House GOP Unveils Details Of Trump Tax Cut Plan

Table of Contents

The House GOP has unveiled details of a new tax cut plan, potentially marking a significant shift in the nation's tax policy. This article provides a comprehensive analysis of the proposed changes, exploring its key features, projected economic impacts, and the political landscape surrounding it. Understanding the intricacies of this "Trump Tax Cut Plan," as it's become known, is crucial for every American citizen.

Key Features of the Proposed Trump Tax Cuts:

Individual Income Tax Rate Reductions: The plan proposes significant reductions in individual income tax rates across various brackets. These reductions aim to stimulate consumer spending and boost economic growth. However, the distributional effects are a key point of debate.

- Bracket 1 (Lowest): Proposed reduction from 10% to 8%. This aims to provide relief to lower-income taxpayers.

- Bracket 2: Proposed reduction from 12% to 10%.

- Bracket 3: Proposed reduction from 22% to 20%.

- Bracket 4 (Highest): Proposed reduction from 37% to 35%.

These changes will likely have a varied impact on different income levels, with higher earners potentially benefiting more significantly, a point of concern for critics. The overall effect on individual taxpayers depends on their specific circumstances and income sources.

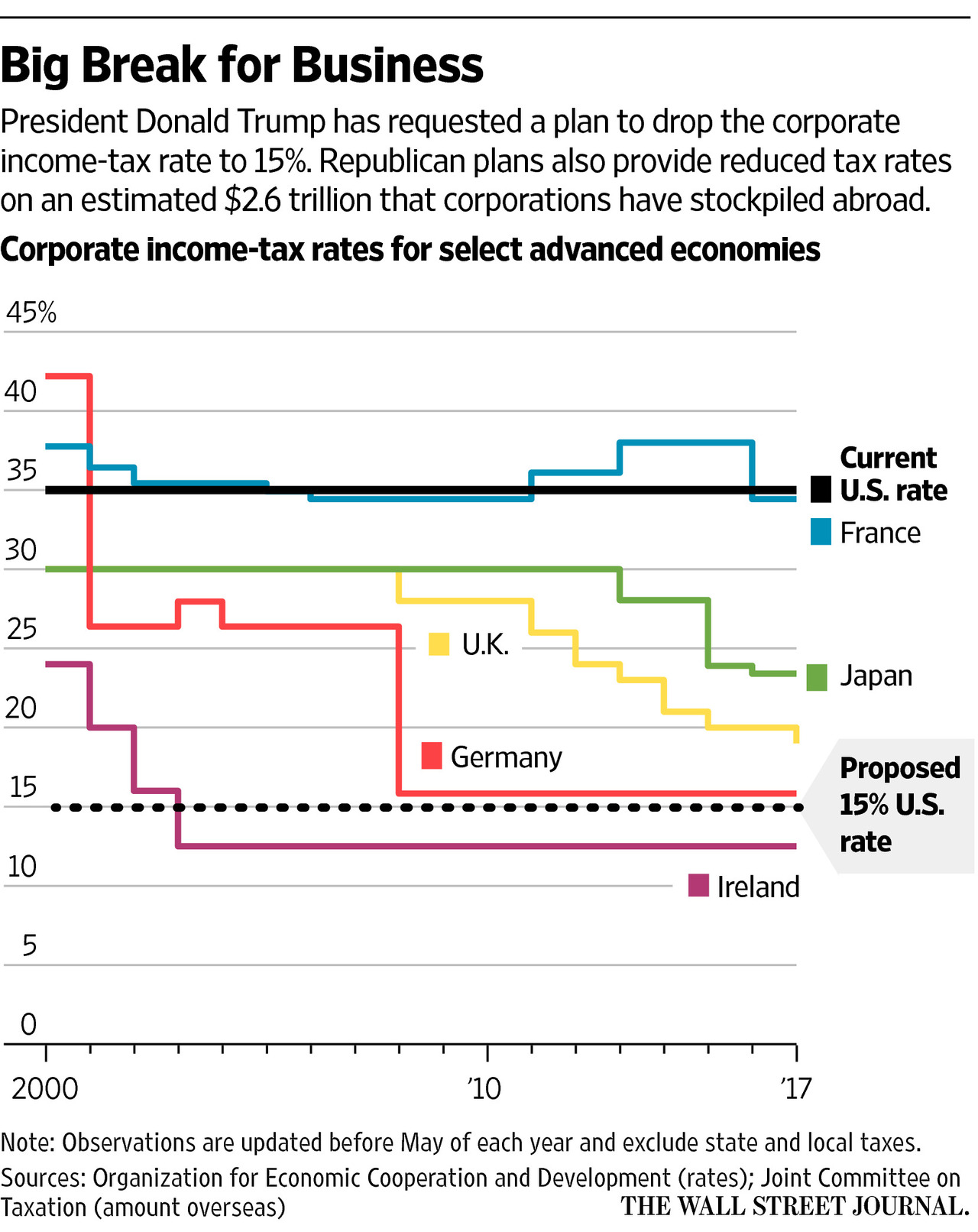

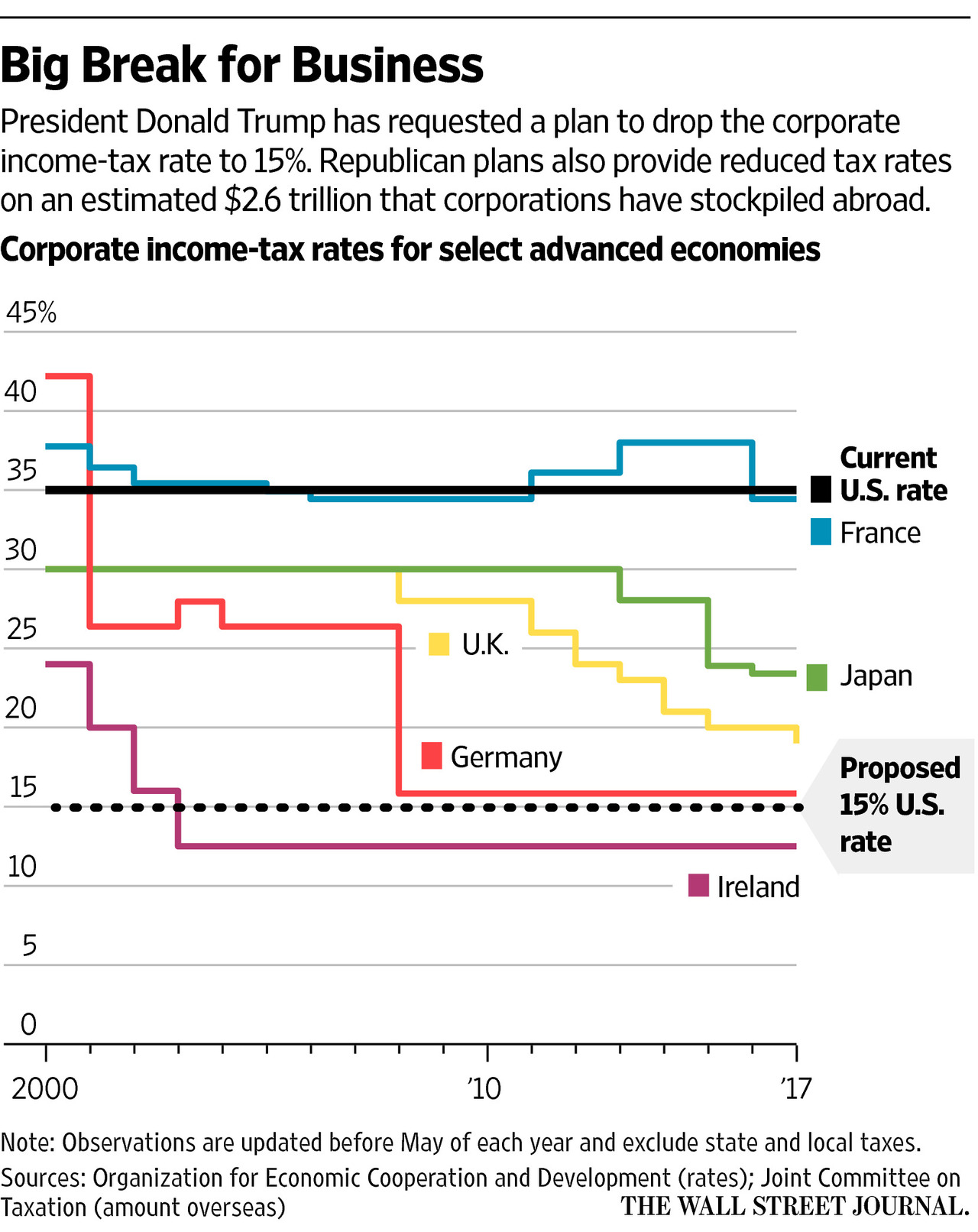

Corporate Tax Rate Cuts: A central component of the plan is a substantial reduction in the corporate tax rate. The proposed reduction from 21% to 15% aims to boost business investment and job creation. This could lead to increased competitiveness for US businesses globally, but also raises concerns about potential revenue shortfalls for the government.

