How Shorting $TRUMP Coin Resulted In A White House Dinner

Table of Contents

H2: Understanding the $TRUMP Coin Phenomenon

H3: What is $TRUMP Coin?

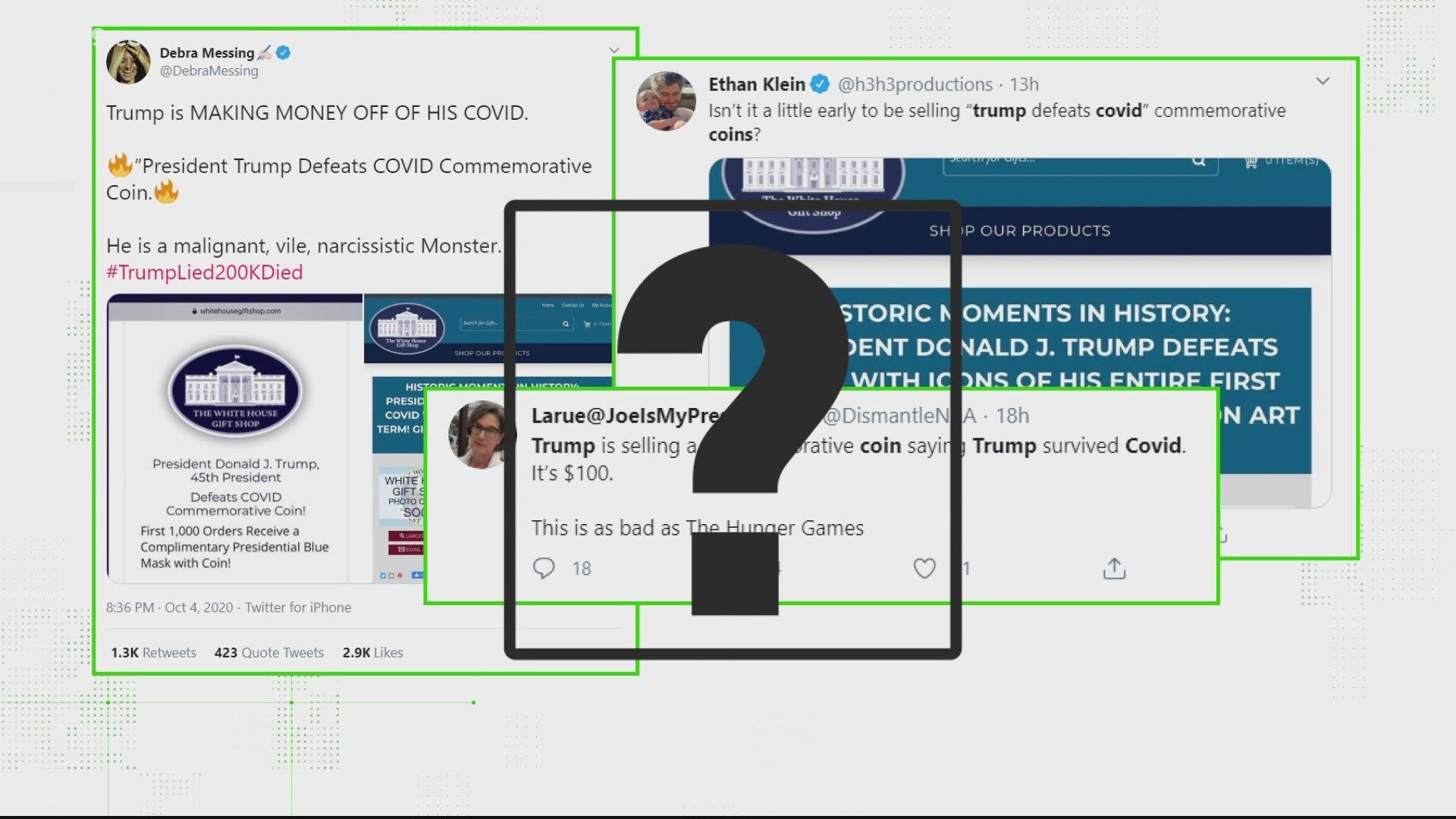

$TRUMP Coin, a cryptocurrency launched in the fervor of a particular political climate, aimed to capitalize on the name and image of a prominent political figure. This association immediately injected a significant level of political influence and market speculation into the coin's existence, making it far more volatile than many other cryptocurrencies. Investing in such a coin inherently carries significant risk due to its susceptibility to news cycles, political events, and overall market sentiment. The lack of intrinsic value and reliance on speculation makes it a prime example of a high-risk, high-reward (or high-loss) investment.

H3: The Market Speculation Surrounding $TRUMP Coin

The price of $TRUMP Coin fluctuated wildly, driven by a cocktail of factors. Positive news cycles or perceived endorsements could lead to dramatic price surges (a "pump"), often followed by equally dramatic crashes ("dumps") as investors cashed out their profits. Negative news or political shifts could trigger equally intense downward spirals. The coin's market capitalization, a measure of its total value, was subject to these rapid and unpredictable changes, reflecting the speculative nature of the investment.

- Market Capitalization: $TRUMP Coin's market cap was highly volatile, reflecting its dependence on speculation and news cycles.

- Pump and Dump Schemes: The coin was susceptible to pump-and-dump schemes, where coordinated efforts artificially inflate the price before a mass sell-off, leaving unsuspecting investors with significant losses.

- Lack of Regulation: The lack of robust regulation in the cryptocurrency market added to the inherent risks associated with $TRUMP Coin, leaving investors vulnerable to fraud and manipulation.

H2: The Strategy Behind the Short Sell

H3: Defining "Shorting" in Cryptocurrency Trading

Shorting, in the context of cryptocurrency trading, involves borrowing a cryptocurrency, selling it at the current market price, and hoping to buy it back later at a lower price. The profit comes from the difference between the selling price and the repurchase price. However, this strategy carries significant risk. If the price rises instead of falling, the losses can be substantial.

