High Stock Market Valuations: Why BofA Believes Investors Shouldn't Panic

Table of Contents

High stock market valuations are a recurring concern for investors. Recent market performance, with indices reaching record highs, has fueled anxieties about a potential market correction or even a crash. However, Bank of America (BofA), a financial giant with significant market influence, offers a counter-narrative, suggesting that current valuations, while elevated, don't automatically predict an impending market downturn. This article explores BofA's reasoning and provides insights into why investors might choose not to panic despite seemingly high stock prices. We'll examine the nuances of high valuations, explore supporting factors for continued market growth, and offer strategies for navigating this environment.

BofA's Rationale: Understanding the Nuances of High Valuations

BofA's argument against immediate panic rests on several key pillars. They contend that a simple focus on valuation metrics alone paints an incomplete picture. Instead, a holistic view encompassing macroeconomic factors and corporate performance is crucial.

-

Low interest rate environment supports higher valuations. Historically low interest rates make borrowing cheaper for companies, fueling investment and boosting earnings, which in turn supports higher stock prices. This low-rate environment increases the present value of future earnings, justifying higher price-to-earnings ratios (P/E).

-

Robust corporate earnings justify current price-to-earnings ratios (P/E). Many companies are reporting strong earnings, indicating that the current valuations are at least partially supported by fundamental performance. This suggests that market growth isn't solely speculative.

-

Strong economic fundamentals suggest continued growth potential. Several key economic indicators point towards continued, albeit perhaps slower, growth in the coming years. This positive outlook supports the argument for sustained, albeit potentially less dramatic, market expansion.

-

BofA's analysis of specific sectors showing resilience. BofA's research doesn't paint a uniformly high valuation across all sectors. Certain sectors show more reasonable valuations based on their growth potential and earnings.

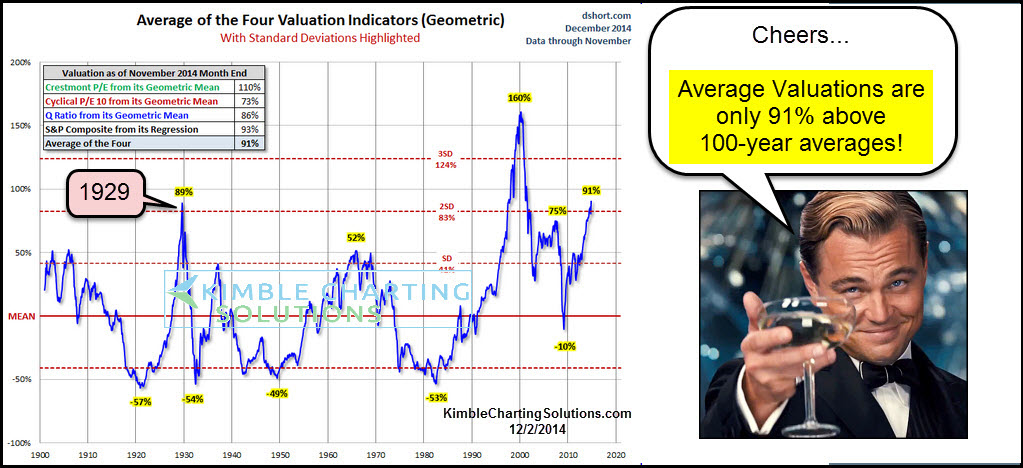

Comparing Current Valuations to Historical Context

Looking solely at current valuation metrics like the P/E ratio or the cyclically adjusted price-to-earnings ratio (Shiller P/E) can be misleading. History shows periods of high valuations followed by extended periods of market growth. While high valuations are a risk factor, they are not necessarily a predictor of an imminent crash.

-

Reference to previous periods of high valuations followed by sustained growth. Examining previous market cycles reveals that high valuations have occurred before without resulting in immediate crashes. These periods often show periods of consolidation followed by further upward movement.

-

Discussion of relevant valuation metrics (P/E ratio, Shiller P/E, etc.). Understanding the nuances of various valuation metrics is critical. The Shiller P/E, for example, adjusts for inflation and provides a longer-term perspective.

-

Mention the influence of factors beyond valuation metrics (e.g., market sentiment, geopolitical events). Market sentiment, global economic conditions, and geopolitical events play significant roles in shaping market performance. These factors can significantly influence valuations regardless of fundamental strengths or weaknesses.

Factors Supporting Continued Market Growth Despite High Valuations

Several factors suggest that market growth can continue despite currently high valuations:

-

Technological advancements driving future growth. Technological innovation is a powerful engine of economic growth. Breakthroughs in areas like artificial intelligence, renewable energy, and biotechnology have the potential to generate significant long-term economic gains, supporting higher valuations.

-

Emerging markets offering new investment opportunities. Emerging markets often present faster growth opportunities than developed economies, creating new avenues for investment and potentially offsetting risks in mature markets.

-

Government policies supporting economic expansion. Government policies, particularly fiscal and monetary policies, can influence market performance. Supportive policies can enhance economic activity and further support market growth.

-

Potential for further interest rate cuts. In the face of economic slowdown, central banks may opt for further interest rate cuts, further supporting market valuations and encouraging borrowing and investment.

Strategies for Navigating High Stock Market Valuations

High valuations don't necessitate a complete withdrawal from the market. Instead, investors can implement strategies to mitigate risk and capitalize on opportunities:

-

Importance of diversification across asset classes. Diversification across different asset classes (stocks, bonds, real estate, etc.) reduces risk and protects against significant losses in any single asset class.

-

Focus on long-term investment goals rather than short-term market fluctuations. A long-term perspective is crucial. Short-term market volatility shouldn't deter you from your long-term investment strategy.

-

Regular portfolio review and rebalancing. Regularly review and rebalance your portfolio to ensure it aligns with your risk tolerance and investment goals.

-

Consideration of value investing strategies. Value investing focuses on identifying undervalued companies with strong fundamentals, offering potential for growth even in a high-valuation market.

-

Importance of understanding your personal risk tolerance. Understand your risk tolerance and adjust your investment strategy accordingly. High valuations may call for a more conservative approach for some investors.

Conclusion

While high stock market valuations are a valid concern, BofA's analysis suggests investors should avoid knee-jerk reactions and panic selling. By considering the broader economic context, historical trends, and implementing a well-diversified long-term strategy, investors can navigate this environment effectively. Don't let high stock market valuations deter you from achieving your financial goals. Learn more about navigating high valuations and developing a robust investment strategy tailored to your needs. Consult with a financial advisor to discuss your specific situation and investment plan in relation to high stock market valuations.

Featured Posts

-

San Diego Padres Pregame Report Rain Delay And Roster Changes

May 16, 2025

San Diego Padres Pregame Report Rain Delay And Roster Changes

May 16, 2025 -

Gurriels Pinch Hit Key Rbi Single Leads Padres Past Braves

May 16, 2025

Gurriels Pinch Hit Key Rbi Single Leads Padres Past Braves

May 16, 2025 -

Peavy Rejoins Padres Organization In Executive Role

May 16, 2025

Peavy Rejoins Padres Organization In Executive Role

May 16, 2025 -

Cobalt Market Congos Quota Plan After Export Ban Fallout

May 16, 2025

Cobalt Market Congos Quota Plan After Export Ban Fallout

May 16, 2025 -

Dodgers Forgotten Prospect Finally Gets His Shot

May 16, 2025

Dodgers Forgotten Prospect Finally Gets His Shot

May 16, 2025