How A Falling Dollar Affects Asian Exchange Rates

Table of Contents

The Mechanism of Currency Fluctuations

Exchange rates, the price of one currency expressed in terms of another, are primarily determined by supply and demand. When the demand for a currency increases relative to its supply, its value appreciates; conversely, decreased demand leads to depreciation. The US dollar, acting as a global reserve currency, plays a pivotal role in this dynamic. Its value significantly influences other currencies due to its widespread use in international trade and finance.

A falling dollar typically means increased demand for other currencies, including those in Asia. This occurs because:

- Increased demand for Asian currencies: As the dollar weakens, goods and services priced in Asian currencies become relatively cheaper for US dollar holders, increasing demand.

- Impact of investor sentiment and capital flows: Investors often shift their investments away from a weakening dollar, seeking higher returns or safer havens in other currencies, pushing up the value of those Asian currencies.

- Role of interest rate differentials: Differences in interest rates between the US and Asian countries influence capital flows. Higher interest rates in Asia can attract foreign investment, strengthening Asian currencies against the dollar.

Impact on Specific Asian Economies

The impact of a falling dollar varies across Asian economies, influenced by each country's unique economic structure and policy responses.

China (RMB/CNY):

China's Yuan (RMB or CNY), operating under a managed float system, experiences a complex interplay of market forces and government intervention. A falling dollar can boost China's export competitiveness, making its goods cheaper for global consumers. However, it can also lead to:

- Increased export competitiveness: A weaker dollar makes Chinese exports more attractive in the international market.

- Potential inflationary pressures: Increased demand for Chinese goods can lead to higher prices within China.

- Capital flight concerns: Investors may move capital out of China if the Yuan is perceived as less stable against the weakening dollar.

Japan (JPY):

The Japanese Yen (JPY) is known for its sensitivity to global economic conditions. A falling dollar can significantly impact Japan's economy:

- Impact on Japanese exports: Similar to China, a weaker dollar can make Japanese exports more competitive globally.

- Impact on tourism: The relative cost of visiting Japan for US tourists decreases, potentially boosting tourism revenue.

- Impact on foreign investment: The attractiveness of Japanese assets for foreign investors might change depending on the relative strength of the Yen against other currencies.

Other Major Asian Economies (e.g., India, South Korea, Singapore):

Other major Asian economies also experience varied impacts. For example:

- India: Reliance on imports makes India vulnerable to fluctuations. A falling dollar can increase import costs, potentially impacting inflation.

- South Korea: Its export-oriented economy benefits from a weaker dollar, as its goods become more competitive globally.

- Singapore: As a major financial hub, Singapore's currency is influenced by global economic factors and its own robust financial policies. The impact of a falling dollar is complex and multi-faceted.

Implications for Businesses and Investors

Fluctuating exchange rates due to a falling dollar present both opportunities and challenges for businesses and investors.

For businesses engaged in international trade with Asia:

- Impact on import and export costs: Changes in exchange rates directly affect the cost of importing raw materials and exporting finished goods. Effective hedging strategies are essential to mitigate currency risk.

- Hedging strategies: Businesses can use various techniques like forward contracts, futures contracts, and options to reduce their exposure to currency fluctuations.

For investors:

- Opportunities for currency trading: Fluctuations in exchange rates create opportunities for profit through currency trading. However, it requires a good understanding of market dynamics and risk management.

- Importance of diversification in international portfolios: Diversifying investments across different currencies and asset classes can help reduce overall portfolio risk.

Conclusion

Understanding how a falling dollar affects Asian exchange rates is crucial for navigating the complexities of the global economy. A weakening dollar impacts Asian currencies through supply and demand dynamics, influencing various economies differently and presenting both opportunities and challenges for businesses and investors. The effects are intricate and depend on numerous factors specific to each country. Staying informed about market trends and exploring resources to effectively manage currency risk is essential. Learn more about currency fluctuations and international finance to make informed decisions in this dynamic global landscape.