H3: Identifying the Opportunity

Our protagonist, let's call him Alex, saw an opportunity to short $TRUMP Coin based on several factors. He analyzed market trends, noting an overbought condition on several technical indicators, suggesting a potential price correction. He also considered recent political developments which seemed to cast a negative light on the coin's namesake.

- Technical Indicators: Alex used technical indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) to identify potential overbought conditions.

- Risk Management: He implemented a strict risk management strategy, limiting his exposure and setting stop-loss orders to minimize potential losses.

- Initial Investment: Alex started with a relatively small investment amount, leveraging his resources to amplify potential gains (and losses).

H2: The Unexpected Outcome: A White House Dinner Invitation

H3: The Connection Between the Trade and the Invitation

Alex's short position on $TRUMP Coin proved remarkably successful. The price plummeted, generating significant profits. It turned out that this financial success, somehow, caught the attention of influential figures connected to the White House. Through a series of (still somewhat mysterious) events, Alex received a dinner invitation.

H3: The Nature of the Invitation

The invitation was to a seemingly informal, yet high-profile White House dinner. While the exact reasoning behind the invitation remains unclear, it suggests an intriguing intersection of finance, politics, and unexpected consequences. The invitation was extended by an individual with close ties to the administration, though the specifics remain shrouded in mystery.

- Irony and Unexpected Nature: The situation is inherently ironic, highlighting the bizarre and unpredictable nature of the cryptocurrency market and its influence on the real world.

- Potential Reasons: Possible explanations for the invitation range from an attempt at networking with successful investors to a more obscure reason related to the political implications of $TRUMP Coin’s performance.

- Ethical Considerations: This situation raises various ethical questions regarding transparency, influence peddling, and the intersection of finance and politics.

