How Extreme Weather Events Could Impact Your Credit Score When Buying A Home

Table of Contents

Damage to Your Property and Its Impact on Credit

Extreme weather events, such as hurricanes, floods, tornadoes, wildfires, and severe winter storms, can cause catastrophic damage to your property. This damage can have a ripple effect, significantly impacting your credit score and your ability to secure a mortgage.

Missed Mortgage Payments Due to Damage

Extreme weather events can cause significant property damage, potentially rendering your home uninhabitable. This can directly lead to missed mortgage payments, severely damaging your credit score. Lenders report late payments to credit bureaus, impacting your credit history.

- Late payments reported to credit bureaus: Even a single late payment can negatively affect your credit score. Multiple missed payments can significantly lower your score.

- Potential foreclosure if damage is severe and insurance insufficient: If the damage is extensive and your homeowner's insurance doesn't cover the repair costs, you may face foreclosure, resulting in a severely damaged credit history.

- Negative impact on credit history and credit score: The negative mark of missed mortgage payments remains on your credit report for seven years, making it challenging to obtain future credit.

Increased Debt from Repairs and Reconstruction

Repairing or rebuilding after a disaster can result in substantial debt. You may need to take out loans or use credit cards to cover these unexpected expenses. This can drastically increase your debt-to-income ratio (DTI), a crucial factor in mortgage approval.

- High DTI negatively impacts credit score applications: Lenders use DTI to assess your ability to manage debt. A high DTI significantly reduces your chances of mortgage approval.

- Multiple loan applications within a short period also lower credit score: Applying for multiple loans to cover repair costs can further lower your credit score due to multiple hard inquiries on your credit report.

- Difficulty securing a mortgage with a high DTI: A high DTI demonstrates increased financial risk to lenders, making it much harder to secure a mortgage.

Impact of Employment and Income Loss Due to Extreme Weather

Extreme weather events don't just damage property; they can also disrupt businesses and lead to job losses, directly affecting your ability to make mortgage payments.

Job Displacement and Missed Payments

Extreme weather can cause widespread business closures and job losses, particularly in severely affected areas. Loss of income directly translates to difficulties in making timely mortgage payments.

- Unemployment affects creditworthiness: Unemployment significantly impacts your creditworthiness, as lenders view it as a high risk.

- Difficulty obtaining new employment after a disaster: Finding new employment after a disaster can be challenging, further exacerbating financial difficulties.

- Creditors may be less willing to grant loans or extensions: With a job loss, securing loans or extensions from creditors becomes significantly harder.

Reduced Income and Credit Utilization

Even if you retain your employment, reduced business activity due to weather events can result in decreased income. This can force increased reliance on credit cards, leading to higher credit utilization and negatively impacting your credit score.

- High credit utilization is a significant factor in credit scoring: Keeping your credit utilization below 30% is crucial for maintaining a good credit score.

- Increased reliance on credit during financial hardship: During financial hardship, many resort to credit cards, increasing utilization and potentially maxing them out.

- Difficulty managing debt with reduced income: Reduced income makes it harder to manage existing debt, potentially leading to missed payments and further credit score damage.

Protecting Your Credit Score Before and After Extreme Weather

Protecting your credit score from the impact of extreme weather requires a two-pronged approach: proactive measures to prepare and reactive measures to manage the aftermath.

Proactive Measures

Taking proactive steps before an extreme weather event can significantly mitigate the potential damage to your credit.

- Maintain sufficient homeowner’s insurance with adequate coverage for extreme weather events: Ensure your policy provides sufficient coverage for the type of extreme weather common in your area.

- Build an emergency fund to cover unexpected expenses related to weather damage: Having savings readily available to cover repair costs can prevent you from relying on high-interest credit.

- Improve your credit score before any extreme weather by reducing debt, making on-time payments, and monitoring your credit report: A strong credit score provides a buffer against the impact of financial hardship.

- Regularly review your credit report for errors: Ensure the information on your credit report is accurate.

- Contact creditors to discuss options if facing financial hardship due to extreme weather: Many creditors offer hardship programs to assist during difficult times.

- Explore government assistance programs for disaster relief: Government agencies often offer financial aid and assistance programs to disaster victims.

Reactive Measures

After an extreme weather event, prompt action is crucial in minimizing the negative impact on your credit.

- File insurance claims promptly after any weather-related damage to your property: Timely filing ensures you receive the necessary funds for repairs as quickly as possible.

- Document all damages with photos and videos: Thorough documentation is essential for supporting your insurance claim.

- Contact your mortgage lender immediately to inform them of the situation and explore potential options: Your lender may offer hardship programs or other options to help you manage your mortgage payments.

- Explore hardship programs offered by mortgage lenders: Many lenders offer forbearance or loan modification programs to help borrowers during financial hardship.

- Seek guidance from credit counseling agencies: Credit counseling agencies can provide advice and support in managing debt.

- Consider debt consolidation to manage high debt levels: Consolidating high-interest debts can help you better manage your finances.

