Honeywell's Potential Acquisition Of Johnson Matthey's Catalyst Unit: Implications And Analysis

Table of Contents

Strategic Rationale for Honeywell

Honeywell, a global leader in aerospace, building technologies, and performance materials, stands to gain significantly from this acquisition.

Expanding Honeywell's Portfolio

Acquiring Johnson Matthey's catalyst unit would diversify Honeywell's portfolio, creating new revenue streams and growth opportunities. This move aligns perfectly with Honeywell's strategy of expanding into high-growth markets.

- Increased market share: The acquisition would catapult Honeywell into a leading position in the catalyst market, significantly boosting its market share.

- Access to new technologies: Johnson Matthey possesses cutting-edge catalyst technologies, particularly in emission control and chemical processing, providing Honeywell with immediate access to valuable intellectual property and expertise.

- Synergy with existing Honeywell businesses: The acquired technology could seamlessly integrate with Honeywell's existing businesses, creating synergies and boosting efficiency across multiple divisions. This integration would streamline operations and unlock further cost savings. Honeywell’s expertise in process control and automation would complement Johnson Matthey’s catalyst technology, leading to enhanced product offerings.

Technological Synergies and Innovation

The combination of Honeywell's engineering prowess and Johnson Matthey's deep understanding of catalyst technology promises significant advancements.

- R&D collaborations: Joint research and development efforts could lead to the creation of next-generation catalysts with improved efficiency and performance.

- Improved catalyst efficiency: Honeywell's expertise in materials science and process optimization could be leveraged to enhance the efficiency of Johnson Matthey's existing catalysts, leading to greater cost savings and reduced environmental impact.

- Development of next-generation emission control technologies: This acquisition would accelerate the development of cleaner and more sustainable technologies, crucial in meeting increasingly stringent emission regulations worldwide. This could include advancements in automotive catalysts, industrial process catalysts, and other related areas.

Strengthening Market Position

The acquisition would solidify Honeywell's position in the competitive catalyst market.

- Competitive advantage: Control over a broader range of catalyst technologies would provide a significant competitive advantage against other major players.

- Enhanced customer relationships: Access to Johnson Matthey's existing customer base would expand Honeywell's reach and strengthen its relationships with key clients.

- Wider geographical reach: Johnson Matthey's global presence would extend Honeywell's market access, opening up new opportunities in diverse regions.

Implications for Johnson Matthey

For Johnson Matthey, divesting its catalyst unit represents a strategic shift.

Strategic Focus and Restructuring

This decision likely reflects Johnson Matthey's desire to streamline operations and focus on its core competencies.

- Focus on core competencies: By divesting the catalyst unit, Johnson Matthey can concentrate resources on other areas of its business where it holds a stronger competitive advantage.

- Debt reduction: The sale could provide significant capital, helping to reduce debt and improve the company's financial position.

- Capital allocation: The proceeds from the sale can be reinvested in high-growth areas or returned to shareholders, enhancing overall value.

Impact on Employees and Operations

The transition will inevitably impact Johnson Matthey's employees and operational structure.

- Job security: The future of employees within the catalyst unit will depend on Honeywell's integration plans, potentially leading to job transitions or redundancies.

- Potential layoffs: Consolidation and restructuring after the acquisition are possible, leading to potential job losses within the acquired unit.

- Changes in operational structure: Integration with Honeywell's existing operations will necessitate changes to Johnson Matthey's operational structure and processes. This could involve changes to manufacturing, distribution, and sales processes.

Market Analysis and Competitive Landscape

The catalyst market is dynamic and driven by several factors.

Market Dynamics and Growth Potential

The global catalyst market exhibits significant growth potential, particularly driven by stricter environmental regulations.

- Market size: The market is substantial, with continuous growth projections.

- Growth rate: The industry’s growth rate is influenced by factors such as automotive production, industrial activity, and environmental regulations.