H2: Lessons Learned from the $TRUMP Coin Short

H3: Risks of Short Selling

Shorting cryptocurrencies, like any speculative investment, carries immense risk. The potential for unlimited losses if the price rises significantly cannot be overstated. Thorough research, careful risk assessment, and prudent risk management are paramount.

H3: The Importance of Diversification

Investing heavily in a single, highly volatile asset like $TRUMP Coin is extremely risky. Diversification across different asset classes is crucial to mitigate the impact of potential losses.

H3: Unforeseen Consequences of Financial Decisions

Alex's story underscores the unpredictable nature of financial markets and the far-reaching, sometimes unexpected, consequences of investment decisions.

- Risk Management Tips: Employ stop-loss orders, diversify your portfolio, and never invest more than you can afford to lose.

- Resources: Utilize reputable educational platforms and financial advisors to expand your knowledge of cryptocurrency trading.

- Avoid Blind Following: Don't blindly follow trends or speculative hype; conduct thorough research before making any investment decisions.

3. Conclusion

The tale of shorting $TRUMP Coin and the subsequent White House dinner invitation serves as a fascinating, albeit cautionary, example of the unpredictable nature of the cryptocurrency market. The story underscores the inherent risks involved in short selling, the importance of diversification, and the unforeseen consequences that can arise from even the most successful trades. While the rewards of a successful $TRUMP Coin short may have led to an unexpected invitation, remember that the path to profit in the volatile cryptocurrency market is paved with risk. Always conduct thorough research, implement sound risk management strategies, and never underestimate the unpredictable forces at play when dealing with $TRUMP Coin or any other politically-influenced or highly speculative cryptocurrency. While a White House dinner may seem like a dream outcome, remember that successful shorting of $TRUMP Coin, or any cryptocurrency, is fraught with risk. Always proceed with caution and prioritize responsible investment strategies.

