Hong Kong's US Dollar Peg: Intervention After A Two-Year Hiatus

Table of Contents

Understanding Hong Kong's Currency Board System and the US Dollar Peg

Hong Kong's unique currency board system is central to understanding the recent intervention.

The Mechanics of the Peg

The Hong Kong dollar (HKD) is pegged to the US dollar (USD) at a fixed exchange rate of HKD 7.8 to USD 1. This linked exchange rate is maintained through a currency board system, a monetary policy regime where the monetary base is fully backed by foreign reserves, primarily US dollars. The HKMA plays a crucial role, acting as the lender of last resort and ensuring the peg's stability. A strong USD typically leads to a stronger HKD, potentially impacting Hong Kong's export competitiveness, while a weak USD can have the opposite effect, increasing inflationary pressures.

- HKMA's Role: The HKMA manages the exchange rate by buying or selling HKD in the open market to maintain the peg.

- USD Strength/Weakness Impact: Fluctuations in the USD directly impact the HKD, influencing monetary policy decisions and economic activity within Hong Kong.

Historical Context of the Peg

The HKD's peg to the USD has been in place since 1983, providing Hong Kong with exchange rate stability and fostering economic growth. However, the peg has faced challenges throughout its history, notably during the Asian Financial Crisis of 1997-98, which prompted significant intervention by the HKMA. This historical context highlights the importance of maintaining the peg for Hong Kong's financial stability and its role in attracting foreign investment.

- Asian Financial Crisis: This event tested the strength of the peg, demonstrating the HKMA's commitment to maintaining it.

- Maintaining Stability: The long-term success of the peg has been a key factor in Hong Kong's economic prosperity and attractiveness to international businesses.

The Two-Year Hiatus and the Reasons for Recent Intervention

The recent intervention marked a significant departure from the two-year period of relative calm.

Factors Leading to Intervention

Several factors contributed to the HKMA's decision to intervene. These included increased capital flows, market speculation driven by global economic uncertainty, and widening interest rate differentials between the US and Hong Kong. Geopolitical tensions and shifts in global investor sentiment also played a part.

- Interest Rate Differentials: Diverging interest rates between the US and Hong Kong can create incentives for capital flows, potentially putting pressure on the peg.

- Global Economic Uncertainties: Events such as the war in Ukraine, high inflation in many countries, and persistent supply chain issues contributed to market volatility impacting the HKD.

- Market Speculation: Concerns about the peg's long-term sustainability, fueled by speculation, can increase pressure on the HKD.

The HKMA's Response and Intervention Strategies

The HKMA responded by employing various strategies to defend the peg, primarily through open market operations involving the buying and selling of HKD to control liquidity and stabilize the exchange rate. The scale and specifics of the intervention remain partially undisclosed, highlighting the sensitivity of maintaining market confidence.

- Open Market Operations: The HKMA uses open market operations to adjust the money supply and counter pressure on the HKD.

- Managing Liquidity: Maintaining sufficient liquidity in the market is crucial for preventing sharp fluctuations in the exchange rate.

Implications and Future Outlook for Hong Kong's US Dollar Peg

The recent intervention has short-term and long-term implications for Hong Kong.

Short-Term Effects

The immediate impact of the intervention included a stabilization of the HKD exchange rate, increased market confidence, and minimal disruption to economic activity. However, interest rate changes might have short-term effects on borrowing costs for businesses and consumers.

- Market Sentiment: The intervention helped improve market sentiment regarding the peg's stability.

- Impact on Businesses: Businesses experienced minimal disruption, benefiting from the continued stability of the exchange rate.

Long-Term Implications

The long-term implications are more complex. While the intervention reinforced the HKMA's commitment to the peg, maintaining it in the face of persistent global economic uncertainty and potential capital flow pressures remains a challenge. The peg's long-term sustainability requires ongoing vigilance and potential adjustments to monetary policy.

- Long-Term Stability: The long-term stability of the peg depends on continued effective management by the HKMA.

- Potential Challenges: Maintaining the peg in the face of significant external shocks or prolonged global economic uncertainty remains a key challenge.

Conclusion: The Future of Hong Kong's US Dollar Peg and its Significance

The recent intervention in Hong Kong's US dollar peg highlights the ongoing importance and challenges associated with this crucial monetary policy. The HKMA's actions successfully stabilized the HKD in the short term, boosting market confidence. However, the long-term sustainability of the peg depends on continued effective management by the HKMA and a careful consideration of evolving global economic conditions. To stay informed about Hong Kong's US dollar peg and its implications for regional and global financial markets, monitor future interventions by the HKMA and analyze the implications of the peg on Hong Kong's economic outlook. Further reading on the HKMA's policies and analyses of global economic trends will provide a deeper understanding of this vital aspect of Hong Kong's economic landscape.

