High Stock Market Valuations: BofA's Analysis And Investor Reassurance

Table of Contents

BofA's Key Findings on Current Market Valuations

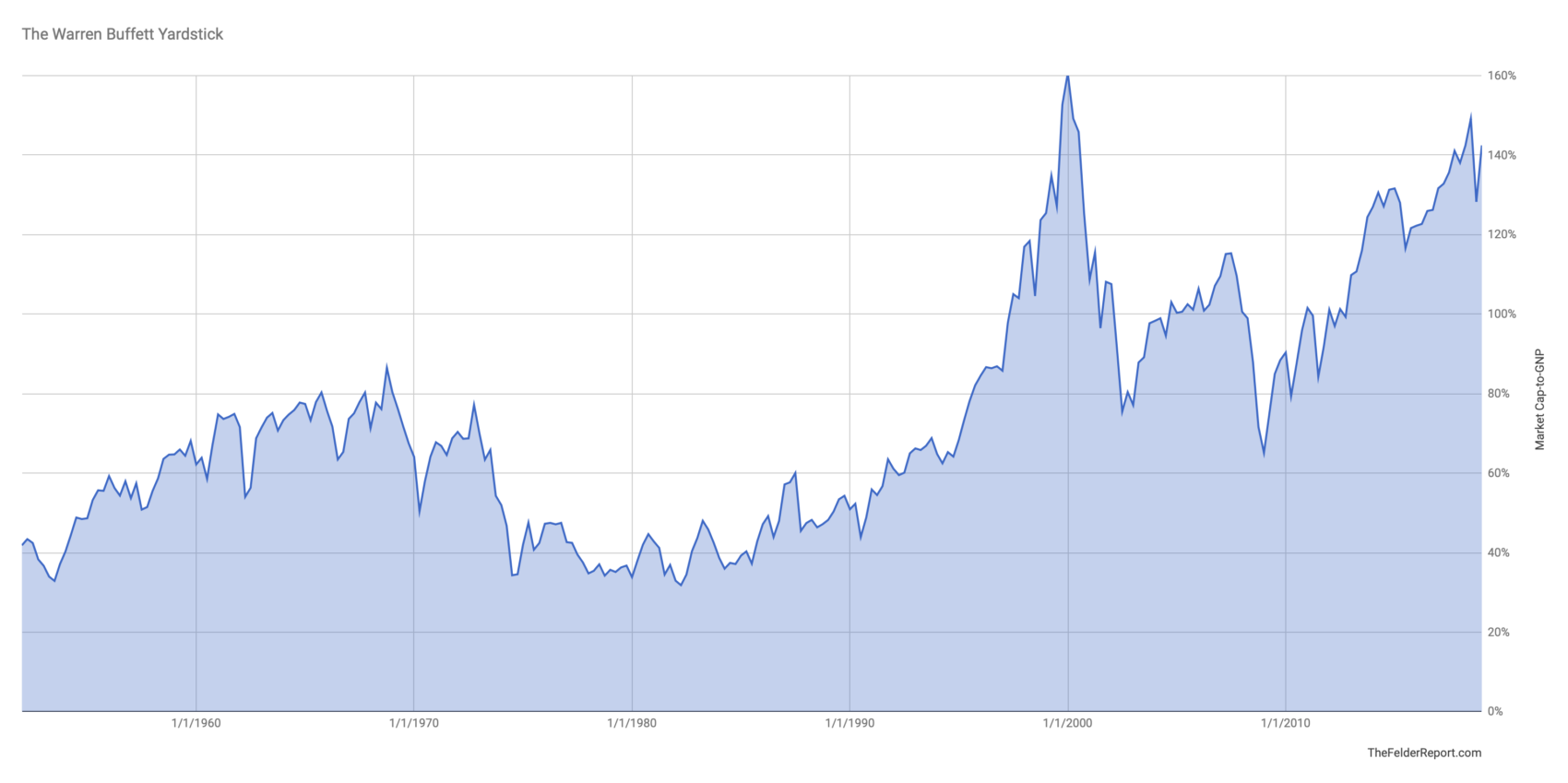

BofA's recent reports on market valuations often utilize key metrics like the Price-to-Earnings ratio (P/E ratio) and the cyclically adjusted price-to-earnings ratio (Shiller PE), alongside broader market indices like the S&P 500, to assess market health. While specific conclusions vary depending on the report's timing, BofA generally provides a nuanced perspective, acknowledging both the potential risks and opportunities presented by high valuations.

-

BofA's Assessment of Overvaluation: BofA's analysis typically doesn't declare a simple "overvalued" or "undervalued" verdict. Instead, they often highlight specific sectors or asset classes showing signs of elevated valuations relative to historical averages or fundamental data. They might caution investors about specific pockets of the market while acknowledging other areas exhibiting more attractive valuations.

-

Sector-Specific Valuations: BofA's reports often dissect valuations across various sectors. For instance, certain technology stocks might be flagged as potentially overvalued due to high growth expectations, while more traditional sectors might appear relatively cheaper. This granular analysis helps investors make more informed decisions about asset allocation.

-

Caveats and Limitations: BofA's analysts are careful to acknowledge the limitations of their models. They might point out the impact of unexpected economic events or shifts in investor sentiment that can significantly affect valuations. These caveats emphasize the inherent uncertainty in predicting future market performance.

Supporting Content: To fully understand BofA's methodology, it's crucial to refer to their original research reports. These reports often include detailed explanations of the data sources (e.g., company financial statements, macroeconomic data), statistical models, and assumptions used in their valuation assessments. [Insert link to relevant BofA report here, if available].

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current valuation landscape. Understanding these is key to making informed investment decisions:

-

Low Interest Rates: Historically low interest rates encourage investors to seek higher returns in the stock market, pushing up prices even for companies with average growth prospects. This increased demand inflates valuations across the board.

