How Did Donald Trump's First 100 Days Impact Elon Musk's Net Worth?

Table of Contents

Trump's Economic Policies and Their Potential Impact on Tesla

Tesla, Elon Musk's electric vehicle company, is highly sensitive to changes in economic policy. Trump's first 100 days brought significant shifts, potentially impacting Tesla's trajectory.

Deregulation and its effect on Tesla's Automotive Sector

Trump's administration signaled a push for deregulation across various sectors. This had potential ramifications for Tesla.

- Easing of Environmental Regulations: The potential rollback of Clean Car Standards could have lowered production costs for Tesla, making its vehicles more competitive. However, it could also have negatively impacted the demand for electric vehicles if it signaled a shift away from environmental consciousness.

- Impact on the Automotive Industry: Deregulation in the broader automotive industry could have created both opportunities and challenges for Tesla. Increased competition from traditional automakers might have pressured Tesla's market share, while reduced regulatory burdens could have eased the path to market expansion.

- Stock Market Reactions: The stock market's response to these regulatory changes would have directly influenced Tesla's valuation and, consequently, Elon Musk's net worth. Positive reactions to deregulation might have boosted Tesla stock, while negative reactions would have had the opposite effect. Analyzing the specific stock market movements during this period is crucial for assessing the impact.

Tax Cuts and Their Influence on Tesla's Financial Performance

Trump's proposed tax cuts were a significant element of his early policy agenda. These cuts could have significantly influenced Tesla's financial performance.

- Corporate Tax Rates: Lower corporate tax rates could have boosted Tesla's profitability, freeing up more capital for reinvestment in research and development (R&D) and expansion. This could have led to long-term growth and a positive impact on the Tesla stock price.

- R&D Investment: Increased profitability, due to tax cuts, could have allowed Tesla to invest more heavily in its innovative technologies, further solidifying its position in the electric vehicle market. This would have positively influenced investor sentiment and stock valuations.

- Investor Confidence: The overall market sentiment towards the tax cuts, and their perceived impact on the economy, would have impacted investor confidence in Tesla. Increased confidence could translate to higher stock prices.

Infrastructure Spending and its Relevance to Tesla's Growth

Trump's focus on infrastructure spending could have indirectly benefited Tesla.

- Increased Demand for Electric Vehicles: Increased government investment in infrastructure could have stimulated demand for electric vehicles as charging stations become more readily available. This increased demand could have benefited Tesla significantly.

- Government Contracts: Opportunities might have arisen for Tesla to secure government contracts related to electric vehicle fleets or charging infrastructure development.

- Renewable Energy Integration: Infrastructure projects often involve renewable energy integration, which could have been a positive development for Tesla's energy division.

Trump's Policies and Their Potential Impact on SpaceX

SpaceX, Musk's space exploration company, is also affected by government policy, albeit in a different way than Tesla.

Space Exploration Policy and its Effect on SpaceX Funding and Contracts

Trump's focus on space exploration could have significantly impacted SpaceX.

- NASA Funding: Changes in NASA's funding priorities under the Trump administration could have directly influenced the number and value of contracts awarded to SpaceX. An increase in funding could have boosted SpaceX’s valuation and growth.

- Space Exploration Priorities: A shift towards certain space exploration goals could have positively or negatively influenced SpaceX's position depending on its alignment with these priorities.

- Commercial Spaceflight: Trump's administration’s stance on the role of commercial spaceflight in national space exploration would have significantly impacted SpaceX.

Regulatory Changes Affecting SpaceX's Satellite Launches

Regulatory changes could have affected SpaceX's satellite launch operations.

- Licensing and Permitting: Streamlining the licensing and permitting processes could have expedited SpaceX's launch schedules, allowing it to increase its market share in the commercial space launch industry.

- International Space Cooperation: Changes in international space cooperation policies could have opened up or limited opportunities for SpaceX to participate in international space projects.

Market Reactions and Investor Sentiment

Understanding the overall market climate during Trump's first 100 days is crucial for evaluating the impact on Tesla and SpaceX.

Overall Market Volatility During Trump's First 100 Days

The first 100 days of the Trump administration saw significant market volatility.

- Economic Uncertainty: Uncertainty surrounding Trump's policies could have led to increased market volatility, affecting the stock prices of both Tesla and SpaceX.

- Global Market Conditions: Global economic factors also played a role, potentially overshadowing the direct impact of Trump’s policies.

- Investor Sentiment: Investor sentiment toward Trump's policies and their potential long-term implications would have affected Tesla and SpaceX stock performance.

Specific Analysis of Tesla and SpaceX Stock Price Fluctuations

A detailed analysis of Tesla and SpaceX stock price fluctuations during this period is needed to understand how these companies were affected. Correlating these fluctuations with specific policy announcements or market events is essential. This analysis requires examining the available market data and employing statistical methods to establish correlations, if any, between Trump's actions and the companies' performance.

Conclusion

Determining the precise impact of Donald Trump's first 100 days on Elon Musk's net worth is complex. While policies like tax cuts and deregulation could have positively influenced Tesla's financial performance, other factors such as market volatility and broader economic trends played a significant role. Similarly, SpaceX's success depends on various factors including NASA's funding and international collaborations, which were subject to shifts under the Trump administration. Analyzing Tesla and SpaceX stock price fluctuations during this period, alongside detailed economic analyses, is crucial for a more complete picture. To further explore this fascinating interplay of politics, economics, and technological innovation, delve deeper into market data from this period and consider the influence of numerous external variables. Share your thoughts: How do you think Donald Trump's policies impacted Elon Musk's net worth?

