Honeywell To Purchase Johnson Matthey Catalyst Technology For $2.4 Billion: Implications And Future Outlook

Table of Contents

Deal Details and Rationale

Honeywell's acquisition of Johnson Matthey's Clean Air division encompasses a significant portfolio of catalyst technologies crucial for automotive emission control and chemical processing. The $2.4 billion deal includes the transfer of intellectual property, manufacturing facilities, and a substantial workforce specializing in catalyst development and production. This strategic move is driven by Honeywell's ambition to expand its presence in the rapidly growing clean energy sector and solidify its position as a leader in emission control solutions. The acquisition offers several key benefits:

- Expansion of Honeywell's existing portfolio in emission control technologies: This acquisition significantly broadens Honeywell's offerings, creating a more comprehensive and competitive product line.

- Increased market share in the automotive catalyst market: By acquiring Johnson Matthey's established market share, Honeywell gains immediate access to a larger customer base and stronger market position.

- Access to Johnson Matthey's advanced technology and intellectual property: This includes proprietary catalysts and manufacturing processes, giving Honeywell a competitive edge in research and development.

- Potential for synergy and cost savings: Combining operations and streamlining processes should lead to significant cost efficiencies and improved profitability.

- Strengthening Honeywell's position in the clean energy transition: The deal aligns perfectly with Honeywell's broader commitment to sustainable technologies and helps them capitalize on the growing demand for cleaner energy solutions.

Impact on the Automotive Industry

The Honeywell Johnson Matthey acquisition will undoubtedly reshape the automotive industry's landscape, particularly concerning emission control. The combined entity will possess considerable influence over the supply and innovation of catalytic converters and other emission control technologies.

- Increased efficiency and cost-effectiveness in automotive emission control systems: Honeywell's enhanced scale and technological capabilities should lead to more efficient and cost-effective emission control solutions.

- Potential for advancements in catalytic converter technology: Access to Johnson Matthey's advanced technology will likely accelerate innovation and lead to more effective and durable catalytic converters.

- Possible consolidation of the automotive catalyst supplier market: This acquisition could trigger further consolidation in the industry, impacting competition and supplier relationships.

- Impact on pricing and availability of catalytic converters: The acquisition's impact on pricing and supply chain dynamics remains to be seen, but it's a crucial factor for automotive manufacturers.

- Long-term effects on vehicle manufacturing and emissions regulations: The deal may influence future vehicle designs and emission standards, promoting cleaner and more sustainable transportation.

Implications for Johnson Matthey

This divestiture marks a significant strategic shift for Johnson Matthey, allowing them to focus resources on other core business areas and potentially pursue new growth opportunities. The funds generated from the sale will likely be used for:

- Focus shift towards other core business areas: Johnson Matthey can now concentrate on expanding its expertise in other technologies and markets.

- Improved financial stability and investment opportunities: The substantial capital injection provides financial flexibility and enhances investment possibilities in R&D and strategic acquisitions.

- Potential for reinvestment in R&D for other technologies: This allows for further innovation and expansion in areas like battery materials and hydrogen technologies.

- Impact on Johnson Matthey's workforce and operations: The transition may require restructuring and workforce adjustments, although Johnson Matthey has indicated plans to minimize disruption.

- Long-term strategic implications for the company's future growth: This strategic repositioning sets the stage for long-term growth and adaptability in a rapidly evolving market.

Potential Challenges and Risks

While promising, the Honeywell Johnson Matthey acquisition presents several potential challenges:

- Integration difficulties and potential disruption: Merging two distinct corporate cultures and operational systems can be complex and time-consuming.

- Regulatory approvals and compliance requirements: The deal faces scrutiny from regulatory bodies to ensure compliance with antitrust and competition laws.

- Maintaining customer relationships and supply chains: A smooth transition is crucial to maintain existing customer relationships and ensure uninterrupted supply chains.

- Potential for unexpected costs or delays: Unforeseen issues during integration can lead to cost overruns and delays in achieving projected synergies.

- Maintaining the quality and innovation of the acquired technology: Preserving the acquired technology's quality and innovative capabilities will be essential for long-term success.

Future Outlook and Predictions

The Honeywell Johnson Matthey acquisition positions Honeywell as a major player in the emission control and clean energy sectors. The long-term effects are likely to be significant:

- Market leadership for Honeywell in emission control technologies: The acquisition should solidify Honeywell's market-leading position.

- Potential for further acquisitions and strategic partnerships: Honeywell may seek further acquisitions to expand its capabilities and market reach.

- Long-term growth opportunities in the clean energy sector: The deal significantly enhances Honeywell's opportunities for growth in the rapidly expanding clean energy market.

- Impacts on technological advancements in catalysis and emission control: The combined expertise and resources should accelerate technological innovation in this field.

- Increased investment in research and development: Honeywell is likely to invest significantly in R&D to further improve existing technologies and develop new ones.

Conclusion

The Honeywell Johnson Matthey Acquisition represents a pivotal moment in the clean technology sector. This $2.4 billion deal positions Honeywell for significant growth, enhancing its capabilities in emission control and setting the stage for future advancements. While integration challenges and regulatory hurdles exist, the long-term potential benefits for Honeywell, the automotive industry, and the broader pursuit of cleaner energy are substantial. Stay informed about the unfolding impact of this major acquisition and its implications for the future of Honeywell Johnson Matthey technology. To stay updated on the latest developments in this transformative deal, continue following news and analysis related to the Honeywell Johnson Matthey Acquisition.

