High-Yield Dividend Investing: The Easy Path To Success

Table of Contents

Building wealth steadily and passively is a dream for many. High-yield dividend investing offers a potentially simple path towards achieving this goal. By carefully selecting companies that consistently pay high dividends, you can generate a reliable stream of income and grow your wealth over time. This article will guide you through the process, making high-yield dividend investing accessible to everyone.

Understanding High-Yield Dividend Stocks

A high-yield dividend stock is a company that pays out a substantial portion of its earnings as dividends relative to its share price. The dividend yield, a key metric, is calculated by dividing the annual dividend per share by the share price. A higher yield generally indicates a higher dividend payout. However, a high dividend yield doesn't automatically signal a good investment.

-

Defining Dividend Yield: Dividend yield is expressed as a percentage and represents the annual dividend payment relative to the current stock price. It's a crucial factor in evaluating the potential income generated from a stock.

-

Dividend Yield and Stock Price: The relationship is inverse. If the stock price rises, the dividend yield falls, and vice versa. This means a stock's yield can fluctuate even if the dividend payment remains constant.

-

Dividend Payout Ratio: This is the percentage of a company's earnings paid out as dividends. A high payout ratio (e.g., above 70%) can be risky, suggesting the company may struggle to reinvest in growth or handle unexpected expenses.

-

Risks of High-Yield Dividend Stocks: While attractive, high-yield dividend stocks can carry risks. These include the possibility of dividend cuts or suspensions if the company faces financial difficulties. Thorough due diligence is essential. Analyzing a company's financial health, including its debt levels and future prospects, helps mitigate these risks.

Identifying Reliable High-Yield Dividend Investments

Selecting reliable high-yield investments requires careful due diligence. You need to analyze the company's fundamentals:

-

Financial Statement Analysis: Scrutinize the balance sheet, income statement, and cash flow statement to assess financial health, debt levels, and profitability.

-

Dividend Growth History: Look for a track record of consistent dividend payments and increases, indicating a commitment to shareholder returns. Companies with a history of dividend growth are often more reliable.

-

Industry and Competitive Landscape: Understand the company's industry and its competitive position. A company in a stable, growing industry with a strong competitive advantage is more likely to sustain its dividend payments.

-

Stock Screeners and Financial Tools: Use online stock screeners and financial analysis tools to filter potential investments based on your criteria (dividend yield, payout ratio, financial strength, etc.). These tools significantly streamline the research process.

Building a Diversified High-Yield Dividend Portfolio

Diversification is crucial for mitigating risk in high-yield dividend investing. Don't concentrate your investments in a single company or sector.

-

Sector Diversification: Spread your investments across different sectors (e.g., technology, healthcare, consumer goods) to reduce the impact of sector-specific downturns.

-

Market Capitalization Diversification: Include a mix of large-cap, mid-cap, and small-cap stocks to balance risk and potential return.

-

Geographic Diversification: Consider diversifying geographically by investing in companies from different countries. This mitigates risks associated with specific national economies.

-

ETFs and Mutual Funds: Exchange-Traded Funds (ETFs) and mutual funds offer instant diversification across numerous stocks, providing a convenient and cost-effective way to build a diversified portfolio. Rebalancing your portfolio periodically is vital to maintain your target asset allocation.

Managing Your High-Yield Dividend Portfolio

Effective long-term management is key to success in high-yield dividend investing.

-

Dividend Reinvestment Plans (DRIPs): DRIPs automatically reinvest your dividends to purchase additional shares, compounding your returns over time.

-

Tax Implications: Be aware of the tax implications of dividend income. Dividends are generally taxed as ordinary income. Consulting a tax professional can ensure you're maximizing your after-tax returns.

-

Portfolio Monitoring and Rebalancing: Regularly monitor your portfolio's performance, and rebalance it periodically to maintain your target asset allocation and risk tolerance.

-

Long-Term Investing: High-yield dividend investing is a long-term strategy. Avoid short-term trading and focus on building a portfolio that can generate passive income for years to come.

Conclusion:

High-yield dividend investing offers a potentially easy and accessible path to building wealth. By understanding dividend yields, identifying reliable companies, diversifying your portfolio, and managing your investments wisely, you can generate passive income and grow your wealth over time. Start your high-yield dividend investing journey today and begin building a more secure financial future. Remember to conduct thorough research and consider seeking professional financial advice before making any investment decisions.

