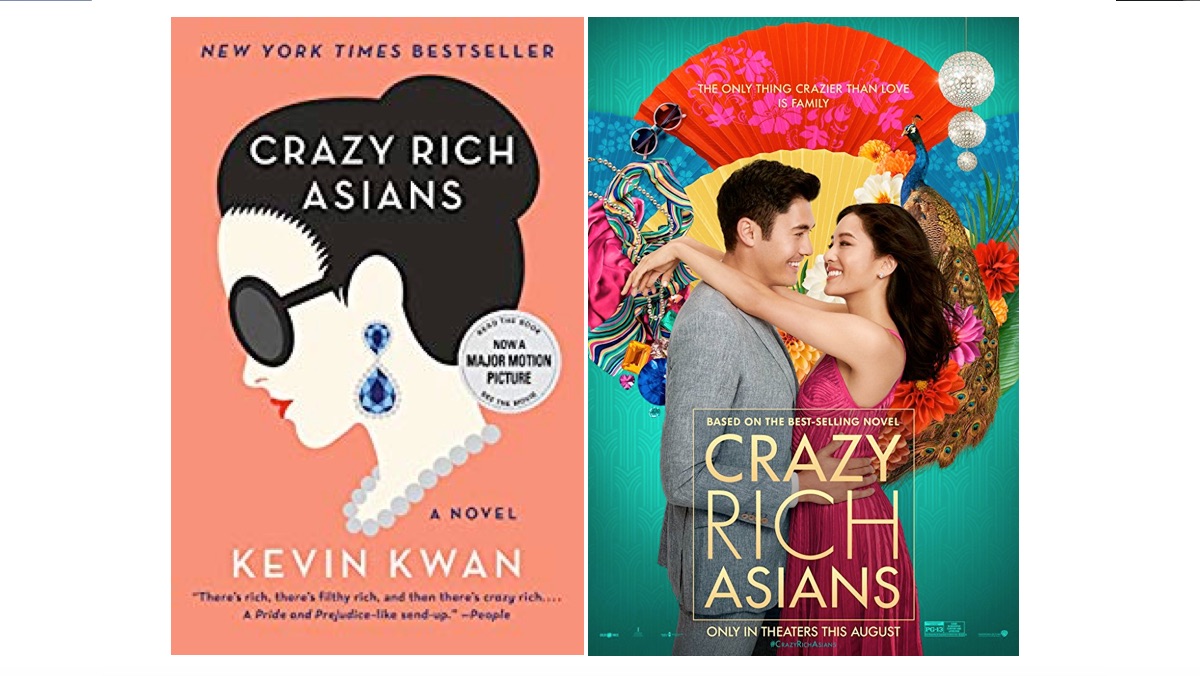

Crazy Rich Asians The Tv Adaptation In Development

May 11, 2025

Crazy Rich Asians The Tv Adaptation In Development

May 11, 2025 -

Yankee Jazz Chisholm Vs Aaron Judge A Statistical Look At Their Early Season Performances

May 11, 2025

Yankee Jazz Chisholm Vs Aaron Judge A Statistical Look At Their Early Season Performances

May 11, 2025 -

Yankees Aaron Judge A Historic Start Mirroring Mlb Legends

May 11, 2025

Yankees Aaron Judge A Historic Start Mirroring Mlb Legends

May 11, 2025 -

Shifting Power In The Arctic Pentagons Greenland Proposal And Its Potential Consequences

May 11, 2025

Shifting Power In The Arctic Pentagons Greenland Proposal And Its Potential Consequences

May 11, 2025

Latest Posts

-

Five Drivers On The Bubble Who Will Miss The 2025 Indy 500

May 11, 2025

Five Drivers On The Bubble Who Will Miss The 2025 Indy 500

May 11, 2025 -

Indy 500 2025 Predicting The Five Drivers Most Likely To Miss The Race

May 11, 2025

Indy 500 2025 Predicting The Five Drivers Most Likely To Miss The Race

May 11, 2025 -

Top 5 Indy 500 Drivers Facing Elimination In 2025

May 11, 2025

Top 5 Indy 500 Drivers Facing Elimination In 2025

May 11, 2025 -

Indy Car Warm Up Palou Leads Dixon At Thermal Club

May 11, 2025

Indy Car Warm Up Palou Leads Dixon At Thermal Club

May 11, 2025 -

Indy Car 2025 Predicting Rahal Letterman Lanigan Racings Performance

May 11, 2025

Indy Car 2025 Predicting Rahal Letterman Lanigan Racings Performance

May 11, 2025