-

Corporate Earnings Growth: Strong corporate earnings growth, or the expectation of it, supports higher stock prices. If companies consistently exceed profit expectations, investors are willing to pay more for their shares, boosting market valuations. However, periods of slower earnings growth can lead to downward pressure on valuations.

-

Inflation's Impact: Inflation introduces significant uncertainty. High inflation erodes purchasing power and can lead to increased interest rates, potentially cooling down the stock market and impacting valuations negatively. Conversely, unexpected deflationary pressures could also affect market sentiment and valuations.

-

Geopolitical Events: Geopolitical instability and uncertainty can create volatility in the stock market. Major global events—wars, trade disputes, or political upheavals—can significantly impact investor confidence and lead to fluctuations in valuations.

Supporting Content: Charts illustrating the correlation between interest rates, inflation, earnings growth, and market indices can provide visual representations of these relationships. Referencing data from reputable sources like the Federal Reserve or the Bureau of Economic Analysis adds weight to the analysis.

Investor Strategies for Navigating High Valuations

Despite potentially high valuations, investors can employ several strategies to navigate the market effectively:

-

Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces your risk exposure. Don't put all your eggs in one basket.

-

Long-Term Investment Horizon: A long-term investment approach helps weather short-term market fluctuations. Focusing on long-term growth rather than short-term gains mitigates the impact of valuation changes.

-

Value Investing: Value investing involves identifying undervalued companies with strong fundamentals. This strategy can be particularly beneficial in a market where some sectors might appear overvalued.

-

Portfolio Rebalancing: Regularly rebalancing your portfolio to your target asset allocation ensures you're not overly exposed to any single sector or asset class that might be experiencing a period of high valuations.

-

Alternative Investments: Consider exploring alternative investments such as commodities, private equity, or hedge funds to further diversify your portfolio and potentially reduce reliance on the traditionally higher-valued stock market.

Supporting Content: Provide examples of diversified portfolios, illustrating different asset allocations and risk profiles. Explain the fundamentals of value investing and how to identify potentially undervalued companies.

Understanding Risk Tolerance and Investment Goals

Before implementing any strategy, it's crucial to understand your individual circumstances:

-

Risk Tolerance Assessment: Determine your risk tolerance through online questionnaires or consultations with a financial advisor. Knowing your comfort level with potential losses is critical for making appropriate investment choices.

-

Investment Goals: Define your short-term and long-term investment objectives. Are you saving for retirement, a down payment on a house, or other specific goals? This clarity helps you align your investment strategy with your needs.

-

Goal Alignment: Ensure your investment strategy aligns with your personal financial goals. Your risk tolerance and investment timeline should inform your asset allocation and investment choices.

Supporting Content: Provide links to risk tolerance questionnaires and resources that help individuals define their financial goals. Discuss the different risk tolerance levels (conservative, moderate, aggressive) and how they affect investment decisions.

Conclusion

BofA's analysis of high stock market valuations provides valuable insights for investors. While the market may appear overvalued in certain sectors, understanding the underlying factors and implementing appropriate strategies, such as diversification and a long-term perspective, can help navigate this environment. Remember, it's crucial to assess your own risk tolerance and investment goals before making any decisions. Don't hesitate to consult a financial advisor for personalized guidance on managing your investments in the face of high stock market valuations. Careful planning and a well-diversified portfolio are key to mitigating the risks associated with high stock market valuations.

Featured Posts

-

New Evidence Undercover Footage Implicates Prince Andrew In Underage Girl Scandal

May 11, 2025

New Evidence Undercover Footage Implicates Prince Andrew In Underage Girl Scandal

May 11, 2025 -

Ru Pauls Drag Race S17 E13 Drag Baby Mamas Preview Family Drama On The Runway

May 11, 2025

Ru Pauls Drag Race S17 E13 Drag Baby Mamas Preview Family Drama On The Runway

May 11, 2025 -

Trump Administration Seeks Tariff Reductions And Rare Earths Relief From China

May 11, 2025

Trump Administration Seeks Tariff Reductions And Rare Earths Relief From China

May 11, 2025 -

Stallone E Os Quadrinhos Uma Analise Da Adaptacao Injusticada

May 11, 2025

Stallone E Os Quadrinhos Uma Analise Da Adaptacao Injusticada

May 11, 2025 -

Analyzing The Next Papal Election Key Factors And Potential Outcomes

May 11, 2025

Analyzing The Next Papal Election Key Factors And Potential Outcomes

May 11, 2025

Latest Posts

-

Zeygaria Kai Imerominies Agonon Nba Playoffs 2024

May 12, 2025

Zeygaria Kai Imerominies Agonon Nba Playoffs 2024

May 12, 2025 -

Nba Playoffs Pliris Enimerosi Gia Ta Zeygaria Kai To Programma Agonon

May 12, 2025

Nba Playoffs Pliris Enimerosi Gia Ta Zeygaria Kai To Programma Agonon

May 12, 2025 -

Analyzing The Injuries Chicago Bulls And New York Knicks Matchup

May 12, 2025

Analyzing The Injuries Chicago Bulls And New York Knicks Matchup

May 12, 2025 -

Watch Ny Knicks Vs Cleveland Cavaliers Live Tv Schedule Streaming Options And Game Time

May 12, 2025

Watch Ny Knicks Vs Cleveland Cavaliers Live Tv Schedule Streaming Options And Game Time

May 12, 2025 -

Knicks Vs Bulls Game Prediction Betting Odds And Expert Analysis February 20 2025

May 12, 2025

Knicks Vs Bulls Game Prediction Betting Odds And Expert Analysis February 20 2025

May 12, 2025