Hong Kong Intervenes In FX Market To Support US Dollar Peg

Table of Contents

Understanding Hong Kong's Linked Exchange Rate System

Hong Kong's currency board system maintains a tight link between the HKD and the USD, offering significant advantages to its economy. This system is crucial for understanding the recent FX market intervention.

The Mechanics of the Peg

The Hong Kong US Dollar peg operates within a narrow trading band, typically 7.75 to 7.85 HKD per USD. The HKMA, acting as the currency board, plays a vital role in maintaining this band.

- HKMA's Actions: The HKMA buys or sells US dollars in the foreign exchange market to keep the HKD within the specified range. If the HKD weakens (approaches the upper limit of the band), the HKMA sells USD to increase the HKD supply, pushing the exchange rate down. Conversely, if the HKD strengthens (approaches the lower limit), the HKMA buys USD to reduce the HKD supply.

- Currency Board Mechanism: Hong Kong's currency board system operates with a high degree of transparency and predictability. The HKMA is required to maintain sufficient foreign currency reserves to back the HKD in circulation. This ensures that the HKD maintains its convertibility to the USD.

- Impact on Interest Rates: The linked exchange rate system effectively ties Hong Kong's interest rates to US interest rates. This is because any significant divergence in interest rates can create arbitrage opportunities, putting pressure on the peg. The HKMA often adjusts its interest rate policy to maintain alignment with US rates and preserve the peg.

Benefits of the US Dollar Peg

The Hong Kong US Dollar peg provides significant benefits to the Hong Kong economy, fostering stability and predictability.

- Reduced Exchange Rate Risk: The peg minimizes exchange rate volatility, reducing risks for businesses engaged in international trade and investment.

- Attracting Foreign Investment: The stability provided by the peg makes Hong Kong an attractive destination for foreign investment, as investors are confident in the predictability of the currency.

- Facilitating International Trade: The ease of converting HKD to USD and vice versa simplifies international transactions, boosting Hong Kong's role as a major trading hub.

Pressures Leading to FX Market Intervention

The recent intervention highlights the pressures that can threaten the Hong Kong US Dollar peg. These pressures often stem from global economic events and speculative activities.

Capital Flows and Speculation

Significant capital flows, both inflows and outflows, can exert considerable pressure on the peg. Speculative attacks, aiming to profit from a potential devaluation of the HKD, further exacerbate the situation.

- Pressure on HKD: Large-scale capital outflows reduce the demand for HKD, pushing the exchange rate towards the upper limit of the trading band. Speculative attacks intensify this pressure by creating a self-fulfilling prophecy.

- Geopolitical Factors and Economic Uncertainty: Global geopolitical events, such as trade wars or political instability, can trigger capital flight and increase uncertainty, putting stress on the HKD. Economic downturns can also lead to reduced investor confidence and capital outflows.

Global Economic Uncertainty

Global economic events and shifts in monetary policy significantly influence the Hong Kong US Dollar peg.

- US Interest Rate Hikes: Increases in US interest rates can attract capital outflows from Hong Kong to the US, putting upward pressure on the HKD/USD exchange rate.

- Trade Wars and Global Slowdowns: Trade tensions and global economic slowdowns can lead to reduced demand for Hong Kong's exports and a weakening of the HKD, necessitating intervention to maintain the peg.

The HKMA's Response and Intervention Strategies

The HKMA employs various strategies to manage the Hong Kong US Dollar peg and counter external pressures. Recent actions demonstrate the authority's commitment to maintaining the system.

HKMA's Actions

During recent periods of stress, the HKMA has actively intervened in the FX market to stabilize the HKD.

- Scale of Intervention: The specific amount of USD bought or sold during these interventions is often not publicly disclosed immediately, but the HKMA’s actions clearly signal its commitment to maintaining the peg within the narrow band. Reports suggest significant intervention, demonstrating the HKMA’s readiness to act decisively.

- HKMA Statements: Alongside its market interventions, the HKMA often releases public statements clarifying its commitment to the peg and assuring market participants of its ability to maintain stability. These statements play a vital role in managing market sentiment and mitigating potential panic selling or buying.

Effectiveness of the Intervention

The effectiveness of the HKMA's interventions is usually judged by the stability of the HKD within the trading band.

- Impact on Exchange Rate: Successful interventions should result in the HKD remaining within the desired trading range, minimizing excessive volatility.

- Market Sentiment: A successful intervention will also help restore confidence in the peg, improving market sentiment and reducing the risk of further speculative attacks.

- Ongoing Challenges: Despite the effectiveness of the HKMA’s interventions, maintaining the Hong Kong US Dollar peg is an ongoing challenge. External shocks and unexpected capital flows will inevitably continue to test the system.

Conclusion

Hong Kong's recent interventions in the FX market highlight the ongoing importance of the Hong Kong US Dollar peg to the city's economic stability. The HKMA's actions, while successful in maintaining the peg within its narrow band, underscore the persistent challenges posed by global economic uncertainty and capital flows. Understanding the mechanics of the currency board system, the pressures on the peg, and the HKMA’s responses is critical for navigating the complexities of Hong Kong's financial landscape.

Call to Action: Stay informed about developments concerning the Hong Kong US Dollar peg and the HKMA's actions to safeguard this crucial link. Understanding the intricacies of this system is vital for investors and businesses operating in Hong Kong and the broader Asian markets. Further research into the Hong Kong currency board and its operations will provide a deeper understanding of the Hong Kong US Dollar peg's future trajectory.