Featured Posts

-

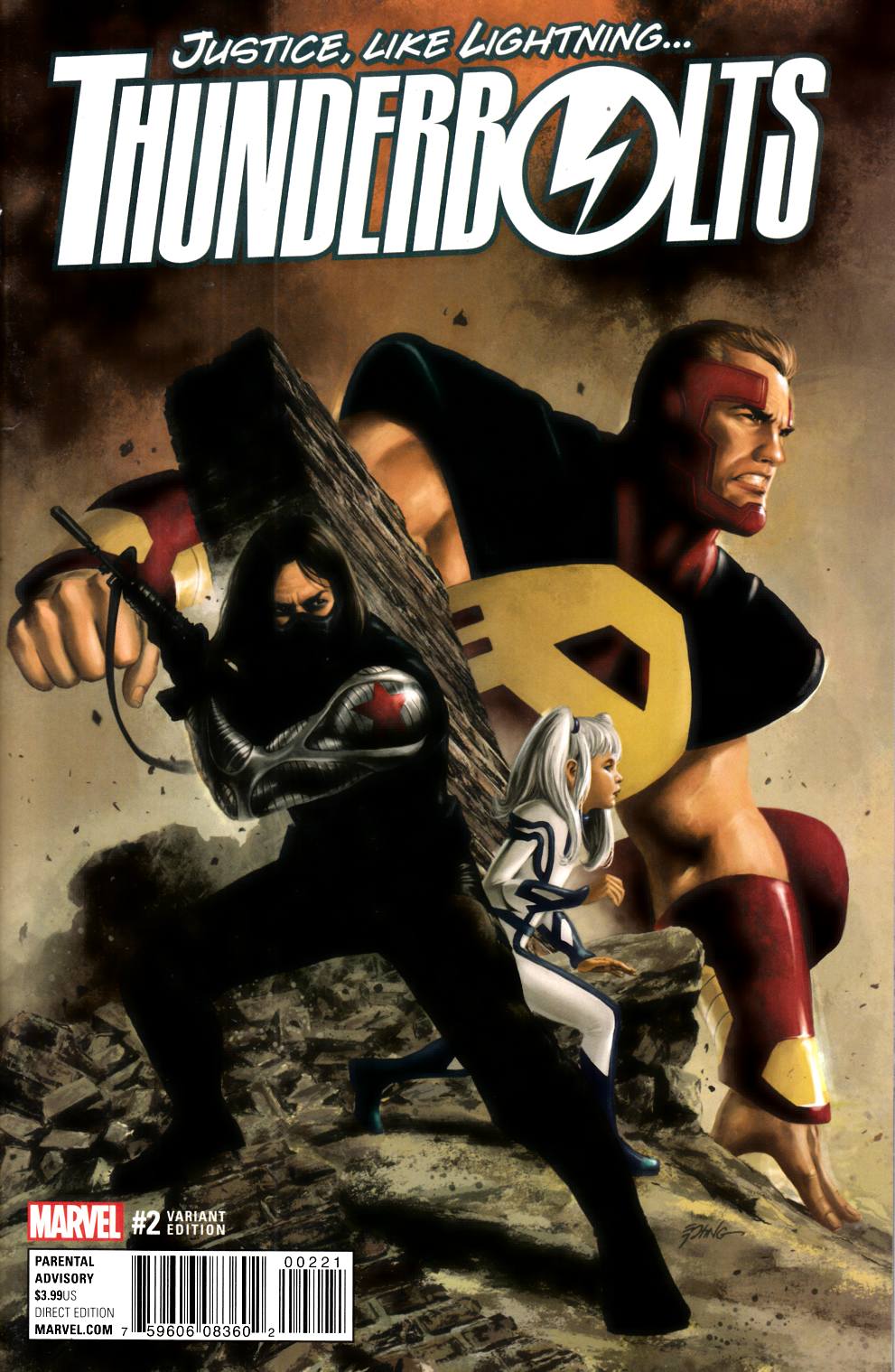

Are Marvels Thunderbolts A Sign Of Resurgence Or Further Decline

May 05, 2025

Are Marvels Thunderbolts A Sign Of Resurgence Or Further Decline

May 05, 2025 -

Max Verstappen New Dad New Interview

May 05, 2025

Max Verstappen New Dad New Interview

May 05, 2025 -

Anna Kendrick Shades Blake Lively At Another Simple Favor Premiere

May 05, 2025

Anna Kendrick Shades Blake Lively At Another Simple Favor Premiere

May 05, 2025 -

Churchill Downs Undergoes Final Renovations Before Kentucky Derby

May 05, 2025

Churchill Downs Undergoes Final Renovations Before Kentucky Derby

May 05, 2025 -

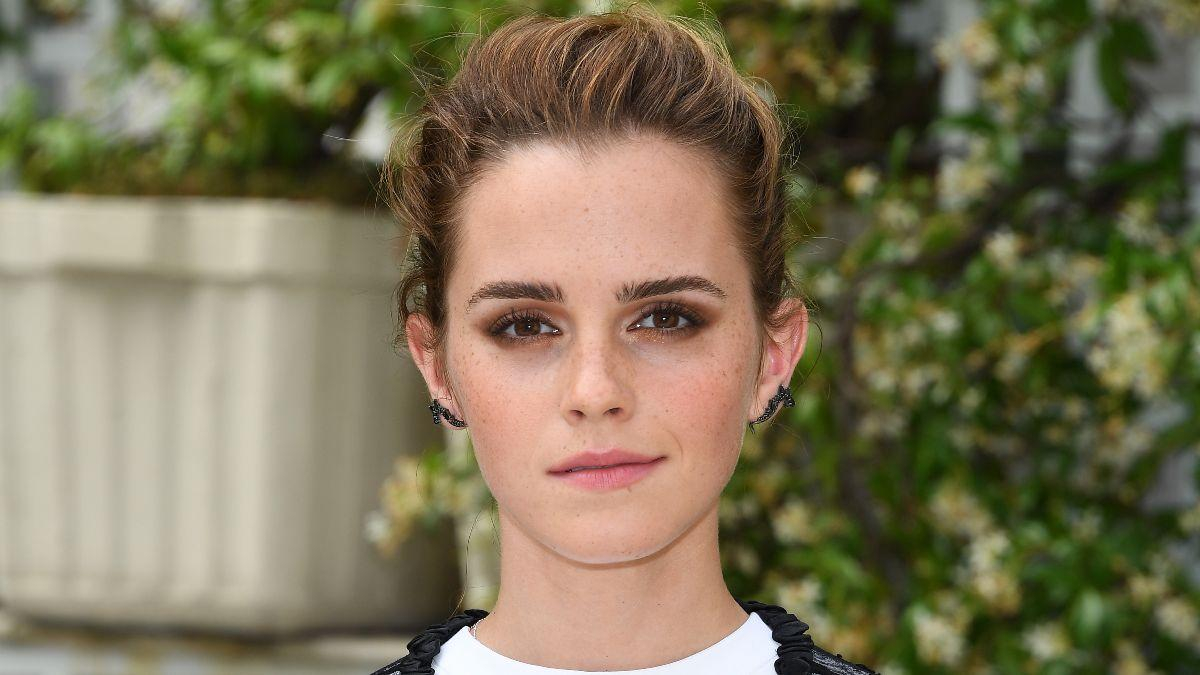

Emma Stooyn I Apisteyti Metamorfosi Toy Forematos Tis

May 05, 2025

Emma Stooyn I Apisteyti Metamorfosi Toy Forematos Tis

May 05, 2025

Latest Posts

-

Emma Stones Snl 50th Anniversary Dress Photos And Details

May 05, 2025

Emma Stones Snl 50th Anniversary Dress Photos And Details

May 05, 2025 -

Premiya Shou Biznes Emma Stoun U Yaskraviy Minispidnitsi

May 05, 2025

Premiya Shou Biznes Emma Stoun U Yaskraviy Minispidnitsi

May 05, 2025 -

Emma Stones Popcorn Dress A Showstopper At Snls 50th Anniversary

May 05, 2025

Emma Stones Popcorn Dress A Showstopper At Snls 50th Anniversary

May 05, 2025 -

Emma Stoun Ta Yiyi Efektniy Obraz Na Premiyi Shou Biznes Minispidnitsya

May 05, 2025

Emma Stoun Ta Yiyi Efektniy Obraz Na Premiyi Shou Biznes Minispidnitsya

May 05, 2025 -

Zoryaniy Stil Emmi Stoun Minispidnitsya Ta Strunki Nogi Na Premiyi

May 05, 2025

Zoryaniy Stil Emmi Stoun Minispidnitsya Ta Strunki Nogi Na Premiyi

May 05, 2025