High Stock Market Valuations: BofA's Argument For Investor Calm

Table of Contents

BofA's Key Arguments for a Sustainable Market

BofA's recent reports present a case for sustained, albeit potentially volatile, market growth. Their analysis centers on several key pillars supporting current high stock valuations.

Strong Corporate Earnings and Profitability

Robust corporate earnings are a cornerstone of BofA's optimistic outlook. The firm points to strong profit margins across various sectors, indicating that companies are not merely inflating their stock prices through speculation. This strong performance is backed by tangible revenue growth. For example, BofA highlights sustained growth in the technology and healthcare sectors, key drivers of overall market performance. Positive earnings revisions further reinforce this trend, suggesting that analysts are increasingly confident in future corporate profitability.

- High profit margins: Many companies are demonstrating impressive profit margins, indicating efficient operations and strong pricing power.

- Strong revenue growth in key sectors: Technology, healthcare, and consumer staples show continued robust revenue expansion.

- Positive earnings revisions: Analysts are upwardly revising their earnings estimates for many companies, reflecting a positive outlook.

Low Interest Rates and Abundant Liquidity

Low interest rates play a crucial role in maintaining high stock valuations. The prolonged period of quantitative easing and other accommodative monetary policies has flooded the market with liquidity. This abundance of readily available capital has increased investor appetite for riskier assets, including stocks. This translates to higher valuations as investors compete for a limited supply of shares.

- Impact of low borrowing costs on businesses: Lower interest rates reduce the cost of capital for businesses, encouraging investment and expansion, thus bolstering earnings.

- Increased investor appetite for riskier assets: Abundant liquidity drives investors towards higher-return assets, such as stocks, even at higher valuations.

- Sustained liquidity in the market: The continued flow of capital into the market supports asset prices and prevents sharp corrections.

Long-Term Growth Potential

BofA's analysis extends beyond short-term indicators, focusing on long-term growth prospects. The firm identifies several factors supporting sustained market expansion, including technological advancements and innovation across various industries, as well as continued growth in emerging markets. Furthermore, the increasing focus on sustainable investing and ESG (Environmental, Social, and Governance) factors is expected to fuel investments in companies aligning with these principles.

- Technological advancements and innovation: Disruptive technologies continue to reshape industries, creating new growth opportunities and boosting productivity.

- Emerging markets growth: Developing economies offer significant growth potential, attracting investment and driving global economic expansion.

- Sustainable investing trends: The increasing demand for sustainable investments fuels growth in companies focusing on environmental and social responsibility.

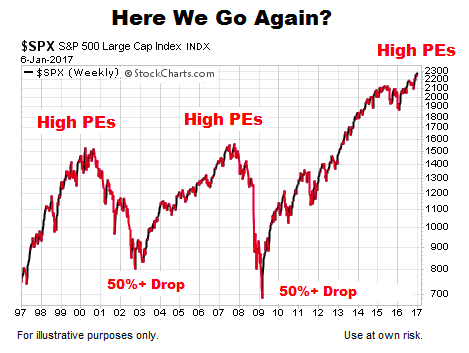

Addressing Concerns about Overvaluation

While BofA presents a positive outlook, acknowledging concerns about overvaluation is crucial.

Valuation Metrics and Their Limitations

Traditional valuation metrics such as the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE) often raise concerns about overvaluation. However, BofA argues that these metrics don't fully capture the current market reality. The impact of low interest rates on valuation multiples, for example, is often not fully reflected in these traditional measures. Moreover, the impact of technological innovation, which can dramatically increase future earnings potential, is difficult to accurately quantify using historical data.

- Historical comparisons and their limitations: Using historical data to assess current valuations can be misleading due to shifts in economic conditions and technological advancements.

- Impact of low interest rates on valuation multiples: Low interest rates justify higher valuation multiples, as the cost of capital is lower.

- The role of innovation in justifying higher valuations: Innovative companies often command higher valuations due to their potential for future growth.

Potential Risks and Mitigation Strategies

Despite the positive outlook, potential risks remain. Inflation, geopolitical uncertainty, and potential interest rate hikes could negatively impact market performance. BofA likely suggests mitigating these risks through diversification, a long-term investment horizon, and employing sound risk management techniques.

- Diversification strategies: Spreading investments across different asset classes and sectors reduces overall portfolio risk.

- Long-term investment horizons: Focusing on long-term growth rather than short-term fluctuations helps navigate market volatility.

- Risk management techniques: Employing strategies like stop-loss orders and hedging can help limit potential losses.