Featured Posts

-

New Affordable Homes For Strathdearn Tomatin Schoolchildren Participate In Groundbreaking Ceremony

May 04, 2025

New Affordable Homes For Strathdearn Tomatin Schoolchildren Participate In Groundbreaking Ceremony

May 04, 2025 -

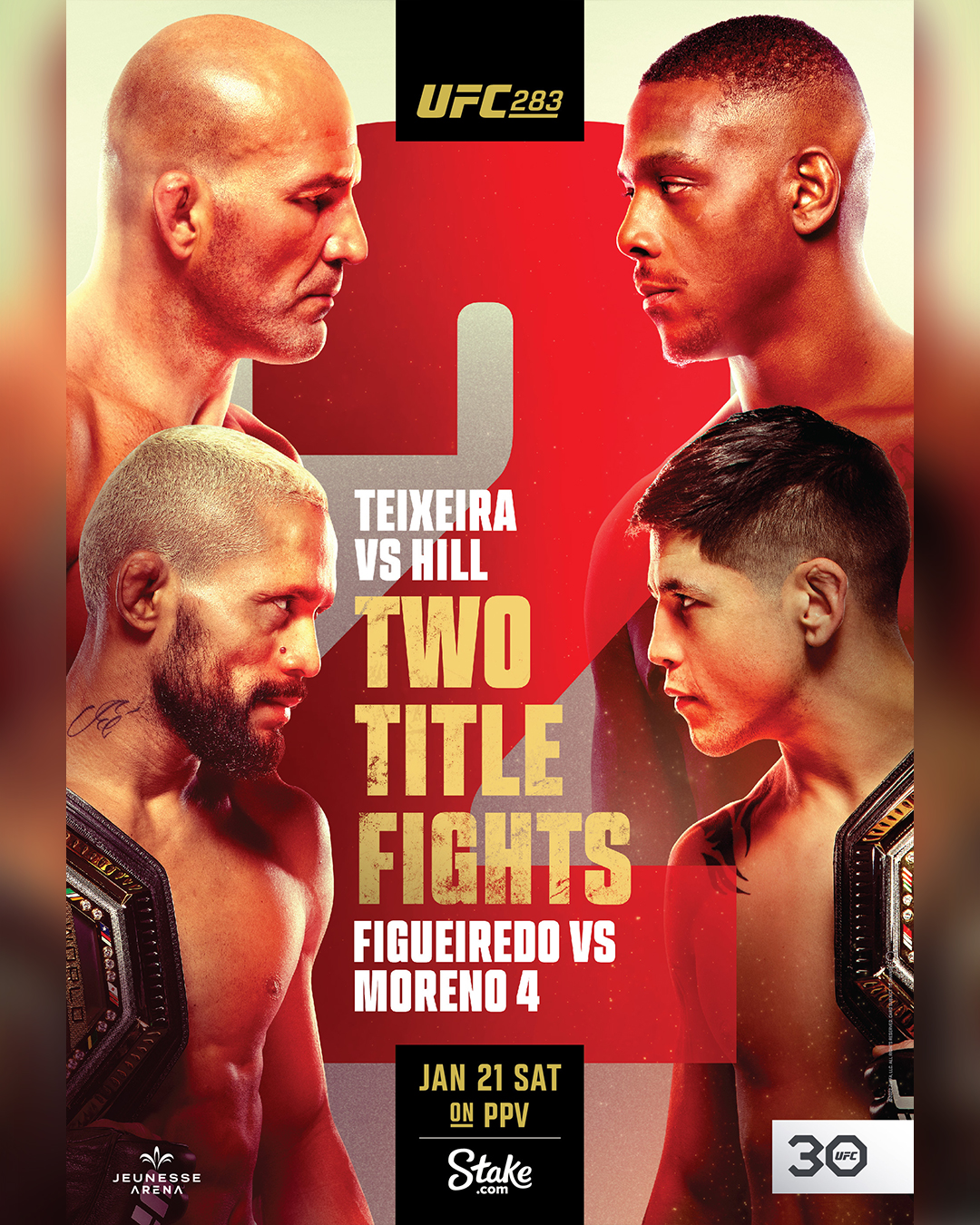

Ufc Fight Night Expert Predictions For Sandhagen Vs Figueiredo Fight

May 04, 2025

Ufc Fight Night Expert Predictions For Sandhagen Vs Figueiredo Fight

May 04, 2025 -

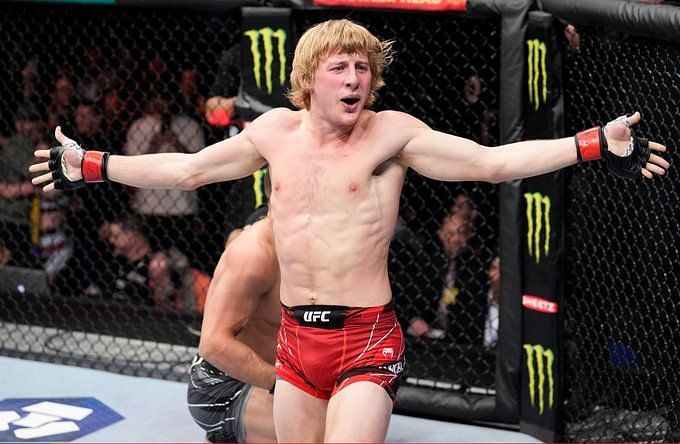

Paddy Pimbletts Dominant Ufc 314 Win Followed By Private Yacht Celebration

May 04, 2025

Paddy Pimbletts Dominant Ufc 314 Win Followed By Private Yacht Celebration

May 04, 2025 -

Sandhagen Vs Figueiredo Ufc Fight Night Predictions And Preview

May 04, 2025

Sandhagen Vs Figueiredo Ufc Fight Night Predictions And Preview

May 04, 2025 -

Bakole Vs Parker Ajagbas Ibf Dream Takes A Hit

May 04, 2025

Bakole Vs Parker Ajagbas Ibf Dream Takes A Hit

May 04, 2025