Conclusion

Extreme weather events pose a significant threat to your financial stability and can directly impact your credit score, potentially jeopardizing your ability to buy a home. By understanding the potential risks and taking proactive and reactive steps to protect yourself, you can mitigate the negative effects on your creditworthiness. Remember to maintain adequate insurance coverage, build an emergency fund, and promptly address any issues with your lender after a weather-related event. Protecting your credit score is crucial for your financial well-being, particularly when considering the significant investment of buying a home. Don’t let extreme weather events derail your homeownership dreams; take steps today to safeguard your credit and ensure a smooth home-buying process. Learn more about protecting your credit score when buying a home, and plan for unforeseen circumstances.

Featured Posts

-

Analysis Canadas Response To Oxford Report On Us Tariffs

May 21, 2025

Analysis Canadas Response To Oxford Report On Us Tariffs

May 21, 2025 -

Addressing The Rise In Femicide A Call For Action And Awareness

May 21, 2025

Addressing The Rise In Femicide A Call For Action And Awareness

May 21, 2025 -

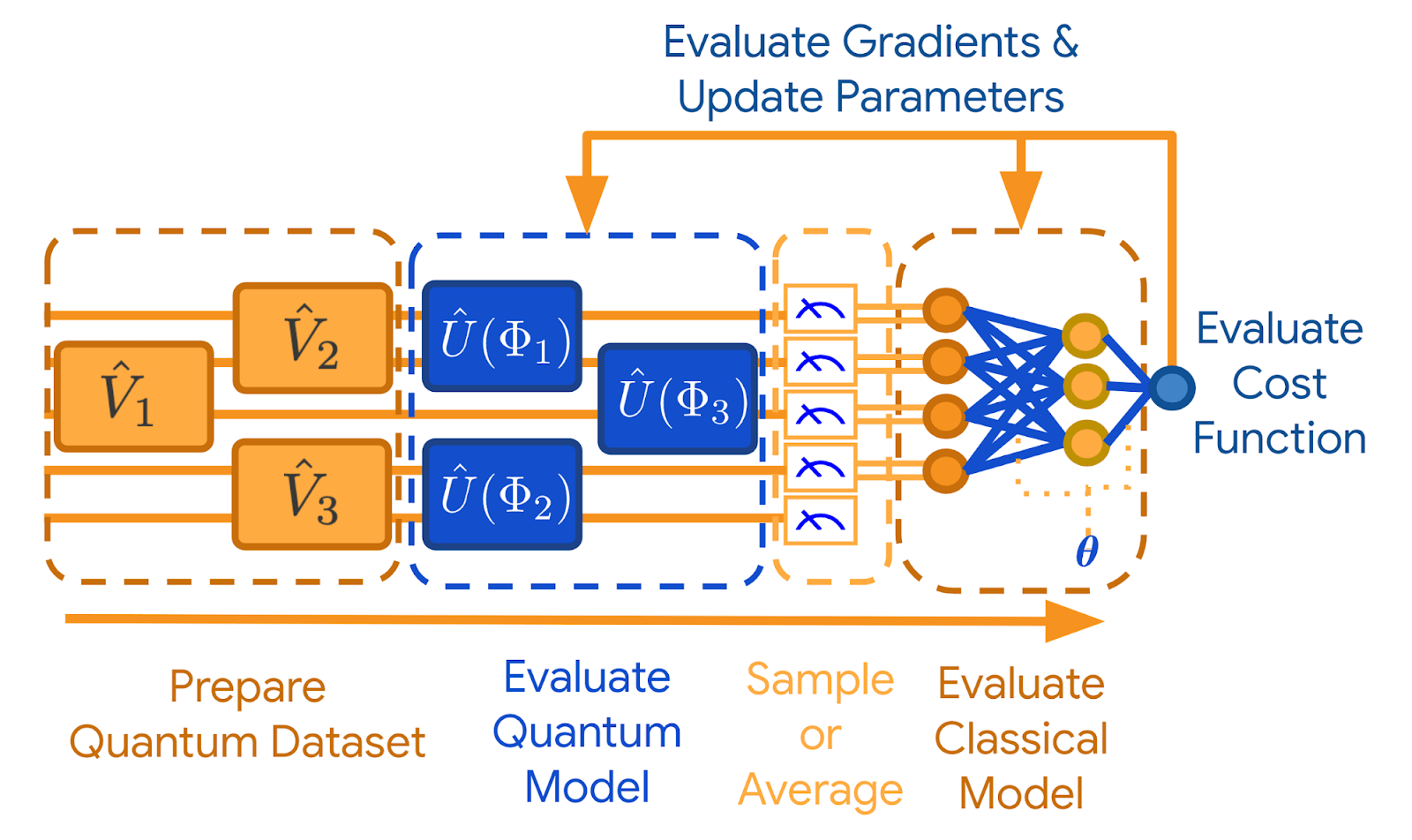

Should You Buy This Ai Quantum Computing Stock On The Dip A Single Powerful Argument

May 21, 2025

Should You Buy This Ai Quantum Computing Stock On The Dip A Single Powerful Argument

May 21, 2025 -

Wwe Raw Zoey Stark Suffers Injury

May 21, 2025

Wwe Raw Zoey Stark Suffers Injury

May 21, 2025 -

Saskatchewan Politics And The Curious Case Of Costco

May 21, 2025

Saskatchewan Politics And The Curious Case Of Costco

May 21, 2025