How Bundestag Elections And Key Business Figures Impact The DAX

Table of Contents

The Political Landscape and its Effect on the DAX

The German political landscape significantly impacts investor confidence and, consequently, the DAX. Understanding the nuances of coalition governments and election outcomes is key to predicting market reactions.

Coalition Governments and Market Stability

Coalition negotiations following a Bundestag election can create periods of uncertainty. The composition of the government and its resulting policy agenda directly affect various sectors.

- Examples of policies affecting specific sectors: A government focused on renewable energy might boost the stock prices of companies in that sector, while policies impacting the automotive industry could lead to fluctuations in related DAX components. Environmental regulations, for instance, can heavily influence the automotive sector's performance and consequently the DAX.

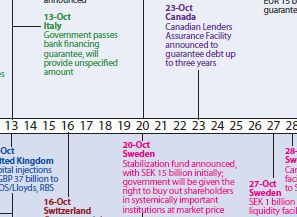

- Historical examples of DAX reactions to coalition changes: Analyzing past coalition formations reveals how the market reacts to different political alliances. For instance, shifts towards more fiscally conservative governments might lead to increased investor confidence, while left-leaning coalitions might trigger different reactions depending on their policy proposals.

- Analysis of investor sentiment during periods of political uncertainty: During coalition negotiations, investor sentiment can become volatile. This uncertainty often translates to market fluctuations, with the DAX reflecting the prevailing level of confidence or apprehension.

Election Results and Market Volatility

Election outcomes, whether a clear majority or a coalition government, significantly influence market predictions and subsequent DAX performance.

- Case studies of DAX reactions to past election results: Studying historical data reveals patterns in the DAX's response to different election results. A surprise outcome could trigger short-term volatility, while a predictable result might lead to more stable market behavior.

- Discussion on the influence of specific party platforms on market sectors: Different parties have distinct economic platforms. For example, a party prioritizing infrastructure spending could positively affect construction companies listed on the DAX, while another party focusing on deregulation might benefit specific industries.

- Analysis of short-term and long-term effects of election outcomes on the DAX: The impact of election results isn't always immediate. Short-term volatility is common, but the long-term effect depends on the government's policies and their implementation.

Key Business Figures and their Influence on the DAX

The actions and decisions of key business figures, both CEOs and influential leaders outside of specific companies, exert considerable influence on the DAX.

CEO Decisions and Corporate Performance

CEOs of DAX-listed companies play a crucial role in shaping their companies' performance and, therefore, the overall index.

- Examples of successful and unsuccessful CEO strategies and their impact on the DAX: Strategic decisions like mergers, acquisitions, or product launches can significantly impact a company's stock price and, consequently, the DAX. Conversely, poor management decisions can lead to stock price declines and affect the index negatively.

- Analysis of the role of corporate governance and transparency in influencing investor confidence: Strong corporate governance and transparent practices build investor confidence, resulting in more stable stock prices. Conversely, scandals or perceived lack of transparency can lead to negative market reactions.

- Discussion on the influence of mergers, acquisitions, and other significant corporate events: Major corporate events often trigger significant fluctuations in the DAX, depending on their perceived success or failure.

The Role of Influential Business Leaders

Beyond CEOs, prominent figures in German business—influential industrialists, leaders of powerful lobbying groups, and prominent economists—can shape market sentiment and DAX performance.

- Examples of influential figures and their impact on specific sectors: Statements or actions from such figures can impact investor confidence in specific sectors, leading to ripples throughout the DAX.

- Analysis of their public statements and actions on investor confidence: Public pronouncements by these individuals can influence market expectations and drive investment decisions. Positive outlooks can boost investor confidence, while negative assessments might lead to selling pressure.

- Discussion on the role of media coverage in shaping public perception: Media portrayal significantly impacts public perception of these figures and their influence on the market. Positive media coverage can enhance their credibility, while negative coverage can erode investor confidence.

Conclusion

This article highlighted the significant influence of both Bundestag elections and key business figures on the DAX. Political stability, governmental policies, CEO decisions, and the actions of prominent business leaders all contribute to market volatility and long-term DAX performance. Understanding these dynamics is essential for navigating the complexities of the German stock market.

Call to Action: Stay informed on upcoming Bundestag elections and the activities of leading German businesses to better understand and predict the future movements of the DAX. Keep researching the impact of Bundestag Elections DAX impact to make informed investment decisions.

Featured Posts

-

Fed Snapshot Reveals The Economic Fallout Of A Canadian Travel Boycott

Apr 27, 2025

Fed Snapshot Reveals The Economic Fallout Of A Canadian Travel Boycott

Apr 27, 2025 -

Microsofts Design Lead Ai And The Human Element

Apr 27, 2025

Microsofts Design Lead Ai And The Human Element

Apr 27, 2025 -

Ariana Grandes Transformation Expert Opinions On Hair And Tattoos

Apr 27, 2025

Ariana Grandes Transformation Expert Opinions On Hair And Tattoos

Apr 27, 2025 -

El Sistema Alberto Ardila Olivares Garantia De Logro En El Futbol

Apr 27, 2025

El Sistema Alberto Ardila Olivares Garantia De Logro En El Futbol

Apr 27, 2025 -

Ramiro Helmeyer A Blaugrana Commitment

Apr 27, 2025

Ramiro Helmeyer A Blaugrana Commitment

Apr 27, 2025

Latest Posts

-

Understanding The Professional Help Behind Ariana Grandes Drastic Style Change

Apr 27, 2025

Understanding The Professional Help Behind Ariana Grandes Drastic Style Change

Apr 27, 2025 -

New Hair New Ink The Professionals Behind Ariana Grandes Style Evolution

Apr 27, 2025

New Hair New Ink The Professionals Behind Ariana Grandes Style Evolution

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Transformation The Professionals Who Made It Happen

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation The Professionals Who Made It Happen

Apr 27, 2025 -

The Team Behind Ariana Grandes Latest Transformation Hair Tattoos And Professional Help

Apr 27, 2025

The Team Behind Ariana Grandes Latest Transformation Hair Tattoos And Professional Help

Apr 27, 2025 -

How Ariana Grande Achieved Her Stunning New Hair And Tattoos Professional Expertise Revealed

Apr 27, 2025

How Ariana Grande Achieved Her Stunning New Hair And Tattoos Professional Expertise Revealed

Apr 27, 2025