Featured Posts

-

Find Cat Deeleys Mint Velvet Dress Liverpool One Shopping Guide

May 23, 2025

Find Cat Deeleys Mint Velvet Dress Liverpool One Shopping Guide

May 23, 2025 -

Londons Royal Albert Hall Hosts Grand Ole Oprys Inaugural International Show

May 23, 2025

Londons Royal Albert Hall Hosts Grand Ole Oprys Inaugural International Show

May 23, 2025 -

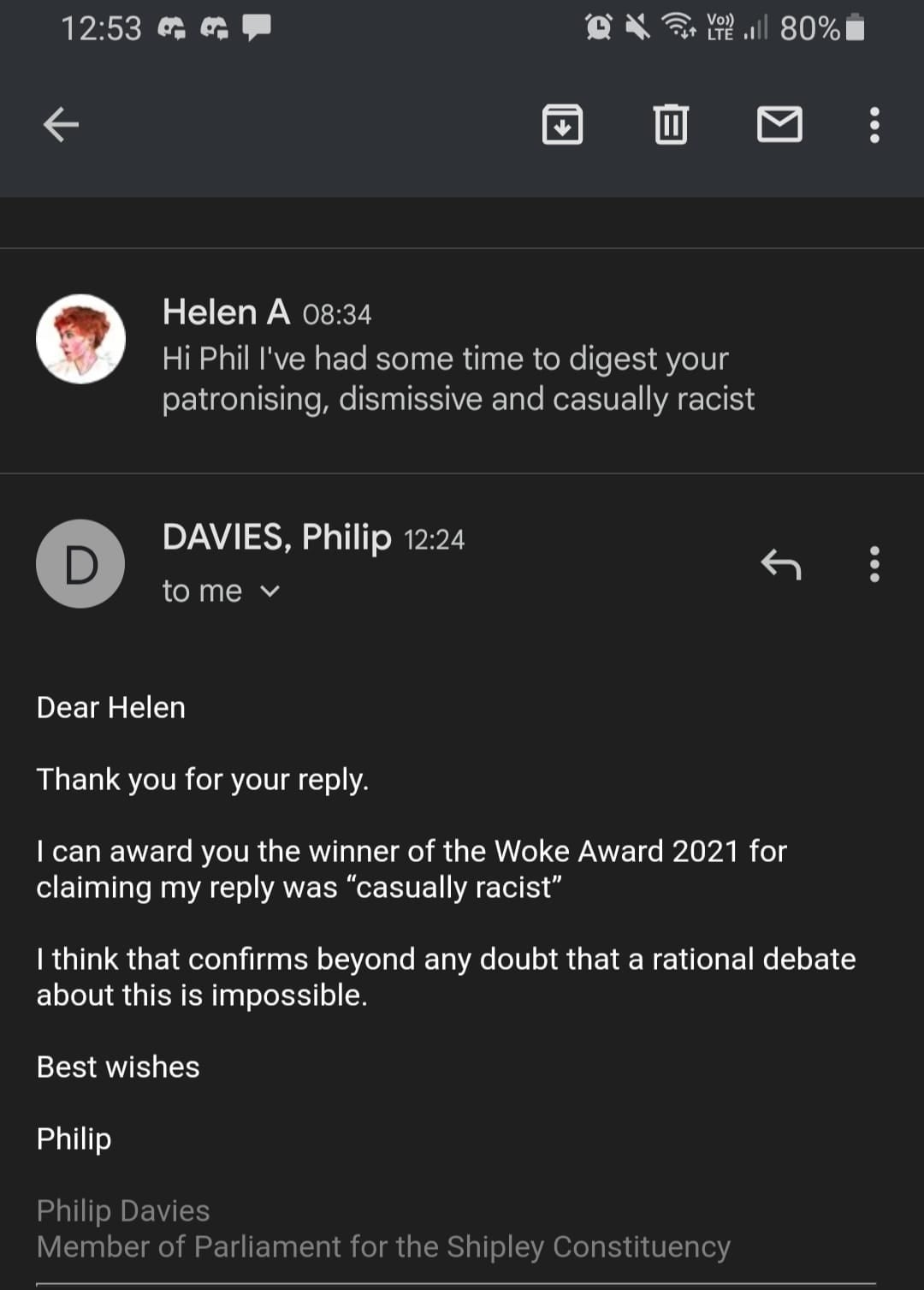

Councils Reduced Response To Mps Send Cases

May 23, 2025

Councils Reduced Response To Mps Send Cases

May 23, 2025 -

Strengthening Ties Ooredoo Qatar And Qtspbf Extend Collaboration

May 23, 2025

Strengthening Ties Ooredoo Qatar And Qtspbf Extend Collaboration

May 23, 2025 -

Freddie Flintoffs Horror Crash Disney Documentary Confirmed

May 23, 2025

Freddie Flintoffs Horror Crash Disney Documentary Confirmed

May 23, 2025

Latest Posts

-

Emissary Claims Hamas Deception The Witkoff Story

May 23, 2025

Emissary Claims Hamas Deception The Witkoff Story

May 23, 2025 -

Hamas Deception Witkoff The Emissary Speaks Out

May 23, 2025

Hamas Deception Witkoff The Emissary Speaks Out

May 23, 2025 -

Witkoff Alleges Hamas Deception A Key Emissarys Story

May 23, 2025

Witkoff Alleges Hamas Deception A Key Emissarys Story

May 23, 2025 -

Witkoffs Claim Duped By Hamas Emissary Reveals Allegation

May 23, 2025

Witkoffs Claim Duped By Hamas Emissary Reveals Allegation

May 23, 2025 -

Emissarys Account Was Witkoff Duped By Hamas

May 23, 2025

Emissarys Account Was Witkoff Duped By Hamas

May 23, 2025