How Australia's Opposition Aims To Save $9 Billion

Table of Contents

Targeting Inefficiencies in Government Spending

The Opposition's plan prioritizes eliminating waste and improving efficiency within government operations. This involves a two-pronged approach: reducing redundancy and improving procurement practices.

Reducing Redundancy and Overlapping Programs

Significant savings can be realized by streamlining government operations. The Opposition identifies numerous instances of duplicated programs and overlapping responsibilities across various departments. Their plan focuses on consolidating these, leading to cost savings and increased efficiency.

- Merging Similar Departments: The proposed merger of the Department of Agriculture and the Department of Water Resources, for example, is expected to eliminate duplicated administrative roles and achieve savings of approximately $500 million over four years. This consolidation fosters better collaboration and resource allocation.

- Eliminating Unnecessary Consultants: The Opposition plans to significantly reduce reliance on expensive external consultants. By prioritizing internal expertise and streamlining project management, they estimate savings of $200 million annually.

- Streamlining Grant Programs: Many grant programs have overlapping criteria and objectives. A review and consolidation of these programs could generate savings of $300 million annually while ensuring funds reach their intended recipients more efficiently.

These cost-cutting measures reflect a commitment to government efficiency and effective program consolidation, contributing significantly to the overall $9 billion savings target. The keywords here are "government efficiency," "program consolidation," "budgetary savings," and "cost-cutting measures."

Improving Procurement Practices

Current government procurement practices often lack transparency and competition, leading to inflated costs. The Opposition proposes significant reforms to achieve value for money.

- Competitive Tendering: Implementing stricter competitive tendering processes for all major government contracts is projected to save at least 15% on procurement costs annually.

- Bulk Purchasing: Negotiating bulk purchases of common goods and services will significantly reduce unit costs, leading to substantial savings across various government departments.

- Improved Contract Negotiation: The Opposition proposes training and improved strategies for government negotiators to ensure optimal contract terms and reduce long-term costs. This includes a focus on cost-effective procurement and strong value for money.

These changes to government procurement will not only improve value for money but also enhance transparency and accountability within the public sector. The key terms here include "government procurement," "value for money," "cost-effective procurement," and "public sector efficiency."

Reforms to Welfare and Social Security Programs

The Opposition's plan also focuses on reforming welfare and social security programs to ensure budgetary integrity while protecting vulnerable Australians.

Addressing Welfare Fraud and Abuse

The Opposition acknowledges that welfare fraud represents a significant drain on public funds. They propose several strategies to combat this:

- Enhanced Data Matching: Utilizing advanced data analytics and cross-referencing data from various government agencies to identify inconsistencies and potential fraud.

- Strengthened Eligibility Criteria: Implementing stricter eligibility criteria and regular reviews to ensure accurate benefit allocation.

- Technological Solutions: Investing in advanced fraud detection software and technologies to proactively identify and prevent fraudulent claims.

These measures are projected to reduce welfare fraud by 10%, resulting in estimated annual savings of $500 million. The keywords here are "welfare reform," "fraud prevention," "social security reform," and "budgetary integrity."

Targeted Assistance for the Most Vulnerable

The Opposition emphasizes that welfare reform must protect Australia's most vulnerable citizens. Their plan includes:

- Targeted Support Programs: Focusing resources on programs that provide targeted assistance to individuals and families genuinely in need, ensuring the social safety net remains strong.

- Improved Case Management: Implementing improved case management practices to ensure timely and effective support for those experiencing hardship.

These initiatives ensure the social safety net remains intact while optimizing the allocation of resources. Keywords include "social safety net," "vulnerable populations," "targeted assistance," and "responsible welfare spending."

Taxation and Revenue Measures

The Opposition's plan includes measures to improve tax collection efficiency and close tax loopholes.

Closing Tax Loopholes

The Opposition aims to close several identified tax loopholes that allow high-income earners and corporations to avoid paying their fair share. They estimate this will generate an additional $1 billion in revenue annually. The rationale is to ensure fairness and equity within the tax system.

Improving Tax Collection Efficiency

Improving the efficiency of the Australian Taxation Office (ATO) is crucial for maximizing revenue. The Opposition proposes:

- Investing in Technology: Upgrading ATO technology to enhance data analysis and improve tax compliance monitoring.

- Strengthening Enforcement: Increasing resources dedicated to investigating and prosecuting tax evasion.

Improved tax collection efficiency and closing tax loopholes are essential for fiscal responsibility and maximizing revenue, furthering the goal of "tax reform," "revenue generation," "tax loopholes," and "fiscal responsibility." "Tax collection," "tax compliance," "ATO efficiency," and "revenue maximization" are also highly relevant.

Conclusion: Saving $9 Billion: A Path to Fiscal Responsibility

The Opposition's plan to save $9 billion represents a comprehensive strategy for achieving fiscal responsibility in Australia. By targeting inefficiencies in government spending, reforming welfare programs, and improving tax collection, the plan offers a realistic path to a stronger economic future. These savings can be reinvested in crucial areas such as infrastructure development and reducing the national debt. Learn more about Australia's $9 billion savings plan, the Opposition's fiscal plan, and how we can achieve budgetary savings by visiting [link to Opposition's website]. Join the conversation and contribute to shaping Australia's economic future.