- Proposed Corporate Tax Rate: 15% (down from 21%).

- Potential Impacts: Increased business investment, job creation, and potentially higher corporate profits. However, this could also lead to increased income inequality and a larger national debt.

Changes to Itemized Deductions: The proposed plan includes modifications to several itemized deductions, potentially affecting a significant portion of taxpayers.

- Mortgage Interest Deduction: Potential changes include limiting the amount of mortgage interest that can be deducted, impacting homebuyers and existing homeowners.

- State and Local Tax (SALT) Deduction: The plan may propose further limitations or complete elimination of this deduction, impacting taxpayers in high-tax states disproportionately.

- Impact Assessment: These changes could significantly reduce the tax benefits for those who itemize, potentially offsetting the benefits of the proposed rate reductions.

Tax Credits for Families and Businesses: The plan may include enhanced or new tax credits. These are intended to provide targeted relief and stimulate specific sectors of the economy.

- Child Tax Credit: A potential increase in the credit amount or expansion of eligibility criteria to benefit more families.

- Business Investment Tax Credit: Potential incentives for investments in renewable energy or other strategically important sectors. Further details are needed to fully assess their impact.

Economic Projections and Potential Impact:

GDP Growth Estimates: Proponents of the tax cut plan suggest it will lead to a significant increase in GDP growth. However, independent economic analyses are needed to evaluate the accuracy of these projections and account for potential unintended consequences. [Cite source 1 for GDP projections, Cite source 2 for a critical analysis]

Job Creation Predictions: The plan’s supporters predict that the tax cuts will stimulate job creation. This prediction is based on the idea that businesses will invest more due to lower tax rates. [Cite source for job creation predictions] However, job creation is a complex factor with many influencing variables, and more research is necessary.

Fiscal Impact and National Debt: The potential impact on the national debt is a significant area of debate. Proponents claim economic growth will offset revenue losses. Critics, however, warn of increased deficits and a ballooning national debt. [Cite sources for fiscal impact projections and national debt analysis] Long-term effects are uncertain and require comprehensive modeling.

Political Response and Public Opinion:

The proposed tax cut plan has generated a highly polarized political response. Democrats express concerns about its impact on income inequality and the national debt. Republican support is generally strong, although internal disagreements persist. Public opinion remains divided, with opinions varying based on income level and political affiliation. [Cite sources for polling data and political analysis] The political climate surrounding this will profoundly impact its fate.

The Future of the Trump Tax Cut Plan: A Call to Action

This article analyzes the key features and projected impacts of the proposed Trump Tax Cut Plan. Its ultimate success depends on economic realities and the ongoing political battle. Its impact on economic growth and income inequality remains intensely debated. Stay informed by following reputable news sources and government websites. Engage in the political discourse. Understand the Trump tax cuts and their potential effect on you and your community. Understanding the details of this plan is vital for shaping its future.

Featured Posts

-

Nba Draft Lottery Espns New Approach

May 13, 2025

Nba Draft Lottery Espns New Approach

May 13, 2025 -

Persipura Jayapura Hancurkan Rans Fc 8 0 Di Playoff Liga 2 Puncaki Klasemen Grup K

May 13, 2025

Persipura Jayapura Hancurkan Rans Fc 8 0 Di Playoff Liga 2 Puncaki Klasemen Grup K

May 13, 2025 -

Community Mourns 15 Year Old After School Stabbing

May 13, 2025

Community Mourns 15 Year Old After School Stabbing

May 13, 2025 -

Mc Kellen In Avengers Doomsday Reimagining Scarlet Witch And Quicksilvers Mcu Origins

May 13, 2025

Mc Kellen In Avengers Doomsday Reimagining Scarlet Witch And Quicksilvers Mcu Origins

May 13, 2025 -

Promosi Terhad Kredit Cas Rm 800 And Tempah Byd Ev Di Mas 2025 9 15 Mei

May 13, 2025

Promosi Terhad Kredit Cas Rm 800 And Tempah Byd Ev Di Mas 2025 9 15 Mei

May 13, 2025