- Key market trends: Key trends include increasing demand for efficient and sustainable catalysts, stringent environmental regulations, and the development of new catalytic applications.

- Regulatory landscape: Government regulations play a crucial role, driving the need for advanced emission control technologies.

Competitive Analysis

The catalyst market is highly competitive, with several key players vying for market share. The Honeywell Johnson Matthey catalyst acquisition would significantly alter this competitive landscape.

- Key competitors: Competitors include other major chemical companies and specialized catalyst manufacturers.

- Market share analysis: The acquisition would shift the existing market share dynamics significantly.

- Competitive strategies: Strategies will include innovation, cost optimization, and strategic acquisitions, further influenced by the Honeywell-Johnson Matthey deal.

Regulatory and Financial Aspects

The acquisition faces potential hurdles and substantial financial implications.

Regulatory Approvals and Antitrust Concerns

Regulatory approvals and antitrust considerations will be crucial for the deal's success.

- Antitrust laws: Authorities will scrutinize the deal to ensure it doesn't create a monopoly or stifle competition.

- Regulatory agencies: Various regulatory bodies will need to approve the acquisition before it can proceed.

- Potential delays or blockages: Antitrust concerns or other regulatory issues could lead to delays or even block the acquisition entirely.

Financial Implications and Valuation

The financial implications are considerable, impacting both Honeywell and Johnson Matthey.

- Acquisition cost: The deal's final price will significantly influence both companies' financial positions.

- Financing methods: Honeywell will need to secure appropriate financing to fund the acquisition.

- Projected returns: Both companies will have to assess the potential returns on investment based on projected synergies and market growth.

Conclusion

The potential Honeywell Johnson Matthey catalyst acquisition is a significant event with far-reaching implications. The strategic advantages for Honeywell are substantial, including portfolio diversification, technological advancements, and enhanced market positioning. For Johnson Matthey, the divestiture allows for strategic refocusing and capital reallocation. However, regulatory scrutiny and financial considerations are critical success factors. The deal's ultimate impact on the catalyst market, competition, and both companies’ future trajectories remains to be seen. To stay informed about further developments regarding the Honeywell Johnson Matthey catalyst acquisition, we strongly advise subscribing to industry news and following the reports of leading financial analysts. Closely monitoring updates on this significant deal is crucial for a comprehensive understanding of its long-term effects on the industry.