Featured Posts

-

Ofitsialnaya Pozitsiya Zakharovoy Po Situatsii S Prezidentom Makronom I Ego Suprugoy

May 03, 2025

Ofitsialnaya Pozitsiya Zakharovoy Po Situatsii S Prezidentom Makronom I Ego Suprugoy

May 03, 2025 -

Suspended Uk Mp Rupert Lowe Breaks Silence On Farage Confrontation

May 03, 2025

Suspended Uk Mp Rupert Lowe Breaks Silence On Farage Confrontation

May 03, 2025 -

Airbus And Us Airlines Who Pays The Tariffs

May 03, 2025

Airbus And Us Airlines Who Pays The Tariffs

May 03, 2025 -

Testing Lower Electricity Prices A Dutch Utility Initiative

May 03, 2025

Testing Lower Electricity Prices A Dutch Utility Initiative

May 03, 2025 -

Extreme V Mware Price Hike At And T Reveals 1050 Cost Increase Proposed By Broadcom

May 03, 2025

Extreme V Mware Price Hike At And T Reveals 1050 Cost Increase Proposed By Broadcom

May 03, 2025

Latest Posts

-

Singapore Elections 2024 A Crucial Test For The Pap

May 04, 2025

Singapore Elections 2024 A Crucial Test For The Pap

May 04, 2025 -

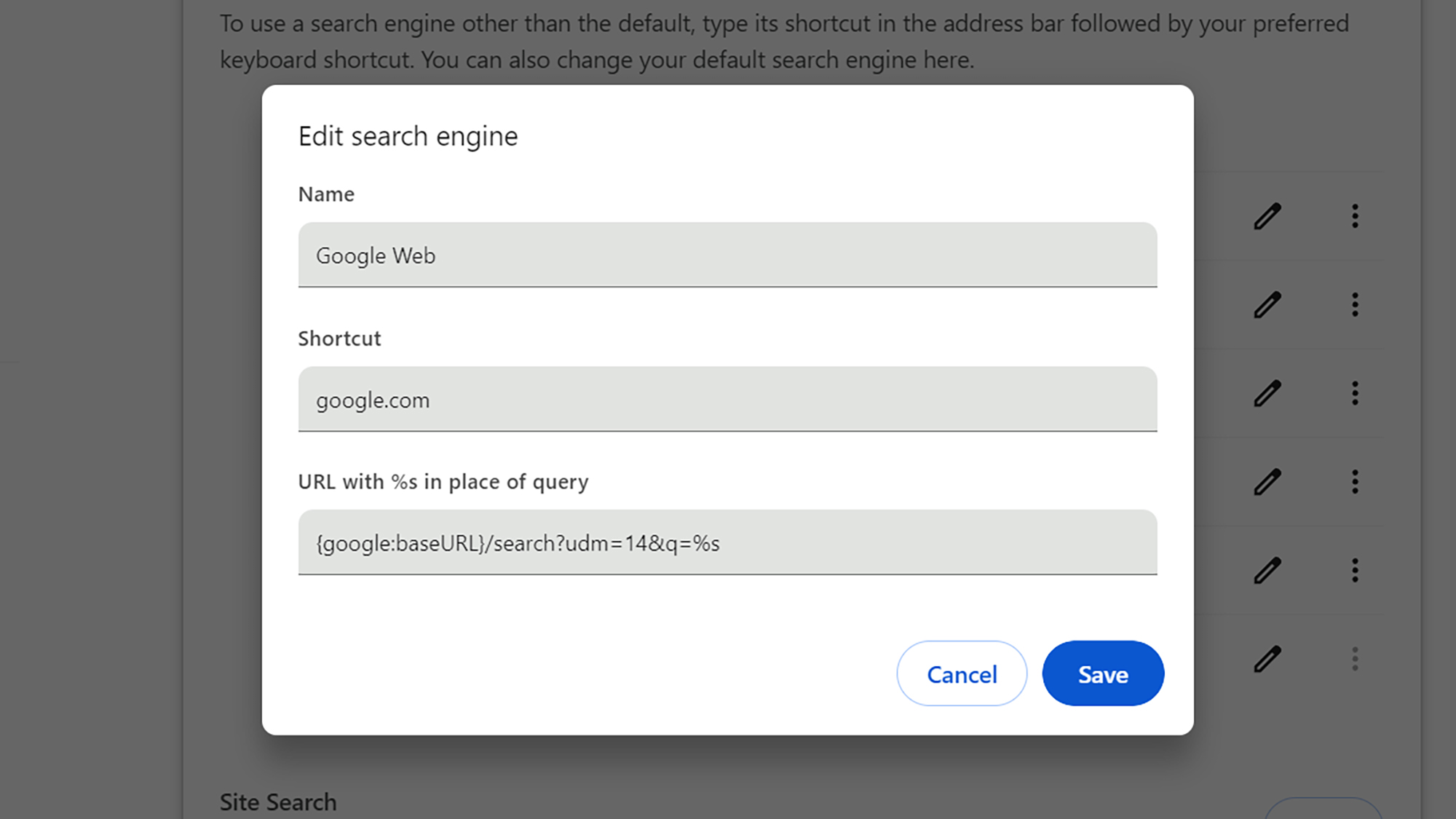

Google Search Ai Data Usage And The Effectiveness Of Opt Outs

May 04, 2025

Google Search Ai Data Usage And The Effectiveness Of Opt Outs

May 04, 2025 -

La Rental Market Exploited After Fires Price Gouging Claims Rise

May 04, 2025

La Rental Market Exploited After Fires Price Gouging Claims Rise

May 04, 2025 -

Understanding Googles Search Ai Training Practices The Opt Out Factor

May 04, 2025

Understanding Googles Search Ai Training Practices The Opt Out Factor

May 04, 2025 -

How Googles Search Ai Uses Web Data After Opt Out

May 04, 2025

How Googles Search Ai Uses Web Data After Opt Out

May 04, 2025