How India's Wealthy Are Investing In Overseas Markets

Table of Contents

Diversification: Reducing Risk in a Volatile Market

Minimizing dependence on a single market is crucial for long-term financial health. Reliance solely on the Indian economy exposes investors to various risks, including:

Minimizing Dependence on the Indian Economy:

- Economic fluctuations: India's economy, while growing rapidly, is still subject to cyclical downturns and global economic influences.

- Political instability: Political uncertainty can impact market sentiment and investment returns.

- Regulatory changes: Changes in government policies and regulations can significantly affect domestic investments.

Diversifying investments across global markets acts as a buffer against these risks. For instance, a downturn in the Indian stock market might be offset by gains in international markets. Recent volatility in the Indian Rupee, for example, highlights the need for a robust overseas investment portfolio diversification strategy. A well-structured India investment strategy global minimizes the impact of localized economic shocks. By strategically allocating assets across different geographies and asset classes, investors can effectively reduce risk global markets.

Hedging Against Currency Fluctuations:

Fluctuations in the Indian Rupee significantly impact the value of domestic investments when considering global assets. Investing in other currencies helps mitigate this risk.

- Reduced Rupee exposure: Holding assets in multiple currencies reduces the overall dependence on the Rupee's performance.

- Potential for gains: If the Rupee depreciates against other currencies, overseas assets can appreciate in value in Rupee terms.

For example, a strong US dollar can offset losses from a weakening Rupee, providing a hedge against currency risk. Effective currency hedging overseas investment is crucial for long-term wealth preservation. Building a diverse global currency portfolio is essential for sophisticated investors seeking to manage this risk.

Seeking Higher Returns

Beyond risk mitigation, overseas investment offers the potential for significantly higher returns.

Accessing Global Market Opportunities:

Developed and emerging markets often present higher return potential compared to India.

- Higher growth potential: Many international markets offer faster growth rates and greater investment opportunities.

- Access to diverse asset classes: Overseas markets provide access to a wider range of asset classes, including real estate, technology stocks, and other specialized investment vehicles.

For example, the technology sector in the US or the real estate market in Canada offer potentially higher returns compared to similar investments in India. A comparative analysis of average returns from different asset classes in India versus selected overseas markets reveals the potential benefits of high-return overseas investment India. Gaining access to these opportunities through a well-defined global market access strategy is key to maximizing returns. Identifying and capitalizing on these international investment opportunities is paramount for wealth growth.

Exploring Alternative Investment Vehicles:

Overseas markets provide access to a variety of alternative investment overseas India options not readily available domestically.

- Private Equity: Investing in private companies offers high growth potential but comes with higher risk.

- Hedge Funds: These funds employ sophisticated strategies to generate returns across market conditions.

- Offshore Bonds: These offer diversification benefits and potential for higher yields than domestic bonds.

These offshore investment strategies, while potentially lucrative, require a deep understanding of the risks involved. These global alternative assets are typically suitable only for sophisticated HNIs with a higher risk tolerance.

Popular Overseas Investment Destinations for Indians

Several countries are particularly popular among Indian investors:

The United States:

US real estate, stocks, and bonds remain attractive to Indian investors due to:

- Market stability: The US market is considered relatively stable and transparent.

- Strong legal framework: Robust investor protection laws exist.

- Diverse investment options: A wide range of asset classes and investment opportunities are available. Specific sectors like technology and healthcare are especially popular among Indian investors.

The United Kingdom:

Similar to the US, the UK offers attractive real estate options and a mature financial market, appealing to Indian investors for similar reasons.

Canada, Australia, and Singapore:

These countries are attractive not only for investment but also for immigration purposes, creating additional incentives for investment.

Emerging Markets:

Investors are increasingly exploring emerging markets in Asia, Africa, and Latin America, seeking higher potential returns despite higher risks.

This diversified approach to overseas investment from India reflects a sophisticated understanding of global markets and opportunities. Understanding the best countries to invest in from India requires careful research and professional advice, helping to construct a strategic global investment map for Indians.

Navigating the Regulatory Landscape for Overseas Investment from India

Understanding and complying with regulations is paramount for successful overseas investment.

Understanding FEMA Regulations:

The Foreign Exchange Management Act (FEMA) governs all foreign exchange transactions in India.

- Permissible investment amounts: FEMA specifies the limits on overseas investments.

- Reporting requirements: Investors must comply with reporting obligations to the Reserve Bank of India (RBI).

Understanding these FEMA regulations overseas investment and ensuring compliance is crucial to avoid penalties.

Seeking Professional Advice:

Given the complexities of international investment, seeking professional guidance is vital.

- Financial advisors: Expertise in global markets is essential for developing a tailored investment strategy.

- Legal professionals: Navigating international legal and tax implications requires specialized legal advice.

Proper India overseas investment compliance requires engaging experienced professionals. Selecting experienced international investment advisors India ensures that investments are structured legally and efficiently.