Featured Posts

-

This Morning Cat Deeleys Emotional Tribute Following Funeral Absence

May 23, 2025

This Morning Cat Deeleys Emotional Tribute Following Funeral Absence

May 23, 2025 -

La Derrota De Panama Una Recopilacion De Los Mejores Memes

May 23, 2025

La Derrota De Panama Una Recopilacion De Los Mejores Memes

May 23, 2025 -

Freddie Flintoffs Face Injury A Post Top Gear Crash Update

May 23, 2025

Freddie Flintoffs Face Injury A Post Top Gear Crash Update

May 23, 2025 -

Kalendar Ta Rezultati Ligi Natsiy 20 03 2025

May 23, 2025

Kalendar Ta Rezultati Ligi Natsiy 20 03 2025

May 23, 2025 -

The Karate Kid Part Iii Exploring Its Themes And Legacy

May 23, 2025

The Karate Kid Part Iii Exploring Its Themes And Legacy

May 23, 2025

Latest Posts

-

Witkoffs Claim Duped By Hamas Emissary Reveals Allegations

May 23, 2025

Witkoffs Claim Duped By Hamas Emissary Reveals Allegations

May 23, 2025 -

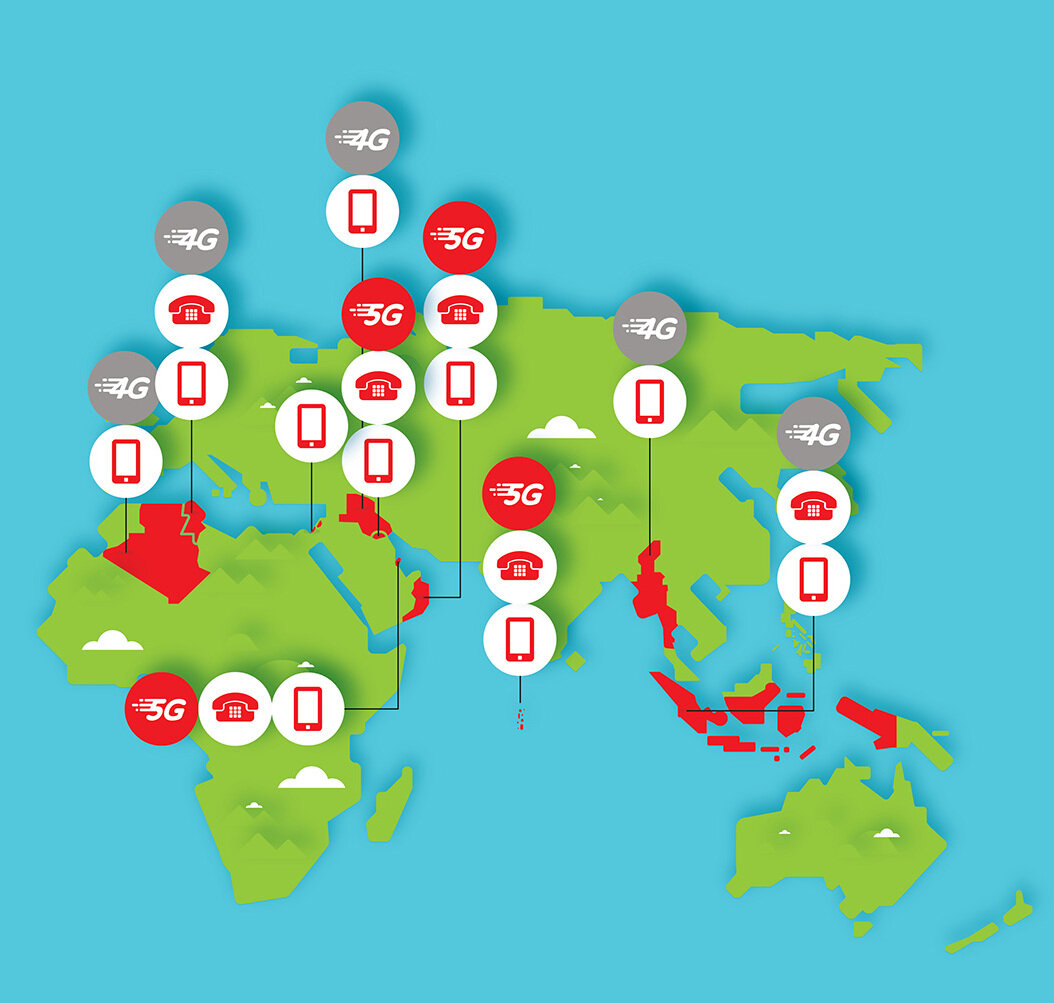

Ooredoo Qatar And Qtspbf Renewed Commitment To Collaboration

May 23, 2025

Ooredoo Qatar And Qtspbf Renewed Commitment To Collaboration

May 23, 2025 -

Extended Partnership Ooredoo Qatar And Qtspbf On Continued Success

May 23, 2025

Extended Partnership Ooredoo Qatar And Qtspbf On Continued Success

May 23, 2025 -

Strengthening Ties Ooredoo Qatar And Qtspbf Extend Collaboration

May 23, 2025

Strengthening Ties Ooredoo Qatar And Qtspbf Extend Collaboration

May 23, 2025 -

Ooredoo And Qtspbf A Winning Partnership Continues

May 23, 2025

Ooredoo And Qtspbf A Winning Partnership Continues

May 23, 2025