Featured Posts

-

Judge Orders Release Of Detained Tufts Student Rumeysa Ozturk

May 11, 2025

Judge Orders Release Of Detained Tufts Student Rumeysa Ozturk

May 11, 2025 -

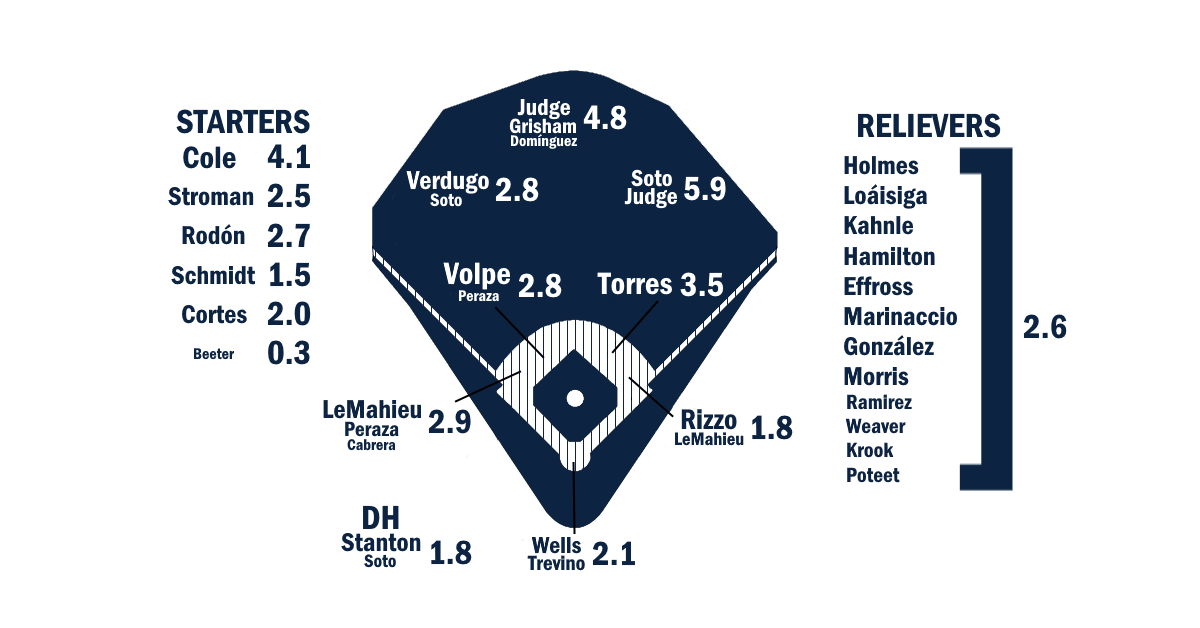

Key Aaron Judge Analytics A 2025 Yankees Preview

May 11, 2025

Key Aaron Judge Analytics A 2025 Yankees Preview

May 11, 2025 -

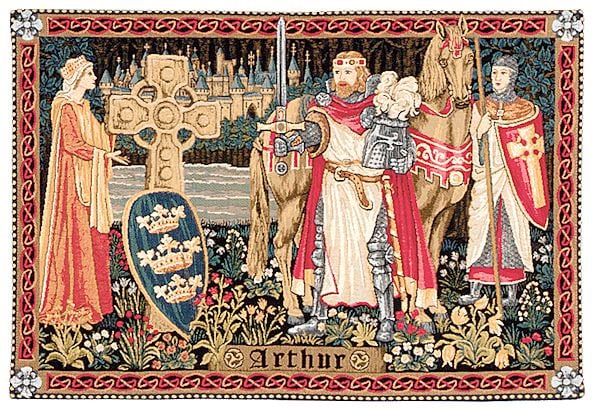

Merlin And Arthur A Medieval Tale Revealed On A Book Cover

May 11, 2025

Merlin And Arthur A Medieval Tale Revealed On A Book Cover

May 11, 2025 -

Mlb Injury News Guardians And Yankees April 21st 23rd

May 11, 2025

Mlb Injury News Guardians And Yankees April 21st 23rd

May 11, 2025 -

Canadas Largest Natural Gas Producer Continued Growth And Expansion

May 11, 2025

Canadas Largest Natural Gas Producer Continued Growth And Expansion

May 11, 2025

Latest Posts

-

Grand Slam Track Revolutionizing The World Of Track And Field

May 11, 2025

Grand Slam Track Revolutionizing The World Of Track And Field

May 11, 2025 -

Michael Johnson Grand Slam High Stakes High Speed Track And Field Competition

May 11, 2025

Michael Johnson Grand Slam High Stakes High Speed Track And Field Competition

May 11, 2025 -

Grand Slam Track Can This New League Save Athletics

May 11, 2025

Grand Slam Track Can This New League Save Athletics

May 11, 2025 -

The Johnson Effect How The Changing Athletics Landscape Impacts Duplantis

May 11, 2025

The Johnson Effect How The Changing Athletics Landscape Impacts Duplantis

May 11, 2025 -

Grand Slam Track Meet Promises Speed And Star Power With Michael Johnson

May 11, 2025

Grand Slam Track Meet Promises Speed And Star Power With Michael Johnson

May 11, 2025