House GOP Tax Bill In Jeopardy: Conservative Demands Halt Progress

Table of Contents

Conservative Demands Fueling the Stalemate

The stalemate surrounding the House GOP Tax Bill is primarily fueled by a coalition of conservative Republicans demanding significant alterations to the proposed legislation. These demands represent a significant challenge to the bill's passage and highlight the internal divisions within the Republican party. The political motivations behind these demands are complex, ranging from genuine policy concerns to strategic leverage for future negotiations.

- Demand #1: Deep Spending Cuts: Conservative Republicans are demanding drastic cuts to government spending, arguing that tax cuts must be paired with fiscal responsibility. They argue that the current bill doesn't go far enough in reducing the national debt.

- Demand #2: Elimination of Specific Tax Loopholes: Another key demand centers on eliminating specific tax loopholes that benefit particular industries or wealthy individuals. Conservatives argue these loopholes undermine the fairness and effectiveness of the overall tax reform.

- Demand #3: Strengthening of Tax Provisions: Some conservatives are pushing for more aggressive tax cuts, particularly for corporations and high-income earners, arguing the current proposals are too moderate and fail to stimulate economic growth adequately.

The political motivations behind these demands are multifaceted. While some conservatives genuinely believe in these policy positions, others see them as bargaining chips to exert influence within the party and secure concessions on other legislative issues. This internal GOP infighting has created significant obstacles to passing the House GOP Tax Bill.

Impact on the Legislative Process

The House GOP Tax Bill is currently stalled, facing significant opposition within the Republican caucus. The bill's progress is uncertain, with potential scenarios ranging from significant amendments to complete failure. The potential consequences of failure are severe, carrying profound implications for the American economy and the political landscape.

- Impact on the Economy: Failure to pass the tax bill could negatively impact GDP growth, potentially hindering job creation and economic expansion. Uncertainty surrounding the tax code could also discourage investment.

- Political Impact on the Republican Party: Failure could severely damage the Republican party's image and credibility, potentially undermining its chances in upcoming elections. It could also fuel discontent among voters who supported the tax reform initiative.

- Potential Impact on Upcoming Elections: The failure of the House GOP Tax Bill could significantly impact the upcoming midterm elections, potentially costing Republicans seats in Congress. The issue is likely to be a major talking point in campaign debates.

Potential compromises are being discussed, including adjustments to spending levels and modifications to certain tax provisions. However, the path forward remains unclear, hampered by the continuing legislative gridlock and deep divisions within the Republican party. Congressional deadlock appears to be a significant risk.

Alternative Scenarios and Future Predictions

Several alternative scenarios could unfold regarding the House GOP Tax Bill.

- Scenario 1: Passage with Amendments: The bill might pass with significant changes, reflecting compromises between different factions within the Republican party.

- Scenario 2: Significant Alterations: The bill may undergo substantial revisions, potentially losing some of its original intent and impact.

- Scenario 3: Complete Failure: The bill could fail to pass entirely, resulting in a significant political setback for the Republican party.

The likelihood of each scenario depends heavily on the ongoing negotiations and the willingness of different factions within the GOP to compromise. Political analysts are divided on the outcome, with some expressing optimism for a negotiated settlement and others predicting failure. The political analysis suggests that the success of the bill hinges on the ability of leadership to unify the party and address the concerns of conservative Republicans. The election implications could be substantial, impacting voter confidence and potentially shifting the political landscape. The future of the tax bill remains uncertain.

Conclusion: The Future of the House GOP Tax Bill Remains Uncertain

The House GOP Tax Bill faces significant hurdles, primarily due to strong resistance from conservative Republicans demanding substantial changes. The potential consequences of its failure are far-reaching, impacting economic growth, the Republican party's political standing, and the upcoming elections. The path forward remains uncertain, requiring significant compromises and strategic maneuvering from the GOP leadership. Will they find a way to overcome the divisions, or will the House GOP Tax Bill ultimately fail?

The future of tax reform hangs in the balance. Stay informed about the ongoing developments concerning the House GOP Tax Bill and its potential impact on the nation. Contact your representatives to express your views and urge them to work towards a solution that serves the best interests of the American people. The House GOP Tax Bill's fate is in their hands.