Featured Posts

-

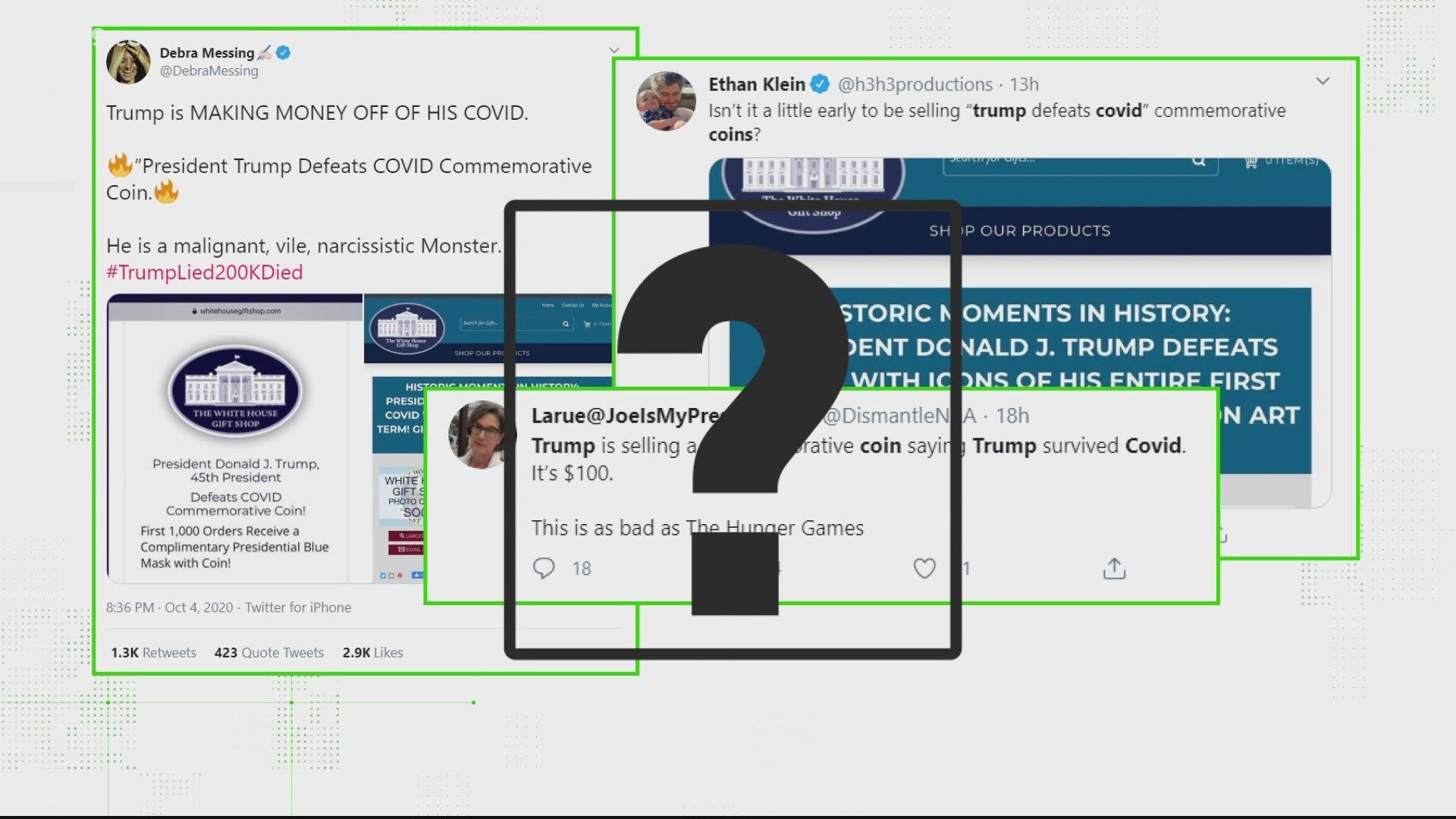

Redeem Pokemon Tcg Pocket Codes For Exclusive Rewards

May 29, 2025

Redeem Pokemon Tcg Pocket Codes For Exclusive Rewards

May 29, 2025 -

Alex Rins Moto2 Style Power Delivery And Argentina Moto Gp Gamble

May 29, 2025

Alex Rins Moto2 Style Power Delivery And Argentina Moto Gp Gamble

May 29, 2025 -

Nike Court Legacy Lift Sneakers On Sale 58 This Week

May 29, 2025

Nike Court Legacy Lift Sneakers On Sale 58 This Week

May 29, 2025 -

New Harry Potter Tv Show Meet The Cast Playing Harry Hermione And Ron

May 29, 2025

New Harry Potter Tv Show Meet The Cast Playing Harry Hermione And Ron

May 29, 2025 -

Mein Schiff Relax Christening Robbie Williams Headline Performance In Malaga

May 29, 2025

Mein Schiff Relax Christening Robbie Williams Headline Performance In Malaga

May 29, 2025

Latest Posts

-

Find Your New Home Two Week Free Accommodation Offer In A German City

May 31, 2025

Find Your New Home Two Week Free Accommodation Offer In A German City

May 31, 2025 -

Incentive Program German City Offers Free Two Week Stay For Potential Residents

May 31, 2025

Incentive Program German City Offers Free Two Week Stay For Potential Residents

May 31, 2025 -

Two Weeks Free Accommodation German Citys Incentive For New Residents

May 31, 2025

Two Weeks Free Accommodation German Citys Incentive For New Residents

May 31, 2025 -

German City Offers Free Two Week Stay To Attract New Residents

May 31, 2025

German City Offers Free Two Week Stay To Attract New Residents

May 31, 2025 -

Update Former Nypd Commissioner Keriks Hospitalization And Expected Recovery

May 31, 2025

Update Former Nypd Commissioner Keriks Hospitalization And Expected Recovery

May 31, 2025