Featured Posts

-

How To Watch Gypsy Rose Life After Lockup Season 2 Online

May 06, 2025

How To Watch Gypsy Rose Life After Lockup Season 2 Online

May 06, 2025 -

Celtics Vs Suns Game Time Tv Channel And Streaming Options For April 4th

May 06, 2025

Celtics Vs Suns Game Time Tv Channel And Streaming Options For April 4th

May 06, 2025 -

Social Media Regret Rumer Williss Comment On Ashton Kutcher

May 06, 2025

Social Media Regret Rumer Williss Comment On Ashton Kutcher

May 06, 2025 -

Stream Gypsy Rose Life After Lockup Season 2 Episode 1 Online Free

May 06, 2025

Stream Gypsy Rose Life After Lockup Season 2 Episode 1 Online Free

May 06, 2025 -

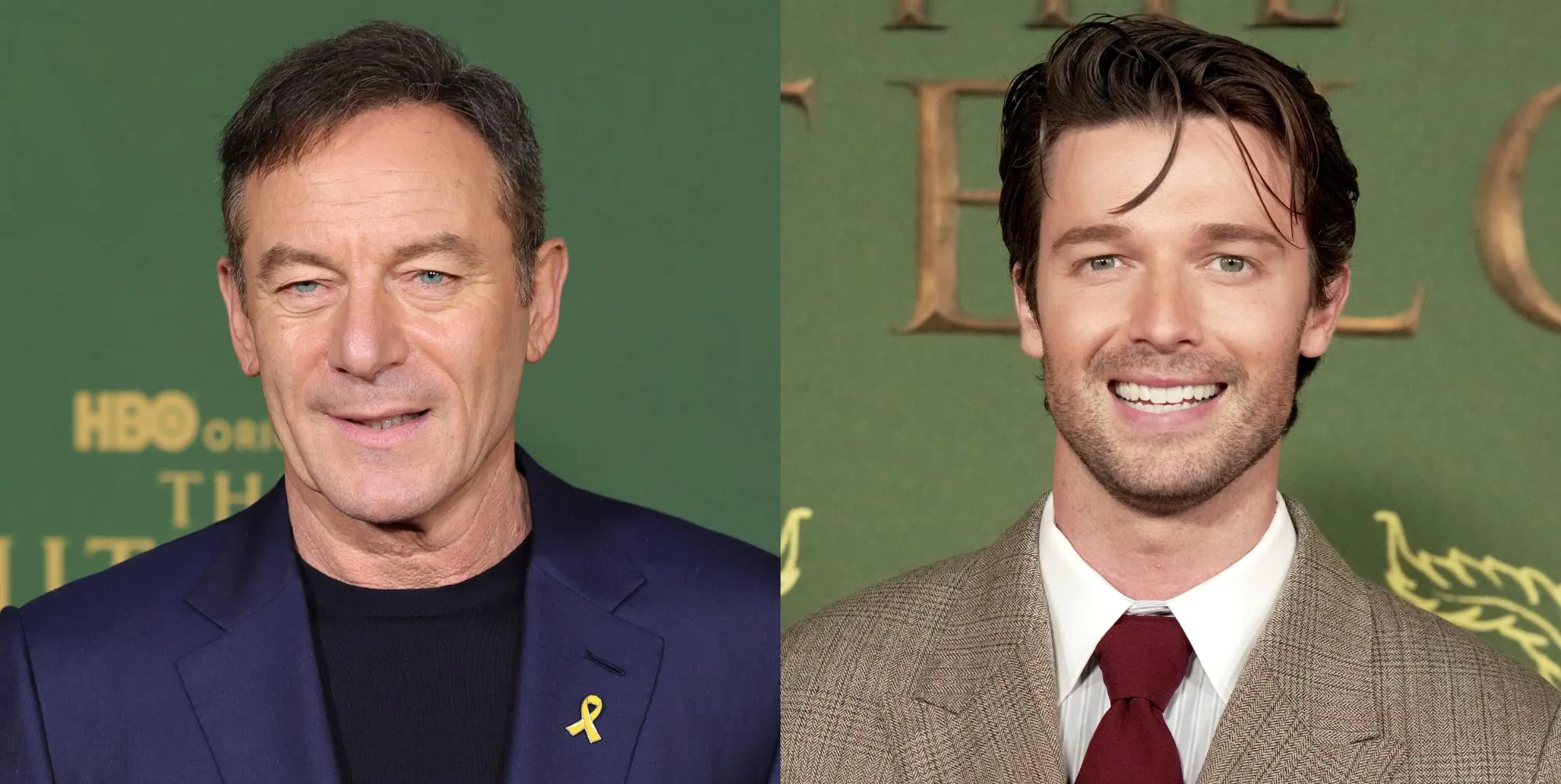

The Real Story Maria Shriver Addresses Patrick Schwarzeneggers White Lotus Part

May 06, 2025

The Real Story Maria Shriver Addresses Patrick Schwarzeneggers White Lotus Part

May 06, 2025