Alternative Perspectives and Counterarguments

It's important to acknowledge that not all analysts share BofA's optimistic view. Some argue that current valuations are unsustainable and predict a significant market correction. These differing opinions highlight the inherent uncertainty in market forecasting. Criticisms of BofA's analysis might include its reliance on forward-looking projections and the potential for unforeseen economic shocks to derail the optimistic scenario.

Navigating High Stock Market Valuations – A Call to Action

BofA's analysis highlights the importance of considering factors beyond traditional valuation metrics when assessing the current market. Key takeaways include the significance of strong corporate earnings, the impact of low interest rates, and the potential for long-term growth. While high stock market valuations warrant careful consideration, BofA's analysis suggests a measured approach. Don't let fear paralyze you; instead, carefully assess your risk tolerance and develop a long-term investment strategy that takes into account the current market dynamics. Learn more about managing your portfolio during periods of high stock market valuations and consult with a financial advisor to create a personalized plan.

Featured Posts

-

Pennsylvania Legal Update April 17 2025 Cozen O Connor

Apr 25, 2025

Pennsylvania Legal Update April 17 2025 Cozen O Connor

Apr 25, 2025 -

Stagecoach 2025 Your Complete Guide To The Country Music Festival

Apr 25, 2025

Stagecoach 2025 Your Complete Guide To The Country Music Festival

Apr 25, 2025 -

Linda Evangelistas Raw Honesty First Reactions To Showing Mastectomy Scars

Apr 25, 2025

Linda Evangelistas Raw Honesty First Reactions To Showing Mastectomy Scars

Apr 25, 2025 -

The Zuckerberg Trump Dynamic Implications For Tech And Governance

Apr 25, 2025

The Zuckerberg Trump Dynamic Implications For Tech And Governance

Apr 25, 2025 -

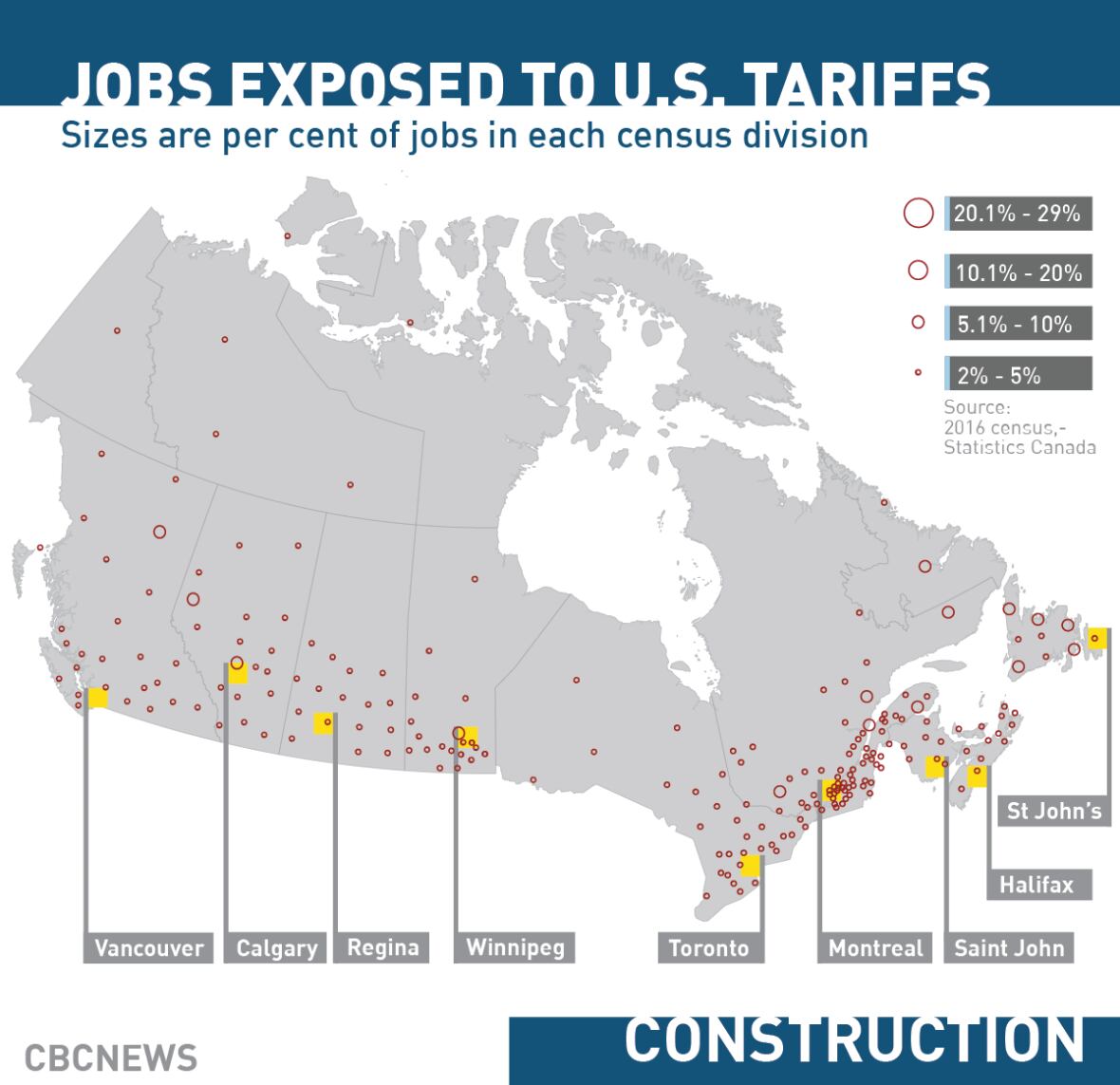

Tariff Hardships For Montreals Guitar Industry

Apr 25, 2025

Tariff Hardships For Montreals Guitar Industry

Apr 25, 2025

Latest Posts

-

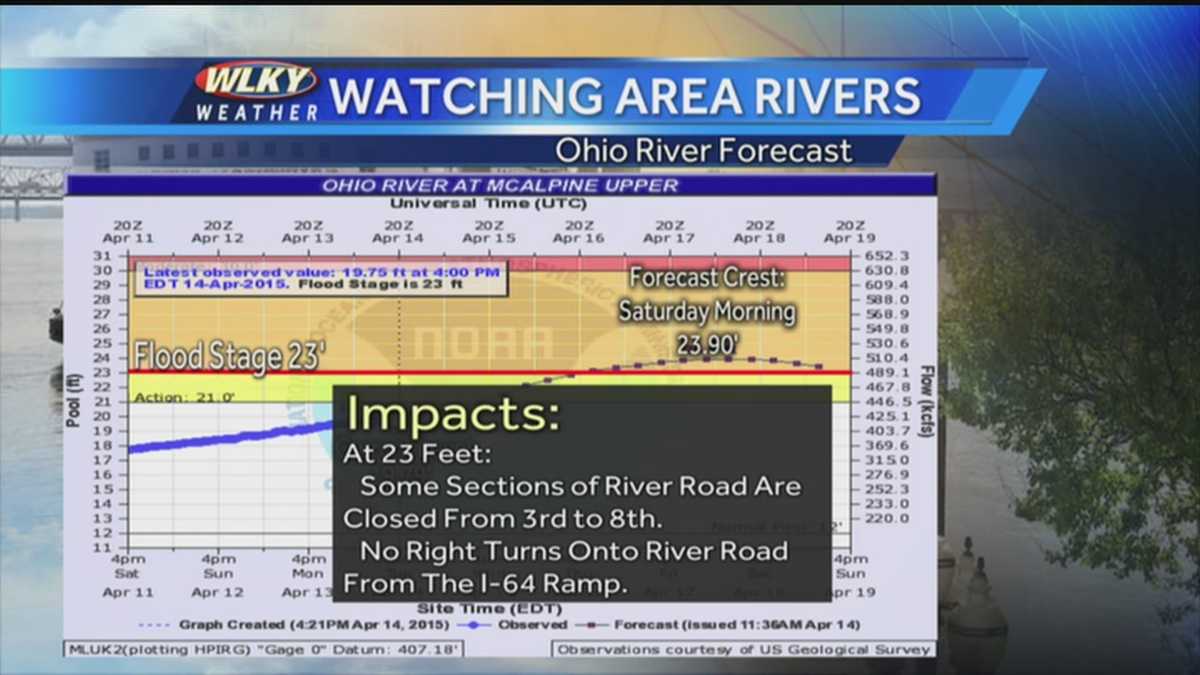

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025 -

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025 -

Analisi Del Venerdi Santo Secondo Feltri

Apr 30, 2025

Analisi Del Venerdi Santo Secondo Feltri

Apr 30, 2025 -

Venerdi Santo La Posizione Di Feltri

Apr 30, 2025

Venerdi Santo La Posizione Di Feltri

Apr 30, 2025 -

Feltri E Il Significato Del Venerdi Santo

Apr 30, 2025

Feltri E Il Significato Del Venerdi Santo

Apr 30, 2025