Featured Posts

-

Amsterdam Hotel Attack Police Investigation After Five Stabbed

May 18, 2025

Amsterdam Hotel Attack Police Investigation After Five Stabbed

May 18, 2025 -

Confirmation Cassie Shares Third Babys Sex On Alex Fines Birthday

May 18, 2025

Confirmation Cassie Shares Third Babys Sex On Alex Fines Birthday

May 18, 2025 -

Kanie Goyest Mia Sygnomi Ston Jay Z Kai Tin Mpigionse

May 18, 2025

Kanie Goyest Mia Sygnomi Ston Jay Z Kai Tin Mpigionse

May 18, 2025 -

Invest In The Future The Countrys Newest Business Hot Spots

May 18, 2025

Invest In The Future The Countrys Newest Business Hot Spots

May 18, 2025 -

Where To Invest A Map Of The Countrys Hottest Business Locations

May 18, 2025

Where To Invest A Map Of The Countrys Hottest Business Locations

May 18, 2025

Latest Posts

-

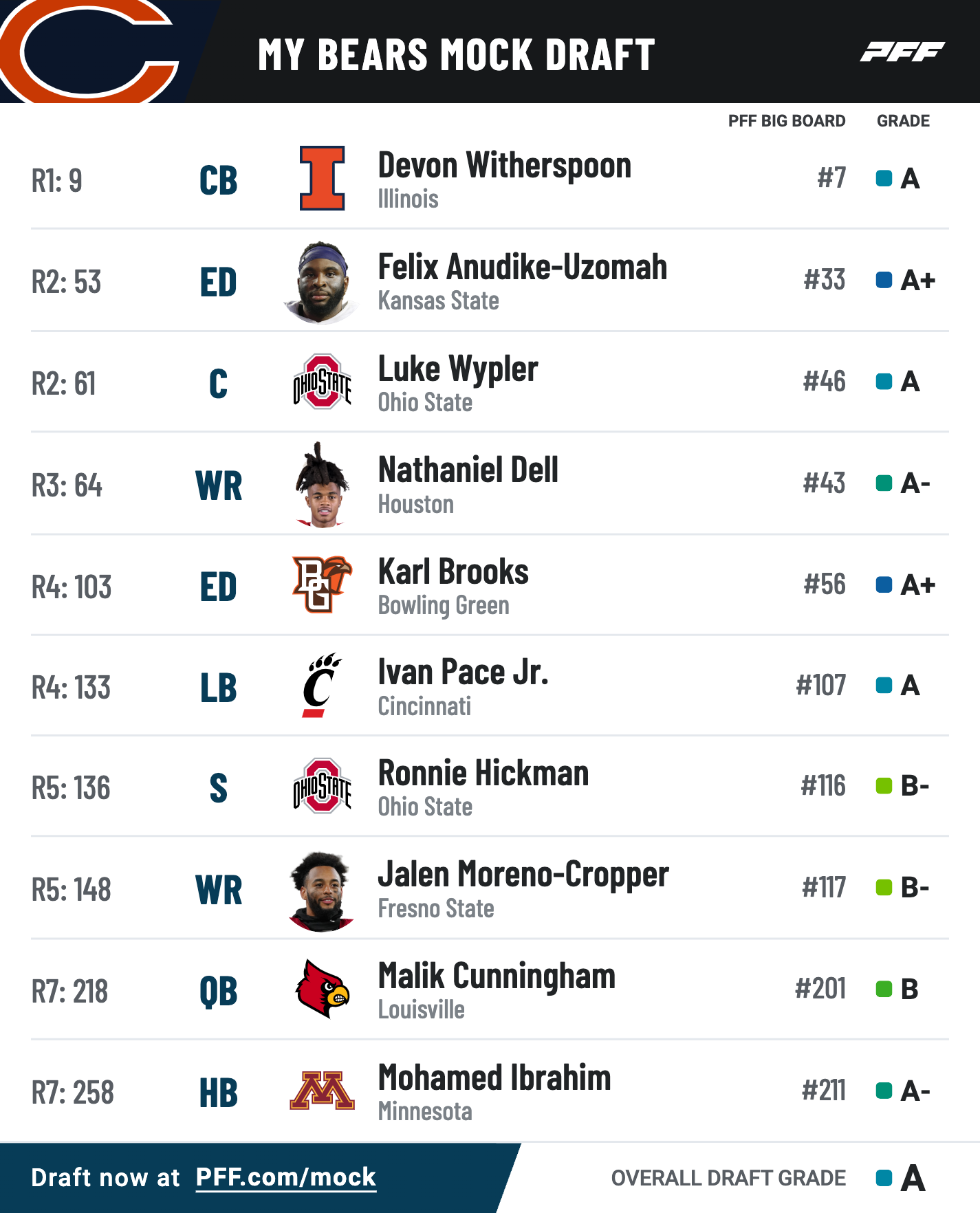

2025 Nfl Draft Analysts Assessment Of The Patriots Future

May 18, 2025

2025 Nfl Draft Analysts Assessment Of The Patriots Future

May 18, 2025 -

Nfl Analyst Predicts Patriots Trajectory Following 2025 Draft

May 18, 2025

Nfl Analyst Predicts Patriots Trajectory Following 2025 Draft

May 18, 2025 -

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025 -

You Toon Caption Contest Winner Announced Booing Bears Takes The Prize

May 18, 2025

You Toon Caption Contest Winner Announced Booing Bears Takes The Prize

May 18, 2025 -

The Swim With Mike Program A Lifeline For The Trojan Community

May 18, 2025

The Swim With Mike Program A Lifeline For The Trojan Community

May 18, 2025