How Norway's Top Investor, Nicolai Tangen, Navigated Trump's Tariffs

Table of Contents

Understanding the Impact of Trump's Tariffs on Norway

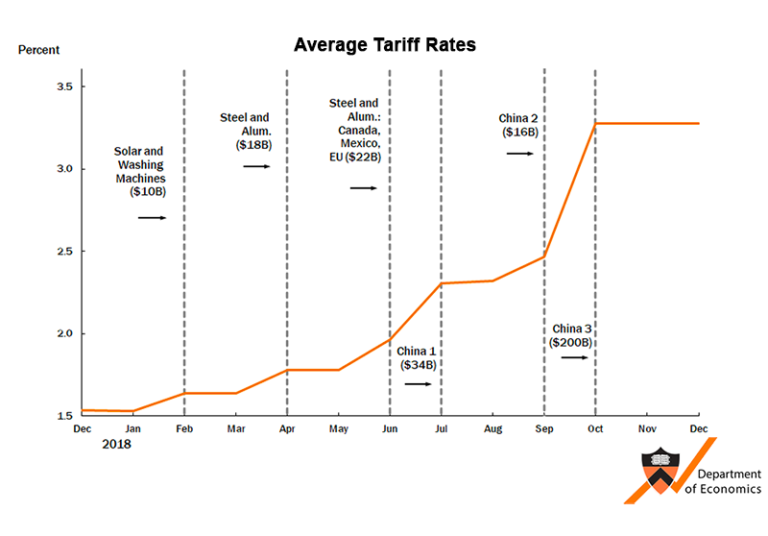

Trump's administration implemented a series of tariffs, primarily targeting China but also impacting other nations, including Norway. These tariffs, ranging from duties on specific goods to broad-based levies, significantly altered the global trade landscape. For Norway, a nation heavily reliant on exports, the potential consequences were substantial. The potential impact of Nicolai Tangen Trump Tariffs on the Norwegian economy was a key concern.

Specific sectors felt the pressure. Norwegian seafood exports to the US, a crucial market, faced increased tariffs, impacting profitability and market share. Similarly, the oil and gas sector, a cornerstone of the Norwegian economy, experienced uncertainty due to the broader geopolitical implications of the tariffs. Aluminum production, another key industry, was also affected by the fluctuating global market conditions created by the protectionist measures.

- Increased import costs for Norwegian goods in the US market, reducing competitiveness.

- Potential retaliatory tariffs from Norway, escalating the trade conflict.

- Uncertainty and volatility in global markets, making investment planning more challenging. This uncertainty significantly impacted the strategies employed to mitigate the effects of Nicolai Tangen Trump Tariffs.

Tangen's Strategic Responses to Tariff Challenges

Faced with the challenges posed by Nicolai Tangen Trump Tariffs, Tangen employed a multi-pronged strategy focused on resilience and long-term value creation. His approach highlighted the importance of proactive risk management and diversification. Rather than reacting to short-term market fluctuations, he prioritized a long-term perspective.

The NBIM, under Tangen’s leadership, didn't panic sell assets. Instead, it focused on:

- Diversification across asset classes and geographies: Reducing reliance on any single sector or region minimized the impact of tariffs on the overall portfolio. This diversification strategy proved crucial in mitigating the risks associated with Nicolai Tangen Trump Tariffs.

- Increased investment in less tariff-sensitive sectors: This involved shifting resources towards sectors less exposed to trade disputes, ensuring a more robust portfolio.

- Hedging strategies to mitigate currency risks: Fluctuations in exchange rates, often exacerbated by trade wars, were addressed through strategic hedging to protect the value of investments.

- Focus on long-term investment horizons: This long-term view allowed NBIM to weather the short-term volatility caused by the tariffs.

The Role of Geopolitical Analysis in Tangen's Decisions

Tangen's success in navigating the Nicolai Tangen Trump Tariffs era wasn't just about financial strategies; it was deeply rooted in geopolitical analysis. His team closely monitored the evolving international landscape, anticipating potential policy shifts and their implications for investments.

- Close monitoring of trade negotiations and policy changes: NBIM maintained a vigilant watch on developments, anticipating potential impacts on their portfolio.

- Incorporation of geopolitical risks into investment models: The fund integrated geopolitical risk assessments into its investment decision-making process.

- Scenario planning to account for various tariff outcomes: NBIM developed sophisticated models considering different scenarios to prepare for various outcomes resulting from the trade conflict.

Lessons Learned and Long-Term Implications for the Norwegian Sovereign Wealth Fund

Tangen’s response to the Nicolai Tangen Trump Tariffs provided valuable lessons for the NBIM and the wider investment community. The fund's performance during this period demonstrated the effectiveness of proactive risk management and diversification.

- Enhanced risk management frameworks: The experience led to improvements in the fund's risk management capabilities, emphasizing a more holistic approach.

- Improved geopolitical analysis capabilities: The fund further strengthened its ability to analyze and incorporate geopolitical factors into its investment strategies.

- Greater emphasis on diversification and resilience: The focus shifted even more toward constructing a portfolio resilient to various global economic shocks.

Conclusion

Nicolai Tangen's successful navigation of the challenges posed by Trump's tariffs underscores the importance of diversification, geopolitical awareness, and robust risk management. His strategies highlight how a long-term perspective, combined with sophisticated analysis, can mitigate the impact of significant global economic uncertainties like those created by the Nicolai Tangen Trump Tariffs. These lessons remain highly relevant for investors facing similar challenges in today's volatile global markets. Learn more about how leading investors like Nicolai Tangen manage risks and navigate complex geopolitical landscapes. Understanding the strategies used to overcome challenges like the impact of Nicolai Tangen Trump Tariffs is crucial for navigating today's volatile markets.

Featured Posts

-

Ufc Kansas City Main Card Odds Predictions And Fighter Breakdowns

May 04, 2025

Ufc Kansas City Main Card Odds Predictions And Fighter Breakdowns

May 04, 2025 -

Aritzia On Trump Tariffs Price Stability And Adjustment Strategies

May 04, 2025

Aritzia On Trump Tariffs Price Stability And Adjustment Strategies

May 04, 2025 -

Ufc In May 2025 Fight Card Schedule And Ufc 315 Preview

May 04, 2025

Ufc In May 2025 Fight Card Schedule And Ufc 315 Preview

May 04, 2025 -

Tony Todds Final On Screen Performance A 25 Year Old Horror Mystery

May 04, 2025

Tony Todds Final On Screen Performance A 25 Year Old Horror Mystery

May 04, 2025 -

Ukraina Makron Zayavil Ob Uspeshnykh Peregovorakh S S Sh A Po Usileniyu Davleniya Na Rossiyu

May 04, 2025

Ukraina Makron Zayavil Ob Uspeshnykh Peregovorakh S S Sh A Po Usileniyu Davleniya Na Rossiyu

May 04, 2025