Conclusion

The increasing trend of overseas investment from India is driven by a desire for diversification, higher returns, and access to global markets. However, understanding the regulatory landscape (especially FEMA regulations overseas investment) and seeking professional guidance is crucial for success. Are you a high-net-worth individual considering overseas investment from India? Explore the opportunities and risks involved by researching further and seeking professional financial advice to build a diversified global portfolio tailored to your needs. Plan your overseas investment strategy today.

Featured Posts

-

Mateo Retegui Numeros Impresionantes Y La Lucha Por La Bota De Oro

Apr 25, 2025

Mateo Retegui Numeros Impresionantes Y La Lucha Por La Bota De Oro

Apr 25, 2025 -

Broadcoms V Mware Acquisition At And T Exposes A Potential 1 050 Cost Increase

Apr 25, 2025

Broadcoms V Mware Acquisition At And T Exposes A Potential 1 050 Cost Increase

Apr 25, 2025 -

Oklahoma School Districts Respond To Icy Conditions Wednesday Closures

Apr 25, 2025

Oklahoma School Districts Respond To Icy Conditions Wednesday Closures

Apr 25, 2025 -

North East England Easter Holiday Ideas

Apr 25, 2025

North East England Easter Holiday Ideas

Apr 25, 2025 -

Legal Representation Following A Car Accident Protecting Your Rights

Apr 25, 2025

Legal Representation Following A Car Accident Protecting Your Rights

Apr 25, 2025

Latest Posts

-

Il Venerdi Santo Un Commento Di Feltri

Apr 30, 2025

Il Venerdi Santo Un Commento Di Feltri

Apr 30, 2025 -

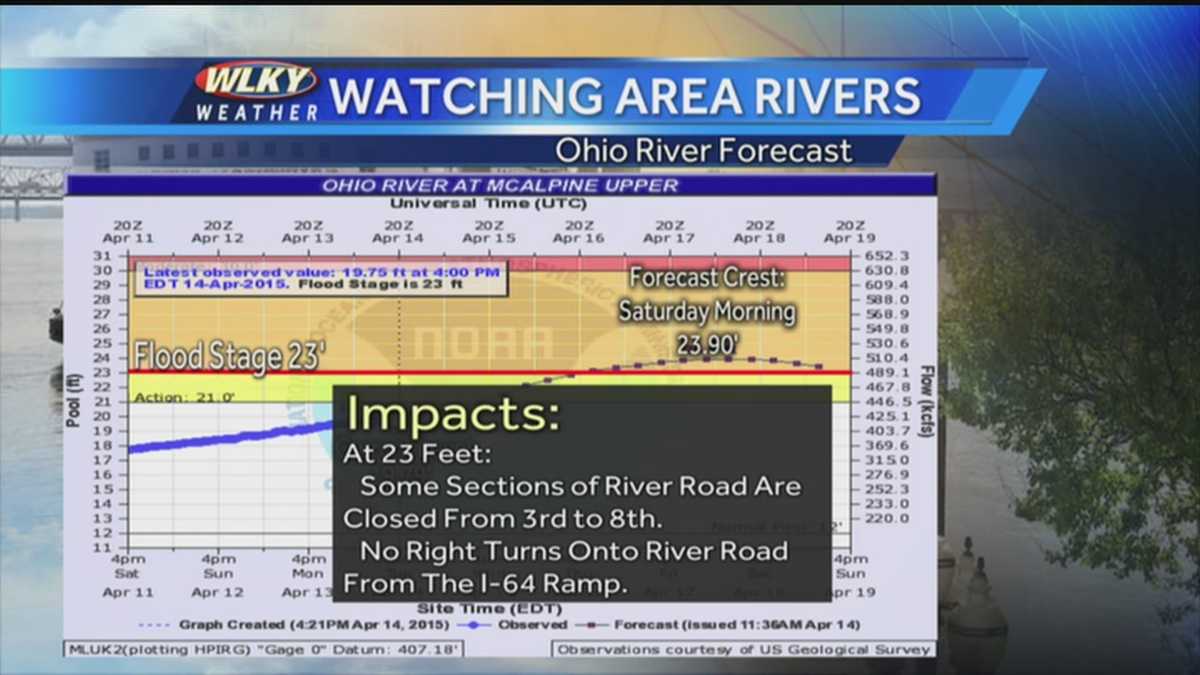

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

Apr 30, 2025

Severe Flooding Cancels Thunder Over Louisville Fireworks Show

Apr 30, 2025 -

Feltri Sul Venerdi Santo Un Opinione Controversa

Apr 30, 2025

Feltri Sul Venerdi Santo Un Opinione Controversa

Apr 30, 2025 -

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025

Kentuckys Louisville Under State Of Emergency Due To Tornado And Imminent Flooding

Apr 30, 2025 -

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025

Ohio River Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 30, 2025