Home Sales Crisis: Understanding The Current Market Downturn

Table of Contents

Rising Interest Rates and Their Impact on Home Sales

The dramatic increase in interest rates is a primary driver of the current home sales crisis. The Federal Reserve's efforts to combat inflation have resulted in significantly higher mortgage rates, directly impacting affordability for potential homebuyers. This translates to:

- Higher mortgage payments: Even with the same loan amount, increased interest rates lead to substantially larger monthly payments, reducing the purchasing power of potential buyers.

- Fewer buyers qualify for loans: Lenders use stricter lending criteria, resulting in fewer individuals qualifying for mortgages. This significantly shrinks the pool of potential homebuyers.

- Increased borrowing costs deter potential investors: Higher interest rates make borrowing more expensive for investors, reducing their activity in the real estate market and further dampening demand.

- Disproportionate impact on different buyer segments: First-time homebuyers, particularly those with lower incomes, are most severely affected by rising interest rates. The luxury market, while still active, is also experiencing a slowdown due to decreased affordability and increased borrowing costs.

For example, a 2% increase in interest rates can increase monthly mortgage payments by hundreds of dollars, making a previously affordable home unattainable for many. Data from the National Association of Realtors shows a sharp decline in mortgage applications since the interest rate hikes began.

Inflation and its Effect on the Housing Market

Soaring inflation is another critical factor fueling the home sales crisis. Increased costs for building materials, labor, and transportation have significantly impacted the construction industry. This has resulted in:

- Increased construction costs lead to higher home prices: The rising cost of lumber, concrete, and other materials directly translates to higher prices for newly constructed homes.

- Reduced supply due to increased costs and labor shortages: Higher construction costs and a shortage of skilled labor have slowed down new home construction, exacerbating the existing inventory shortage.

- Effect on the affordability of both new and existing homes: The combined effect of inflation and increased interest rates makes both new and existing homes less affordable for a significant portion of the population.

The Consumer Price Index (CPI) has shown consistent increases in the cost of construction materials, directly impacting the overall cost of housing. This further complicates the already challenging housing market landscape.

Inventory Shortage and its Role in the Crisis

The current home sales crisis is further amplified by a persistent shortage of homes for sale. This imbalance between supply and demand creates a highly competitive market:

- Reasons for low inventory: Many homeowners are hesitant to sell their homes due to concerns about finding a suitable replacement in a tight market. Furthermore, restricted building and regulatory hurdles also contribute to the limited supply.

- Impact on buyer competition and bidding wars: Low inventory fuels intense competition among buyers, often leading to bidding wars that drive up prices even further.

- Geographic variations in inventory levels: While some areas experience more severe shortages than others, the low inventory is a nationwide problem impacting many different real estate markets.

Data from Realtor.com shows inventory levels are significantly lower compared to previous years, underscoring the severity of the supply shortage.

Economic Uncertainty and Consumer Confidence

Widespread economic uncertainty and declining consumer confidence have significantly impacted buyer behavior. The fear of a potential recession is creating hesitancy among potential homebuyers:

- Fear of recession impacting buyer decisions: Concerns about job security and potential economic downturns are prompting many to postpone major purchases, including homes.

- Job security concerns leading to hesitancy in purchasing homes: The uncertainty about future employment prospects makes it more difficult for people to commit to a significant financial obligation like a mortgage.

- Impact on investor activity in the real estate market: Economic uncertainty reduces investor confidence, decreasing investment in the real estate market and slowing down demand.

The Consumer Confidence Index has shown a decline, reflecting a sense of unease among consumers, which directly impacts their purchasing decisions in the housing market.

Potential Solutions and Future Outlook for Home Sales

Addressing this home sales crisis requires a multi-pronged approach. Potential solutions include:

- Potential for interest rate adjustments: The Federal Reserve may adjust interest rate hikes based on inflation data, potentially easing the burden on homebuyers.

- Government incentives for homebuyers: Government programs designed to incentivize homeownership, such as tax credits or down payment assistance, could stimulate demand.

- Predictions for future home prices and sales volume: Experts offer varying predictions, but most agree that a stabilization or slight decline in home prices is likely in the near term.

The future of the housing market is complex and depends on numerous interacting factors. A balanced and nuanced approach is necessary to navigate this challenging period.

Conclusion

The current home sales crisis is a complex issue driven by rising interest rates, inflation, an inventory shortage, and economic uncertainty. These factors have combined to create a challenging environment for both buyers and sellers. Understanding the nuances of this home sales crisis is crucial. Stay informed by following reputable market analyses and consulting with a real estate expert to make the best decisions for your individual circumstances. This will allow you to navigate the current home sales crisis effectively and make informed choices about your property investments.

Featured Posts

-

Analyzing The Posthaste Effects Of The Recent Tariff Ruling In Canada

May 31, 2025

Analyzing The Posthaste Effects Of The Recent Tariff Ruling In Canada

May 31, 2025 -

Trumps Iran Deal Will It Box Israel In

May 31, 2025

Trumps Iran Deal Will It Box Israel In

May 31, 2025 -

Nyt Mini Crossword Thursday April 10 Clues And Solutions

May 31, 2025

Nyt Mini Crossword Thursday April 10 Clues And Solutions

May 31, 2025 -

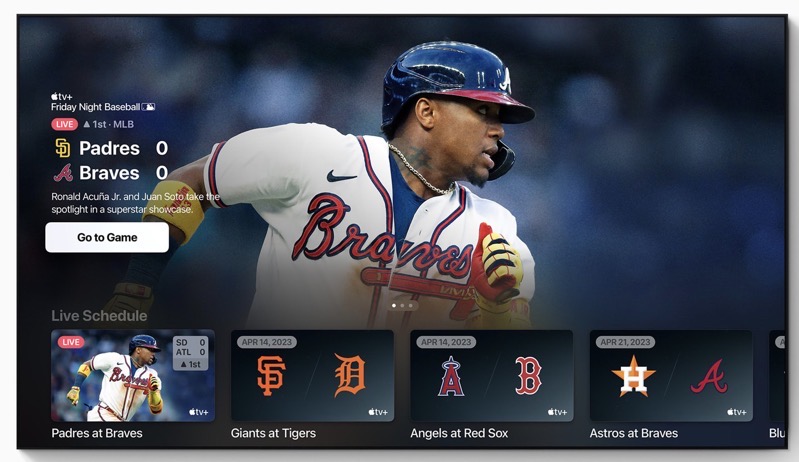

Friday Night Baseball Tigers Face Twins To Start Road Trip

May 31, 2025

Friday Night Baseball Tigers Face Twins To Start Road Trip

May 31, 2025 -

Twins Guardians Baseball Game April 29th Rain Delay And Start Time

May 31, 2025

Twins Guardians Baseball Game April 29th Rain Delay And Start Time

May 31, 2025