Featured Posts

-

Elon Musks Space X Stake Surges Now Worth 43 B More Than Tesla Holdings

May 09, 2025

Elon Musks Space X Stake Surges Now Worth 43 B More Than Tesla Holdings

May 09, 2025 -

Franco Colapinto Sponsors Accidental F1 News Reveal On Live Television

May 09, 2025

Franco Colapinto Sponsors Accidental F1 News Reveal On Live Television

May 09, 2025 -

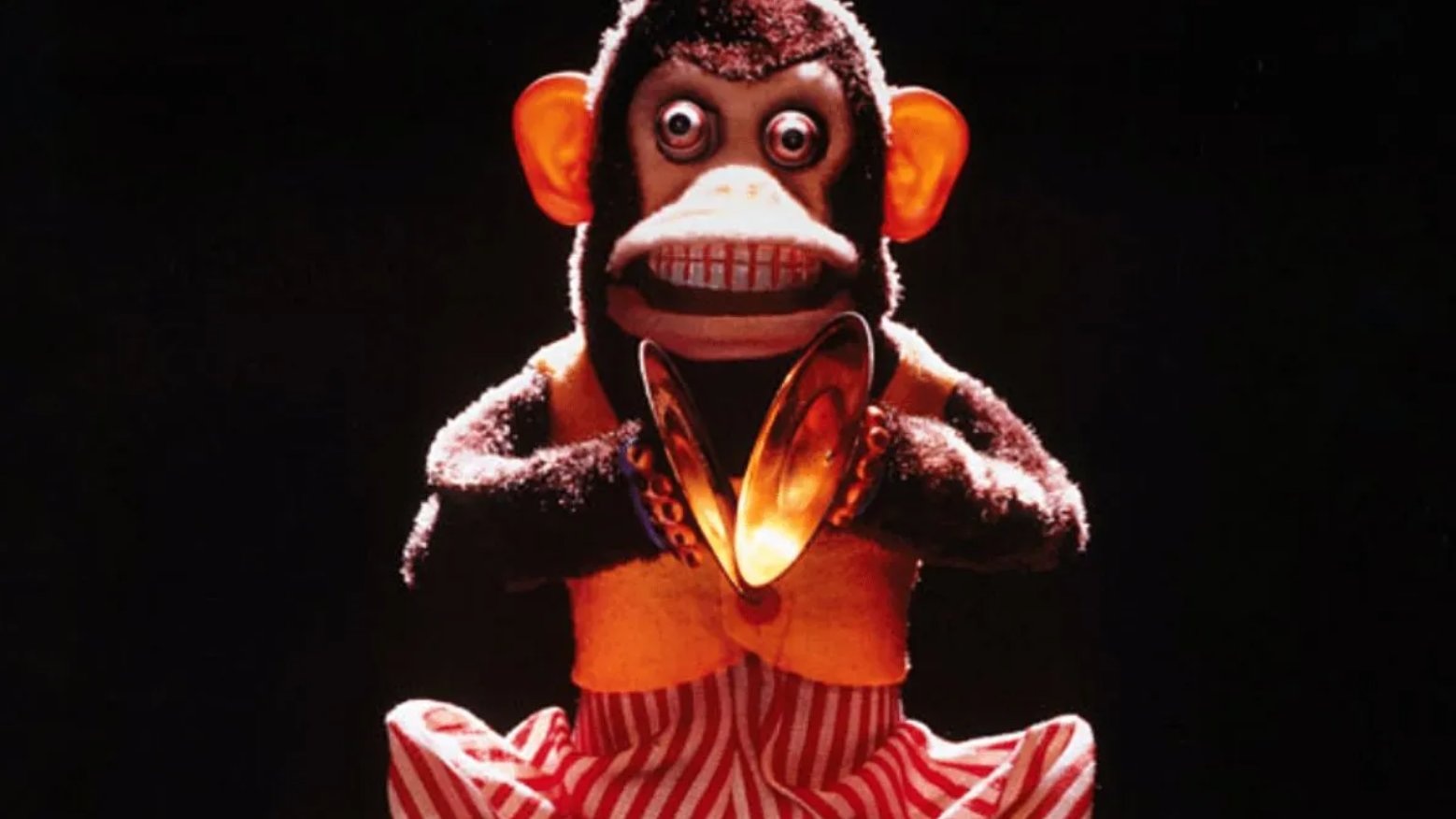

Will 2025 Be A Banner Year For Stephen King Even With A Poor The Monkey Film

May 09, 2025

Will 2025 Be A Banner Year For Stephen King Even With A Poor The Monkey Film

May 09, 2025 -

Elon Musks Financial Empire A Comprehensive Look At His Business Acumen

May 09, 2025

Elon Musks Financial Empire A Comprehensive Look At His Business Acumen

May 09, 2025 -

Wynne Evans Post Strictly Come Dancing Career Update

May 09, 2025

Wynne Evans Post Strictly Come Dancing Career Update

May 09, 2025